SysGroup PLC Deferred Consideration and Issue of Equity re Q4Ex (7744W)

14 February 2017 - 6:00PM

UK Regulatory

TIDMSYS

RNS Number : 7744W

SysGroup PLC

14 February 2017

14 February 2017

SysGroup plc

("SysGroup" or the "Company" or the "Group")

Payment of Deferred Consideration and Issue of Equity

On 10 December 2014 the Group announced the acquisition of Q4Ex

Limited ("Q4Ex"), which has since become the Merchant and

Distribution division of the Group.

The terms of the acquisition (the "Initial Terms") made

provision for deferred and contingent consideration of up to

GBP1,456,000 payable subject to the achievement of certain

financial hurdles set (the "Earn-out Consideration"). The Earn-out

Consideration comprised three payments being two tranches of up to

GBP520,000 and a further payment of up GBP416,000, all of which was

to be satisfied through the issue of new ordinary shares ("Earn-out

Shares"). The Earn-out Shares are to be issued at an effective

fixed price of 68p per ordinary share, following the share

consolidation completed in July 2016.

The Group has today entered into a deed of variation to the

Initial Terms with the vendors of Q4Ex (the "Revised Terms"), which

provides the Non-Executive Directors of the Board of SysGroup with

the discretion to settle a portion of the Earn-out Consideration in

cash at effective fixed price of 59p per Earn-out Share (the "Cash

Price"). No other terms were amended.

In February 2016 the vendors of Q4Ex received the GBP520,000 of

Earn-out Shares for the period ended 29 February 2016. Q4Ex has

since performed in line with management expectations and has

exceeded the financial hurdles set for the second earn-out period

to 30 September 2016, triggering the maximum earn-out of GBP520,000

for the period. The Non-Executive Directors have elected to settle

the Earn-out Consideration through the issue of 340,981 Earn-out

Shares and the balance through the payment of GBP250,000 at the

Cash Price.

The Board expects, subject to final review, Q4Ex to exceed the

financial targets for the period to 31 December 2016, which will

trigger a final payment of Earn-out Consideration of GBP416,000.

The Board currently intends to settle Earn-out Consideration

through the issue of Earn-out Shares. A further announcement will

be made in due course.

Change in Directors' holdings

In light of the issue of the Earn-out Shares, the percentage

holdings of the directors of the Group will be as follows:

Director Number of Ordinary Shares % of Enlarged Share Capital(1)

Christopher Evans(2) 844,846 3.76

Michael Edelson 689,600 3.07

Robert Khalastchy 6,346 0.03

Amy Yateman-Smith(3) Nil Nil

Notes:

1. The Group's share capital of 22,492,132 ordinary shares of 1p

each as enlarged by the 340,981 Earn-out Shares, which are expected

to be admitted to trading on AIM on 17 February 2017 ("Enlarged

Share Capital").

2. Christopher Evans is a vendor of Q4Ex and received 109,114 Earn-out Shares

3. Representative of Livingbridge VC LLP

Admission to trading and total voting rights

Application has been made to the London Stock Exchange for the

Earn-out Shares to be admitted to trading on AIM. Admission is

expected to take place on 17 February 2017. The Earn-out Shares

will rank pari passu with the existing issued Ordinary Shares.

Following the issue of the Earn-out Shares, the Company will

have 22,492,132 Ordinary Shares, with each Ordinary Share carrying

the right to one vote. The Company has no Ordinary Shares held in

treasury. The total of 22,492,132 Ordinary Shares may therefore be

used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure and

Transparency Rules.

For further information please Tel: 0151 559 1777

contact:

SysGroup plc

Chris Evans, CEO

Julian Llewellyn, CFO

Shore Capital (Nomad and Broker) Tel: 020 7408 4090

Bidhi Bhoma / Edward Mansfield

Newgate Communications Tel: 020 7653 9848

Bob Huxford / Adam Lloyd / Ed

Treadwell

About SysGroup

SysGroup is a leading provider of Cloud Hosting, Managed

Services and expert IT Consultancy. The Group delivers solutions

that ensure clients understand and benefit from industry-leading

technologies and advanced hosting capabilities. The SysGroup team

focuses on a customer's strategic and operational requirements -

enabling them to free up resources, grow their core business and

avoid the distractions and complexity of delivering IT

services.

The Group has offices in Liverpool, Coventry, London and East

Sussex.

For more information, visit http://www.sysgroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEOKNDPOBKDOBD

(END) Dow Jones Newswires

February 14, 2017 02:00 ET (07:00 GMT)

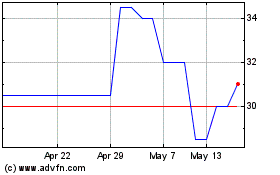

Sysgroup (LSE:SYS)

Historical Stock Chart

From Jan 2025 to Feb 2025

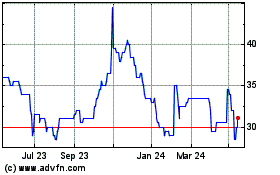

Sysgroup (LSE:SYS)

Historical Stock Chart

From Feb 2024 to Feb 2025