TIDMSFT

RNS Number : 6602S

Sinosoft Technology plc

14 September 2010

SINOSOFT TECHNOLOGY PLC

("Sinosoft" or "the Company")

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2010, Proposed cancellation of

admission to AIM and tender offer to buy back shares

Sinosoft, the China based developer and provider of e-Government software and

services, announces its consolidated interim results for the Group (being the

Company and its subsidiaries), for the six months ended 30 June 2010.

The Board of Sinosoft today also announces proposals ("the Proposals") to cancel

the Company's admission to AIM ("Cancellation") and to give those shareholders

who are not able or willing to continue to own shares in the Company following

the proposed Cancellation an opportunity to dispose of their interest in the

Company through a tender offer to buy-back shares at a price of 8p per ordinary

share of 0.148642p ("Ordinary Share"). So as to implement the Proposals, the

Company will need to effect a reduction of capital. The Proposals will be

subject to both Court and shareholder approval.

Highlights

l Turnover up 4.9% to US$4.8M (2009: US$4.5M)

l Gross profit down21.1% to US$2.9M (2009: US$3.6M)

l Research & Development ("R&D") expenditure up 66.0% to US$1.5M (2009:

US$0.9M)

l Operating loss of US$0.7M (2009: profit of US$0.3M)

l Foreign currency losses of US$4.6M

l Net loss of US$4.4M (2009 profit of US$0.77M)

l Cash and cash equivalents of US$8.4m (30 June 2009 $12.6M)

l Strategic review of options undertaken with a proposal to cancel the

admission to AIM and for a buy-back tender offer at 8p per share

Commenting on the results, Mark Greaves, Chairman of Sinosoft said: "The

uncertain economic climate has led the Company to produce mixed operating

results, with a clear negative impact on certain divisions, with other divisions

such as tax software having performed reasonably well. However, the financial

performance in the period was seriously impacted by the losses on unauthorized

foreign exchange transactions and the Board, following a detailed strategic

review, has taken the decision that shareholders' interests will best be served

by the Company seeking to cancel the admission to AIM and to provide those

shareholders who wish to sell their shares the opportunity to do so."

For further information please contact:

+---------------------+----------------------+--------------------------------------+

| Sinosoft Technology | Mr. Yifa Yu | +86 025 84815959 |

| plc | | yuyifa@sinosoft-technology.com |

+---------------------+----------------------+--------------------------------------+

| | | |

+---------------------+----------------------+--------------------------------------+

| Westhouse | Tim Metcalfe / | 020 7601 6100 |

| Securities | Richard Baty | |

| | | |

+---------------------+----------------------+--------------------------------------+

| Tavistock | Simon Compton | 020 7920 3150 |

| Communications | | |

+---------------------+----------------------+--------------------------------------+

Operational Review

Although the economic climate is in better shape than it was in the last quarter

of 2008 and the first quarter of 2009, a lot of uncertainty still remains in the

recovery. In such challenging times, we have managed to increase our turnover

for the six months to 30 June 2010 by US$0.2m compared to the same period last

year. However, although turnover has increased marginally, sales achieved by

our E-government division and Information Integration division were lower than

the same period last year.

As a result of tighter monitoring of cost that was implemented following the

crisis of late 2008, we have been able to continue to bring down selling and

distribution costs as well as administrative costs. However, our continued

strategy of investing in research and development in previous years has meant

that a higher amount of amortisation will be incurred in subsequent years. This

accounts for the higher research and development cost when compared to the same

period of last year.

Tax software

Our focus on the development and sale of value added software to our existing

users has continued to bear fruit for the Group. While revenue has only been

marginally higher than last year, there is no doubt that the strategy of

diversifying away from SAT has been successful and should help this division to

perform reasonably during the year. We are currently continuing our R&D

programme and are looking to push out more new products in this area.

e-Government software

During the latest Chinese People's Political Consultative Conference (CPPCC)

held in March 2010, the government communicated its intention to improve the

level of IT services that it provides to its citizens in the coming year.

However, this division has witnessed a decrease in turnover, partly due to the

timing of the Chinese government calling for tenders for such projects. In

addition, the complexity of some of the projects signed this year has resulted

in the division not being able to recognise the associated turnover during the

first half of the year. The Group is currently actively pursuing further

opportunities arising from government initiatives by leveraging on our history

of successfully securing and completing such projects.

Information Integration

Revenue in this division has always been derived mainly from large corporate

clients that use the Group's products and services to restructure and streamline

their IT infrastructure. As the Group continues to witness a slowdown in

corporate IT spending that started during 2009, revenue for this division

continues to register a decline.

Systems Integration

Traditionally a low margin division, the increase in turnover during this half

year has resulted in a lower overall gross profit margin for the Group compared

to the prior year. Although dependent on customers installing new systems and

with the continued decline in corporate IT spending, this division has

nevertheless performed well, primarily due to a project for the Technology Park

located at Pukou, which is expected to be completed by the end of this year.

Trading outlook

Traditionally, the Group's revenues are weighted towards the latter half of the

year, although Information Integration and System Integration may continue to

witness difficult conditions as a result of reduced corporate spending. The

Board does, however, believe, the Company is well positioned to achieve further

growth in the areas of e-Government and tax software and the strategy remains to

focus on these growth areas to help mitigate the negative effects brought about

by continued difficult trading in the other two divisions.

Financial Review

As announced on 9 July 2010 and further updated on 16 July 2010 the Company

incurred a net loss of US$3.8M in the first half of the year arising from a

number of foreign exchange contracts in respect of which the Company's internal

stop loss limits were not complied with. As stated on 16 July 2010 all

remaining foreign exchange positions have been closed out. In closing out these

positions a further loss of US$1.2m was incurred post 30 June, which will

further negatively impact on the Company's full year results. The net loss on

investment of US$3.8m is the sum of the total loss on investments of US$4.6

million and finance costs of US$0.2 million less finance income of US$1 million.

Although revenues in 2010 are expected to be higher than in 2009, the Company

expects to book a net loss for the full year as a result of the US$5m foreign

exchange contract losses.

Proposed cancellation of admission to AIM, tender offer to buy back shares in

the Company and associated reduction of capital ("the Proposals")

Under the Proposals, which will be subject to both shareholder and Court

approval, a tender offer ("Tender Offer") will be made pursuant to which

shareholders will be able to tender all of their Ordinary Shares to be purchased

by the Company at a price of 8p per Ordinary Share. It is also proposed that

the Company's admission to AIM will be cancelled.

The proposed Tender Offer price of 8p per Ordinary Share represents a premium of

56.0% to the closing mid-price on 13 September 2010, the last trading day prior

to release of this announcement and a premium of 8.5% to the closing mid price

on 8 July 2010, the day immediately preceding the trading update announced on 9

July detailing the foreign exchange losses.

It is intended that the Company will shortly publish a circular setting out

further details of the Proposals. The circular will also contain a notice

convening a general meeting at which the approval of shareholders will be

sought.

Implementation of the Proposals

The Board has concluded that it would be in the best interests of the Company to

cancel trading in the Company's shares on AIM and continue its growth strategy

away from the public market, at least in the near term. In particular such

cancellation should allow the Company to grow without the pressure a quoted

company may face to deliver short term performance over long term positioning

and growth. The cancellation should also save the Company costs associated with

being quoted and, importantly, will allow executive management more time to

focus on driving the business forward. Ultimately, the Board believes that

greater shareholder value will be derived by operating the Company's business

off-market in the immediate future.

As the Group has funds above those required to meet its near term operational

objectives, the Board believes that it is appropriate to give those shareholders

who are not able or willing to continue to own shares in the Company following

the Cancellation an opportunity to dispose of their interest in the Company

through the Tender Offer. As shareholders holding about 69.1% of the issued

share capital of the Company have indicated that they would provide irrevocable

undertakings not to accept the Tender Offer, the Board have calculated that a

maximum of about GBP4.30m would payable under the Tender Offer, including stamp

duty and costs. This figure is subject to further detailed analysis and

professional advice.

In considering the maximum level of cash which would be returned to Shareholders

under the Tender Offer, the Board has taken account of the levels of funding

remaining in the group to enable it to meet its current working capital

requirements. The Tender Offer is intended to be funded out of the cash

resources of the Company and by the Company or its subsidiaries obtaining

additional bank funding. The Tender Offer will be conditional on the additional

bank funding being available.

The aggregate buy-back price for the shares under the Tender Offer can only be

paid out of the distributable reserves of the Company. As the distributable

reserves of the Company are not sufficient to support the maximum amount payable

under the Tender Offer, the Company will have to undergo a Court approved

capital reduction ("Capital Reduction"). In order to implement the Tender Offer

and Capital Reduction, the Company will have to obtain the approval of

shareholders in general meeting as well as Court approval. The Tender Offer

will accordingly be conditional on such approvals being obtained. The Company

will seek to cancel the admission of the Company's Ordinary Shares to AIM

whether or not the Tender Offer becomes unconditional.

Those shareholders who want to continue to own shares in the Company after the

cancellation of admission to AIM may do so, although they should understand that

as the shares will no longer be traded on a market and they may not be able to

dispose of their shareholding in the Company easily or at all.

Cancellation of Admission

If the required resolution is passed at a general meeting of shareholders, the

Directors intend to cancel the admission of the Company's shares to trading on

AIM. In accordance with the AIM Rules for Companies, cancellation of admission

is conditional upon consent of not less than 75 per cent. of votes cast by

shareholders at a general meeting. Such consent will be sought at a general

meeting of shareholders. The time of the general meeting and the principal

effects and timing of the cancellation will be set out in the circular to be

sent to shareholders.

Takeover Code

Although the Company is incorporated in England and Wales and the Ordinary

Shares are admitted to trading on AIM, as the Company's central place of

management is in China the Company is not considered to be resident in the UK

for the purposes of the City Code on Takeovers and Mergers (the "City Code")

which for the time being does not apply to the Company. Accordingly, the

Company is not subject to takeover regulation in the UK under the City Code

until such time as the position changes. Investors should be aware that the

protections afforded to shareholders by the City Code which are designed to

regulate the way in which takeovers and the purchase by a company of its own

shares are conducted will not be available.

Other matters

Further information including details of any proposed amendments to the articles

of association of the Company will be set out in the circular to be sent to

shareholders.

CONSOLIDATED INCOME STATEMENT

+---------------------------+--------------+-------------+-------------+

| | 6 months | 6 months | 12 |

| | | | months |

| | | | ended |

+---------------------------+--------------+-------------+-------------+

| | ended 30 | ended 30 | 31 |

| | June | June | December |

+---------------------------+--------------+-------------+-------------+

| | 2010 | 2009 | 2009 |

+---------------------------+--------------+-------------+-------------+

| | US$ | US$ | US$ |

+---------------------------+--------------+-------------+-------------+

| | (reviewed) | (reviewed) | (audited) |

| | | | |

+---------------------------+--------------+-------------+-------------+

| | | | |

+---------------------------+--------------+-------------+-------------+

| Revenue | 4,764,320 | 4,543,113 | 14,513,309 |

+---------------------------+--------------+-------------+-------------+

| Cost of sales | (1,904,323) | (916,897) | (4,919,180) |

+---------------------------+--------------+-------------+-------------+

| | | | |

+---------------------------+--------------+-------------+-------------+

| Gross profit | 2,859,997 | 3,626,216 | 9,594,129 |

+---------------------------+--------------+-------------+-------------+

| Other income | 346,157 | 209,627 | 866,233 |

+---------------------------+--------------+-------------+-------------+

| Research and development | (1,549,678) | (933,514) | (2,206,895) |

| cost | | | |

+---------------------------+--------------+-------------+-------------+

| Selling and distribution | (905,092) | (1,012,707) | (2,152,110) |

| expenses | | | |

+---------------------------+--------------+-------------+-------------+

| Administrative expenses | (1,425,773) | (1,427,171) | (3,242,317) |

+---------------------------+--------------+-------------+-------------+

| Other operating expenses | (22,418) | (177,572) | 439,524 |

+---------------------------+--------------+-------------+-------------+

| | | | |

+---------------------------+--------------+-------------+-------------+

| Profit from operations | (696,807) | 284,879 | 3,298,564 |

+---------------------------+--------------+-------------+-------------+

| Finance cost | (234,948) | (16,014) | (1,147,509) |

+---------------------------+--------------+-------------+-------------+

| Finance income | 1,078,654 | 653,051 | 2,256,244 |

+---------------------------+--------------+-------------+-------------+

| Loss on investment | (4,647,645) | 55,769 | |

+---------------------------+--------------+-------------+-------------+

| | | | |

+---------------------------+--------------+-------------+-------------+

| Profit before tax | (4,500,746) | 977,685 | 4,407,299 |

+---------------------------+--------------+-------------+-------------+

| | | | |

+---------------------------+--------------+-------------+-------------+

| Taxation | 57,277 | (210,747) | (752,486) |

+---------------------------+--------------+-------------+-------------+

| | | | |

+---------------------------+--------------+-------------+-------------+

| Profit for the period | (4,443,469) | 766,938 | 3,654,813 |

+---------------------------+--------------+-------------+-------------+

| | | | |

+---------------------------+--------------+-------------+-------------+

| Earnings per ordinary | | | |

| share | | | |

+---------------------------+--------------+-------------+-------------+

| Basic (US$ per share) | (0.0268) | 0.0046 | 0.0207 |

+---------------------------+--------------+-------------+-------------+

| Diluted ( US$ per share) | (0.0268) | 0.0046 | 0.0207 |

+---------------------------+--------------+-------------+-------------+

+------------------------------+-------------+-------------+-------------+

| CONSOLIDATED BALANCE SHEET |

+------------------------------------------------------------------------+

| | 30 June | 30 June | 31 |

| | | | December |

+------------------------------+-------------+-------------+-------------+

| | 2010 | 2009 | 2009 |

+------------------------------+-------------+-------------+-------------+

| | US$ | US$ | US$ |

+------------------------------+-------------+-------------+-------------+

| | (reviewed) | (reviewed) | (audited) |

| | | | |

+------------------------------+-------------+-------------+-------------+

| ASSETS | | | |

+------------------------------+-------------+-------------+-------------+

| Non-current assets | | | |

+------------------------------+-------------+-------------+-------------+

| Property, plant and | 792,345 | 883,632 | 802,919 |

| equipment | | | |

+------------------------------+-------------+-------------+-------------+

| Intangible assets | 6,876,963 | 6,733,100 | 7,524,899 |

+------------------------------+-------------+-------------+-------------+

| Long term investment | - | 4,403,363 | 4,406,969 |

+------------------------------+-------------+-------------+-------------+

| Total non-current assets | 7,669,308 | 12,020,095 | 12,737,787 |

+------------------------------+-------------+-------------+-------------+

| | | | |

+------------------------------+-------------+-------------+-------------+

| Current assets | | | |

+------------------------------+-------------+-------------+-------------+

| Inventories | 1,055,231 | 334,655 | 716,392 |

+------------------------------+-------------+-------------+-------------+

| Trade receivables | 10,363,923 | 7,202,347 | 10,561,671 |

+------------------------------+-------------+-------------+-------------+

| Other receivables | 3,757,828 | 1,360,925 | 1,815,086 |

+------------------------------+-------------+-------------+-------------+

| Investments | 4,452,419 | 86,945 | 29,775 |

+------------------------------+-------------+-------------+-------------+

| Cash deposits | - | - | |

+------------------------------+-------------+-------------+-------------+

| Cash and cash equivalents | 8,429,480 | 12,577,728 | 14,935,073 |

+------------------------------+-------------+-------------+-------------+

| Total current assets | 28,058,881 | 21,562,600 | 28,057,997 |

+------------------------------+-------------+-------------+-------------+

| | | | |

+------------------------------+-------------+-------------+-------------+

| Total assets | 35,728,189 | 33,582,695 | 40,792,784 |

+------------------------------+-------------+-------------+-------------+

| | | | |

+------------------------------+-------------+-------------+-------------+

| LIABILITIES & EQUITY | | | |

+------------------------------+-------------+-------------+-------------+

| Current liabilities | | | |

+------------------------------+-------------+-------------+-------------+

| Short term loan | 1,178,047 | - | 1,171,612 |

+------------------------------+-------------+-------------+-------------+

| Trade payables | 3,269,978 | 566,632 | 3,412,871 |

+------------------------------+-------------+-------------+-------------+

| Other payables | 1,739,216 | 156,229 | 1,584,884 |

+------------------------------+-------------+-------------+-------------+

| Total current liabilities | 6,187,241 | 722,861 | 6,169,367 |

+------------------------------+-------------+-------------+-------------+

| | | | |

+------------------------------+-------------+-------------+-------------+

| Non-current liabilities | | | |

+------------------------------+-------------+-------------+-------------+

| Deferred tax | 1,249,334 | 837,689 | 1,299,631 |

+------------------------------+-------------+-------------+-------------+

| Total non-current | 1,249,334 | 837,689 | 1,299,631 |

| liabilities | | | |

+------------------------------+-------------+-------------+-------------+

| | | | |

+------------------------------+-------------+-------------+-------------+

| Total liabilities | 7,436,575 | 1,560,550 | 7,468,998 |

+------------------------------+-------------+-------------+-------------+

| Net assets | 28,291,614 | 32,022,145 | 33,323,786 |

+------------------------------+-------------+-------------+-------------+

| | | | |

+------------------------------+-------------+-------------+-------------+

| Equity | | | |

+------------------------------+-------------+-------------+-------------+

| Share capital | 424,023 | 424,023 | 424,023 |

+------------------------------+-------------+-------------+-------------+

| Share premium | 11,283,551 | 11,283,551 | 11,283,551 |

+------------------------------+-------------+-------------+-------------+

| Merger reserve | (1,118,051) | (1,118,051) | (1,118,051) |

+------------------------------+-------------+-------------+-------------+

| Other reserves | 7,061,210 | 8,118,637 | 7,649,913 |

+------------------------------+-------------+-------------+-------------+

| Retained earnings | 10,640,881 | 13,313,985 | 15,084,350 |

+------------------------------+-------------+-------------+-------------+

| Total Equity | 28,291,614 | 32,022,145 | 33,323,786 |

+------------------------------+-------------+-------------+-------------+

| | | | |

+------------------------------+-------------+-------------+-------------+

| Total liabilities & equity | 35,728,189 | 33,582,695 | 40,792,784 |

+------------------------------+-------------+-------------+-------------+

+----------------------------+-------------+-------------+-------------+

| CASH FLOW STATEMENT | 6 months | 6 months | 12 |

| | | | months |

| | | | ended |

+----------------------------+-------------+-------------+-------------+

| | ended 30 | ended 30 | 31 |

| | June | June | December |

+----------------------------+-------------+-------------+-------------+

| | 2010 | 2009 | 2009 |

+----------------------------+-------------+-------------+-------------+

| | US$ | US$ | US$ |

+----------------------------+-------------+-------------+-------------+

| | (reviewed) | (reviewed) | (audited) |

| | | | |

+----------------------------+-------------+-------------+-------------+

| Operating activities | | | |

+----------------------------+-------------+-------------+-------------+

| Income before taxation | (4,500,746) | 977,685 | 4,407,299 |

| from continuing operations | | | |

+----------------------------+-------------+-------------+-------------+

| Adjustments for: | | | |

+----------------------------+-------------+-------------+-------------+

| Interest income | - | (653,051) | (422,972) |

+----------------------------+-------------+-------------+-------------+

| Interest expense | - | 16,014 | 19,567 |

+----------------------------+-------------+-------------+-------------+

| Exchange difference | 4,643,927 | (55,769) | 1,127,941 |

+----------------------------+-------------+-------------+-------------+

| Excess on acquisition of | | | (445,573) |

| fair value net assets of | | | |

| subsidiary over cost | | | |

+----------------------------+-------------+-------------+-------------+

| Investment income | (1,057,926) | (209,627) | - |

+----------------------------+-------------+-------------+-------------+

| Share based payment | - | 143,589 | 23,142 |

+----------------------------+-------------+-------------+-------------+

| Impairment loss in | 7,978 | (156,990) | (119,345) |

| receivables | | | |

+----------------------------+-------------+-------------+-------------+

| Depreciation of property, | 97,033 | 96,518 | 115,120 |

| plant and equipment | | | |

+----------------------------+-------------+-------------+-------------+

| Impairment of property, | | | 6,049 |

| plant and equipment | | | |

+----------------------------+-------------+-------------+-------------+

| Amortisation for | 1,728,780 | 1,293,370 | 2,957,106 |

| intangible assets | | | |

+----------------------------+-------------+-------------+-------------+

| Income taxes deferred | 57,277 | - | - |

+----------------------------+-------------+-------------+-------------+

| Operating cash generated | 976,323 | 1,451,739 | 7,668,334 |

| before working capital | | | |

| changes | | | |

+----------------------------+-------------+-------------+-------------+

| Decrease in inventories | (338,839) | 309,222 | (72,515) |

+----------------------------+-------------+-------------+-------------+

| Decrease/ (increase) in | (1,744,995) | 1,713,434 | (2,265,667) |

| trade and other | | | |

| receivables | | | |

+----------------------------+-------------+-------------+-------------+

| Decrease/(Increase) in | 14,162 | (3,750,846) | 1,873,203 |

| trade and other payables | | | |

+----------------------------+-------------+-------------+-------------+

| (Decrease) in deferred | (50,297) | - | |

| income | | | |

+----------------------------+-------------+-------------+-------------+

| Cash generated by | (1,143,646) | (276,451) | 7,203,355 |

| operations | | | |

+----------------------------+-------------+-------------+-------------+

| Income taxes paid | - | (141,310) | (158,474) |

+----------------------------+-------------+-------------+-------------+

| Interest paid | - | (16,014) | (19,567) |

+----------------------------+-------------+-------------+-------------+

| NET CASH (USED IN) / | (1,143,646) | (433,775) | 7,025,314 |

| GENERATED FROM OPERATING | | | |

| ACTIVITIES | | | |

+----------------------------+-------------+-------------+-------------+

| Investing activities | | | |

+----------------------------+-------------+-------------+-------------+

| Interest received | - | 653,051 | 422,972 |

+----------------------------+-------------+-------------+-------------+

| Gain on disposal of | - | 209,627 | - |

| investment | | | |

+----------------------------+-------------+-------------+-------------+

| Proceeds on disposal of | 1,445,254 | 1,376,198 | |

| trading investment | | | |

+----------------------------+-------------+-------------+-------------+

| Purchase of property, | (1,129,904) | (1,063) | (55,201) |

| plant and equipment | | | |

+----------------------------+-------------+-------------+-------------+

| Proceeds on disposal of | | | 111,471 |

| property, plant and | | | |

| equipment | | | |

+----------------------------+-------------+-------------+-------------+

| Purchase of intangible | - | (1,177,504) | (4,202,061) |

| assets | | | |

+----------------------------+-------------+-------------+-------------+

| Acquisition of subsidiary | | | (308,581) |

+----------------------------+-------------+-------------+-------------+

| Entrust loan made | - | - | 1,433,369 |

+----------------------------+-------------+-------------+-------------+

| Decrease/(increase) in | - | 460,276 | 460,276 |

| pledged bank deposits | | | |

+----------------------------+-------------+-------------+-------------+

| NET CASH USED IN INVESTING | 315,350 | 1,520,585 | (2,137,755) |

| ACTIVITIES | | | |

+----------------------------+-------------+-------------+-------------+

+----------------------------+---------------+-------------+-------------+

| Financing activities | | | |

+----------------------------+---------------+-------------+-------------+

| Repayment of borrowing | - | (1,170,515) | - |

+----------------------------+---------------+-------------+-------------+

| Dividend paid | - | | (953,653) |

+----------------------------+---------------+-------------+-------------+

| NET CASH USED IN FINANCING | - | (1,170,515) | (953,653) |

| ACTIVITIES | | | |

+----------------------------+---------------+-------------+-------------+

| NET DECREASE IN CASH AND | (828,296) | (83,705) | 3,933,906 |

| CASH EQUIVALENTS | | | |

+----------------------------+---------------+-------------+-------------+

| Effect of exchange rate | (5,677,297) | 209,046 | (1,451,220) |

| changes | | | |

+----------------------------+---------------+-------------+-------------+

| CASH AND CASH EQUIVALENTS | 14,935,073 | 12,452,387 | 12,452,387 |

| AT BEGINNING OF YEAR | | | |

+----------------------------+---------------+-------------+-------------+

| CASH AND CASH EQUIVALENTS | 8,429,480 | 12,577,728 | 14,935,073 |

| AT THE END OF PERIOD | | | |

+----------------------------+---------------+-------------+-------------+

STATEMENT OF CHANGES IN EQUITY

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| | Share | Share | Merger | Other | Retained | Total |

| | capital | premium | reserve | reserves | earnings | |

+ +----------------------+------------+-------------+-----------+-------------+-------------+

| | US$ | US$ | US$ | US$ | US$ | US$ |

+ +----------------------+------------+-------------+-----------+-------------+-------------+

| | Reviewed | Reviewed | Reviewed | Reviewed | Reviewed | Reviewed |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Balance as at 1 | 424,023 | 11,283,551 | (1,118,051) | 7,785,172 | 12,547,047 | 30,921,742 |

| January 2009 | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Profit for the | - | - | - | - | 766,938 | 766,938 |

| period | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Appropriation of | - | - | - | 143,589 | - | 143,589 |

| reserve funds | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Effect of exchange | - | - | - | 189,876 | - | 189,876 |

| rates | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Dividend paid | - | - | - | - | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Balance as at 30 | 424,023 | 11,283,551 | (1,118,051) | 8,118,637 | 13,313,985 | 32,022,145 |

| June 2009 | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Profit for the | - | - | - | - | 1,770,364 | 1,770,364 |

| period | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Transfer to | - | - | - | (468,722) | | (468,722) |

| statutory reserve | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Balance as at 31 | 424,023 | 11,283,551 | (1,118,051) | 7,649,915 | 15,084,349 | 33,323,787 |

| December 2009 | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Profit for the | - | - | - | - | (4,443,469) | (4,443,469) |

| period | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Effect of exchange | - | - | - | (588,705) | - | (588,705) |

| rates | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

| Balance as at 30 | 424,023 | 11,283,551 | (1,118,051) | 7,061,210 | 10,640,881 | 28,291,614 |

| June 2010 | | | | | | |

+----------------------+----------------------+------------+-------------+-----------+-------------+-------------+

NOTES TO THE INTERIM REPORT

1. The consolidated interim financial information has been reviewed, not

audited. The figures for the year ended 31 December 2009 have been extracted

from the financial statements which have been filed with the Registrar of

Companies. The auditors' report on those financial statements was unqualified

and did not contain a statement under section 498(2) of the Companies Act 2006.

2. The financial information set out in this report has been prepared in

accordance with accounting policies as set out in the Group's annual report and

financial statements for the year ended 31 December 2009 as described in those

financial statements except for the adoption of IAS 1 Presentation of Financial

Statements (Revised 2007).

3. Functional and presentation currency

Sterling is the functional currency of the Company as it is the currency of the

primary economic environment in which it operates. The US Dollar ("US$") is the

currency used to present the financial information in order to improve

understanding of the financial position of the Company by increasing

comparability with the financial information of Nanjing Skytech Co. Limited and

Jiangsu Sky Information Limited, the operating subsidiaries whose functional

currency is the Chinese Renminbi.

4. Segment information

The segment reporting format is determined to be business segments, as the

Group's principal activity is conducted in the People's Republic of China.

The Group's operations are organized into two operating divisions namely

software development and system integration.

The software segment provides export tax, e-Government and information

integration software.

The system integration provides consultancy and the implementation of IT

solutions, which includes provision of hardware and peripherals

+----------------------+--------------------+--------------------+--------------------+

| | Revenue |

| | |

+-------------------------------------------+-----------------------------------------+

| | 30 June | 30 June | 31 Dec |

+----------------------+--------------------+--------------------+--------------------+

| | 2010 | 2009 | 2009 |

+----------------------+--------------------+--------------------+--------------------+

| | US$ | US$ | US$ |

+----------------------+--------------------+--------------------+--------------------+

| | | | |

+----------------------+--------------------+--------------------+--------------------+

| Software development | 2,724,250 | 3,459,036 | 9,208,265 |

+----------------------+--------------------+--------------------+--------------------+

| System Integration | 2,040,070 | 1,084,077 | 5,305,044 |

+----------------------+--------------------+--------------------+--------------------+

| | | | |

+----------------------+--------------------+--------------------+--------------------+

| | 4,764,320 | 4,543,113 | 14,513,309 |

+----------------------+--------------------+--------------------+--------------------+

| | | | |

+----------------------+--------------------+--------------------+--------------------+

Attributable expenses cannot be allocated on a reasonable basis to the revenue

streams above. As a result, the segmental analysis is limited to the group

revenue and the group is unable to show operating profit for the primary

segmental analysis.

5. Earnings per share

The calculation of basic earnings per Ordinary Share and the fully diluted

earnings per Ordinary Share is based on the profit attributable to the Group and

the weighted average number of Ordinary Shares of each period.

+--------------------------+----------------+-------------+--------------+

| | 30 June | 30 June | 31 |

| | | | December |

+--------------------------+----------------+-------------+--------------+

| | 2010 | 2009 | 2009 |

+--------------------------+----------------+-------------+--------------+

| | US$ | US$ | US$ |

+--------------------------+----------------+-------------+--------------+

| | (reviewed) | (reviewed) | (audited) |

| | | | |

+--------------------------+----------------+-------------+--------------+

| | | | |

+--------------------------+----------------+-------------+--------------+

| Profit for the period | US$(4,443,469) | US$766,938 | US$3,654,813 |

| | | | |

+--------------------------+----------------+-------------+--------------+

| | | | |

+--------------------------+----------------+-------------+--------------+

| Number of shares - | 165,582,189 | 165,582,189 | 165,582,189 |

| weighted average - basic | | | |

+--------------------------+----------------+-------------+--------------+

| Basic earnings per share | US$(0.0268) | US$0.0046 | US$ |

| | | | 0.0221 |

+--------------------------+----------------+-------------+--------------+

| | | | |

+--------------------------+----------------+-------------+--------------+

| Number of shares - | 165,582,189 | 165,582,189 | 165,582,189 |

| weighted average - | | | |

| diluted | | | |

+--------------------------+----------------+-------------+--------------+

| Diluted earnings per | US$(0.0268) | US$0.0046 | US$0.0221 |

| share | | | |

+--------------------------+----------------+-------------+--------------+

6. Dividend

Sinosoft Technology Plc paid a dividend amounting to GBP513,305 on 19 July 2010

7. Related party transactions

The group had no related party transactions in the interim period for 2010 or

2009.

8. Events after the balance sheet date

Sinosoft Technology Plc entered into certain foreign exchange contracts which

have, in aggregate, resulted in a net loss to the Company of approximately

US$3.8 million (comprising total loss on investment of US$4.6 million and

finance cost of US$0.2 million less finance income of US$1 million) as of 30

June, 2010. The Company finally closed the foreign exchange positions on 16

July, 2010 with the total loss on the foreign exchange contracts increasing to

approximately US$ 5 million.

INDEPENDENT REVIEW REPORT

TO SINOSOFT TECHNOLOGY PLC

Introduction

We have been instructed by the Company to review the financial information for

the six months ended 30 June 2010, which comprises the consolidated income

statement, consolidated balance sheet, consolidated statement of changes in

equity, consolidated cash flow statement and related notes. We have read the

other information contained in the interim report and considered whether it

contains any apparent misstatements or material inconsistencies with the

financial information.

This report is made solely to the Company in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 issued by the Auditing

Practices Board. Our work has been undertaken so that we might state to the

Company those matters that we are required to state to them in an independent

review report and for no other purpose. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the Company, for

our review work, for this report, or for the conclusions we have formed.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by the Directors. Rule 18 of the

AIM Rules for Companies requires that the interim report must be presented and

prepared in a form consistent with that adopted in the Company's annual accounts

having regard to the accounting standards applicable to such annual accounts.

Review work performed

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410 issued by the Auditing Practices Board for use

in the United Kingdom. A review consists principally of making enquires of

Group management and applying analytical procedures to the financial information

and underlying financial data and, based thereon, assessing whether the

accounting policies and presentation have been consistently applied, unless

otherwise disclosed. A review excludes audit procedures such as tests of

controls and verification of assets, liabilities and transactions. It is

substantially less in scope than an audit performed in accordance with the

International Standards on Auditing (UK and Ireland) issued by the Auditing

Practices Board and therefore provides a lower level of assurance than an audit.

Accordingly we do not express an audit opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modification that

should be made to the consolidated financial information as presented for the

six months ended 30 June 2010.

SRLV

Chartered Accountants & Registered Auditors DATED: 14 September

2010

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR USRURRWAKAAR

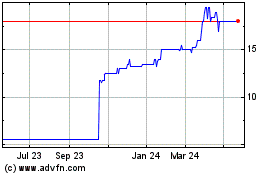

Software Circle (LSE:SFT)

Historical Stock Chart

From Apr 2024 to May 2024

Software Circle (LSE:SFT)

Historical Stock Chart

From May 2023 to May 2024