TIDMSUPR

RNS Number : 0962W

Supermarket Income REIT PLC

08 December 2023

8 December 2023

SUPERMARKET INCOME REIT PLC

(the "Company")

RESULT of ANNUAL GENERAL MEETING

Supermarket Income REIT plc (LSE: SUPR), announces that at the

Company's Annual General Meeting ("AGM") held on Thursday, 7

December 2023, all resolutions were passed on a poll and the

results of the poll and proxy votes received are set out below.

Resolutions 1 to 13 (inclusive) were proposed as ordinary

resolutions and resolutions 14 to 17 (inclusive) were proposed as

special resolutions.

Resolution Votes For* % Votes Against % Total votes Total votes Vote Withheld

validly cast cast as % of **

issued share

capital

Receive annual

accounts for

year ended 30

1 June 2023 766,101,824 99.67% 2,539,700 0.33% 768,641,524 61.68% 735,070

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

Approve

Directors'

remuneration

2 report 765,925,240 99.81% 1,451,488 0.19% 767,376,728 61.58% 1,999,866

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

Approve

Company's

dividend

3 policy 769,285,466 99.99% 54,697 0.01% 769,340,163 61.73% 36,431

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

4 Authority to 768,933,870 99.95% 387,483 0.05% 769,321,353 61.73% 55,241

offer a scrip

dividend

alternative

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

Re-elect Nick

Hewson as a

5 Director 759,233,086 99.11% 6,855,261 0.89% 766,088,347 61.47% 3,288,247

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

Re-elect

Vincent Prior

6 as a Director 763,478,826 99.26% 5,677,298 0.74% 769,156,124 61.72% 220,470

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

Re-elect Jon

Austen as a

7 Director 769,005,561 99.98% 149,529 0.02% 769,155,090 61.72% 221,504

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

8 Re-elect 766,495,487 99.98% 181,343 0.02% 766,676,830 61.52% 2,699,764

Cathryn

Vanderspar as

a Director

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

Re-elect

Frances Davies

9 as a Director 766,528,990 99.98% 147,840 0.02% 766,676,830 61.52% 2,699,764

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

Elect Sapna

Shah as a

10 Director 768,963,901 99.98% 190,952 0.02% 769,154,853 61.72% 221,741

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

11 To re-appoint 766,412,454 99.99% 91,890 0.01% 766,504,344 61.51% 2,872,250

BDO LLP as the

Company's

auditor

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

12 To authorise 769,035,397 99.96% 282,176 0.04% 769,317,573 61.73% 59,021

the board of

Directors to

determine the

auditors'

remuneration

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

13 To authorise 751,636,575 97.70% 17,670,821 2.30% 769,307,396 61.73% 69,198

the Directors

to allot

shares under

section 551

Companies Act

2006

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

14 To disapply 737,701,288 96.07% 30,150,701 3.93% 767,851,989 61.61% 1,524,605

statutory

pre-emption

rights under

section 570

Companies Act

2006

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

15 To disapply 732,613,753 95.47% 34,779,901 4.53% 767,393,654 61.58% 1,982,940

statutory

pre-emption

rights under

section 570

Companies Act

2006 up to a

further

10%

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

16 To authorise 740,369,984 97.31% 20,431,676 2.69% 760,801,660 61.05% 8,574,934

the Company to

make market

purchase of

its own

ordinary

shares

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

17 To permit 740,960,439 96.32% 28,325,282 3.68% 769,285,721 61.73% 90,873

general

meetings to be

called on 14

days' notice

--------------- ------------ ------- -------------- ------ --------------- --------------- ---------------

* Includes discretionary votes

** A vote withheld is not a vote in law and is not counted in

the calculation of the votes for or against a resolution.

Every shareholder has one vote for every Ordinary Share held. As

at 7 December 2023, the share capital of the Company consisted of

1,246,236,185 Ordinary Shares with voting rights. The Company does

not hold any shares in Treasury.

In accordance with Listing Rule 9.6.2 copies of all the

resolutions passed, other than ordinary business, will be submitted

to the National Storage Mechanism and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

FOR FURTHER INFORMATION

Atrato Capital Limited +44 (0)20 3790 8087

Steven Noble / Rob Abraham / Chris ir@atratocapital.com

McMahon

Stifel Nicolaus Europe Limited +44 (0)20 7710 7600

Mark Young / Matt Blawat / Rajpal

Padam

Goldman Sachs International

Jimmy Bastock / Tom Hartley +44 (0)20 7774 1000

FTI Consulting +44 (0)20 3727 1000

Dido Laurimore / Eve Kirmatzis SupermarketIncomeREIT@fticonsulting.com

/ Andrew Davis

Hanway Advisory Limited +44 (0)7407 825 603

Luke Cheshire / Rebecca Lillington cosec@hanwayadvisory.com

NOTES TO EDITORS:

Supermarket Income REIT plc (LSE: SUPR) is a real estate

investment trust dedicated to investing in grocery properties which

are an essential part of the UK's feed the nation infrastructure.

The Company focuses on grocery stores which are omnichannel,

fulfilling online and in-person sales. All of the Company's

supermarkets are let to leading UK supermarket operators,

diversified by both tenant and geography.

The Company provides investors with attractive, long-dated,

secure, inflation-linked, growing income with the potential for

capital appreciation over the longer term.

The Company is listed on the premium segment of the Official

List of the UK Financial Conduct Authority and its Ordinary Shares

are traded on the Main Market of the London Stock Exchange, having

listed initially on the Specialist Fund Segment of the Main Market

on 21 July 2017.

Atrato Capital Limited is the Company's Investment Adviser.

Further information is available on the Company's website

www.supermarketincomereit.com

LEI: 2138007FOINJKAM7L537

Stifel Nicolaus Europe Limited, which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively for Supermarket Income REIT plc and no one

else in connection with this announcement and will not be

responsible to anyone other than the Company for providing the

protections afforded to clients of Stifel Nicolaus Europe Limited

nor for providing advice in connection with the matters referred to

in this announcement.

Goldman Sachs International, which is authorised by the

Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority in the

United Kingdom, is acting exclusively for Supermarket Income REIT

plc and no one else in connection with this announcement and will

not be responsible to anyone other than the Company for providing

the protections afforded to clients of Goldman Sachs International

nor for providing advice in connection with the matters referred to

in this announcement.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGFSMFWWEDSEDE

(END) Dow Jones Newswires

December 08, 2023 02:00 ET (07:00 GMT)

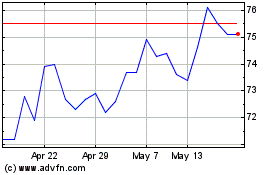

Supermarket Income Reit (LSE:SUPR)

Historical Stock Chart

From Apr 2024 to May 2024

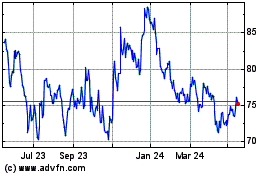

Supermarket Income Reit (LSE:SUPR)

Historical Stock Chart

From May 2023 to May 2024