Secure Property Dev & Inv PLC Corporate update & Accounts Publication Extension (5680P)

11 June 2020 - 4:00PM

UK Regulatory

TIDMSPDI

RNS Number : 5680P

Secure Property Dev & Inv PLC

11 June 2020

Secure Property Development & Investment PLC/ Index: AIM /

Epic: SPDI / Sector: Real Estate

Secure Property Development & Investment PLC ('SPDI' or 'the

Company')

Corporate update and Accounts Publication Extension

Secure Property Development and Investment PLC, (AIM: SPDI), the

South Eastern European focused property and investment company, is

pleased to provide an update on its corporate activities, including

the impact on its business of the COVID-19 virus, as well as

progress being made on the transaction with the Arcona Property

Fund N.V. ('Arcona'). The Company also announces that it has been

granted by AIM Regulation an additional period of up to three

months to publish its annual audited accounts for the year ended 31

December 2019.

Commercial property portfolio unaffected by COVID-19

SPDI is pleased to report that as a result of its property

operations being focused on the food and the telco sectors, all of

the large/anchor tenants in the Company's properties in Bucharest,

including Favorit, a 3PL logistics operator servicing Carrefour;

Danone, the international food company; ANCOM, the Romanian

Telecoms Regulatory Authority; and the supermarket chain Mega

Image, have experienced little or no disruption from either the

COVID-19 crisis or the lockdown in Romania. As a result, at this

current time, the Directors are confident that the Company's

results for the 2020 financial year will not suffer any material

adverse effects from the coronavirus pandemic crisis.

Like other companies all over the world, during the pandemic,

SPDI has experienced both delayed payment receipts as well as

general delays when interacting with banks, lawyers, accountants,

and auditors, most of whom were home bound, while carrying out its

business activities. While the Directors believe conditions are

returning to normal, during the last three months site visits

required to carry out property valuations as part of the annual

audit have been prohibited by lockdowns in the respective

countries. The lockdowns have also affected the annual audit with

accountants and auditors in all related countries (Romania,

Bulgaria, Ukraine, Cyprus) working from home.

As a result of the above, SPDI applied to AIM Regulation for a

three month extension to the period pursuant to AIM Rule 19 that

the Company is required to publish its annual accounts within six

months of the year end (further to the guidance provided by AIM

Regulation in Inside AIM on 26 March 2020). This extension has been

granted and accordingly, SPDI expects to publish its full year

audited accounts by no later than 30 September 2020.

2019 FY Results expected to be in line with forecasts

The Directors are pleased to report that the Company's 2019

results are expected to be in line with management expectations.

With all its commercial properties almost fully let, annual rental

income for the 2019 year stands at EUR2,1m, an 18% increase

compared to the previous year when the effect of assets sold in

2018 is stripped out.

The improved financial performance is largely due to the

temperature-controlled component of the Innovations Terminal in

Bucharest being fully let during the year. 2019 year-end cash

experienced a minor cash management-related drop to EUR738k. The

combination of the relatively positive economic performance of the

countries in which SPDI is active and the strong rental income from

the Company's properties indicates that the value of the Company's

properties will likely be maintained as part of the 2019 audit. As

mentioned earlier, the respective valuations of the Company's

properties are currently taking place after being delayed by the

COVID-19 outbreak.

Arcona Property Fund Transaction

As previously announced, SPDI agreed to transfer its property

portfolio, excluding its Greek logistics properties, to Arcona

Property Fund ("Arcona") in exchange for new shares and warrants in

Arcona to create a larger Central and South Eastern European

focused investment vehicle ('the Transaction'). The Transaction, as

previously announced, is being implemented in three stages.

Stage One of the Transaction, as per announcements on 1 November

2019 and on 6 December 2019, saw the transfer of certain of its

Ukrainian assets as well as all of its Bulgarian assets, in

exchange for 593,534 new shares in Arcona and 144,264 warrants over

shares in Arcona. Stage One of the Transaction has completed.

Discussions with Arcona for the completion of Stage 2 of the

Transaction are progressing slowly during the pandemic and enforced

lockdowns. However the Company expects activity to pick up as

measures put in place to combat COVID-19 in the various related

jurisdictions (Holland, Czech Republic for Arcona, Romania, Cyprus

and the UK for SPDI) are eased, but with signing and closing of

Stage 2 now expected not before Q4 2020. Discussions regarding

Stage 3 of the Transaction are at a preliminary stage.

Lambros Anagnostopoulos, Chief Executive Officer of SPDI, said;

"SPDI places the safety and wellbeing of its employees as its

highest priority. The situation in respect of COVID-19 is an

evolving one and the Board will continue to review its potential

impact on its staff and the business and provide further updates as

appropriate. In the meantime, we are highly encouraged by the

financial performance of the Company to date, which we view as

testament to our focus on prime retail estate in excellent

locations, fast growing economies in South Eastern Europe and blue

chip tenants operating in defensive industries."

**ENDS**

For further information, please visit www.secure-property.eu or

contact:

Lambros Anagnostopoulos SPDI Tel: +357 22 030783

Rory Murphy Strand Hanson Limited Tel: +44 (0) 20 7409 3494

Ritchie Balmer

Jack Botros

Jon Belliss Novum Securities Limited Tel: +44 (0) 207 399 9400

Frank Buhagiar St Brides Partners Ltd Tel: +44 (0) 20 7236 1177

Cosima Akerman

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGPUCAQUPUGPU

(END) Dow Jones Newswires

June 11, 2020 02:00 ET (06:00 GMT)

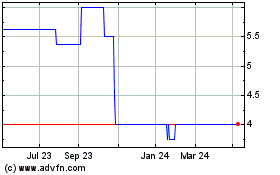

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Feb 2024 to Feb 2025