Urban Logistics REIT PLC Completion of acquisition (1969A)

10 September 2018 - 4:00PM

UK Regulatory

TIDMSHED

RNS Number : 1969A

Urban Logistics REIT PLC

10 September 2018

Urban Logistics REIT plc

("Urban Logistics" or the "Company")

Completion of acquisition

Further to the announcement of 11 April 2018, Urban Logistics is

pleased to announce that on Friday 7 September it completed the

second of two portfolio acquisitions totalling GBP36 million from

LondonMetric Plc.

As previously announced, the Company's recent acquisition

comprised two portfolios. It has now completed the acquisition of

Portfolio 2 at an aggregate acquisition price of GBP16.5 million,

representing a net initial yield of 5.8%. The gross consideration

including costs for Portfolio 2 was GBP17.9 million.

Portfolio 2 comprises three well located assets:

-- Northampton - a 45,243 sq ft warehouse let to Encon on an

annual rent of GBP225,000 until August 2023; with a rent review due

in September 2018;

-- Nottingham - a 113,717 sq ft warehouse let to Hillary's

Blinds on an annual rent of GBP568,310 until July 2027 (also

included is a 2.2 acre land site to the north of the warehouse);

and

-- Sheffield - a 54,556 sq ft warehouse let to Cogne UK on an

annual rent of GBP230,000 until September 2026, with a rent review

due in September 2021.

As previously announced, the gross consideration for Portfolios

1 and 2 is c.GBP38.7 million, (including purchaser costs of GBP2.4

million, principally SDLT and finance costs of GBP0.3 million)

representing a blended net initial yield of 5.9%. The Company is

now fully invested following its April 2018 capital raise.

Portfolios 1 and 2 have an average capital value of GBP72 per sq

ft, substantially below the cost of replacement, with low average

rents of GBP4.57 per sq ft and a weighted average unexpired lease

term of 5.5 years.

Commenting on the completion, Chief Executive, Richard Moffitt

said:

"Having fully deployed the investment capital raised in April in

another off-market acquisition, we are focused on developing the

value of our assets and sourcing new acquisition opportunities to

grow the business. Structural demand for well-located urban

logistics assets serving the needs of UK businesses remains

strong."

For further information contact:

Urban Logistics REIT plc

Richard Moffitt +44 (0)20 7591 1600

Montfort - Financial PR and IR adviser

Olly Scott +44 (0)78 1234 5205

N+1 Singer - Nominated Adviser and Broker

James Maxwell

James Moat +44 (0)20 7496 3000

About Urban Logistics REIT

Urban Logistics REIT plc is a property investment company,

quoted on the AIM market of the London Stock Exchange, (AIM:

SHED).

The Company has been established to invest in UK-based

industrial and logistics properties with the objective of

generating attractive dividends and capital returns for its

shareholders. Its investment strategy focuses on strategically

located smaller single let industrial and logistics properties

servicing high-quality tenants. Investment returns will be

generated by an experienced management team focusing on quality

stock selection and active asset management.

A number of structural and commercial factors currently support

the attractive opportunity in the last mile/regional industrial and

logistics real estate sub-sectors targeted by the Company,

including: strong occupier demand, (driven by the growth of

e-commerce and investment by retailers in their associated supply

chain) and a decline in the supply of lettable space in industrial

and logistics real estate across the UK, (being more than one third

lower than the most recent peak of 2009).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQDVLBBVKFBBBE

(END) Dow Jones Newswires

September 10, 2018 02:00 ET (06:00 GMT)

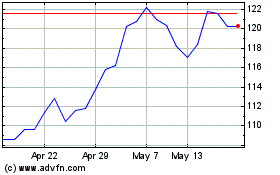

Urban Logistics Reit (LSE:SHED)

Historical Stock Chart

From Jan 2025 to Feb 2025

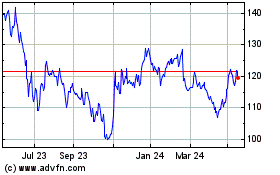

Urban Logistics Reit (LSE:SHED)

Historical Stock Chart

From Feb 2024 to Feb 2025