TIDMSTAN

RNS Number : 5510C

Standard Chartered PLC

02 May 2012

Standard Chartered PLC

Interim Management Statement

2 May 2012

Standard Chartered today releases its Interim Management

Statement (IMS) for the first quarter of 2012.

Peter Sands, Group Chief Executive, commented, "Standard

Chartered has had a strong start to 2012, with good performances

across a broad spread of geographies and products. We continue to

benefit from the disciplined execution of our strategy and are very

well positioned in dynamic markets with strong fundamentals. We are

in excellent shape, we are a growth company and are differentiated

by our liquidity and capital strength. Macroeconomic sentiment is

showing signs of improvement, although there remain clear

uncertainties and risks in the global environment."

The Group had a strong start to the year, with high single digit

income growth over the comparative period of 2011. The Group's

first quarter performance builds on the excellent momentum seen at

the end of 2011 with good income progression in both businesses

over the comparable period. Income growth has, however, been

impacted by the continued strength of the USD against Asian

currencies in the first quarter, as indicated at the time of the

full year results.

From a geographic perspective, diverse double digit income

growth in Hong Kong, Malaysia, Indonesia, China and the Americas,

UK and Europe region has more than compensated for the impact of

subdued domestic business sentiment in India. In Korea, we continue

to make progress with the repositioning of our business and are

seeing the benefits of the Early Retirement Programme (ERP) in the

cost line.

Across the Group, expenses remain under tight control; in the

first quarter income growth exceeded cost growth. Headcount levels

at the end of the first quarter were broadly flat on the end of

2011. In light of the Group's strong start to 2012 we have approved

an accelerated release of investment spend over and above budget

levels.

In the first quarter loan impairment was above the level seen in

the comparable period of 2011, in line with expectation, with

credit quality remaining good. The increase year on year was driven

by Consumer Banking, where loan impairment has increased in line

with disciplined growth in the book and mix change, as previously

guided.

Overall the Group delivered low double digit growth in operating

profit in the first quarter over the comparable period in 2011.

The Group remains highly liquid and well capitalised and we

continue to see disciplined growth on both sides of the balance

sheet, in both Consumer Banking and Wholesale Banking. Risk

Weighted Asset growth was well controlled in the first quarter of

2012.

Consumer Banking

Consumer Banking delivered good single digit income growth on

the first quarter of 2011.

Income continued to be broadly spread, with Deposit income

growing at a double digit rate, reflecting good volume growth and

improved margins. Credit Cards and Personal Loans performed well,

with double digit income growth year on year, as we selectively

grew our unsecured business, especially in Hong Kong, Singapore,

Malaysia, Taiwan and Korea.

Wealth Management income was in line with the strong first

quarter of 2011 and up on the run rate seen in the second half of

2011. Mortgage income was down on the first quarter of 2011 with

assets broadly stable on the year end position and continued margin

pressure.

SME performed well, with double digit income growth over the

comparable period in 2011, driven by Trade and Cash Management.

Expenses have been well controlled in the first quarter of 2012,

and were up on the comparable period in 2011 by a single digit

rate.

There has been growth on both sides of the balance sheet since

the year end, with a partial benefit from currency translation.

Liability margins in the first quarter increased on the year end

position, whilst asset margins were broadly flat on the level seen

during the second half of 2011.

Asset quality continues to be good within the Consumer Banking

business, reflecting our disciplined approach to risk management

and stable leading indicators. Loan impairment was, as expected,

higher than the run rate in the second half of 2011, by a mid

single digit rate, reflecting continued growth in the portfolio and

deliberate shifts in product mix.

Wholesale Banking

The Wholesale Banking business had a strong start to 2012 with

client income growing at a high single digit rate over the

comparable period in 2011. Client income continued to contribute

around 80 per cent of total Wholesale Banking income.

Commercial banking, by which we mean Cash, Trade and associated

FX, continues to be the core of our Wholesale Banking business and

performed well in the first quarter. Margins in Cash were broadly

stable and margins in Trade improved compared to the second half of

2011. Cash and Trade average balances continue to grow well,

however, the rate of growth in balances moderated compared to the

growth seen in 2011 due to a combination of reduced growth in

market activity, our stance on pricing and increased competition.

Transaction Banking income showed strong double digit growth over

the first quarter of 2011.

In Corporate Finance, income in the first quarter of 2012 was

marginally down on the very strong comparative period in 2011. The

deal pipeline remains robust.

Financial Markets client income showed high single digit income

growth over the first quarter of 2011. Compared to the second half

run rate of 2011 Financial Markets client income grew at a strong

double digit rate, with double digit growth in FX, Rates and

Credit. Volumes in the first quarter of 2012 were up on the

comparable period in 2011.

Own account income grew at a low double digit rate year on year.

Financial Markets own account income was down on the comparable

period in 2011, which was a very strong quarter. However, ALM and

Principal Finance income grew at a double digit rate.

Wholesale Banking expenses were marginally above the run rate

seen in the second half of 2011.

Whilst we continue to monitor closely a small number of

accounts, overall asset quality remains good. The loan impairment

charge in the first quarter was, as expected, very low.

Group

Overall, the Group had a strong start to the year, building on a

strong close to 2011, underpinned by continued momentum in the

balance sheet and well diversified income streams. The Group

remains very well capitalised and highly liquid. We look forward to

providing a further performance update in our pre-close trading

statement in June.

For further information, please contact:

James Hopkinson, Head of Investor Relations +44 (0)20 7885 7151

Ashia Razzaq, Head of Investor Relations, Asia +852 2820 3958

Jon Tracey, Head of Media Relations +44 (0)20 7885 7613

This announcement contains or incorporates by reference

'forward-looking statements' regarding the belief or current

expectations of Standard Chartered, the Directors and other members

of its senior management about the Company's businesses and the

transactions described in this announcement. Generally, words such

as "may", "could", "will", "expect", "intend", "estimate",

"anticipate", "believe", "plan", "seek", "continue" or similar

expressions identify forward-looking statements.

These forward-looking statements are not guarantees of future

performance. Rather, they are based on current views and

assumptions and involve known and unknown risks, uncertainties and

other factors, many of which are outside the control of the Company

and/or its Group and are difficult to predict, that may cause

actual results to differ materially from any future results or

developments expressed or implied from the forward-looking

statements. Such risks and uncertainties include changes in the

credit quality and the recoverability of loans and amounts due from

counterparties; changes in the Group's financial models

incorporating assumptions, judgments and estimates which may change

over time; risks relating to capital, capital management and

liquidity; risks arising out of legal and regulatory matters,

investigations and proceedings; the policies and actions of

regulatory authorities; the impact of tax; operational risks

inherent in the Group's business; risks arising out of the Group's

holding company structure; risks associated with the recruitment,

retention and development of senior management and other skilled

personnel; risks associated with business expansion and engaging in

acquisitions; global macroeconomic risks; risks arising out of the

dispersion of the Group's operations, the locations of its

businesses and the legal, political and economic environment in

such jurisdictions; competition; risks associated with the UK

Banking Act 2009 and other similar legislation or regulations;

changes in the credit ratings or outlook for the Group; market,

interest rate, commodity prices, equity price and other market

risk; foreign exchange risk; financial market volatility; systemic

risk in the banking industry and amongst other financial

institutions or corporate borrowers; cross-border country risk;

risks arising from operating in markets with less developed

judicial and dispute resolution systems; risks arising out of

regional hostilities, terrorist attacks, social unrest or natural

disasters and failure to generate sufficient level of profits and

cash flows to pay future dividends.

Any forward-looking statement contained in this announcement

based on past or current trends and/or activities of Standard

Chartered should not be taken as a representation that such trends

or activities will continue in the future. No statement in this

announcement is intended to be a profit forecast or to imply that

the earnings of the Company for the current year or future years

will necessarily match or exceed the historical or published

earnings of the Company.

Each forward-looking statement speaks only as of the date of the

particular statement. Save in respect of any requirement under

applicable law or regulation, Standard Chartered expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Standard Chartered's expectations

with regard thereto or any change in events, conditions or

circumstances on which any such statement is based.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSGMGGKDZZGZZG

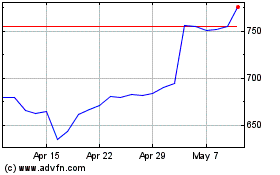

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Jan 2025 to Feb 2025

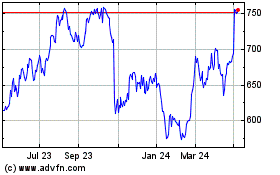

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Feb 2024 to Feb 2025