TIDMSYNT

RNS Number : 0990Q

Synthomer PLC

16 June 2020

16th June 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, CANADA, JAPAN

OR AUSTRALIA OR ANY OTHER JURISDICTION IN WHICH IT WOULD BE

UNLAWFUL TO DO SO

Synthomer plc

Announcement of intention to offer EUR520 million of unsecured

senior notes and Q2 trading update

Synthomer plc ('Synthomer' or 'the Group') today announces that

it intends, subject to market conditions, to offer EUR520 million

in aggregate principal amount of unsecured senior notes due 2025

(the 'Notes'). The Notes will be unconditionally guaranteed by

certain of its subsidiaries.

OMNOVA acquisition

Consistent with previously announced plans, the Group intends to

use the proceeds from the offering to (a) refinance Synthomer's

existing EUR520 million bridge facility which was introduced in

2019 as part of the financing arrangements to fund, together with

certain other funding, the acquisition of OMNOVA Solutions Inc.

('OMNOVA') and (b) pay certain costs, expenses and fees related to

the offering of the Notes. The acquisition has established

Synthomer as a global speciality chemicals company with significant

scale and a strong platform from which to invest in future growth.

Integration is progressing in line with expectations and the Group

is on track to deliver $29.6m of synergies, with a 50% run rate at

the end of 12 months.

Following the issuance of the Notes, Synthomer expects to have a

long term and sustainable financing structure. The Group has a

strong balance sheet with significant leverage covenant headroom

(4.25x and 4x EBITDA for 2020 and 2021 respectively) and

significant liquidity underpinned by the 2024 committed unsecured 5

year EUR460 million revolving credit facility and $260 million term

loan bank facilities.

The new financing structure will give Synthomer flexibility to

be able to respond to the current challenging macroeconomic

environment and in due course be able to take advantage of future

growth opportunities.

April and May Trading

In addition, Synthomer today provides its Q1 interim financial

statements and an update on current trading which have been

prepared in connection with the Group's Notes offering:

As announced previously, Synthomer (excluding OMNOVA),

experienced a solid start to the year with EBITDA approximately 5%

ahead of the comparative Q1 period, and in line with expectations

set out at the time of the Group's full year results

announcement.

On April 1(st) , 2020, Synthomer completed the acquisition of

OMNOVA and accordingly our Q2 trading update relates to the

enlarged group comprising the Synthomer and OMNOVA legacy

businesses. April and May volumes were impacted by COVID-19 and

whilst demand for Nitrile latex, non-wovens and adhesives remained

strong, sales into industrial markets including automotive,

coatings, graphic paper, carpet and the oil and gas sector were

lower. Volumes were lower than a strong comparative period by

approximately 20% although volumes did strengthen towards the end

of May.

Performance Elastomers

During April and May our Nitrile latex business continued to

benefit from the additional 90 kilotonnes of capacity introduced in

Q4 2018 at our Pasir Gudang site. In addition, we saw further

strengthening of demand due to COVID-19 leading to higher Nitrile

volumes. Nitrile unit gross margins improved during April and May

on the back of lower raw material cost.

Styrene Butadiene Rubber ('SBR') market conditions were impacted

due to weaker demand with volumes and unit gross margins below

prior year in the paper, carpet and foam end markets. The strategic

review of our European SBR network is ongoing and a further update

is expected to be provided at the interim results in August.

Functional Solutions

April and May volumes were lower in all industrial segments

compared to a strong comparative period, but this was partly

compensated for by stronger unit gross margins as a result of

improved mix and softer raw material markets. Progress has been

supported by the acquisition of OMNOVA and by the expansion of our

dispersion facilities in Worms, Germany and Roebuck, USA which

introduced low cost capacity to drive organic growth in

differentiated applications.

Industrial Specialities

April and May volumes were lower in all industrial segments

compared to a strong comparative period. Unit gross margins were in

line with 2019.

Acrylate Monomers

Going forward Synthomer's acrylate monomer business, which

supplies both the Group's internal demand and external customers,

will be reported separately. In April and May, sales volumes and

margins were lower compared to the comparative 2019 period.

As announced in the Group's update on April 29(th) , Synthomer

has taken a number of prudent and proactive actions to preserve the

strength of its balance sheet and reduce capital expenditure for

the current year. Over the medium term the Board remains confident

that Synthomer is well positioned due to the Group's strong

geographic and end market diversity combined with self-help

initiatives and the future benefits to come from the successful

acquisition and integration of OMNOVA.

For additional information regarding our business, please see

our Disclosure Statement found on our website at

https://www.synthomer.com/investor-relations/financials/results-centre.

Cautionary Statement

The Notes will be offered only to qualified institutional buyers

pursuant to Rule 144A and outside the United States pursuant to

Regulation S under the U.S. Securities Act of 1933, as amended (the

'Securities Act'), subject to prevailing market and other

conditions. There is no assurance that the offering will be

completed or, if completed, as to the terms on which it is

completed. The Notes to be offered have not been registered under

the Securities Act or the securities laws of any other jurisdiction

and may not be offered or sold in the United States absent

registration or unless pursuant to an applicable exemption from the

registration requirements of the Securities Act and any other

applicable securities laws. This press release does not constitute

an offer to sell or the solicitation of an offer to buy the Notes,

nor shall it constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

The Notes are not intended to be offered, sold or otherwise made

available to and should not be offered, sold or otherwise made

available to any retail investor in the European Economic Area

('EEA') or the United Kingdom. For these purposes, a retail

investor means a person who is one (or more) of: (i) a retail

client as defined in point (11) of Article 4(1) of Directive

2014/65/EU (as amended, 'MiFID II'); (ii) a person that is not a

qualified investor as defined in Article 2(e) of the Prospectus

Regulation; or (iii) a customer within the meaning of Directive

(EU) 2016/97 (as amended, the 'Insurance Distribution Directive'),

where that customer would not qualify as a professional client as

defined in point (10) of Article 4(1) of MiFID II.

This announcement does not constitute and shall not, in any

circumstances, constitute a public offering nor an invitation to

the public in connection with any offer within the meaning of

Regulation (EU) 2017/1129 (as amended or superseded, the

'Prospectus Regulation'). The offer and sale of the Notes will be

made pursuant to an exemption under the Prospectus Regulation from

the requirement to produce a prospectus for offers of

securities.

In the United Kingdom, this announcement is directed only at (i)

persons having professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 (the

'Order'), or (ii) high net worth entities falling within Article

49(2)(a) to (d) of the Order, or (iii) persons to whom it would

otherwise be lawful to distribute them, all such persons together

being referred to as 'Relevant Persons.' The Notes are only

available to, and any invitation, offer or agreement to subscribe,

purchase or otherwise acquire such Notes will be engaged in only

with, Relevant Persons.

MiFID II professionals/ECPs-only/ No PRIIPs KID - Manufacturer

target market (MIFID II product governance) is eligible

counterparties and professional clients only (all distribution

channels). No PRIIPs key information document (KID) has been

prepared as not available to retail investors in EEA or the United

Kingdom.

Neither the content of Synthomer's website nor any website

accessible by hyperlinks on Synthomer's website is incorporated in,

or forms part of, this announcement. The distribution of this

announcement into certain jurisdictions may be restricted by law.

Persons into whose possession this announcement comes should inform

themselves about and observe any such restrictions. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

This announcement contains inside information within the meaning

of Regulation (EU) No 596/2014 of 16 April 2014 on market

abuse.

Forward-Looking Statements

This press release may include forward-looking statements. These

forward-looking statements can be identified by the use of

forward-looking terminology, including the terms 'believes',

'estimates', 'anticipates', 'expects', 'intends', 'may', 'will' or

'should' or, in each case, their negative, or other variations or

comparable terminology. These forward-looking statements include

all matters that are not historical facts and include statements

regarding Synthomer's or its affiliates' intentions, beliefs or

current expectations concerning, among other things, Synthomer's or

its affiliates' results of operations, financial condition,

liquidity, prospects, growth, strategies and the industries in

which they operate. By their nature, forward-looking statements

involve risks and uncertainties because they relate to events and

depend on circumstances that may or may not occur in the future.

Readers are cautioned that forward-looking statements are not

guarantees of future performance and that Synthomer's or its

affiliates' actual results of operations, financial condition and

liquidity, and the development of the industries in which they

operate may differ materially from those made in or suggested by

the forward-looking statements contained in this press release. In

addition, even if Synthomer's or its affiliates' results of

operations, financial condition and liquidity, and the development

of the industries in which they operate are consistent with the

forward-looking statements contained in this press release, those

results or developments may not be indicative of results or

developments in subsequent periods.

The forward-looking statements and information contained in this

announcement are made as of the date hereof and Synthomer

undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

-S-

Enquiries:

Synthomer plc Tel: + 44 7764 859147

Calum MacLean, Chief Executive Officer

Stephen Bennett, Chief Financial Officer

Tim Hughes, President, Corporate Development

Teneo Tel: + 44 7703 330 269

Charles Armitstead / Matt Denham

Consolidated income statement

for the three months ended 31 March 2020

Three months ended Three months ended

31 March 2020 31 March 2019

(unaudited) (unaudited)

----------------------------------- ---------------------------

Underlying Special Underlying Special

performance Items IFRS performance Items IFRS

GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Revenue 338.4 338.4 375.1 375.1

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Company and subsidiaries before

Special Items 31.7 - 31.7 30.5 - 30.5

Acquisition costs and related

gains - 6.0 6.0 - - -

Amortisation of acquired

intangibles - (2.1) (2.1) - (2.4) (2.4)

Restructuring and site closure

costs - - - - (0.5) (0.5)

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Company and subsidiaries 31.7 3.9 35.6 30.5 (2.9) 27.6

Share of joint ventures 0.6 - 0.6 0.3 - 0.3

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Operating profit/(loss) 32.3 3.9 36.2 30.8 (2.9) 27.9

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Interest payable (1.6) - (1.6) (1.6) - (1.6)

Interest receivable 0.2 - 0.2 0.2 - 0.2

Fair value loss on unhedged interest

derivatives - (2.2) (2.2) - (1.9) (1.9)

------------------------------------- ------- ----- ------------------ ------------ ------- --------

(1.4) (2.2) (3.6) (1.4) (1.9) (3.3)

Net interest expense on defined

benefit obligation (0.5) - (0.5) (0.7) - (0.7)

Interest element of lease payments (0.3) - (0.3) (0.3) - (0.3)

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Finance costs (2.2) (2.2) (4.4) (2.4) (1.9) (4.3)

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Profit/(loss) before taxation 30.1 1.7 31.8 28.4 (4.8) 23.6

Taxation (5.4) 0.3 (5.1) (4.0) 0.4 (3.6)

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Profit/(loss) for the period 24.7 2.0 26.7 24.4 (4.4) 20.0

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Profit/(loss) attributable to

non-controlling interests - - - - 0.1 0.1

Profit/(loss) attributable to

equity holders of the parent 24.7 2.0 26.7 24.4 (4.5) 19.9

------------------------------------- ------- ----- ------------------ ------------ ------- --------

24.7 2.0 26.7 24.4 (4.4) 20.0

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Earnings/(loss) per share

Basic 5.8p 0.5p 6.3p 6.7p (1.2)p 5.5p

Diluted 5.8p 0.5p 6.3p 6.6p (1.2)p 5.4p

------------------------------------- ------- ----- ------------------ ------------ ------- --------

Consolidated income statement

for the three months ended 31 March 2020 (continued)

Year ended 31 December

2019

(audited)

------------------------------

Underlying Special

performance Items IFRS

GBPm GBPm GBPm

---------------------------------------- --- ------------ ------- -------

Revenue 1,459.1 - 1,459.1

--------------------------------------------- ------------ ------- -------

Company and subsidiaries before

Special Items 124.9 - 124.9

Acquisition costs - (9.2) (9.2)

Amortisation of acquired intangibles - (8.7) (8.7)

Restructuring and site closure - (0.8) (0.8)

Foreign Exchange gain on rights

issue - 3.5 3.5

Company and subsidiaries 124.9 (15.2) 109.7

Share of joint ventures 0.9 - 0.9

--------------------------------------------- ------------ ------- -------

Operating profit/(loss) 125.8 (15.2) 110.6

--------------------------------------------- ------------ ------- -------

Interest payable (6.7) - (6.7)

Interest receivable 0.9 - 0.9

Fair value loss on unhedged

interest derivatives - (0.5) (0.5)

--------------------------------------------- ------------ ------- -------

(5.8) (0.5) (6.3)

Net interest expense on defined

benefit obligation (2.7) - (2.7)

Interest element of lease

payments (1.1) - (1.1)

--------------------------------------------- ------------ ------- -------

Finance costs (9.6) (0.5) (10.1)

--------------------------------------------- ------------ ------- -------

Profit/(loss) before taxation 116.2 (15.7) 100.5

Taxation (16.3) 1.4 (14.9)

--------------------------------------------- ------------ ------- -------

Profit/(loss) for the year 99.9 (14.3) 85.6

--------------------------------------------- ------------ ------- -------

Profit attributable to non-controlling

interests 0.4 0.6 1.0

Profit/(loss) attributable

to equity holders of the parent 99.5 (14.9) 84.6

--------------------------------------------- ------------ ------- -------

99.9 (14.3) 85.6

-------------------------------------------- ------------ ------- -------

Earnings/(loss) per share

Basic 25.3p (3.8)p 21.5p

Diluted 25.2p (3.8)p 21.4p

--------------------------------------------- ------------ ------- -------

Consolidated statement of comprehensive income

for the three months ended 31 March 2020

Three months ended Three months ended

31 March 2020 31 March 2019

(unaudited) (unaudited)

-------------------------------- ---------------------------------

Equity Equity

holders holders

of the Non-controlling of the Non-controlling

parent interests Total parent interests Total

GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------------- -------- --------------- ----- -------- --------------- ------

Profit for the period 26.7 - 26.7 19.9 0.1 20.0

------------------------------------- -------- --------------- ----- -------- --------------- ------

Actuarial gains/(losses) 12.6 - 12.6 (13.9) - (13.9)

Tax relating to components of

other comprehensive income (4.0) - (4.0) 4.4 - 4.4

------------------------------------- -------- --------------- ----- -------- --------------- ------

Total items that will not be

reclassified to profit or loss 8.6 - 8.6 (9.5) - (9.5)

------------------------------------- -------- --------------- ----- -------- --------------- ------

Exchange differences on translation

of foreign operations 12.8 0.4 13.2 (10.0) (0.2) (10.2)

Fair value loss on hedged interest

derivatives (0.7) - (0.7) (5.3) - (5.3)

Gains on net investment hedges

taken to equity - - - 0.3 - 0.3

Total items that may be reclassified

subsequently to profit or loss 12.1 0.4 12.5 (15.0) (0.2) (15.2)

------------------------------------- -------- --------------- ----- -------- --------------- ------

Other comprehensive income/(expense)

for the period 20.7 0.4 21.1 (24.5) (0.2) (24.7)

Total comprehensive income/(expense)

for the period 47.4 0.4 47.8 (4.6) (0.1) (4.7)

------------------------------------- -------- --------------- ----- -------- --------------- ------

Year ended 31 December

2019 (audited)

---------------------------------

Equity

holders

of the Non-controlling

parent interests Total

GBPm GBPm GBPm

------------------------------------------ -------- --------------- ------

Profit for the year 84.6 1.0 85.6

------------------------------------------- -------- --------------- ------

Actuarial losses (27.2) - (27.2)

Tax relating to components of other

comprehensive income 4.7 - 4.7

------------------------------------------- -------- --------------- ------

Total items that will not be reclassified

to profit or loss (22.5) - (22.5)

------------------------------------------- -------- --------------- ------

Exchange differences on translation

of foreign operations (15.3) (0.4) (15.7)

Fair value loss on hedged interest

derivatives (8.7) - (8.7)

Losses on net investment hedges

taken to equity (1.9) - (1.9)

Total items that may be reclassified

subsequently to profit or loss (25.9) (0.4) (26.3)

-------------------------------------------

Other comprehensive expense for

the year (48.4) (0.4) (48.8)

Total comprehensive income for the

year 36.2 0.6 36.8

------------------------------------------- -------- --------------- ------

Consolidated statement of changes in equity

for the three months ended 31 March 2020

Capital Hedging

Share Share redemption and translation Retained Non-controlling Total

capital premium reserve reserve earnings Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------- -------- -------- ----------- ---------------- --------- ----- --------------- -------

At 1 January 2020 42.5 421.1 0.9 (19.5) 204.4 649.4 21.1 670.5

----------------------- -------- -------- ----------- ---------------- --------- ----- --------------- -------

Profit for the period - - - - 26.7 26.7 - 26.7

Other comprehensive

income

for the period - - - 12.1 8.6 20.7 0.4 21.1

----------------------- -------- -------- ----------- ---------------- --------- ----- --------------- -------

Total comprehensive

income

for the period - - - 12.1 35.3 47.4 0.4 47.8

Share-based payments - - - - 0.4 0.4 - 0.4

Dividends - - - - - - - -

----------------------- -------- -------- ----------- ---------------- --------- ----- --------------- -------

At 31 March 2020

(Unaudited) 42.5 421.1 0.9 (7.4) 240.1 697.2 21.5 718.7

----------------------- -------- -------- ----------- ---------------- --------- ----- --------------- -------

Capital Hedging

Share Share redemption and translation Retained Non-controlling Total

capital premium reserve reserve earnings Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

At 1 January 2019 34.0 230.5 0.9 6.4 192.1 463.9 21.1 485.0

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

Profit for the period - - - - 19.9 19.9 0.1 20.0

Other comprehensive

expense

for the period - - - (15.0) (9.5) (24.5) (0.2) (24.7)

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

Total comprehensive

(expense)/income

for the period - - - (15.0) 10.4 (4.6) (0.1) (4.7)

Share-based payments - - - - 0.4 0.4 - 0.4

Dividends - - - - - - - -

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

At 31 March 2019

(Unaudited) 34.0 230.5 0.9 (8.6) 202.9 459.7 21.0 480.7

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

Capital Hedging

Share Share redemption and translation Retained Non-controlling Total

capital premium reserve reserve earnings Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

At 1 January 2019 34.0 230.5 0.9 6.4 192.1 463.9 21.1 485.0

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

Profit for the period - - - - 84.6 84.6 1.0 85.6

Other comprehensive

expense

for the year - - - (25.9) (22.5) (48.4) (0.4) (48.8)

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

Total comprehensive

(expense)/income

for the year - - - (25.9) 62.1 36.2 0.6 36.8

Issue of shares 8.5 190.6 - - - 199.1 - 199.1

Share-based payments - - - - (1.9) (1.9) - (1.9)

Dividends - - - - (47.9) (47.9) (0.6) (48.5)

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

At 31 December 2019

(Audited) 42.5 421.1 0.9 (19.5) 204.4 649.4 21.1 670.5

---------------------- -------- -------- ----------- ---------------- --------- ------ --------------- -------

Consolidated balance sheet

as at 31 March 2020

31 March 31 March 31 December

2020 2019 2019

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

-------------------------------------- ----------- ----------- -----------

Non-current assets

Goodwill 335.3 328.1 324.4

Acquired intangible assets 57.6 63.9 56.8

Other intangible assets 27.1 5.9 22.0

Property, plant and equipment 408.6 405.7 404.9

Deferred tax assets 19.1 28.0 22.8

Investment in joint ventures 8.3 8.2 7.5

-------------------------------------- ----------- ----------- -----------

Total non-current assets 856.0 839.8 838.4

-------------------------------------- ----------- ----------- -----------

Current assets

Inventories 129.0 134.6 121.9

Trade and other receivables 219.3 257.6 190.6

Cash and cash equivalents 475.1 74.7 103.6

Derivative financial instruments 4.3 0.5 4.9

-------------------------------------- ----------- ----------- -----------

Total current assets 827.7 467.4 421.0

-------------------------------------- ----------- ----------- -----------

Total assets 1,683.7 1,307.2 1,259.4

-------------------------------------- ----------- ----------- -----------

Current liabilities

Borrowings (399.0) (85.4) -

Trade and other payables (199.4) (229.8) (232.9)

Lease liabilities (7.5) (8.1) (7.5)

Current tax liabilities (40.5) (39.8) (38.7)

Provisions for other liabilities and

charges (4.6) (8.6) (4.9)

Derivatives financial instruments (17.2) (12.4) (14.3)

-------------------------------------- ----------- ----------- -----------

Total current liabilities (668.2) (384.1) (298.3)

-------------------------------------- ----------- ----------- -----------

Non-current liabilities

Borrowings (103.2) (230.5) (82.9)

Trade and other payables (0.5) (0.7) (0.5)

Lease liabilities (32.7) (35.9) (34.4)

Deferred tax liabilities (31.0) (32.9) (30.8)

Retirement benefit obligations (127.5) (139.8) (140.0)

Provisions for other liabilities and

charges (1.9) (2.6) (2.0)

-------------------------------------- ----------- ----------- -----------

Total non-current liabilities (296.8) (442.4) (290.6)

-------------------------------------- ----------- ----------- -----------

Total liabilities (965.0) (826.5) (588.9)

-------------------------------------- ----------- ----------- -----------

Net assets 718.7 480.7 670.5

-------------------------------------- ----------- ----------- -----------

Equity

Share capital 42.5 34.0 42.5

Share premium 421.1 230.5 421.1

Capital redemption reserve 0.9 0.9 0.9

Hedging and translation reserve (7.4) (8.6) (19.5)

Retained earnings 240.1 202.9 204.4

-------------------------------------- ----------- ----------- -----------

Equity attributable to equity holders

of the parent 697.2 459.7 649.4

Non-controlling interests 21.5 21.0 21.1

-------------------------------------- ----------- ----------- -----------

Total equity 718.7 480.7 670.5

-------------------------------------- ----------- ----------- -----------

Consolidated cash flow statement

for the three months ended 31 March 2020

Three months Three months Year ended

ended ended

31 March 2020 31 March 31 December

2019 2019

(unaudited) (unaudited) (audited)

---------------- -------------- -----------------

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------------------------- ------- ------- ------ ------ ------ -------

Operating

Cash generated from operations (18.2) (16.9) 170.2

Interest received 0.2 0.3 0.9

Interest paid (1.4) (2.1) (7.0)

Interest element of lease payments (0.3) (0.3) (1.1)

----------------------------------------------- ------- ------- ------ ------ ------ -------

Net interest paid (1.5) (2.1) (7.2)

UK corporation tax paid - - -

Overseas corporate tax paid (4.6) (2.6) (11.1)

----------------------------------------------- ------- ------- ------ ------ ------ -------

Total tax paid (4.6) (2.6) (11.1)

----------------------------------------------- ------- ------- ------ ------ ------ -------

Net cash (outflow)/inflow from operating

activities (24.3) (21.6) 151.9

----------------------------------------------- ------- ------- ------ ------ ------ -------

Investing

Dividends received from joint ventures 0.2 0.5 1.6

Purchase of property, plant and equipment

and intangible assets (13.9) (14.4) (69.1)

Sale of property, plant and equipment - - 0.3

----------------------------------------------- ------- ------- ------ ------ ------ -------

Net capital expenditure (13.9) (14.4) (68.8)

Net cash outflow from investing activities (13.7) (13.9) (67.2)

----------------------------------------------- ------- ------- ------ ------ ------ -------

Financing

Dividends paid - - (47.9)

Dividends paid to non-controlling

interests - - (0.6)

Proceeds on issue of shares - - 199.1

Settlement of equity-settled share-based

payments - - (2.5)

Repayment of principal portion of

lease liabilities (1.7) (1.7) (6.8)

Repayment of borrowings - - (216.3)

Proceeds of borrowings 391.6 - 15.0

----------------------------------------------- ------- ------- ------ ------ ------ -------

Net cash inflow/(outflow) from financing

activities 389.9 (1.7) (60.0)

----------------------------------------------- ------- ------- ------ ------ ------ -------

Increase/(decrease) in cash and bank

overdrafts during the period 351.9 (37.2) 24.7

----------------------------------------------- ------- ------- ------ ------ ------ -------

Comprising increase/(decrease) to:

Cash and cash equivalents 369.5 (20.9) 4.1

Bank overdrafts (17.6) (16.3) 20.6

----------------------------------------------- ------- ------- ------ ------ ------ -------

Increase/(decrease) in cash and bank

overdrafts during the period 351.9 (37.2) 24.7

----------------------------------------------- ------- ------- ------ ------ ------ -------

Cash, cash equivalents and bank overdrafts

at 1 January 103.6 76.2 76.2

Foreign exchange and other movements (5.6) (2.4) 2.7

----------------------------------------------- ------- ------- ------ ------ ------ -------

Cash, cash equivalents and bank overdrafts

at period end 449.9 36.6 103.6

----------------------------------------------- ------- ------- ------ ------ ------ -------

Notes to the interim financial statements

1. Basis of preparation

Synthomer plc is a public limited company incorporated and

domiciled in the United Kingdom under the Companies Act. The

Company is listed on the London Stock Exchange and the address of

the registered office is Temple Fields, Harlow, Essex, CM20

2BH.

These interim financial statements have been prepared in

accordance with applicable law, the Disclosure and Transparency

Rules of the Financial Conduct Authority and with IAS 34 Interim

Financial Reporting, as adopted by the European Union.

These interim financial statements do not comprise statutory

accounts within the meaning of section 434 of the Companies Act

2006. Statutory accounts for the year ended 31 December 2019 were

approved by the Board of Directors on 5 March 2020 and delivered to

the Registrar of Companies. The report of the auditors on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under section 498 of

the Companies Act 2006.

The interim financial statements do not include all the notes of

the type normally included in annual financial statements.

Accordingly, this report is to be read in conjunction with the

Annual Report for the year ended 31 December 2019 and any public

announcements made by the Company during the interim reporting

period.

After making enquiries and taking account of reasonably possible

changes in trading performance, the Directors are satisfied that,

at the time of approving the interim financial statements for the

Group, it is appropriate to adopt the going concern basis.

2. Accounting policies

The annual financial statements of Synthomer plc are prepared in

accordance with IFRSs as adopted by the European Union and

applicable law. The same accounting policies and methods of

computations are followed in these financial statements as in the

most recent audited annual financial statements. There are no

updates to IFRSs effective from 2020 that impact the Group.

3. Special Items

IFRS and Underlying performance

The IFRS profit measures show the performance of the Group as a

whole and as such include all sources of income and expense,

including both one-off items and those that do not relate to the

Group's ongoing businesses. To provide additional clarity on the

ongoing trading performance of the Group's businesses, management

uses "Underlying" performance as an alternative performance measure

to plan for, control and assess the performance of the segments.

Underlying performance differs from the IFRS measures as it

excludes Special Items.

Special Items

Special Items are disclosed separately in order to provide a

clearer indication of the Group's underlying performance.

Special Items are either irregular, and therefore including them

in the assessment of a segment's performance would lead to a

distortion of trends, or are technical adjustments which ensure the

Group's financial statements are in compliance with IFRS but do not

reflect the operating performance in the year, or both. An example

of the latter is the amortisation of acquired intangibles, which

principally relates to acquired customer relationships. The Group

incurs costs, which are recognised as an expense in the income

statement, in maintaining these customer relationships. The Group

considers that the exclusion of the amortisation charge on acquired

intangibles from Underlying performance avoids the potential double

counting of such costs and therefore excludes it as a Special Item

from Underlying performance.

The definition of Special Items is shown in note 17 and has been

consistently applied.

Special Items comprise:

Three months Three months Year ended

ended 31 ended 31 31 December

March 2020 March 2019 2019

Unaudited Unaudited Audited

GBPm GBPm GBPm

----------------------------------------- ------------ ------------ ------------

Special Items

Acquisition costs and related gains 6.0 - (9.2)

Amortisation of acquired intangibles (2.1) (2.4) (8.7)

Restructuring and site closure costs - (0.5) (0.8)

Foreign exchange gain on rights issue - - 3.5

Operating profit/(loss) 3.9 (2.9) (15.2)

----------------------------------------- ------------ ------------ ------------

Fair value loss on unhedged interest

derivatives (2.2) (1.9) (0.5)

----------------------------------------- ------------ ------------ ------------

Finance costs (2.2) (1.9) (0.5)

----------------------------------------- ------------ ------------ ------------

Profit/(loss) before taxation 1.7 (4.8) (15.7)

----------------------------------------- ------------ ------------ ------------

The following items of income and expense were reported as

Special Items and accordingly were excluded from Underlying

performance:

-- Acquisition costs and related gains in the three months to

March 2020 relate to the acquisition of OMNOVA Solutions Inc and

comprise GBP2.7 million of costs offset by a gain of GBP8.7 million

on a foreign exchange derivative entered into in July 2019 to hedge

the acquisition price. Acquisition costs in 2019 also relate to the

acquisition of OMNOVA partly offset by a gain of GBP4.0m on the

foreign exchange derivative.

-- Amortisation of intangibles decreased during the period as

the final tranche of customer-related intangibles from the 2011

PolymerLatex acquisition reached the end of their amortisation

period in Q1 2019.

-- Restructuring and site closure costs in 2019 related to the

reorganisation of the Group into global business segments.

-- Foreign exchange gain on rights issue represents a gain made

on a forward contract which was entered into to swap the proceeds

of the Sterling rights issue into Euro in order to pay down part of

the Group's Euro borrowings.

-- In July 2018 the Group entered into swap arrangements to fix

Euro interest rates on the full value of the EUR440 million

committed unsecured revolving credit facility. The fair value of

the unhedged interest derivatives relates to the mark-to-market of

the swap at the respective period ends in excess of the Group's

current borrowings.

4. Segmental analysis

The Group's Executive Committee, chaired by the Chief Executive

Officer, examines the Group's performance.

With the acquisition of Omnova the Group has reassessed how the

business will be managed going forwards. The Group's Acrylates

business, which was previously managed and reported within the

Industrial Specialities division has been identified as a separate

segment by the Group's Executive Committee. A new management

structure has been implemented and management information for

Acrylates is now reported separately to the Committee.

The Group's reportable segments are:

Performance Elastomers

Performance Elastomers is focused on healthcare, paper, carpet

and foam markets through our water-based Nitrile Butadiene Rubber

latex (NBR) and Styrene Butadiene Rubber latex (SBR) products.

Functional Solutions

Functional Solutions is focused on coatings, construction,

adhesives and technical textiles markets through our water-based

acrylic and vinylic based dispersions products.

Industrial Specialities

Industrial Specialities is focused on speciality chemical

additives and non-water-based chemistry for a broad range of

applications from polymer additives to emerging materials and

technologies.

Acrylates

Acrylates is focused on the production of acrylate monomers

which are sold to external customers in European markets as well as

our European Functional Solutions business.

The Group's Executive Committee is the chief operating decision

maker and primarily uses a measure of earnings before interest,

tax, depreciation and amortisation (EBITDA) to assess the

performance of the operating segments. No information is provided

to the Group's Executive Committee at the segment level concerning

interest income, interest expense, income tax or other material

non-cash items.

No single customer accounts for more than 10% of the Group's

revenue.

A segmental analysis of Underlying performance and Special Items

is shown below.

Three months ended March 2020 (unaudited)

Unallocated

Performance Functional Industrial corporate

Elastomers Solutions Specialities Acrylates expenses Total

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------------- ----------- ---------- ------------- --------- ----------- ------

Revenue

Total revenue 149.7 132.4 41.4 17.4 - 340.9

Inter-segmental revenue - - - (2.5) - (2.5)

-------------------------------- ----------- ---------- ------------- --------- ----------- ------

149.7 132.4 41.4 14.9 - 338.4

-------------------------------- ----------- ---------- ------------- --------- ----------- ------

EBITDA 23.9 20.2 6.0 (1.1) (3.9) 45.1

Depreciation and amortisation (5.6) (4.9) (1.5) (0.7) (0.1) (12.8)

-------------------------------- ----------- ---------- ------------- --------- ----------- ------

Operating profit before Special

Items 18.3 15.3 4.5 (1.8) (4.0) 32.3

Special Items (0.4) (0.8) (0.7) (0.2) 6.0 3.9

-------------------------------- ----------- ---------- ------------- --------- ----------- ------

Operating profit 17.9 14.5 3.8 (2.0) 2.0 36.2

Finance costs (4.4)

-------------------------------- ----------- ---------- ------------- --------- ----------- ------

Profit before taxation 31.8

-------------------------------- ----------- ---------- ------------- --------- ----------- ------

Three months ended March 2019 (unaudited)

-------------------------------------------------------------------------

Unallocated

Performance Functional Industrial corporate

Elastomers Solutions Specialities Acrylates expenses Total

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Revenue

Total revenue 156.7 159.1 42.4 18.8 - 377.0

Inter-segmental revenue - - - (1.9) - (1.9)

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

156.7 159.1 42.4 16.9 - 375.1

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

EBITDA 22.4 17.6 5.8 1.1 (3.8) 43.1

Depreciation and amortisation (6.2) (4.0) (1.3) (0.6) (0.2) (12.3)

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Operating profit before Special

Items 16.2 13.6 4.5 0.5 (4.0) 30.8

Special Items (1.0) (1.0) (0.7) (0.2) - (2.9)

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Operating profit 15.2 12.6 3.8 0.3 (4.0) 27.9

Finance costs (4.3)

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Profit before taxation 23.6

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Year ended December 2019 (audited)

-------------------------------------------------------------------------

Industrial Unallocated

Performance Functional Specialities Acrylates corporate

Elastomers Solutions (restated) (restated) expenses Total

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Revenue

Total revenue 623.7 612.8 157.9 70.9 - 1,465.3

Inter-segmental revenue - - - (6.2) - (6.2)

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

623.7 612.8 157.9 64.7 - 1,459.1

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

EBITDA 96.3 69.9 23.8 1.0 (13.1) 177.9

Depreciation and amortisation (24.8) (17.6) (5.4) (3.4) (0.9) (52.1)

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Operating profit before Special

Items 71.5 52.3 18.4 (2.4) (14.0) 125.8

Special Items (0.3) (4.3) (4.1) (0.6) (5.9) (15.2)

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Operating profit 71.2 48.0 14.3 (3.0) (19.9) 110.6

Finance costs (10.1)

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

Profit before taxation 100.5

-------------------------------- ----------- ---------- ------------- ----------- ----------- -------

5. Reconciliation of profit from operations to cash generated

from operations

Three months Three months Year ended

ended 31 ended 31 31 December

March 2020 March 2019 2019

Unaudited Unaudited Audited

GBPm GBPm GBPm

----------------------------------------- ------------ ------------ ------------

Operating profit 36.2 27.9 110.6

Less: share of profit of joint ventures (0.6) (0.3) (0.9)

------------------------------------------ ------------ ------------ ------------

35.6 27.6 109.7

Adjustments for:

Depreciation of property, plant and

equipment 10.6 10.3 43.4

Depreciation of right of use assets 1.8 1.8 7.3

Amortisation of other intangibles 0.4 0.2 1.4

Share-based payments 0.4 0.4 0.6

Special Items (3.9) 2.9 15.2

Cash impact of acquisition costs (2.2) - (7.5)

Cash impact of restructuring and site

closure (0.5) (0.7) (4.4)

Cash impact of foreign exchange gain

on deal contingent 12.7 - -

Cash impact of foreign exchange gain

on rights issue - - 3.5

Pension funding (4.4) (4.1) (17.5)

(Increase) / decrease in inventories (3.6) 3.6 15.0

(Increase) / decrease in trade and

other receivables (22.5) (31.1) 34.3

Increase / (decrease) in trade and

other payables (42.6) (27.8) (30.8)

Cash generated from operations (18.2) (16.9) 170.2

------------------------------------------ ------------ ------------ ------------

6. Tax

Tax on the Underlying profit before taxation for the three month

period was charged at 17.9% (three months ended 31 March 2019:

14.1%; year ended 31 December 2019: 14.0%), representing the best

estimate of the annual effective income tax rate expected for the

full year.

Inclusion of the best estimate for the tax charge on the Special

Items results in a tax rate of 15.1% (three months ended 31 March

2019: 13.2%; year ended 31 December 2019: 14.8%), on the IFRS

profit before taxation. The difference in the effective tax rate on

the Underlying profit before tax and the IFRS profit before tax

reflects the tax associated with the Special Items, some of which

are not taxable or subject to tax deductions.

7. Earnings per share

Three months ended Three months ended

31 March 2020 31 March 2019

------------------------------ ------------------------------

Underlying Special Underlying Special

performance Items IFRS performance Items Total

Earnings

Profit/(loss) attributable

to equity holders of the

parent GBPm 24.7 2.0 26.7 24.4 (4.5) 19.9

Number of shares(1)

Weighted average number

of ordinary shares - basic '000 424,849 363,997

Effect of dilutive potential

ordinary shares '000 1,937 2,198

Weighted average number

of ordinary shares - diluted '000 426,786 366,195

Earnings/(loss) per share(1)

Basic earnings/(loss) per

share pence 5.8 0.5 6.3 6.7 (1.2) 5.5

Diluted earnings/(loss)

per share pence 5.8 0.5 6.3 6.6 (1.2) 5.4

1 - The weighted average number of ordinary shares for the three

months to 31 March 2019 used in the calculation of earnings per

share, has been adjusted by multiplying by an adjustment factor of

1.0713 to reflect the bonus element in the shares issued under the

terms of the rights issue which completed on 29 July 2019.

Year ended 31 December

2019

------------------------------

Underlying Special

performance Items Total

Earnings

Profit/(loss) attributable

to equity holders of the

parent GBPm 99.5 (14.9) 84.6

Number of shares

Weighted average number

of ordinary shares - basic '000 393,349

Effect of dilutive potential

ordinary shares '000 2,109

Weighted average number

of ordinary shares - diluted '000 395,458

Earnings/(loss) per share

Basic earnings/(loss) per

share pence 25.3 (3.8) 21.5

Diluted earnings/(loss)

per share pence 25.2 (3.8) 21.4

8. Financial instruments

The risks associated with the Group's financial instruments and

related polices are detailed in the 2019 Annual Report in note 22

to the financial statements. There have been no changes in the

risks and the management thereof since 31 December 2019.

F air values have been obtained from the relevant institutions

where appropriate. Where market values are not available, fair

values of financial assets and financial liabilities have been

calculated by discounting expected future cash flow at prevailing

interest rates and by applying period end exchange rates. The

carrying amount of borrowings approximates to book value.

The fair value of the Group's financial instruments are measured

using inputs other than quoted prices that are directly or

indirectly observable (Level 2 as defined in IFRS 13).

There are no significant differences between the carrying value

and fair value of either financial assets or financial

liabilities.

9. Defined benefit schemes

The value of the defined benefit plan assets has been updated to

reflect their market value as at 31 March 2020. Actuarial gains or

losses are recognised in the Consolidated Statement of

Comprehensive Income in accordance with the Group's accounting

policy. The liabilities have been updated to reflect the change in

the discount rate and other assumptions.

10. Analysis of net debt

31 March 31 March 31 December

2020 2019 2019

GBPm GBPm GBPm

-------------------------- -------- -------- -----------

Bank overdrafts (25.2) (38.1) -

Current borrowings (373.8) (47.3) -

-------------------------- -------- -------- -----------

Current liabilities (399.0) (85.4) -

Non-current borrowings (103.2) (230.5) (82.9)

-------------------------- -------- -------- -----------

Non-current liabilities (103.2) (230.5) (82.9)

Total borrowings (502.2) (315.9) (82.9)

-------------------------- -------- -------- -----------

Cash and cash equivalents 475.1 74.7 103.6

Net debt (27.1) (241.2) 20.7

-------------------------- -------- -------- -----------

Net debt is defined in the glossary of terms in note 17.

Capitalised debt costs, which have been recognised as a reduction

in borrowings in the financial statements, amounted to GBP3.4

million at 31 March 2020 (31 March 2019: GBP1.9m, 31 December 2019:

GBP1.7 million).

On 31 March 2020 the Group drew down EUR420.7m of its EUR520.0m

unsecured bridge facility in order to settle its deal contingent

currency derivative in preparation for the completion of the

acquisition of Omnova Solutions Inc on 1 April 2020.

Three months Three months

ended ended Year ended

31 March 31 March 31 December

2020 2019 2019

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

-------------------------------------------- ------------ ------------ ------------

Net cash (outflow)/inflow from operating

activities (24.3) (21.6) 151.9

Add: dividends received from joint ventures 0.2 0.5 1.6

Less: net capital expenditure (13.9) (14.4) (68.8)

(38.0) (35.5) 84.7

Dividends paid - - (47.9)

Dividends paid to non-controlling interests - - (0.6)

Proceeds on issue of shares - - 199.1

Settlement of equity-settled share-based

payments - - (2.5)

Repayment of principal portion of lease

liabilities (1.7) (1.7) (6.8)

Foreign exchange and other movements (8.1) 10.0 8.7

-------------------------------------------- ------------ ------------ ------------

(Increase)/decrease in net debt (47.8) (27.2) 234.7

-------------------------------------------- ------------ ------------ ------------

Net debt at 1 January 20.7 (214.0) (214.0)

-------------------------------------------- ------------ ------------ ------------

Net debt at period end (27.1) (241.2) 20.7

-------------------------------------------- ------------ ------------ ------------

11. Capital commitments

The capital expenditure authorised but not provided for in the

interim financial statements as at 31 March 2020 was GBP11.6m (31

March 2019: GBP14.4m, 31 December 2019: GBP11.7m).

12. Contingent liabilities

During 2018, the European Commission (the 'Commission')

initiated an investigation into practices relating to the purchase

of Styrene monomer by companies, including Synthomer, operating in

the European Economic Area. The Company has and will continue to

fully cooperate with the Commission during its investigation. As

the investigation is ongoing and the Commission does not provide

feedback on its work until the investigation is complete, it is not

possible to determine whether or not a liability exists in relation

to this matter.

13. Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

included in this note. Other than the relationship with the UK

defined benefit pension scheme as disclosed in note 26 of the 2019

Annual Report, there were no other related party transactions

requiring disclosure.

Following the rights issue which completed on 29 July 2019,

Kuala Lumpur Kepong Berhad Group holds 20.98% of the Company's

shares and is considered to be a related party from this date.

14. Post balance sheet events

On 1 April 2020, the Group completed its acquisition of Omnova

Solutions Inc at a price of $10.15 per share, representing an

enterprise value of $824 million (GBP654 million). The acquisition

strengthens Synthomer's presence in North America and increases its

presence in Europe and Asia. The asset identification and fair

value allocation processes are currently under review. At the date

of this report it is impracticable to disclose the provisional fair

values of the acquired assets, liabilities, contingent liabilities

and goodwill.

It is unclear what impact the unprecedented COVID-19 pandemic

will have on the Group's financial performance for the year.

Speciality chemicals are designated as key industrial assets in the

geographies in which Synthomer operates and throughout the peak of

the pandemic in Asia and Europe, the Group continued to operate 37

of its 38 global manufacturing sites. April and May volumes for the

enlarged business were impacted across the Group and whilst demand

for Nitrile latex, non-wovens and adhesives remained strong, sales

into industrial markets including automotive, coatings, graphic

paper, carpet and the oil & gas sector were impacted by

COVID-19. Volumes were lower than a strong comparative period by

approximately 20% although volumes did strengthen towards the end

of May.

Synthomer has a strong financial position, but a number of steps

have been taken to mitigate the impact of COVID-19 and to preserve

liquidity, cashflow and financial position. These include reducing

capital expenditure for 2020 to approximately GBP50.0m from the

GBP73.5m originally anticipated (including OMNOVA) and suspension

of the final dividend for 2019. The Group's Board, Executive and

Senior Management have also frozen their salaries at 2019 levels

and delayed any further review until October 2020.

15. Seasonality

Historically, the Group has seen no visible fixed pattern to

seasonality in Q1 trading compared to rest of the year but we do

note seasonality in our working capital with an expected outflow in

Q1 compared to the December position. However, in 2020 it is

unclear what impact the COVID-19 pandemic will have on the Group's

financial performance for the full year.

16. Risks and uncertainties

The Group faces a number of risks which, if they arise, could

affect its ability to achieve its strategic objectives. As with any

business, risk assessment and the implementation of mitigating

actions and controls are vital to successfully achieving the

Group's strategy. The Directors are responsible for determining the

nature of these risks and ensuring appropriate mitigating actions

are in place to manage them.

These principal risks are categorised into the following

types:

-- Strategic

-- Operational

-- Compliance

-- Financial

With the exception of the impact of COVID-19, referred to in

notes 14 and 15, the Directors consider that the principal risks

and uncertainties which could have a material impact on the Group's

performance in the remaining part of the financial year remain the

same as those stated on pages 32 to 36 of 2019 Annual Report which

is available on our website

www.synthomer.com/investor-relations.

17. Glossary of terms

EBITDA EBITDA is calculated as operating profit from continuing

operations before depreciation, amortisation and

Special Items.

Operating profit Operating profit represents profit from continuing

activities before finance costs and taxation.

----------------------------------------------------------------------

Special Items Special Items are either irregular, and therefore

including them in the assessment of a segment's

performance would lead to a distortion of trends,

or are technical adjustments which ensure the Group's

financial statements are in compliance with IFRS

but do not reflect the operating performance in

the year, or both. An example of the latter is

the amortisation of acquired intangibles, which

principally relates to acquired customer relationships.

The Group incurs costs, which are recognised as

an expense in the income statement, in maintaining

these customer relationships. The Group considers

that the exclusion of the amortisation charge on

acquired intangibles from Underlying performance

avoids the potential double counting of such costs

and therefore excludes it as a Special Item from

Underlying performance.

The following are consistently disclosed separately

as Special Items in order to provide a clearer

indication of the Group's underlying performance:

* Restructuring and site closure costs;

* Sale of a business or significant asset;

* Acquisition costs;

* Amortisation of acquired intangible assets;

* Impairment of non-current assets;

* Fair value adjustments in respect of derivative

financial instruments where hedge accounting is not

applied;

* Items of income and expense that are considered

material, either by their size and/or nature;

* Tax impact of above items; and

* Settlement of prior period tax issues.

----------------------------------------------------------------------

Underlying performance Underlying performance represents the statutory

performance of the Group under IFRS, excluding

Special Items.

----------------------------------------------------------------------

Net debt Cash and cash equivalents together with short-

and long-term borrowings.

----------------------------------------------------------------------

Leverage Net debt divided by EBITDA.

The Group's financial covenants are calculated

using the accounting standards adopted by the Group

at 31 December 2018 and accordingly, net debt and

EBITDA exclude the impact of IFRS 16.

----------------------------------------------------------------------

Ktes Kilotonnes or 1,000 tonnes (metric).

----------------------------------------------------------------------

Responsibility statement

The Directors confirm that these interim financial statements

have been prepared in accordance with International Accounting

Standard 34, Interim Financial Reporting, as adopted by the

European Union.

The Directors of Synthomer plc are listed in the 2019 Annual

Report and there have been no subsequent changes.

The Directors are responsible for the maintenance and integrity

of, amongst other things, the financial and corporate governance

information as provided on the Synthomer website. Legislation in

the United Kingdom governing the preparation and dissemination of

financial information may differ from legislation in other

jurisdictions.

On behalf of the Board of Directors

C G MacLean S G Bennett

Chief Executive Officer Chief Financial Officer

15 June 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUNRKRRWUNARR

(END) Dow Jones Newswires

June 16, 2020 05:11 ET (09:11 GMT)

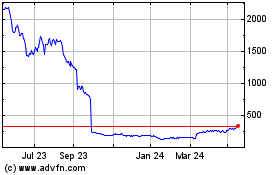

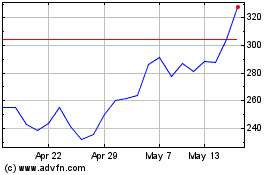

Synthomer (LSE:SYNT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Synthomer (LSE:SYNT)

Historical Stock Chart

From Jul 2023 to Jul 2024