South32 Limited 2025 Interim Dividend Currency Exchange Rates

13 March 2025 - 7:28PM

RNS Regulatory News

RNS Number : 5498A

South32 Limited

13 March 2025

13 March 2025

South32

Limited

(Incorporated in Australia under the Corporations Act

2001 (Cth))

(ACN 093

732 597)

ASX / LSE

/ JSE Share Code: S32; ADR: SOUHY

ISIN:

AU000000S320

south32.net

2025 INTERIM DIVIDEND

CURRENCY EXCHANGE RATES

South32 Limited (ASX, LSE, JSE: S32;

ADR: SOUY) (South32) announced on 13 February 2025 that the Board

resolved to pay an interim dividend of US 3.4 cents per share

(fully franked) for the half year ended 31 December 2024, with a

payment date of 3 April 2025.

The US cent currency exchange rate

applicable to the dividend payable in Australian cents, British

pence and New Zealand cents is determined as the

average exchange rate realised on foreign exchange

trades during the period 24 February 2025

to 12 March 2025, and is detailed below:

|

Currency

|

Exchange

rate

|

Dividend per ordinary share

in local currency

|

|

Australian cents

|

0.629950

|

5.397254

|

|

British pence

|

1.276238

|

2.664080

|

|

New Zealand cents

|

0.570640

|

5.958222

|

On 28 February 2025, South32

announced to the Johannesburg Stock Exchange that the US cent

currency exchange rate applicable to the dividend payable in South

African cents to shareholders on the South African branch register

on the Record Date is the average exchange rate realised on foreign

exchange trades during the period 24 February 2025 to 28 February

2025.

|

Currency

|

Exchange

rate

|

Dividend per ordinary share

in local currency

|

|

South African cents

|

18.41483

|

62.61042

|

Shareholders can manage their

shareholding via the Computershare Investor Centre at

www.computershare.com

to:

|

·

|

update their address, communication

preferences, banking and tax details;

|

|

·

|

view their holdings, dividend and

payment, and transaction history information; and

|

|

·

|

download statements and

documents

|

Alternatively, refer to the relevant

Investor Centre noted below:

About us

Our purpose is to make a difference

by developing natural resources, improving people's lives now and

for generations to come. We are trusted by our owners and partners

to realise the potential of their resources. We produce

minerals and metals critical to the world's energy transition from

operations across the Americas, Australia and Southern Africa and

we are discovering and responsibly developing our next generation

of mines. We aspire to leave a positive legacy and build

meaningful relationships with our partners and communities to

create brighter futures together.

Further information on South32 can

be found at www.south32.net.

Approved

for release by Graham Kerr, Chief Executive Officer

JSE Sponsor: The Standard Bank of South Africa Limited

13 March 2025

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

DIVJJMPTMTTBMRA

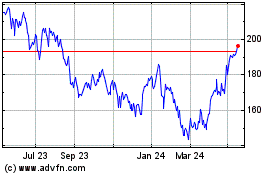

South32 (LSE:S32)

Historical Stock Chart

From Mar 2025 to Apr 2025

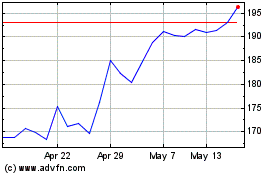

South32 (LSE:S32)

Historical Stock Chart

From Apr 2024 to Apr 2025