TIDMBVS TIDMGFRD

RNS Number : 6125S

Bovis Homes Group PLC

07 November 2019

THIS ANNOUNCEMENT (INCLUDING THE APPIX) AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL.

THE FOLLOWING ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A

PROSPECTUS OR A PROSPECTUS EXEMPTED DOCUMENT. THE COMPANY EXPECTS

TO PUBLISH LATER TODAY THE CIRCULAR IN CONNECTION WITH THE

ACQUISITION AND THE PROSPECTUS IN CONNECTION WITH THE ADMISSION OF

THE CONSIDERATION SHARES. ANY VOTING DECISION BY SHAREHOLDERS IN

CONNECTION WITH THE ACQUISITION SHOULD BE MADE ON THE BASIS OF THE

INFORMATION CONTAINED IN THE CIRCULAR.

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

7 November 2019

For immediate release

Bovis Homes Group PLC

Proposed acquisition of the Linden Homes and Partnerships &

Regeneration businesses of Galliford Try plc, Placing and Bonus

Issue

Bovis Homes Group PLC ("Bovis Homes") today announces that it

has agreed to acquire Galliford Try plc's ("Galliford Try") Linden

Homes and Partnerships & Regeneration businesses (the "Target

Businesses") for consideration of GBP1.075 billion[1] (the

"Acquisition").

The consideration is comprised of a combination of shares in

Bovis Homes (the "Consideration Shares") and cash resulting in

Galliford Try Shareholders receiving a stake of 29.3 per cent. in

the Enlarged Group upon Completion (after implementation of the

Placing and the Bonus Issue described below).

Bovis Homes also announced today a non pre-emptive placing of up

to 13,472,591 new ordinary shares of GBP0.50 each in the capital of

the Company (the "Placing Shares") representing approximately 9.99

per cent. of Bovis Homes' existing issued share capital (the

"Placing"), which is expected to raise gross proceeds of up to

GBP157 million[2]. Bovis Homes proposes to use the net proceeds of

the Placing to part fund the cash component of the Acquisition

consideration.

Acquisition highlights

-- An excellent and unique opportunity for Bovis Homes to

acquire a top UK housebuilder and a leading partnerships business,

expected to transform the Group and deliver the following key

benefits:

o Creates a top five national housebuilder with the capacity to

deliver more than 12,000 homes per year over the medium term,

enabling the Enlarged Group to compete more effectively against the

established major housebuilders;

o Gives Bovis Homes a leading position in the high-growth, more

resilient partnerships market with Galliford Try Partnerships being

one of the leading and most established businesses in this

area;

o Opportunity to shift Partnerships' revenue mix towards higher

margin land-led development;

o Highly complementary geographic footprints strengthening core

areas for Bovis Homes and providing the opportunity to expand into

attractive regions; and

o Brings together two high-quality, well recognised

housebuilding brands of Bovis Homes and Linden Homes enabling dual

branding opportunities increasing overall production and sales.

-- The Bovis Homes management team is uniquely positioned to

integrate the businesses successfully with strong leadership across

all business areas.

-- The Board believes that the Enlarged Group will achieve

estimated recurring run-rate pre-tax cost synergies of at least

GBP35 million per annum by the end of the second full financial

year following Completion

-- It is anticipated that the Acquisition will be low

double-digit EPS enhancing in the first full financial year

post-Completion with further significant EPS enhancement in the

second full financial year post-Completion

-- The transaction is structured to ensure a robust balance sheet post Completion

-- Total consideration of GBP1.075 billion[3] comprising:

o The issue to Galliford Try shareholders of 63,739,385

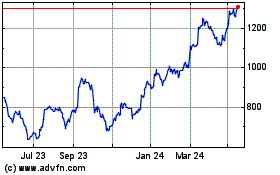

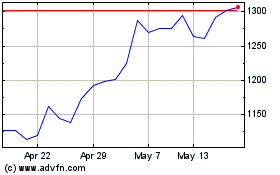

Consideration Shares valued at GBP675 million based on Bovis Homes'

closing share price on 9 September 2019[4]

o cash of GBP300 million to be financed by:

-- 9.99% Accelerated Bookbuild (gross proceeds of up to

GBP157m);

-- GBP100m New Term Loan; and

-- utilisation of the Company's balance sheet resources;

o the novation from Galliford Try to Bovis Homes of Galliford

Try's GBP100 million 4.03% senior unsecured notes due February

2027.

The Acquisition is a 'Class 1 transaction' for Bovis Homes under

the Listing Rules and accordingly requires the approval of

Shareholders.

Bonus Issue and second interim dividend

As included in the announcement dated 10 September 2019, Bovis

Homes today announces that, conditional upon completion of the

Acquisition ("Completion"), rather than pay the expected special

dividend of GBP60 million, it will return value to shareholders by

way of a bonus issue (the "Bonus Issue") settled at Completion

through the issue of 5,665,723 ordinary shares of GBP0.50 each in

the capital of the Company ("Shares") to shareholders on the

Company's register of members as at 6.00 p.m. on 2 January 2020.

This will include holders of the Placing Shares but exclude

recipients of the Consideration Shares.

As at the Latest Practicable Date, the Bonus Issue is expected

to be for an amount up to GBP66 million (calculated using a share

price of GBP11.63, being the closing share price on the Latest

Practicable Date) through the issuance of up to 5,665,723 Shares

settled at Completion.

Bovis Homes also announces today that it expects to pay a cash

dividend of up to 41 pence per Share in May 2020 (the "Second

Interim Dividend") to shareholders on the Company's register of

members as at 6.00 p.m. on 27 December 2019 which shall include

holders of the Placing Shares but exclude recipients of the

Consideration Shares.

The Second Interim Dividend will be in lieu of the Bovis Homes

2019 final dividend and the payment date of the Second Interim

Dividend is in line with the normal final dividend payment

timetable.

Next Steps

-- Bovis Homes expects to post a shareholder circular (the

"Circular") later today to convene a General Meeting for approval

of the Acquisition, the Bonus Issue and certain related matters on

2 December 2019.

-- Bovis Homes also expects to publish a prospectus (the

"Prospectus") later today relating to the Consideration Shares and

the application for admitting new shares to the premium segment of

the Official List and to trading on the London Stock Exchange's

Main Market for listed securities.

-- The Circular and the Prospectus have been submitted to the

FCA for approval and are expected to be made available later today

at www.bovishomesgroup.co.uk. A copy of each of the Circular and

the Prospectus will be submitted to the National Storage Mechanism

and will shortly be available for viewing at

www.morningstar.co.uk/uk/nsm.

-- Bovis Homes also expects that a Scheme Document in relation

to the Acquisition will be sent or made available by Galliford Try

to Galliford Try Shareholders on 8(th) November 2019. The Scheme

Document contains, amongst other things, notices convening a

meeting of the Galliford Try Shareholders convened at the direction

of the Court (the "Galliford Try Court Meeting") and a general

meeting of Galliford Try Shareholders (the "Galliford Try General

Meeting"). The Galliford Try Court Meeting and the Galliford Try

General Meeting will take place on 29 November 2019. It is expected

that the Scheme Document will be made available on the Galliford

Try website: www.gallifordtry.co.uk.

-- Completion is anticipated to occur on 3 January 2020.

Greg Fitzgerald, CEO of Bovis Homes said:

"This is an exciting and transformational opportunity to create

a leading UK housebuilder with an enhanced customer proposition and

the ability to increase delivery to more than 12,000 new homes per

year.

The combination with Galliford Try Partnerships gives Bovis

Homes a market leading position in the high growth, more resilient

partnerships market, with significant potential to increase revenue

and profit while delivering more affordable homes at a time when

they are needed more than ever.

I am very focused on successfully integrating these businesses

in early 2020 with strong management across all business areas, and

on delivering the clear benefits from the combination including at

least GBP35 million of synergies as quickly as possible.

Over the past few years we have worked hard to ensure the

customer is central to everything we do. As a combined business,

this commitment to delivering high levels of build quality and

customer satisfaction will remain a core objective."

Presentation for analysts and investors

A presentation for analysts and investors will be held this

morning at 8.00 a.m. at Lazard & Co., Limited, 50 Stratton

Street, London, W1J 8LL.

The presentation will also be accessible via a live audiocast

available at www.bovishomesgroup.co.uk.

The person responsible for making this announcement on behalf of

Bovis Homes is Earl Sibley, Group Finance Director.

For further information please contact:

Bovis Homes Group PLC

Earl Sibley, Group Finance Director

Susie Bell, Head of Investor Relations 01732 280272

Lazard & Co., Limited (Sponsor and Joint Financial

Adviser to Bovis Homes)

William Rucker

Vasco Litchfield

Patrick Long

Louise Campbell 020 7187 2000

Numis Securities Limited (Joint Financial Adviser,

Sole Bookrunner and Sole Broker to Bovis Homes)

Heraclis Economides

Richard Thomas

Ben Stoop

Alasdair Abram 020 7260 1000

Powerscourt (PR Adviser to Bovis Homes)

Justin Griffiths

Nick Dibden 020 7250 1446

IMPORTANT NOTICE

IMPORTANT NOTICE RELATED TO FINANCIAL ADVISERS

Lazard & Co., Limited ("Lazard") is authorised and regulated

by the Financial Conduct Authority in the United Kingdom. Numis

Securities Limited ("Numis") is authorised and regulated by the

Financial Conduct Authority in the United Kingdom. Lazard and Numis

are acting exclusively for the Company and are acting for no one

else in connection with the Acquisition. They will not regard any

other person as a client in relation to the Acquisition and will

not be responsible to anyone other than the Company for providing

the protections afforded to their respective clients, nor for

providing advice in connection with the Acquisition or any other

matter, transaction or arrangement referred to in this

Announcement.

Lazard, Numis and their respective affiliates may have engaged

in transactions with, and provided various investment banking,

financial advisory and other services to the Company and its

affiliates, for which they received customary fees. Lazard, Numis

and their respective affiliates may provide such services to Bovis

Homes and its affiliates in the future.

Shareholders and prospective investors in the Shares (including

the Consideration Shares) will be deemed to have acknowledged that

they have not relied on Lazard, Numis or any person affiliated with

them in connection with any investigation of the accuracy of any

information contained in this Announcement for their investment

decision.

Apart from the responsibilities and liabilities, if any, which

may be imposed on Lazard and Numis by the FSMA or the regulatory

regime established thereunder, neither Lazard nor Numis nor any of

their respective affiliates accept any responsibility or liability

whatsoever for the contents of this Announcement, including its

accuracy, completeness or verification, or for any other statement

made or purported to be made by it, or on its behalf, in connection

with the Group, the Enlarged Group, the Acquisition, Admission or

the Consideration Shares, and nothing in this Announcement is, or

shall be relied upon as, a promise or representation in this

respect, whether or not to the past or future. Lazard, Numis and

their respective affiliates accordingly disclaim all and any duty,

liability or responsibility whatsoever (whether direct or indirect

and whether arising in tort, contract, under statute or otherwise

(save as referred to above)) which it might otherwise have in

respect of this Announcement or any such statement.

FORWARD-LOOKING STATEMENTS

This Announcement may include certain forward-looking

statements, beliefs or opinions, including statements with respect

to the Group's, Target Businesses' or the Enlarged Group's

business, financial condition and results of operations. These

forward-looking statements can be identified by the use of

forward-looking terminology, including the terms "believes",

"estimates", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

various or comparable terminology or by discussions of strategy,

plans, objectives, goals, future events or intentions. These

statements are made by the Directors in good faith based on the

information available to them at the date of this Announcement and

reflect the Directors' beliefs and expectations. By their nature,

these statements involve risk and uncertainty because they relate

to events and depend on circumstances that may or may not occur in

the future. A number of factors could cause actual results and

developments to differ materially from those expressed or implied

by the forward-looking statements, including, without limitation,

developments in the global economy, changes in regulation and

government policies, spending and procurement methodologies,

currency fluctuations, a failure in the Group's, Target Businesses'

or the Enlarged Group's health, safety or environmental policies

and other factors discussed in the Prospectus and the Circular.

No representation or warranty is made that any of these

statements or forecasts will come to pass or that any forecast

results will be achieved. Forward-looking statements may, and often

do, differ materially from actual results. Any forward-looking

statements in this Announcement speak only as of their respective

dates, reflect the Directors' current view with respect to future

events and are subject to risks relating to future events and other

risks, uncertainties and assumptions relating to the Group's,

Target Businesses' or the Enlarged Group's operations and growth

strategy. You should specifically consider the factors identified

in this Announcement which could cause actual results to differ

before making any decision in relation to the Acquisition. Subject

to the requirements of the FCA, the London Stock Exchange, the

Listing Rules and the Disclosure Guidance and Transparency Rules

(and/or any regulatory requirements) or applicable law, the

Company, Lazard and Numis explicitly disclaim any obligation or

undertaking publicly to release the result of any revisions to any

forward-looking statements in this Announcement that may occur due

to any change in the Company's expectations or to reflect events or

circumstances after the date of this Announcement.

No statement in this Announcement (including any statement of

estimated cost savings or synergies) is or is intended to be a

profit forecast or estimate for any period and no statement in this

Announcement should be interpreted to mean that earnings of the

Group or the Target Businesses, as appropriate, for the current or

future financial years will necessarily match or exceed the

historical or published earnings or earnings per share or dividend

per share for the Group or the Target Businesses, as

appropriate.

Any information contained in this Announcement on the price at

which shares or other securities in the Company have been bought or

sold in the past, or on the yield on such shares or other

securities, should not be relied upon as a guide to future

performance.

FURTHER INFORMATION

This Announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer,

invitation or solicitation to purchase, otherwise acquire,

subscribe for, sell, otherwise dispose of or issue of any

securities or the solicitation of any vote or approval in

connection with the Acquisition or otherwise, in any jurisdiction

in which such offer, invitation or solicitation is unlawful.

Bovis Homes expects to publish and make available the Circular

and the Prospectus containing information on the Consideration

Shares and the Enlarged Group later today. Bovis Homes urges

Shareholders to read the Prospectus and the Circular once published

carefully because they contain important information in relation to

the Acquisition, the Consideration Shares and the Enlarged

Group.

Bovis Homes understands that Galliford Try expects to publish

its Scheme Document in due course and that Galliford Try urges

Galliford Try Shareholders to read the Scheme Document and the

Prospectus carefully because they contain important information in

relation to the Scheme, the Consideration Shares and the Enlarged

Group.

Any vote in respect of resolutions to be proposed at the General

Meeting to approve the Acquisition and related matters should be

made only on the basis of the information contained in the

Prospectus and the Circular.

This Announcement is not a prospectus or prospectus equivalent

documents.

The Acquisition will be subject to the applicable requirements

of the London Stock Exchange and the FCA.

OVERSEAS SHAREHOLDERS

The Consideration Shares have not been, and will not be,

registered under the applicable securities laws of any jurisdiction

outside the United Kingdom. Accordingly, the Consideration Shares

may not be offered, sold, delivered or otherwise transferred,

directly or indirectly, in, into or from any such jurisdiction, or

to, or for, the account or benefit of citizens or residents of any

such jurisdiction, except pursuant to an applicable exemption from,

or in a transaction not subject to, applicable securities laws of

those jurisdictions, or otherwise permitted under applicable

securities laws of those jurisdictions. Shareholders outside the

United Kingdom are required by the Company to inform themselves

about and observe any restrictions on the offer, sale or transfer

of the Consideration Shares.

No action has been taken by the Company or the Banks to obtain

any approval, authorisation or exemption to permit the allotment or

issue of the Consideration Shares or the possession or distribution

of this Announcement (or any other publicity material relating to

the Consideration Shares) in any jurisdiction other than the United

Kingdom.

Unless otherwise determined by the Company or required by and

permitted by applicable law and regulation, the Acquisition will

not be implemented and documentation relating to the Acquisition

shall not be made available, directly or indirectly, in, into or

from an excluded territory where to do so would violate the laws of

that jurisdiction (an "Excluded Territory") and no person may vote

their Shares with respect to the Acquisition at the General

Meeting, or to execute and deliver Forms of Proxy appointing

another to vote at the General Meeting on their behalf) by any use,

means, instrumentality or form within an Excluded Territory or any

other jurisdiction if to do so would constitute a violation of the

laws of that jurisdiction.

It is the responsibility of each person to satisfy themselves as

to the full observance of the laws and regulations of the relevant

jurisdiction in connection with the issuance of the Consideration

Shares and the implementation of the Acquisition and to obtain any

governmental, exchange control or other consents which may be

required, to comply with other formalities which are required to be

observed and to pay any issue, transfer or other taxes due in such

jurisdiction. To the fullest extent permitted by applicable law,

the Company, the Board, the proposed members of the Board for the

Enlarged Group, the Banks and all other persons involved in the

Acquisition disclaim any responsibility or liability for the

failure to satisfy any such laws, regulations or requirements by

any person.

ADDITIONAL INFORMATION FOR US SHAREHOLDERS

The Shares have not been, and the Consideration Shares will not

be registered under the US Securities Act or under the securities

laws of any state or other jurisdiction of the United States and

may not be offered or sold within the United States, except

pursuant to an applicable exemption from, or in a transaction not

subject to, the registration requirements of the US Securities Act

and in compliance with any applicable securities laws of any state

or other jurisdiction of the United States. The Consideration

Shares to be issued to New Topco Shareholders pursuant to the

Acquisition are expected to be issued in reliance upon an exemption

from the registration requirements of the US Securities Act

afforded by section 3(a)(10) thereof and exemptions from

registration and qualification under applicable state securities

laws. New Topco Shareholders who will be affiliates (within the

meaning of the US Securities Act) of Galliford Try or Bovis Homes

before, or of Bovis Homes after, the Scheme Effective Date will be

subject to certain US transfer restrictions relating to the

Consideration Shares received in connection with the Scheme.

The Shares have not been, and the Consideration Shares will not

be, approved or disapproved by the US Securities and Exchange

Commission, any state securities commission in the United States or

any other US regulatory authority, nor have any of the foregoing

authorities passed upon or endorsed the merits of the offering of

the Consideration Shares or the accuracy or adequacy of this

Announcement. Any representation to the contrary is a criminal

offence in the United States.

If you are in any doubt about the contents of this Announcement

or the action you should take, you are recommended to seek your own

independent financial advice immediately from your stockbroker,

bank manager, solicitor, accountant or independent financial

adviser duly authorised under the Financial Services and Markets

Act 2000 (as amended) if you are resident in the United Kingdom or,

if not, from another appropriately authorised independent financial

adviser.

Bovis Homes Group PLC - Proposed Acquisition of Galliford Try's

Linden Homes

and Partnerships & Regeneration businesses

1 Introduction

Bovis Homes Group PLC ("Bovis Homes") today announces that it

had entered into an agreement with Galliford Try plc ("Galliford

Try") regarding a combination of Bovis Homes and Galliford Try's

Linden Homes and Partnerships & Regeneration businesses (the

"Target Businesses") for consideration of GBP1.075 billion[5]

(subject to certain customary completion adjustments linked to

Linden Homes' and Partnerships & Regeneration's asset value).

Linden Homes was valued as a multiple of TGAV[6] and Partnerships

& Regeneration was valued as a multiple of earnings.[7]

The consideration will consist of:

(i) the issue to Galliford Try Shareholders in respect of their

shareholding in New Topco of 63,739,385 new ordinary shares of

GBP0.50 each in the capital of the Company (the "Shares") (valued

at GBP675 million based on Bovis Homes' closing share price on 9

September 2019) (the "Consideration Shares"); plus

(ii) the payment of GBP300 million in cash (the "Cash Consideration") to Galliford Try; and

(iii) the novation from Galliford Try to Bovis Homes of

Galliford Try's GBP100 million 4.03% senior unsecured notes due

February 2027 (the "Private Placement Bond").

At Completion, Bovis Homes will also assume Galliford Try's

rights and obligations under two of Galliford Try's pension

schemes.

As a result, the Galliford Try Shareholders are expected to hold

in aggregate 29.3 per cent. of the Enlarged Group at Completion

(after implementation of the Placing and the Bonus Issue described

below).

Bovis Homes also today announced a non pre-emptive placing of up

to 13,472,591 new Shares representing approximately 9.99 per cent.

of Bovis Homes' existing issued share capital (the "Placing"),

which is expected to raise gross proceeds of up to GBP157 million.

Bovis Homes proposes to use the net proceeds of the Placing and

funds to be drawn down at Completion from the new debt financing

(details of which are set out in paragraph 10) to fund the Cash

Consideration.

The Acquisition, because of its size in relation to the Company,

is a Class 1 transaction for the Company under the Listing Rules

and will therefore require the approval of Shareholders. A General

Meeting has been convened for 11.00 a.m. on 2 December 2019 (or any

adjournment thereof) at the Spa Hotel, Mount Ephraim, Royal

Tunbridge Wells, Kent TN4 8XJ for Shareholders to consider and, if

thought fit, approve the Resolutions.

The Acquisition relates solely to a combination of Bovis Homes

and the Target Businesses and does not relate to a merger with

Galliford Try. The Acquisition envisages Galliford Try remaining a

UK-listed construction-focused group owned entirely by the

Galliford Try Shareholders.

2 Background to and reasons for the Acquisition

The Acquisition presents an excellent and unique opportunity for

Bovis Homes to acquire both (i) a top UK housebuilder, Linden

Homes; and (ii) a leading partnerships business, Galliford Try

Partnerships. The Enlarged Group will be firmly positioned as one

of the UK's top housebuilders (across both private and affordable

housing), and more importantly the Acquisition will establish the

Enlarged Group as one of the leaders in the highly attractive, high

growth partnerships business.

Over the last two and a half years, Bovis Homes has delivered an

impressive turnaround, including a dramatic improvement in build

quality and customer satisfaction, the successful launch of a new

housing range and the investment in and upgrade of people, systems

and infrastructure. As a standalone business, Bovis Homes is

approaching its target capacity of delivering 4,000 units per year

from its existing housebuilding operating structure. It is from

this position of strength, both operationally and financially, that

the Group has decided to undertake this Acquisition as it believes

it has the required people and capabilities to successfully

integrate the Target Businesses.

The Acquisition is expected to deliver the following key

benefits for Bovis Homes:

Creates a top five national housebuilder

The combination of the Group and the Target Businesses will

create one of the leading UK national housebuilders with the

capacity to deliver more than 12,000 new units per year over the

medium term. The Enlarged Group will have an enhanced national

customer proposition and coverage enabling it to compete more

effectively against the major players in the UK private and

affordable housebuilding sector. Combined, the Enlarged Group will

have a total consented land bank of over 33,000 owned plots and a

valuable pipeline of strategic land totalling c. 33,000 plots.

Accelerates Bovis Homes' move into the high-growth partnerships

and regeneration sector

The Acquisition will significantly accelerate the Group's move

into partnerships housing. The Group announced the launch of its

own partnerships business in early 2019, identifying partnerships

housing as a key sustainable growth area less connected to the

housing market cycle with more resilient earnings across the cycle.

In particular, the Group's diversification into partnerships

housing reduces risk.

Galliford Try Partnerships is one of the leading and most

established national brands in this area and with a very strong

track record of growth, is a partner of choice for housing

associations, local authorities and government agencies. There

remains a fundamental housing shortage in the UK, and government

support to increase housing supply is strong with a significant

increase in investment from housing associations in particular.

Galliford Try Partnerships has a hybrid business model with

revenues and profits generated from a mix of contracting and

development. Bovis Homes sees real opportunity to significantly

grow the combined partnerships business, specifically increasing

the proportion of revenue from higher margin land-led development.

The strength of the Enlarged Group's balance sheet is expected to

support new land investment for the partnerships business including

a strong pipeline of strategic land pull-though. This is consistent

with the strategic direction of Bovis Homes' nascent partnerships

business which, since launch, has established seven land-led

developments in partnership with housing associations where the

gross margin is at a similar level to the Bovis Homes housing

business's gross margin. The Directors believe that there is the

potential to grow Galliford Try Partnerships to a business

generating revenue over GBP1 billion and an operating margin in

excess of 10 per cent.

Enhanced geographic footprint with growth potential

The Acquisition provides the opportunity for growth nationally.

The geographic reach of the Target Businesses is highly

complementary to Bovis Homes' geographic footprint such that the

Acquisition is expected to both strengthen core areas for Bovis

Homes, such as the South Coast, and provide the opportunity to

expand into attractive regions, such as Yorkshire.

In addition, synergy opportunities are expected to be realised

from the significant geographic overlap between Bovis Homes and the

Target Businesses. For housebuilding, Bovis Homes expects the

optimal structure to be 12 to 14 housebuilding operating regions as

compared to the 17 regions which will exist at Completion. Each

housebuilding operating region will have an optimum size of c. 550

to 625 units completed p.a. providing opportunity for the combined

housebuilding business to grow and deliver more than 8,000 units

p.a. This compares to pro forma completions of 7,055 for the 12

months ended 30 June 2019.

Galliford Try Partnerships is well served by its existing

operating structure of ten operating regions working alongside

housebuilding. Following Completion, Bovis Homes' nascent

partnerships business will be fully integrated with Galliford Try

Partnerships and the Board believes that the Enlarged Group's

partnerships business presents a significant opportunity to shift

the business mix to more land-led, higher margin developments

supported by the strength of the Enlarged Group's balance

sheet.

Two leading housebuilding brands

Bovis Homes and Linden Homes bring together two high quality,

well-recognised housebuilding brands. In order to leverage these

brands, the Enlarged Group will look to maximise the opportunities

from dual-branding, where each brand will be re-positioned to

ensure that it has the greatest appeal to its specific and

differentiated target market. This model is successfully

implemented by other larger UK housebuilders and Bovis Homes and

Linden Homes are already successfully selling alongside each other

on six developments with the immediate opportunity to dual-brand a

further c.15 developments.

When acquiring land, the Enlarged Group will be able to select

the best-positioned brand for the new housing development which

meets customers' needs and will maximise demand. On larger sites,

particularly those pulled through from the strategic land bank, the

Enlarged Group will be able to promote both brands on a single

development site in order to increase overall production, demand

and sales rates, and drive higher returns on capital employed.

The Enlarged Group's partnerships business will also leverage

the Linden Homes and Bovis Homes brands for its mixed tenure

developments, alongside the Drew Smith brand which is the regional

branch of Galliford Try Partnerships for the South of England.

High quality combined land bank

The Enlarged Group is expected to have a high quality total

consented land bank of more than 33,000 owned plots and c. 33,000

plots of strategic land.

The Enlarged Group is expected to capitalise on future land

opportunities through its ability to compete more competitively in

the land sector. With a dual-branded housebuilding business and a

focus on significantly increasing partnership revenues from

land-led development, the Enlarged Group is expected to be much

better positioned to acquire larger sites and in particular higher

margin strategic opportunities.

Strengthens the senior management team

Greg Fitzgerald, CEO of the Group, is uniquely positioned to

successfully integrate Bovis Homes and the Target Businesses,

having formerly been CEO and then Executive Chairman of Galliford

Try plc for 11 years until 2016. Greg has been in housebuilding for

35 years and knows the Target Businesses well, having overseen the

acquisition of Linden Homes by Galliford Try in 2007 and the launch

of Galliford Try Partnerships in 2012.

There is strong leadership across the Target Businesses with the

Acquisition bringing the best from each business into the Enlarged

Group. In addition to the strength of the business leadership, the

continuity of management across the Enlarged Group following the

Acquisition will help mitigate risks arising through the

integration process.

Enhances shareholder value with attractive financial returns

The Directors believe that the Acquisition will enhance

shareholder value. It is anticipated that the Acquisition will be

low double digit EPS enhancing in the first full financial year

post-Completion with further significant EPS enhancement in the

second full financial year post-Completion.

The Directors expect the Acquisition to result in estimated

recurring run-rate pre-tax cost synergies of at least GBP35 million

per annum by the end of the second full financial year following

Completion of which the in-year EBIT impact in the first full

financial year following Completion is estimated to be c. GBP12m.

The Directors believe that the Acquisition represents a significant

opportunity to deliver potential cost synergies across the

following areas:

-- streamlining the regional and divisional operating models of

the combined business (approximately 55 per cent. of the estimated

recurring run-rate pre-tax cost synergies); and

-- procurement-related synergies (approximately 45 per cent. of

the estimated recurring run-rate pre-tax cost synergies).

The Directors expect that the realisation of these cost

synergies will require one-off implementation costs of

approximately GBP35 million. These are expected to be phased across

a two-year period following Completion. Detailed integration

planning will take place after Completion at which time

restructuring and redundancy proposals will be subject to

engagement with relevant stakeholders (including consultation with

employee representative bodies where required by law).

The Directors believe that synergies will accrue from overhead

savings, procurement savings and geographic overlap. The Directors

have considered dis-synergies as a result of the transaction and do

not believe that there are any material dis-synergies.

Basis of belief

In developing the synergy benefits, the Board has undertaken a

rigorous process covering the following steps:

-- the Board has worked to evaluate and assess the potential

synergies available from the Acquisition;

-- the assessment and quantification of the potential synergies

has been informed by the Board's extensive industry experience,

knowledge of Bovis Homes and the Target Businesses, as well as

information gathered during the due diligence process in respect of

the Target Businesses;

-- the cost synergies have been assessed relative to the

pre-Acquisition cost base of the carved out Target Businesses for

the year ended 30 June 2019 (FY19) and of the Group for the LTM

period ended 30 June 2019. The Directors have sought to normalise

costs to reflect a more typical cost position, including adjusting

overhead costs to reflect current forecast unit volumes and

normalised staff costs; and

-- key assumptions have been discussed with the Target

Businesses' operational management team.

The cost synergies indicated above are contingent on Completion

and could not be achieved independently of the Acquisition. The

Directors confirm that the cost synergies reflect both beneficial

elements and relevant costs associated with achieving these cost

synergies.

Nothing in this document, including any statement of estimated

costs savings or synergies, is intended as a profit forecast.

3 Integration

In the period leading up to Completion, Bovis Homes and

Galliford Try will work together to develop a detailed integration

plan.

It is expected that the Enlarged Group will assume a new

corporate name. This corporate name will be used for both the

Enlarged Group's housebuilding and partnerships businesses.

The Enlarged Group's housebuilding business will operate with

both the Bovis Homes and Linden Homes brands, maximising the

opportunities from dual-branding. Each of the housebuilding

operating regions will develop both Bovis Homes and Linden Homes

units. The Enlarged Group's partnerships business will use the

Bovis Homes and Linden Homes brands alongside its own Drew Smith

brand in the South of England, for its mixed tenure

development.

During 2020, the intention is to steady state both Bovis Homes

and Linden Homes revenues as the Group focuses on a successful

integration of the two businesses.

4 Information on Bovis Homes

Bovis Homes is a top 10 UK housebuilder operating across the

south of England, excluding London, developing high-quality private

and affordable housing. The Group purchases land in targeted prime

locations, typically on the edge of towns or villages, with over 90

per cent. on greenfield sites. It has specialist buyers in each of

its operating regions who work with land vendors including local

authorities to identify high quality land opportunities that at

least meet its minimum hurdle rates and enable it to create

sustainable places for its customers to live. The Group uses its

own well-designed, contemporary standard housing range on the

majority of its developments and employs local suppliers and

sub-contractors. A key priority of the Group is to deliver high

levels of customer satisfaction throughout the customers' entire

Bovis Homes journey delivered by it its own team of trained

customer service and sales advisors.

Bovis Homes has two divisions: the West and East, which comprise

seven operating regions, each with a regional head office

well-located for its developments. These include Kings Hill in

Kent, which is also Bovis Homes' headquarters, Basingstoke, Exeter,

Bishops Cleeve near Cheltenham, Stafford, Coleshill near Birmingham

and Milton Keynes. It directly employs c.1,300 employees.

Bovis Homes announced the launch of its partnerships business in

early 2019, identifying partnerships housing as a key sustainable

growth area less connected to the housing market cycle with more

resilient earnings across the cycle.

For the financial year ending 31 December 2018, Bovis Homes

completed 3,759 units, of which 2,567 were private housing and

1,192 were affordable housing, with an average selling price of

GBP273,200. At 30 June 2019, Bovis Homes had a land bank of 16,215

plots representing around 3.7 years' supply, with an average gross

margin of 24.9 per cent., and a strategic land portfolio comprising

19,745 plots.

As at 30 June 2019, the gross assets of Bovis Homes were

GBP1,565.3 million. Bovis Homes' operating profit for the year

ended 31 December 2018 was GBP174.2 million.

The table below summarises the results of Bovis Homes for the

three years ended 31 December 2016, 31 December 2017 and 31

December 2018.

Year ended 31 Dec 2016 Year ended 31 Dec 2017 Year ended 31 Dec 2018

GBPm GBPm GBPm

Group revenue 1,054.8 1,028.2 1,061.4

Profit from operations before exceptional

items 160.0 128.0 174.2

5 Information on the Target Businesses

5.1 Linden Homes

Linden Homes develops high quality private and affordable

housing in prime locations with a commitment to providing excellent

customer service, primarily for first-time buyers and families. It

has 10 divisions with a strong presence in the South and East of

England and a growing presence in other regions of the UK. Linden

Homes acquires prime sites with good transport links and local

amenities, where it can create communities that people aspire to

live in.

For the financial year ended 30 June 2019, Linden Homes

completed 3,229 units, of which 2,227 were private housing and

1,002 were affordable housing, with an average selling price of

GBP284,000. At September 2019, Linden Homes had a land bank of

12,600 plots representing around 3.5 years' supply, with an average

gross margin of 24.4 per cent., and a strategic land portfolio

comprising 2,850 acres, sufficient to generate 13,240 plots.

Linden Homes' operating profit (including share of joint

ventures profit before interest and tax, but excluding

amortisation) for the year ended 30 June 2019 was GBP160.5

million.

The table below summarises the results of Linden Homes for the

three years ended 30 June 2017, 30 June 2018 and 30 June 2019.

Year ended 30 June 2017 Year ended 30 June 2018 Year ended 30 June 2019

GBPm GBPm GBPm

Group revenue and share of joint

ventures' revenue excluding part

exchange revenue 937.4 947.3 820.4

Profit from operations including share

of joint ventures' profit 170.3 184.4 160.5

5.2 Partnerships & Regeneration

Partnerships & Regeneration is Galliford Try's specialist

affordable housing and regeneration business. Partnerships &

Regeneration delivers mixed-tenure solutions working with housing

association, local authority and private sector partners, combining

contracting, land-led contracting and mixed-tenure development with

a proven track record of delivery and quality. During the financial

year ended 30 June 2019, Partnerships & Regeneration completed

1,178 units at an average selling price of GBP217,000. Notable

recent project wins include partnerships with:

-- Homes England to deliver 885 homes across the UK under the

delivery partner panel;

-- Enfield Council to build the first 725 homes at the GBP6.0

billion Meridian Water development in the Lea Valley; and

-- Ealing Council to create a new mixed-use scheme, including 470 homes.

Partnerships & Regeneration's operating profit (including

share of joint ventures profit before interest and tax, but

excluding amortisation) for the year ended 30 June 2019 was GBP34.8

million.

The table below summarises the results of Partnerships &

Regeneration for the three years ended 30 June 2017, 30 June 2018

and 30 June 2019.

Year ended 30 June 2017 Year ended 30 June 2018 Year ended 30 June 2019

GBPm GBPm GBPm

Group revenue and share of joint

ventures' revenue excluding part

exchange revenue 330.2 475.2 623.2

Profit from operations including share

of joint ventures' profit 14.9 23.6 34.8

As at 30 June 2019, the combined gross assets of Linden Homes

and Partnerships & Regeneration were GBP1,633.0 million.

5.3 Partnerships & Regeneration's previous acquisitions

Drew Smith

On 12 May 2017, Partnerships & Regeneration acquired the

Drew Smith business from its owners for a final price of GBP30.5

million (after applying the earn-out provisions and additional

payments). The acquisition was of the entire share capital of Drew

Smith Limited and Drew Smith Homes Limited.

Drew Smith is a mixed-tenure developer which has relationships

with the registered provider and regeneration sector. It has

operations in Hampshire, Dorset, Surrey, Sussex and Berkshire, with

strong contracting, housebuilding and land acquisition

capabilities. The business has a strong contracting order book and

a number of land assets in planning as well as approximately 84

employees. The acquisition of Drew Smith was consistent with

Galliford Try's stated strategy of national footprint growth

through expansion into new geographies and margin improvement

through leveraging mixed-tenure expertise. The transaction

accelerated Partnerships & Regeneration's growth in the

southern region where mixed-tenure housing demand is generally

high.

The goodwill of GBP24.8 million arising from the acquisition is

attributable to the acquired workforce of Drew Smith. None of the

goodwill recognised is expected to be deductible for income tax

purposes.

Strategic Team Group

On 1 July 2019, Partnerships & Regeneration acquired the

entire share capital and control of Strategic Team Group Limited

("STG") and its trading subsidiary Strategic Team Maintenance Co.

Limited for approximately GBP11.0 million (of which GBP2.0 million

is deferred, GBP1.0 million for 12 months and GBP1.0 million for 24

months) (the "STG Transaction"), delivering a mature operating

platform in Yorkshire and expanding Partnerships &

Regeneration's presence in Cheshire. STG is a well-established

regional business with 120 employees and a revenue in its last full

year of c. GBP60 million.

Pursuant to the acquisition documentation of the STG

Transaction, there is an obligation on Partnerships &

Regeneration to pay any outstanding deferred consideration within

20 Business Days of a change of control event occurring. Change of

control is defined specifically by reference to Partnerships &

Regeneration ceasing to be part of the Galliford Try Group.

Assuming no waiver is obtained on or before the Acquisition, Bovis

Homes will have to pay just over GBP1.8 million in deferred

consideration to the sellers of STG within 20 Business Days of

Completion.

STG operates a new homes contracting business and a maintenance

and minor works business. The profile and geographical split of its

order book provides an excellent strategic fit with a client base

known to Galliford Try Partnerships. STG is on the Homes England

delivery partner panel.

6 Current trading and prospects

6.1 The Group

The Group has traded well during the second half of 2019 to date

maintaining an average sales rate per outlet per week of 0.6. The

Group is fully sold for its targeted FY 2019 completions and

expects to deliver another controlled and disciplined period end in

December.

Uncertainty surrounding Brexit in recent weeks has resulted in

some increased pressure on pricing and for the second half to date

the Group has seen a c. 1-2 per cent. reduction in underlying sales

prices.

This has been offset by a reduction in build cost inflation and

the Group's own build cost saving and margin initiatives.

Customer satisfaction remains a top priority and the Group is

delighted that its customer satisfaction score continues to reflect

this, trending at a 5-star HBF customer satisfaction rating (above

90 per cent.) for the year from 1 October 2018.

The Group has made further progress with its partnerships

business, entering into two land led partnerships with LiveWest in

the second half of 2019. The 50:50 JV arrangements are for

developments at Exeter (Alphington) and Taunton (Comeytrowe).

Looking to 2020, the Group has all the land it requires, has

already secured more than 20 per cent. of private sales, a higher

proportion than in previous years, and all of its affordable

units.

6.2 Galliford Try

On 11 September 2019, Galliford Try announced its annual results

for the year ended 30 June 2019.

Since 11 September 2019, there has continued to be political and

macroeconomic uncertainty affecting the markets in which Galliford

Try's businesses operate, particularly Linden Homes and

Construction.

The Galliford Try Board remains confident in achieving the

Galliford Try Group's full year expectations, but anticipates that

the result will be more weighted to the second half of the year

than in previous years.

Galliford Try is continuing its negotiations with Transport

Scotland in relation to the Aberdeen Western Peripheral Route

claim, and separately its GBP54 million claim for three contracts

with a single client remains ongoing.

7 Board and management of the Enlarged Group

It is proposed that, upon Completion:

-- Greg Fitzgerald and Earl Sibley, currently the Chief

Executive Officer and Group Finance Director of the Company,

respectively, will retain their positions in the Enlarged

Group;

-- Graham Prothero, who is currently the Chief Executive Officer

of Galliford Try, will become the Chief Operating Officer of the

Enlarged Group; and

-- the six Non-Executive Directors of the Company (including Ian

Tyler in his role as independent Chairman), will retain their

independent positions in the Enlarged Group.

The current Senior Managers of the Company are Martin Palmer,

James Watson, Darrell White and Keith Carnegie.

Following Completion, it is proposed that Stephen Teagle will be

appointed as the Chief Executive of Partnerships of the Enlarged

Group.

8 Bonus Issue, dividends and dividend policy

The Group dividend policy strategy has been, and will continue

to be, to maintain a robust and efficient balance sheet and to

deliver sustainable dividends to Shareholders.

In September 2017, the Group announced its intention that

surplus capital resulting from its balance sheet optimisation

initiatives totalling GBP180 million, would be returned to

Shareholders in the three years to 2020. The first GBP60 million

was paid as a special dividend to Shareholders in November

2018.

The Company's intention was to pay a further GBP60 million to

Shareholders by way of special dividend in November 2019. As

included in the announcement dated 10 September 2019, the Company

has agreed that, conditional upon Completion, rather than pay the

expected special dividend of GBP60 million, it will return value to

Shareholders by way of a bonus issue (the "Bonus Issue") settled at

Completion through the issue of 5,665,723 Shares (the "Bonus Issue

Shares") to Shareholders on the Company's register of members as at

6.00 p.m. on 2 January 2020, being the last date on which transfers

will be accepted for registration to participate in the Bonus Issue

(which, for the avoidance of doubt, shall include holders of the

Placing Shares but exclude recipients of the Consideration Shares)

(the "Bonus Issue Record Time").

The Company is expected to capitalise a sum of up to

GBP2,832,861.50 from its retained profits to pay up in full

5,665,723 Shares. If calculated as at the Latest Practicable Date

assuming that the maximum number of Placing Shares is issued,

Shareholders are expected to receive:

for every 1 Share held at the Bonus Issue Record Time, 0.03819

Bonus Issue Shares[8]

As at the Latest Practicable Date, the Bonus Issue was expected

to be for an amount up to GBP66 million (calculated using a share

price of GBP11.63 being the closing share price on the Latest

Practicable Date) through the issuance of up to 5,665,723 Shares

payable as at Completion.

Combining the Bonus Issue with the GBP60 million paid as a

special dividend in November 2018, the Company expects to pay up to

GBP126 million of the initially proposed GBP180 million by way of

capital return. Reflecting the Group's new strategy driven by the

Acquisition, the Company does not expect to pay any further special

dividend payments in relation to the GBP180 million capital return

initiative as set out in September 2017. Details of the proposed

dividend policy for the Enlarged Group are set out below.

Instead of paying the Bovis Homes 2019 final dividend, the

Company expects to pay a cash dividend of up to 41 pence per Share

in May 2020 to Shareholders on the Company's register of members as

at 6.00 p.m. on 27 December 2019 (the "Second Interim Dividend"),

whereby the relevant Shareholders (which, for the avoidance of

doubt, shall include holders of the Placing Shares but exclude

recipients of Consideration Shares and Bonus Issue Shares) shall be

entitled to receive their pro rata entitlements to the Second

Interim Dividend. The payment date of the Second Interim Dividend

is in line with the normal final dividend payment timetable.

Dividend policy for the Enlarged Group

For 2020, the Enlarged Group's focus will be on the successful

integration of Bovis Homes and the Target Businesses and best

positioning the Enlarged Group for the future with the reduction of

indebtedness being a key priority.

Going forwards, the Enlarged Group expects to maximise

sustainable dividends to Shareholders through ordinary dividend

cover of 2 times moving towards a cover of 1.75 times following a

period of integration and deleveraging. The Group will also

consider the prevailing strength of the balance sheet and general

economic circumstances, with particular regard to the cyclicality

of the industry.

The "Dividend Reinvestment Plan" is intended to continue

following Completion giving Shareholders the opportunity to

reinvest their dividends to buy Shares through a special dealing

arrangement.

9 Summary of the key terms of the Acquisition

The Acquisition relates solely to the acquisition by Bovis Homes

of the Target Businesses (consisting of Galliford Try's Linden

Homes and Partnerships & Regeneration businesses) and does not

entail a merger with Galliford Try. It is envisaged that New

Galliford Try, a newly incorporated public limited company which

will be the holding company of the Galliford Try Continuing Group,

will remain a UK-listed construction-focused group owned entirely

by the Galliford Try Shareholders.

Galliford Try will undertake a corporate restructuring (the

"Restructuring") so that all Galliford Try Shareholders can receive

the benefit of the Acquisition whilst simultaneously ensuring that

Galliford Try receives the relevant cash proceeds to support the

Galliford Try Continuing Group after Completion.

9.1 Sale and Purchase Agreement (the "SPA")

On 7 November 2019, the Company, Galliford Try and New Topco, a

newly-incorporated Jersey-registered company which will be inserted

as the holding company of Galliford Try pursuant to the Scheme,

entered into a SPA in connection with the Acquisition.

Pursuant to the terms of the SPA, the consideration will be

settled through:

-- the issue by the Company to Galliford Try Shareholders of the

Consideration Shares in consideration for the acquisition of New

Topco Shares held by them following the Restructuring;

-- the novation of the Private Placement Bond from Galliford Try

to Bovis Homes in part consideration for the acquisition of the

Partnerships & Regeneration Shares; and

-- the payment of the Cash Consideration to Galliford Try in

part consideration for the acquisition of the Partnerships &

Regeneration Shares.

The consideration payable by Bovis Homes for the Target

Businesses is subject to customary completion adjustment mechanisms

linked to the TGAV of the Target Businesses on the date of

Completion.

The novation of the Private Placement Bond entails the effective

transfer of all rights and obligations under the Private Placement

Bond from Galliford Try to Bovis Homes upon Completion. At

Completion, Galliford Try will automatically be relieved of its

debt obligations under the Private Placement Bond and Bovis Homes

will immediately and automatically assume all such obligations.

In addition, it is agreed that at Completion, Bovis Homes will

assume Galliford Try's rights and obligations under two of

Galliford Try's pension schemes, being the Galliford Try Final

Salary Pension Scheme and the Galliford Try (Holdings) Limited

Pension & Assurance Scheme. ("Transferring Pension Schemes").

The Transferring Pension Schemes have a combined membership of

approximately 2,059 individuals and have combined assets of

approximately GBP244.8 million. The remaining pension scheme, being

the Galliford Try Special Scheme will remain with Galliford Try.

The Galliford Try Special Scheme currently only has five members

and is in the process of being wound up. Further details are set

out at paragraph 13.

The Acquisition is conditional upon satisfaction (or waiver in

accordance with the terms of the SPA) of the following conditions,

or their satisfaction subject only to Completion:

-- the Restructuring having been effected in accordance with the

Restructuring Plan, including the completion of the Reorganisation,

the Scheme becoming effective in accordance with its terms, the

Reduction of Capital being confirmed by the Jersey Financial

Services Commission and the Demerger having been completed;

-- the passing of the Galliford Try Resolutions at the Galliford

Try General Meeting by the requisite majorities;

-- the passing of the Resolutions at the General Meeting by the requisite majorities;

-- the Company having raised proceeds of not less than 9.99% of

its existing issued share capital (calculated as at the Latest

Practicable Date) pursuant to the Placing (the "Equity Raise

Condition");

-- subject only to Completion having occurred, the Admission of

the Consideration Shares becoming effective; and

-- the Deed of Novation having become wholly unconditional in accordance with its terms.

The Acquisition will not proceed, and the SPA will be

terminated, if the conditions have not been satisfied or waived on

or before 7.00 p.m. on 3 January 2020 or in the case of the Equity

Raise Condition, 7.00 p.m. on 7 November 2019 (or such other time

and date as may be agreed between the Company and Galliford

Try).

The Acquisition is not conditional on CMA clearance and Bovis

Homes and Galliford Try will jointly submit a briefing paper to the

CMA explaining why the Acquisition does not raise any competition

concerns.

9.2 Restructuring

It is intended that the Restructuring will be implemented by way

of the process summarised below.

9.2.1 Scheme

Galliford Try will implement a scheme of arrangement pursuant to

which New Topco, a new Jersey-registered company will be inserted

as the new holding company of Galliford Try (the "Scheme"). Under

the terms of the Scheme, all existing Galliford Try Shares will be

cancelled and Galliford Try Shareholders will receive one New Topco

A Share for every Galliford Try Share that they hold.

Upon the Scheme becoming effective, Galliford Try will transfer

the Linden Homes business to New Topco by way of a distribution in

specie such that Linden Homes becomes a subsidiary of New Topco and

a sister company of Galliford Try. Galliford Try will retain the

Linden Homes Special Share, which has been newly issued by Linden

Homes, in order to facilitate the payment of the Linden Homes TGAV

Adjustment Amount.

New Topco will undertake a bonus issue of shares to Galliford

Try Shareholders such that each Galliford Try Shareholder will

receive one New Topco B Share for each New Topco A Share that they

hold. The New Topco B Shares are to be issued to facilitate the

Demerger, as described in paragraph 9.2.2. The New Topco A Shares

will carry an entitlement to the returns in New Topco attributable

to Linden Homes. The New Topco B Shares will carry an entitlement

to the returns attributable to the Galliford Try Continuing Group,

and to Partnerships & Regeneration.

9.2.2 Reduction of Capital and Demerger

Upon the Scheme becoming effective, New Topco will undertake a

reduction of capital (the "Reduction of Capital") pursuant to which

each of the New Topco B Shares will be cancelled. The reduction of

capital will be satisfied by the transfer of the entire issued

share capital of Galliford Try (including Partnerships &

Regeneration and Galliford Try's construction business) to New

Galliford Try. New Galliford Try is a company which has been

incorporated for the purposes of holding the Galliford Try

Continuing Group after Completion and which will be owned entirely

by Galliford Try Shareholders. In exchange for the shares in

Galliford Try, New Galliford Try will issue New Galliford Try

Shares to Galliford Try Shareholders on the basis of one New

Galliford Try Share for every New Topco B Share held by that

Galliford Try Shareholder (the "Demerger"). Application will be

made for the entire issued share capital of New Galliford Try to be

admitted to listing on the premium segment of the Official List and

to the London Stock Exchange's Main Market for listed securities

with effect from 8.00 a.m. on 3 January 2020.

Following completion of the Reduction of Capital and the

Demerger, New Galliford Try will be the sole beneficial owner of

Galliford Try (including the Partnerships & Regeneration

business).

New Topco will remain the sole beneficial owner of the Linden

Homes business.

9.3 Acquisition of Linden Homes business

Immediately following the Reduction of Capital and Demerger

becoming effective, the entire issued share capital of New Topco

(being the New Topco A Shares following cancellation of the New

Topco B Shares) which will then be held by the Galliford Try

Shareholders, will be transferred to the Company pursuant to the

mandatory transfer provisions in the articles of association of New

Topco (the "New Topco Articles"), in consideration for the issue of

the Consideration Shares to the Galliford Try Shareholders in

accordance with the terms of the SPA. As a result, Bovis Homes will

own the Linden Homes business indirectly through holding the entire

issued share capital of its sole parent company, New Topco.

The transfer will be effected by means of a form of transfer or

other instrument or instruction of transfer, or by means of CREST,

and, to give effect to such transfer, any person may be appointed

by the Company as agent and attorney for each shareholder of New

Topco to transfer their shares in New Topco.

9.4 Acquisition of Partnerships & Regeneration business

Simultaneously with completion of the acquisition of the Linden

Homes business (by way of acquiring New Topco pursuant to the

mandatory transfer provisions in the New Topco Articles), the

Company will acquire the Partnerships & Regeneration business

from Galliford Try by way of share sale in consideration of the

payment of the Cash Consideration to Galliford Try and the

novation, from Galliford Try to Bovis Homes, of the Private

Placement Bond.

9.5 Timing

Subject to the satisfaction or waiver of the conditions under

the SPA, the Company anticipates that each of the steps of the

Restructuring (including the Scheme) will be implemented and become

effective after the close of trading on the London Stock Exchange

on 2 January 2019. Completion and Admission of the Consideration

Shares is expected to occur not later than 8.00 a.m. on 3 January

2020. Following Completion, the Target Businesses will be

wholly-owned subsidiaries of the Company.

10 Financing the Acquisition

The Acquisition will be funded through a combination of (i) the

Placing, (ii) the Term Loan, (iii) existing cash on the Group's

balance sheet and (iv) the issuance of the Consideration

Shares.

10.1 Cash Consideration

The Company proposes to finance the Cash Consideration payable

by Bovis Homes for the Target Businesses of GBP300 million

using:

10.1.1 up to GBP157 million from the expected gross proceeds of the Placing;

10.1.2 approximately GBP100 million to be drawn down at Completion from the Term Loan; and

10.1.3 Bovis Homes' existing balance sheet cash resources, which

includes an additional amount of cash (approximately GBP60 million)

available as a result of paying the expected special dividend to

Shareholders by way of a Bonus Issue instead.

Placing

Bovis Homes has announced today a Placing to institutional

investors on a non pre-emptive basis of up to 13,472,591 new

ordinary shares of GBP0.50 each in the capital of the Company (the

"Placing Shares"), which represents approximately 9.99 per cent. of

the Company's existing issued ordinary share capital.

The issue of the Placing Shares is to be effected by way of a

cash box placing. The Company will allot and issue the Placing

Shares on a non pre-emptive basis to the placees in consideration

for Numis transferring its holdings of ordinary shares and

redeemable preference shares in Project Finch Finance (Jersey)

Limited to the Company ("Finch Jersey Limited"). Accordingly,

instead of receiving cash as consideration for the issue of Placing

Shares, at the conclusion of the Placing the Company will own the

entire issued share capital of Finch Jersey Limited whose only

asset will be its cash reserves, which will represent an amount

approximately equal to the net proceeds of the Placing.

The Placing Shares will be issued pursuant to the allotment

authority that Shareholders granted to the Company at its annual

general meeting on 22 May 2019.

The Placing is being conducted, subject to the satisfaction of

certain conditions, through an accelerated bookbuild that was

launched immediately following the announcement of the Placing on 7

November 2019. Ahead of the Placing, the Company consulted with a

number of its leading Shareholders to gauge their feedback as to

the Acquisition. Feedback from this consultation was supportive

overall and as a result the Board chose to proceed with the Placing

to part finance the Acquisition. The Placing has been structured as

an accelerated bookbuild to minimise execution and market risk.

The Placing is expected to raise gross proceeds of up to GBP157

million. The net proceeds of the Placing will be placed on deposit

pending Completion. If Completion does not occur, the Acquisition

will not proceed but Bovis Homes will be in receipt of the net

proceeds of the Placing. In such circumstances, Bovis Homes will

consider how best to return the Placing proceeds to its

Shareholders.

New Facilities Agreement

Barclays Bank PLC, National Westminster Bank plc, HSBC UK Bank

plc and Lloyds Bank plc, each in their capacities as original

lenders, have provided debt financing commitments in respect

of:

-- a GBP100 million term loan facility (the "Term Loan"); and

-- a GBP375 million revolving credit facility (the "New RCF")

split into two tranches of (i) GBP355,000,000 (the "New RCF Tranche

1") and (ii) GBP20,000,000 ("New RCF Tranche 2"), with an accordion

option for an additional GBP25 million in respect of the New RCF

Tranche 1,

pursuant to a new GBP475 million term loan and revolving credit

facilities agreement to be put in place at the time of signing the

Acquisition Agreements (the "New Facilities Agreement").

The Term Loan will be used to part-fund the Cash Consideration.

The New RCF is intended to first refinance the existing Bovis Homes

Limited revolving credit facility, and thereafter to be available

for general corporate and working capital purposes.

10.2 Consideration Shares

Pursuant to the terms of the SPA, 63,739,385 Consideration

Shares will be issued in connection with the Acquisition. Bovis

Homes will publish today a prospectus in relation to the Admission

of the Consideration Shares (the "Prospectus") which will be filed

with the FCA and made available to the public in accordance with

Rule 3.2 of the Prospectus Regulation Rules.

Applications will be made to the FCA and to the London Stock

Exchange for Admission of the Consideration Shares. It is currently

expected that Admission of the Consideration Shares will become

effective at 8.00 a.m. on 3 January 2020.

The Consideration Shares will be issued and credited as fully

paid up and will rank pari passu in all respects with the Shares

then in issue, including, as further outlined below, the right to

receive and retain in full all dividends or other distributions

made, paid or declared in respect of the Shares by reference to a

record date falling after to the date of issue of the Consideration

Shares. The Consideration Shares will be issued in registered form

and will be capable of being held in certificated and

uncertificated form. Irrespective of the date on which the

Consideration Shares are issued, Galliford Try Shareholders who

receive Consideration Shares in respect of their shareholding in

New Topco shall not be entitled to receive any dividend declared,

made or paid by the Company by reference to a record date falling

prior to the date of issue of the Consideration Shares, which for

the avoidance of doubt shall include the Second Interim Dividend

and the Bonus Issue.

11 Fractional entitlements

11.1 Consideration Shares

The fractional entitlements of Galliford Try Shareholders (in

respect of their shareholding in New Topco Shares) at Completion to

Consideration Shares shall be aggregated and Bovis Homes shall

procure that the maximum whole number of Consideration Shares

resulting therefrom shall be allotted and issued to a person

appointed by Bovis Homes to hold such Consideration Shares on

behalf of the relevant Galliford Try Shareholders. Bovis Homes

shall procure that such Consideration Shares are sold in the market

as soon as practicable after Completion and that the net proceeds

of sale (after the deduction of all commissions and expenses

incurred in connection with such sale, including any value added

tax payable on the proceeds of sale) shall be paid in due

proportion to the relevant Galliford Try Shareholders (rounded down

to the nearest penny), by way of cheque or credit to the relevant

CREST account. However, fractional entitlements to amounts (after

the deduction of all commissions and expenses incurred in

connection with such sale, including any value added tax payable on

the proceeds of sale) of GBP5.00 or less shall not be paid to the

relevant Galliford Try Shareholders who would otherwise be entitled

to them under the Acquisition due to the administrative costs

incurred in doing so, but shall be retained for the benefit of the

Company.

11.2 Bonus Issue Shares

The fractional entitlements of Shareholders at Completion to

Bonus Issue Shares shall be aggregated and Bovis Homes shall

procure that the maximum whole number of Bonus Issue Shares

resulting therefrom shall be allotted and issued to a person

appointed by Bovis Homes to hold such Bonus Issue Shares on behalf

of the relevant Shareholders. Bovis Homes shall procure that such

Bonus Issue Shares are sold in the market as soon as practicable

after Completion and that the net proceeds of sale (after the

deduction of all commissions and expenses incurred in connection

with such sale, including any value added tax payable on the

proceeds of sale) shall be paid in due proportion to the relevant

Shareholders (rounded down to the nearest penny), by way of cheque

or credit to the relevant CREST account. However, fractional

entitlements to amounts (after the deduction of all commissions and

expenses incurred in connection with such sale, including any value

added tax payable on the proceeds of sale) of GBP5.00 or less shall

not be paid to the relevant Galliford Try Shareholders who would

otherwise be entitled to them under the Bonus Issue due to the

administrative costs incurred in doing so, but shall be retained

for the benefit of the Company.

12 Dilution

Bovis Homes proposes to issue up to 13,472,591 Shares in

connection with the Placing, 63,739,385 Consideration Shares in

connection with the Acquisition and 5,665,723 Shares in connection

with the Bonus Issue. Subject to Completion, the Company's issued

ordinary share capital will increase by up to 61.5 per cent,

relative to the number of Shares in issue as at the Latest

Practicable Date.

Immediately following Completion, assuming that (i) up to

13,472,591 Placing Shares are issued (ii) 63,739,385 Consideration

Shares are issued and (iii) 5,665,723 Bonus Issue Shares are issued

in connection with the Acquisition, existing Shareholders at the

Latest Practicable Date will, together, own up to approximately

70.7 per cent. of the ordinary share capital of the Enlarged Group

and the Galliford Try Shareholders will hold in aggregate up to

29.3 per cent. of the ordinary share capital of the Enlarged

Group.

13 Pensions

Bovis Homes will assume Galliford Try's rights and obligations

in relation to the Transferring Pensions Schemes and will become

the sole statutory employer and principal employer of the

Transferring Pension Schemes. Galliford Try will be discharged from

all future obligations in relation to the Transferring Pension

Schemes and will cease participation in the Transferring Pension

Schemes on or around Completion.

The transfer of all of Galliford Try's current and future

obligations in relation to the Transferring Pension Schemes will be

effected by means of two flexible apportionment agreements in

respect of each Transferring Pension Scheme, each entered into

before Completion between the trustee of the applicable