TIDMURU

RNS Number : 5242X

URU Metals Limited

26 April 2023

26 April 2023

URU Metals Limited

("URU")

Update from ZEB Nickel Corp

URU notifies that ZEB Nickel Corp. has today announced the

commencement of exploration drilling at the Zeb Project, as well as

the appointment of a capital markets advisor and market maker.

URU successfully completed the disposal of the Zeb Project,

located in Limpopo, South Africa (the "Project") to ZEB Nickel

Corp. in August 2021 and the Project remains the primary focus of

URU, through its 73.81% interest in Zeb Nickel Corp. and URU's

continuing role as the technical adviser on the Project.

The ZBNI announcement is as follows:

Exploration Drilling Commenced at Zeb Nickel Project Area

Vancouver, BC, April 26, 2023 - ZEB Nickel Corp. (ZBNI:TSX-V)

(OTC:ZBNIF) ("Zeb" or the "Company") is pleased to announce that

further exploration drilling has commenced at the Company's

flagship Zeb Nickel Project.

Figure 1: Drill rig site establishment at the Zeb Project.

This phase of exploration drilling will simultaneously target

three mineralized zones, as shown in figure 2 below:

1. a higher-grade nickel mineralized zone identified at the base

of the historical drilling within ZEB 1 mineralized package;

2. last completed exploration program discovered

nickel-copper-platinum group element (Ni-Cu-PGE) mineralization

located adjacent to and beneath ZEB 1, this style of mineralization

is referred to as Target 2. Target 2 was intersected in 10 pervious

drillholes and accounts for approximately 3000 meters of

drilling.

3. a massive to semi-massive Ni-PGE mineralization seemingly

associated with what appears to be an ultramafic "plumbing system"

beneath and to the east of the (Target 3). Target 3 has been

intersected in three drillholes with a total of 1100 meters of

drilling.

Figure 2: Schematic geological cross section showing 7 of the 32

existing drillholes, and the location of the new drilling planned

to intersect higher-grade nickel near the base ZEB 1, the down dip

extension of Target 2; and semi-massive to massive nickel sulfide

mineralization (Target 3).

The Company looks forward to updating the market with the

results from this phase of drilling.

Qualified Person and Quality Control/Quality Assurance

Richard Montjoie has supervised the preparation of the

scientific and technical information that forms the basis for this

news release and has approved the disclosure herein. Mr. Montjoie

is not independent of the Company. Mr. Montjoie is a registered

member of the South African Council for Natural Scientific

Professions (SACNASP) membership number 400131/09. Mr. Montjoie

holds a M.Sc. Honors in Economic Geology from the University of

Witwatersrand, South Africa, and is fellow of the Geological

Society of South Africa (GSSA).

James Nieuwenhuys , Non-executive Chairman of Zeb Nickel,

commented: "Over the years the Project team have assimilated and

refined the geological model and we are now confident that this

next round of drilling will confirm areas of high-grade Ni and

Ni-Cu-PGE mineralization. Our aim is to produce a preliminary

economic assessment to map out an achievable path, subject to a

positive feasibility study, to the development of a fully

de-risked, low-cost, high-grade nickel sulfide project."

Furthermore, the Company is pleased to announce that it has

retained INFOR Financial Inc. ("INFOR Financial") to provide

capital markets advisory and market making services for the

Company.

The Company has entered a services agreement (the "Agreement")

with INFOR Financial, pursuant to which INFOR Financial has agreed

to perform the following general capital markets support

services:

-- introduce the Company to capital market participants and

institutional investors that may include investment funds, mutual

funds, private capital sources and other potential strategic

investors; and

-- market making services, with the objective of maintaining

active and orderly trading in the market and improving liquidity of

the Company's common shares, undertaken by one of INFOR Financial's

proprietary traders in compliance with all applicable rules of the

TSX Venture Exchange (TSXV) and the New Self-Regulatory

Organization of Canada (New SRO), and all applicable laws.

For its services, INFOR Financial will be paid a monthly fee of

$10,000 CAD, plus applicable tax. The Agreement may be terminated

by either party on 30 days' notice, subject to a minimum six-month

term following its commencement date. Zeb Nickel Corp and INFOR

Financial act at arm's length, and to the Company's knowledge INFOR

Financial has no present interest, directly or indirectly, in the

Company or its securities, but may acquire securities in the future

in connection with additional capital market services that may be

provided to the Company. The funds and shares required for the

market making service are provided by INFOR Financial. The fee

payable by the Company to INFOR Financial is for services only.

INFOR Financial will be responsible for the costs it incurs in

buying and selling the Company's shares, and no third party will be

providing funds or securities for the market making activities.

INFOR Financial and the Company are unrelated and unaffiliated

entities, but INFOR Financial and/or its clients may have an

interest, directly or indirectly, in the securities of the Company

.

About the Company and Project

Zeb Nickel Corp is focused on exploring for and developing

world-class mineral deposits, with a focus on metals that are

critical in the production of rechargeable batteries, such as

nickel, graphite, lithium, cobalt, manganese, copper and aluminum.

The Company is currently focused on developing its flagship Zeb

Nickel Project, located in Limpopo, South Africa. The Zeb Nickel

Project is a developing Class 1 nickel sulfide project

strategically located in the Bushveld Complex in South Africa.

ZBNI announcement ends

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

URU's obligations under Article 17 of MAR.

For further information, please contact:

URU Metals Limited

John Zorbas

(Chief Executive Officer) +1 416 504 3978

SP Angel Corporate Finance LLP

(Nominated Adviser and Broker)

Ewan Leggat

Harry Davies-Ball + 44 (0) 203 470 0470

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDQLBLXZLXBBZ

(END) Dow Jones Newswires

April 26, 2023 09:00 ET (13:00 GMT)

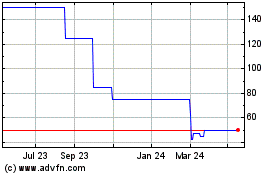

Uru Metals (LSE:URU)

Historical Stock Chart

From Jan 2025 to Feb 2025

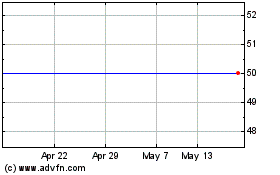

Uru Metals (LSE:URU)

Historical Stock Chart

From Feb 2024 to Feb 2025