TIDMWCW

RNS Number : 9109K

Walker Crips Group plc

23 December 2022

23 December 2022

Walker Crips Group plc

("Walker Crips", the "Company" or the "Group")

Results for the six months ended 30 September 2022

Highlights

-- Total revenues increased by 2.3% to GBP16.06 million (2021: GBP15.69 million)

-- Gross profit increased by 11.6% to GBP12.28 million (2021: GBP11.00 million)

-- Operating profit of GBP162,000 (2021: GBP120,000) and profit

before tax of GBP145,000 (2021: GBP54,000)

-- Operating profit pre-exceptional items ([3]) of GBP162,000 (2021: GBP232,000)

-- Profit before tax pre-exceptional items ([3]) of GBP145,000 (2021: GBP166,000)

-- Adjusted EBITDA of GBP1.13 million (2021: GBP1.29 million) ([1])

-- Underlying cash generated from operations of GBP1,610,000 (2021: GBP548,000) ([2])

-- Cash and cash equivalents of GBP10.6 million (2021: GBP8.38 million)

-- Assets Under Management ("AUM") decreased by 13.1% to GBP3.1

billion (March 2022: GBP3.6 billion)

-- Total Assets Under Management and Administration ("AUMA")

decreased by 10.8% to GBP4.9 billion (March 2022: GBP5.5

billion)

-- Interim dividend 0.25 pence per share (2021: 0.30 pence per share)

[1] Adjusted EBITDA represents earnings before exceptional items

([3]) , interest, taxation, depreciation and amortisation on an

IFRS basis. The Directors present this result as it is a metric

widely used by stakeholders when considering an entity's financial

performance. A full reconciliation is provided in the Chairman's

statement.

[2] Underlying cash generated from operations shows the cash

generated from operations adjusted for lease liability payments

under IFRS 16, non-cyclical working capital movements and cash

exceptional items. The Directors consider that this metric helps

readers understand the cash generating performance of the Group. A

full reconciliation to reported results is presented in the

Chairman's statement.

[3] Exceptional items are disclosed in note 10 to the accounts

and a full reconciliation to reported results is presented in the

Chairman's statement.

Martin Wright, Chairman of Walker Crips, commented:

"A strong contribution from our structured products business

together with the positive income effect of the rising interest

rate environment helped mitigate the reduction in investment

management revenues and trading commissions that are reflective of

lower market levels, resulting in much improved reported gross

profits. However, this improvement has been offset by the

inflationary impact on costs, particularly salaries, reflecting the

tight labour market, and additional costs taken on in the period.

The difficult economic environment and inflationary cost pressures

remain a challenging headwind and our focus continues to be on

revenue growth, improving operating efficiency and systems, and

cost control."

For further information, please contact:

Walker Crips Group plc Tel: +44 (0)20 3100 8000

Craig Harrison, Media Relations

Four Communications Tel: +44 (0)20 3920 0555

Jonathan Atkins walkercrips@fourcommunications.com

Singer Capital Markets (Broker) Tel: +44 (0)20 7496 3000

Justin McKeegan / George Tzimas

Further information on Walker Crips Group is available on the

Company's website: www.walkercrips.co.uk

Chairman's statement

Introduction

Markets continue to be challenging on the back of falls in

financial markets that have led to AUMA reducing to GBP4.9 billion,

down 10.9% from GBP5.5 billion in March 2022. This has inevitably

impacted our results, with traditional trading commissions and

investment management fees falling. However, this reduction has

been offset by the strong performance of our structured products

team and increased interest margins on client deposits, leading to

much improved reported gross profits. Pressures on our cost base,

particularly salaries, have dented this improvement such that the

Group reports an operating profit of GBP162,000 for the first six

months compared to GBP120,000 in the same period last year

(GBP232,000 when adjusted for exceptional items). The results are

further explained in the trading update below.

The Group balance sheet and capital base remain sufficiently

robust to support our short- and medium-term strategy and pay an

interim dividend to shareholders. As at the reporting date, the

Group's net assets are GBP21.7 million (September 2021: GBP22.1

million; March 2022: GBP22.1 million) and cash and cash equivalents

GBP10.6 million (September 2021: GBP8.4 million; March 2022:

GBP11.1 million). Our focus continues to be on revenue growth,

improving operating efficiency and the robustness of our

infrastructure and cost control.

During the period, the Group has made progress on a number of

ongoing initiatives, particularly the project to improve our

regulatory and compliance framework. In terms of strategy, your

Board is clear that the Group needs to grow its core business in

both investment management and wealth management. It is also clear

and determined that the central infrastructure supporting that

business will be robust and fit for purpose, to avoid the

repetition of shortcomings resulting in exceptional costs that have

beset the business over the last eighteen months or so, as well as

keeping pace with changes. This has meant taking some decisions

that are long term and which involve incurring costs before the

benefits are seen. In addition, during the period we have made good

progress on several other key areas of regulatory importance,

including a project to implement and embed the new regulatory

initiative, "the Consumer Duty" which places increased emphasis on

delivering good outcomes for retail customers, a principle close to

our heart and our mission. Further, in the annual report and

accounts for the year to 31 March 2022, I explained that the Group

had identified the need to make redress payments to a small number

of customers as a result of the inappropriate and unacceptable

actions of one associate. Significant progress with the redress

calculation methodology, discussions with insurers and importantly

discussions with the clients affected has been made and we expect

to bring this matter to a final resolution in the very near

future.

Group performance

Revenue for the period was GBP16.06 million (2021: GBP15.69

million), an increase of 2.3%. Breaking this down, broking income,

on the back of significant market uncertainties, reduced by GBP1.1

million compared to the same period last year. Non-broking income,

with improved performance from our structured investment division

and retained margin on managed deposits, offset by a reduction in

management fees and arbitrage profits, saw an increase of GBP1.5

million in the same period. Improved performance from our inhouse

revenue generators helped in increasing the Group gross margin in

the period from 70.2% to 76.5%.

The Group reported an operating profit of GBP162,000 and a

profit before tax of GBP145,000, up 35.0% and up 168.5%,

respectively, compared to the same period last year (operating

profit 2021: GBP120,000; profit before tax 2021: GBP54,000).

However, adjusting for exceptional items in the prior year, the

Group's operating profit and profit before tax were down GBP70,000

(30.2%) and GBP21,000 (12.7%) respectively. I note that there are

no exceptional items in the current half-year results.

Adjusted EBITDA declined by GBP158,000 (or 12.3%) to GBP1.13m,

caused by pressures on costs which outweigh the increase in

revenue. Administrative expenses, excluding salaries and

exceptional items, increased by GBP224,000 (or 4.7%). Salaries,

whilst in line with the budget, saw an increase of GBP1,121,000 (or

18.8%) in the period. It should be noted that, in line with the

strategy, this combination of inflationary pressures and the need

to reward our people fairly, coupled with our ongoing investment in

key personnel, training and systems, means we are likely to see

further increases in our cost-base in the second half of this

financial year. Our cost base is closely monitored by management

who are very much focused on ways to improve margins and operating

efficiencies.

Reconciliation of operating profit to operating profit

before exceptional items

Unaudited Unaudited Audited

September September March

2022 2021 2022

GBP'000 GBP'000 GBP'000

----------------------------------------- ----------------------- ---------------------- --------------------------

Operating profit 162 120 326

Operating exceptional items (note

10) - 112 1,540

Operating profit before exceptional

items 162 232 1,866

----------------------------------------- ----------------------- ---------------------- --------------------------

Reconciliation of profit before tax to profit

before tax and exceptional items

Unaudited Unaudited Audited

September September March

2022 2021 2022

GBP'000 GBP'000 GBP'000

----------------------------------------- ----------------------- ---------------------- --------------------------

P rofit before tax 145 54 324

Exceptional items (note 10) - 112 1,437

Profit before tax and exceptional

items 145 166 1,761

----------------------------------------- ----------------------- ---------------------- --------------------------

Adjusted EBITDA

Unaudited Unaudited Audited

September September March

2022 2021 2022

GBP'000 GBP'000 GBP'000

----------------------------------------- ----------------------- ---------------------- --------------------------

Operating profit 162 120 326

Operating exceptional items (note

10) - 112 1,540

Amortisation / depreciation 560 563 1,165

Right-of-use-assets depreciation

charge 408 493 873

Adjusted EBITDA 1,130 1,288 3,904

----------------------------------------- ----------------------- ---------------------- --------------------------

Underlying cash generated from

operations

Unaudited Unaudited Audited

September September March

2022 2021 2022

GBP'000 GBP'000 GBP'000

----------------------------------------- ----------------------- ---------------------- --------------------------

Net cash inflow from operations 25 213 4,217

Working capital 1,559 768 (2,257)

Lease liability payments under IFRS

16 (278) (545) (1,052)

Cash outflow on operating exceptional

items 304 112 435

Underlying cash generated in the

period 1,610 548 1,343

----------------------------------------- ----------------------- ---------------------- --------------------------

Investment Management

The Group's Investment Management division saw its revenue

increase by 2% to GBP15.1 million (September 2021: GBP14.8 million)

compared to the same period last year. The increase was largely

driven by the continuing success of our Structured Investment

division and the increased retained interest on managed deposits

offsetting declines in management fees and trading commissions. The

increase in revenue, however, did not translate directly to an

increase in operating profits. The division reported an operating

profit of GBP616,000, down 10.5% compared to last year (September

2021: GBP688,000), reflective of the pressures on salaries and

costs generally, including increased regulatory compliance

requirements.

The downturn in global market indices, as well as economic

uncertainties, are likely to impact the investment management

division in the second half of this financial year, however rising

interest rates, our strong position in the structured investments

market and our steady Barker Poland arm should provide us with much

needed stability as we navigate through this period.

Wealth Management

Our Wealth Management division recorded total revenues of

GBP949,000, up 11.6% from the same period last year. The

year-on-year increase in revenue is partly down to our investment

in new advisers last year. The Wealth Management division is

focused on generating revenue growth, both organically and through

the recruitment of new advisers. In the short-term, as noted, the

associated costs and time needed to bed-down new advisers, have a

negative short-term impact on profitability which, together with

the inflationary impact on costs, means the division reported an

operating loss of GBP162,000 (September 2021: loss of GBP240,000

before exceptional items).

Group strategy

The underlying performance of the Group and diversity of our

product range reflects a level of resilience in financial

performance that enables the Group to focus on its prime objectives

of growing revenue and improving gross margins in investment

management and wealth management. As referenced above, this is

coupled with realising operational efficiencies and, at the same

time, taking decisions to invest to improve our central

infrastructure regulatory and compliance framework for the long

term.

Dividends

The Board has declared an interim dividend of 0.25 pence per

share (2021: 0.30 pence per share), which will be paid on 20

January 2023 to shareholders on the register on 6 January 2023. The

ex-dividend date will be 5 January 2023. The reduced interim

dividend reflects the reduction in performance compared to the

prior year when adjusted for exceptional items.

Our aim is always to reward shareholders for their continued

support and pay dividends when appropriate. The Board will continue

to monitor the Group's progress, and set the final dividend based

on performance, capital headroom, market outlook and short-term and

long-term cash flow considerations.

Outlook

There is little doubt that we have a difficult period ahead. The

second half of the year will face headwinds from the various

macro-economic uncertainties, which are beyond the Group's control.

Rising inflation and interest rates, coupled with the uncertain UK

political landscape, is unlikely to be market friendly, but your

Board remains cautiously optimistic that our strategy will overcome

these short-term issues and that the Group will emerge with an

improved infrastructure and a platform for growth across our

disciplines.

Martin Wright

Chairman

23 December 2022

Walker Crips Group plc

Walker Crips Group plc

Condensed consolidated income statement

For the six months ended 30 September 2022

Unaudited Unaudited Audited

September September March

2022 2021 2022

Notes GBP'000 GBP'000 GBP'000

--------------------------------------- ------ ------------------- ------------------- ------------------

4,

Revenue 7 16,057 15,690 32,820

Commissions and fees paid 8 (3,774) (4,725) (9,110)

Share of after-tax profit of associate 9 - 43 57

---------------------------------------- ------ ------------------- ------------------- ------------------

Gross profit 12,283 11,008 23,767

Administrative expenses (12,121) (10,776) (21,901)

Exceptional items 10 - (112) (1,540)

---------------------------------------- ------ ------------------- ------------------- ------------------

Operating profit 4 162 120 326

Investment revenue 28 - 9

Finance costs (45) (66) (114)

Exceptional item - profit on disposal

of associate investment - - 103

---------------------------------------- ------ ------------------- ------------------- ------------------

Profit before tax 145 54 324

Taxation (28) (10) (151)

Profit for the period attributable

to equity holders of the Parent

Company 117 44 173

---------------------------------------- ------ ------------------- ------------------- ------------------

E arnings per share

--------------------------------------- ------ ------------------- ------------------- ------------------

0.2

Basic and diluted 5 7p 0.10p 0.41p

---------------------------------------- ------ ------------------- ------------------- ------------------

Walker Crips Group plc

Condensed consolidated statement of comprehensive income

For the six months ended 30 September 2022

Unaudited Unaudited Audited

September September March

2022 2021 2022

GBP'000 GBP'000 GBP'000

-------------- ----------- ---------------

Profit for the period 1 17 44 173

------------------------------------------- -------------- ----------- ---------------

Total comprehensive income for the

period attributable to equity holders

of the Parent Company 1 17 44 173

------------------------------------------- -------------- ----------- ---------------

Walker Crips Group plc

Condensed consolidated statement of financial position

As at 30 September 2022

Unaudited Unaudited Audited

September September March

2022 2021 2022

Notes GBP'000 GBP'000 GBP'000

---------------------------------- ------ --------------------- --------------------- -----------------

Non-current assets

Goodwill 4,388 4,388 4,388

Other intangible assets 5,387 6,169 5,752

Property, plant and equipment 1,015 1,330 1,169

Right-of-use-assets 2,336 3,120 2,597

Investment in associate 9 - 19 -

Investments - fair value through

profit or loss 12 - 37 -

13,126 15,063 13,906

---------------------------------- ------ --------------------- --------------------- -----------------

Current assets

Trade and other receivables 30,2 66 30,061 50,003

Investments - fair value through

profit or loss 13 1,413 1,011 1,647

Cash and cash equivalents 10, 623 8,376 11,113

42,302 39,448 62,763

---------------------------------- ------ --------------------- --------------------- -----------------

Total assets 55,428 54,511 76,669

---------------------------------- ------ --------------------- --------------------- -----------------

Current liabilities

Trade and other payables (29,528) (27,680) (49,625)

Current tax liabilities (225) (278) (132)

Deferred tax liabilities (349) (306) (414)

Provisions (27) (64) (1,137)

Lease liabilities (166) (621) (245)

Dividends payable ( 511) (53) -

Deferred cash consideration (37) - (89)

---------------------------------- ------ --------------------- --------------------- -----------------

(30,843) (29,002) (51,642)

---------------------------------- ------ --------------------- --------------------- -----------------

Net current assets 11,459 10,446 11,121

---------------------------------- ------ --------------------- --------------------- -----------------

Long-term liabilities

Deferred cash consideration (16) (33) (29)

Lease liabilities (2,287) (2,690) (2,300)

Provisions (564) (675) (586)

---------------------------------- ------ --------------------- --------------------- -----------------

(2,867) (3,398) (2,915)

---------------------------------- ------ --------------------- --------------------- -----------------

Net assets 21,718 22,111 22,112

---------------------------------- ------ --------------------- --------------------- -----------------

Equity

Share capital 2,888 2,888 2,888

Share premium account 3,763 3,763 3,763

Own shares (312) (312) (312)

Retained earnings 10,656 11,049 11,050

Other reserves 4,723 4,723 4,723

Equity attributable to equity holders

of the Parent Company 21,718 22,111 22,112

------------------------------------------ --------------------- --------------------- -----------------

Walker Crips Group plc

Condensed consolidated statement of cash flows

For the six months ended 30 September 2022

Unaudited Unaudited Audited

September September March

2022 2021 2022

Notes GBP'000 GBP'000 GBP'000

--------------------------- ---------------------------- ------------------------------- --------------------------

Operating activities

Cash generated from

operations 15 25 213 4,217

Tax paid - - (120)

--------------------------- ---------------------------- ------------------------------- --------------------------

Net cash generated from

operating

activities 25 213 4,097

--------------------------- ---------------------------- ------------------------------- --------------------------

Investing activities

Purchase of property,

plant and equipment (30) (24) (119)

(Purchase) / sale of

investments held

for trading (221) 63 (342)

Consideration paid on

acquisition of

intangibles (9) - (93)

Dividends received 24 - 9

Dividends received from

associate investment - 26 57

Consideration received on

sale of associate - - 105

Interest received 5 - -

--------------------------- ---------------------------- ------------------------------- --------------------------

Net cash (used in) /

generated from

investing activities (231) 65 (383)

--------------------------- ---------------------------- ------------------------------- --------------------------

Financing activities

Dividends paid - (202) (383)

Interest paid (6) (10) (21)

Repayment of lease

liabilities * (239) (489) (959)

Repayment of lease

interest * (39) (56) (93)

--------------------------- ---------------------------- ------------------------------- --------------------------

Net cash used in financing

activities (284) (757) (1,456)

--------------------------- ---------------------------- ------------------------------- --------------------------

Net (decrease) / increase

in cash

and cash equivalents ( 490) (479) 2,258

Net cash and cash

equivalents at beginning

of period 11,113 8,855 8,855

--------------------------- ---------------------------- ------------------------------- --------------------------

Net cash and cash

equivalents at end

of period 10, 623 8,376 11,113

--------------------------- ---------------------------- ------------------------------- --------------------------

* Total IFRS 16 lease liability payments of GBP278,000

(September 2021: GBP545,000; March 2022: GBP1,052,000).

Walker Crips Group plc

Condensed consolidated statement of changes in equity

For the six months ended 30 September 2022

Share Own

Share premium shares Capital Retained Total

capital account held redemption Other earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Equity as at

31 March 2021 2,888 3,763 (312) 111 4,612 11,260 22,322

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Total

comprehensive

income for

the

period - - - - - 44 44

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Contributions

by and

distributions

to owners

Dividends paid - - - - - (255) (255)

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Total

contributions

by and

distributions

to owners - - - - - (255) (255)

Equity as at

30 September

2021 2,888 3,763 (312) 111 4,612 11,049 22,111

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Total

comprehensive

income for

the

period - - - - - 129 129

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Contributions

by and

distributions

to owners

Dividends paid - - - - - (128) (128)

Total

contributions

by and

distributions

to owners - - - - - (128) (128)

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Equity as at

31 March 2022 2,888 3,763 (312) 111 4,612 11,050 22,112

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Total

comprehensive

income for

the

period - - - - - 117 117

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Contributions

by and

distributions

to owners

Dividends paid

and payable - - - - - (511) (511)

Total

contributions

by and

distributions

to owners - - - - - (511) (511)

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Equity as at

30 September

2022 2,888 3,763 (312) 111 4,612 10,656 21,718

--------------- --------------------- --------------------- --------------------- --------------------- --------------------- ------------------------- -------------------------

Walker Crips Group plc

Notes to the condensed consolidated financial statements

For the six months ended 30 September 2022

1. General information

Walker Crips Group plc ("the Company") is the Parent Company of

the Walker Crips group of companies ("the Group"). The Company is a

public limited company incorporated in England and Wales under the

Companies Act 2006. The Company's registered office is at Old

Change House, 128 Queen Victoria Street, London EC4V 4BJ.

2. Basis of preparation and significant accounting policies

Basis of preparation

The Group's consolidated financial statements are prepared in

accordance with International Financial Reporting Standards as

adopted by the European Union ("IFRS"). These condensed financial

statements are presented in accordance with IAS 34 Interim

Financial Reporting. They do not include all disclosures that would

otherwise be required in a complete set of financial statements;

however, selected explanatory notes are included for events and

transactions that are significant to an understanding of the

Group's financial position and performance.

The condensed consolidated financial statements have been

prepared on the basis of the accounting policies and methods of

computation set out in the Group's consolidated financial

statements for the year ended 31 March 2022 and therefore should be

read in conjunction with the Group's audited financial statements

for that year. The interim financial information is unaudited and

does not constitute statutory accounts as defined in section 434 of

the Companies Act 2006.

The Group's financial statements for the year ended 31 March

2022 have been reported on by the auditors and delivered to the

Registrar of Companies. The report of the auditors was unqualified

and did not draw attention to any matters by way of emphasis. They

also did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006. The interim financial information has

neither been audited nor reviewed pursuant to guidance issued by

the Audit Procedures Board.

The interim condensed consolidated financial statements are

presented in GBP sterling (GBP) and are rounded to the nearest

thousand, unless stated otherwise.

Going concern

The Directors are satisfied that the Group has sufficient

resources to continue in operation for a period of at least twelve

months from the date of this report. Accordingly, the Directors

continue to adopt the going concern basis in preparing the

condensed consolidated financial statements.

As at 30 September 2022, the Group had net assets of GBP21.7

million (31 March 2022: GBP22.1 million), net current assets of

GBP11.5 million (31 March 2022: GBP11.1 million) and net cash and

cash equivalents of GBP10.6 million (31 March 2022: GBP11.1

million). The Group reported an operating profit of GBP162,000 for

the period to 30 September 2022 (30 September 2021: GBP120,000),

and net cash generated from operating activities of GBP25,000 (30

September 2021: 213,000).

The Directors consider the going concern basis to be appropriate

following their assessment of the Group's financial position and

its ability to meet its obligations as and when they fall due. In

making the going concern assessment, the Directors have taken the

following into account:

- Capital structure and liquid resources;

- Trading performance in the six-month period to 30 September 2022;

- The base case and stressed cash flow forecasts over the

financial reporting periods ending 31 March 2023 and 31 March

2024;

- Stress tests, including reversed stress test scenarios, to

assess the Group's ability to withstand significant market-wide

events; and

- The principal risks facing the Group.

Key assumptions that the Directors have made in preparing the

base case cash flow forecasts are that:

- Revenues reflect the impact of (i) reduced trading activity,

(ii) higher retained interest income from managing client deposits,

(iii) no further significant impact from the pandemic other than

that already known, and (iv) the FTSE 100 index remaining at the

lower 7000 range for a large part of the next 12 months; and

- Base case costs prudently reflect only the actions Management

has taken to date and inflation of 10% over the period to 31 March

2024

Key stress scenarios that the Directors have considered

include:

- A 'bear stress scenario' representing a 10% fall in income

compared to the base case scenario in reporting periods ending 31

March 2023 and 31 March 2024;

- A 'severe stress scenario' representing a 20% fall in

commission income and 15% fall in fee income compared to the base

case for each forecast period; and

- Both stress scenarios assume no mitigating actions.

Our reverse stress testing further indicates that revenues would

have to decline by 25.4% over the next 18 months compared to base

case to reach our liquidity and pillar 1 regulatory capital ratio

thresholds. These reverse stresses make no allowance for any

mitigating actions available to the Group and the Directors

consider them to be remote scenarios.

Although the pandemic remains a risk, the Directors believe that

the stress conditions assessed demonstrate the Group's financial

resilience and operating flexibility. At the report date, the

Directors were not aware of any material uncertainties that would

cast doubt over the Group's ability to continue as a going

concern.

Taxation

The tax charge in the income statement represents the sum of the

tax currently payable and deferred tax.

The tax currently payable is based on the taxable profit for the

period. Taxable profit differs from net profit as reported in the

income statement because it excludes items of income or expense

that are taxable or deductible in other years and it further

excludes items that are never taxable or deductible. The Group's

liability for current tax is calculated using tax rates that have

been enacted or substantively enacted by the statement of financial

position date. The amount of taxable profit in the current period

has been estimated.

Deferred tax is calculated at the tax rates that are expected to

apply in the period in which the liability is settled or the asset

is realised based on tax rates that have been enacted or

substantively enacted by the statement of financial position

date.

Deferred tax assets and liabilities are offset when the Group

has a legally enforceable right to do so and presented as a net

number on the face of the statement of financial position.

Use of estimates and judgements

Estimates and judgements used in the preparation of these

interim condensed consolidated financial statements are continually

evaluated and are based on historical experience and other factors,

including expectations of future events that are believed to be

reasonable.

There have been no material revisions to the nature and amounts

of estimates of numbers reported in prior periods. The effects of

COVID-19 have not made any significant changes to various

methodologies adopted by the Group in assessing judgments and

estimates made in the preparation of these interim condensed

consolidated financial statements.

Key sources of estimates and judgements that have a significant

impact on the carrying values of assets and liabilities are

discussed below:

Impairment of goodwill - estimation and judgement

The Group tests biannually whether goodwill allocated to each of

the cash-generating units have suffered any impairment. Impairment

tests are carried out more frequently if there are events or

changes in circumstances that indicate that the carrying amount of

the asset may exceed the recoverable amount.

Determining whether goodwill is impaired requires an estimation

of the fair value less costs to sell and the value-in-use of the

cash-generating units to which goodwill has been allocated. The

fair value less costs to sell involves estimation of values based

on the application of earnings multiples and comparison to similar

transactions. The value-in-use calculation requires the entity to

estimate the future cash flows expected to arise from the

cash-generating unit and apply a discount rate in order to

calculate present value. The assumptions and inputs involve

judgements and create estimation uncertainty.

The last annual test was performed for the six months ending 30

September 2022. The carrying amount of goodwill at the statement of

financial position date was GBP4.4 million (31 March 2022: GBP4.4

million).

Other intangible assets - judgement

Acquired client lists are capitalised based on current fair

values. When the Group purchases client relationships from other

corporate entities, a judgement is made as to whether the

transaction should be accounted for as a business combination or a

separate purchase of intangible assets. In making this judgement,

the Group assesses the acquiree against the definition of a

business combination in IFRS 3. Payments to newly recruited

Investment Managers are capitalised when they are judged to be made

for the acquisition of client relationship intangibles. The useful

lives are estimated by assessing the historic rates of client

retention, the ages and succession plans of the Investment Managers

who manage the clients and the contractual incentives of the

Investment Managers. The Directors conduct a review of indicators

of impairment and also consider a life of up to twenty years to be

both appropriate and in line with industry peers.

The Group reviews the carrying amounts of its intangible assets

to determine whether there is any indication that those assets have

suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any). Where the asset does

not generate cash flows that are independent from other assets, the

Group estimates the recoverable amount of the cash-generating unit

to which the asset belongs.

No intangible asset acquisitions were made in the period to 30

September 2022.

Provisions - estimation and judgement

The Group has made provisions for dilapidations under four

leases for its offices. The Group did not enter into any new

property leases in the period but terminated two of its existing

lease agreements. The amounts of the provisions are, where

possible, estimated using quotes from professional building

contractors. The property, plant and equipment elements of the

dilapidations are depreciated over the terms of their respective

leases. The obligations in relation to dilapidations are inflated

using an estimated rate of inflation and discounted using

appropriate gilt rates to present value. The change in liability

attributable to inflation and discounting is recognised in interest

expense.

Remaining provisions made at the year ended 31 March 2022 in

relation to upgrading our financial crime control framework and

customer redress and associated costs have been transferred to

trade and other payables given the progress made during the period

in resolving these matters.

IFRS 16 "Leases" - estimation and judgement

IFRS 16 requires certain judgements and estimates to be made and

those significant judgements are explained below:

- Following a review of all leases, the Group has opted to use

single discount rates for leases with reasonably similar

characteristics. The discount rates used have had an impact on the

right-of-use asset values, lease liabilities on initial recognition

and lease finance costs included within the income statement and

statement of financial position.

- IFRS 16 defines a lease term as the non-cancellable period of

a lease, together with the options to extend or terminate a lease

if the lessee is reasonably certain to exercise the lease options

available at the time of reporting. Where a lease includes the

option for the Group to extend the lease term, the Group has

exercised the judgement, based on current information, that such

leases will be extended to the full length available, and this is

included in the calculation of the value of the right of use assets

and lease liabilities on initial recognition and valuation at the

reporting date.

3. Changes in significant accounting policies

The accounting policies applied in these interim condensed

consolidated financial statements are consistent with those applied

in the Group's consolidated financial statements as at and for the

year ended 31 March 2022.

4. Revenue and segmental analysis

For segmental reporting purposes, the Group currently has three

operating segments:

- Investment Management, being portfolio-based transaction execution and investment advice;

- Wealth Management, being financial planning and pension advice; and

- Software as a Service ("SaaS"), comprising provision of

regulatory and admin software to regulated companies.

Walker Crips Investment Management's activities focus

predominantly on investment management of various types of

portfolios and asset classes.

Walker Crips Wealth Management provides advisory and

administrative services to clients in relation to their financial

planning, life insurance, inheritance tax and pension

arrangements.

EnOC Technologies Limited ("EnOC") provides cloud-based software

solutions to our business partners including all Walker Crips

Group's regulated entities. Fees payable by subsidiary companies to

EnOC have been eliminated on consolidation.

These activities are the basis on which the Group reports its

primary segment information. Unallocated corporate expenses are

disclosed separately. Revenues between Group entities and

reportable segments are excluded from the below analysis.

Investment Wealth SaaS Total

Revenue Management Management

GBP'000 GBP'000 GBP'000 GBP'000

----------- -------------------------- ---------------------------- ------------------------------ -------------------------- -----------------------

6 months

to

30

September

2022 15,100 949 8 16,057

----------- -------------------------- ---------------------------- ------------------------------ -------------------------- -----------------------

6 months

to 30

September

2021 14,810 850 30 15,690

----------- -------------------------- ---------------------------- ------------------------------ -------------------------- -----------------------

Year to 31

March

2022 30,937 1,845 38 32,820

----------- -------------------------- ---------------------------- ------------------------------ -------------------------- -----------------------

Operating Unallocated Operating

profit Costs profit

/ (loss)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- -------------------------- ---------------------------- ------------------------------ -------------------------- -----------------------

6 months

to

30

September

2022 616 (162) (61) (2 31) 162

----------- -------------------------- ---------------------------- ------------------------------ -------------------------- -----------------------

6 months

to 30

September

2021 688 (16) (41) (511) 120

----------- -------------------------- ---------------------------- ------------------------------ -------------------------- -----------------------

Year to 31

March

2022 1,160 (258) (102) (474) 326

----------- -------------------------- ---------------------------- ------------------------------ -------------------------- -----------------------

5. Earnings per share

The calculation of basic earnings per share for continuing

operations is based on the post-tax profit for the period of

GBP117,000 (2021: post-tax profit of GBP44,000) and on 42,577,328

(2021: 42,577,328) ordinary shares of 6 2/3p, being the weighted

average number of ordinary shares in issue during the period. There

is no dilution applicable to the current period.

6. Dividends

The interim dividend of 0.25 pence per share (2021: 0.30 pence

per share) is payable on 20 January 2023 to shareholders on the

register at the close of business on 6 January 2023. The associated

ex-dividend date is 5 January 2023. The interim dividend has not

been included as a liability in this interim report.

7. Total income

Six months Six months

ended 30 ended 30 Year ended

September September 31 March

2022 2021 2022

GBP'000 GBP'000 GBP'000

----------------------------- ----------- ----------- -------------

Revenue from contracts with

customers 15,138 15,221 31,694

Other revenue 919 469 1,126

----------------------------- ----------- ----------- -------------

16,057 15,690 32,820

----------------------------- ----------- ----------- -------------

Investment revenue 28 - 9

----------------------------- ----------- ----------- -------------

16,085 15,690 32,829

----------------------------- ----------- ----------- -------------

The Group's income can also be categorised as follows for the

purpose of measuring a key performance indicator; the ratio of

non-broking income to total income.

Six months % Six months % Year %

ended ended ended

30 September 30 September 31 March

2022 2021 2022

Income GBP'000 GBP'000 GBP'000

Broking 2,956 18 4,099 26 8,059 25

Non-broking 13,129 82 11,591 74 24,770 75

16,085 100 15,690 100 32,829 100

-------------- ---- -------------- ---- ---------- ----

8. Commissions and fees paid

Commissions and fees paid comprise:

Six months Six months

ended 30 ended 30 Year ended

September September 31 March

2022 2021 2022

GBP'000 GBP'000 GBP'000

---------------------------- ----------- ----------- -------------

To authorised external

agents 3 25 61

To self-employed certified

persons 3,771 4,700 9,049

---------------------------- ----------- ----------- -------------

3,774 4,725 9,110

---------------------------- ----------- ----------- -------------

9. Investment in associate

Six months Six months

Six months ended ended ended

30 September 31 March 30 September

2022 2022 2021

GBP'000 GBP'000 GBP'000

----------- --------------------------------------- ------------------------------------- --------------------------------------

Brought

forward - 19 2

Share of

after-tax

profit - 14 43

Dividends - (31) (26)

Disposals - (2) -

----------- --------------------------------------- ------------------------------------- --------------------------------------

Carried

forward - - 19

------------ -------------------------------------- ------------------------------------- --------------------------------------

Associate

The Group disposed of its 33.33% interest in its associate,

Walker Crips Property Income Limited ("WCPIL"), in the previous

financial year.

10. Exceptional items

As a result of their materiality, the Directors disclose certain

amounts separately in order to present results which are not

distorted by significant non-recurring events. There are no

reported exceptional items for the six months to 30 September

2022.

Exceptional items included within Six months Year ended

operating profit ended 30 31 March

September 2022

2021

GBP'000 GBP'000

-------------------------------------------- ------------------------------ -----------------------------

Restructuring, redundancy and other

costs (note a) 336 516

Net compensation income (note b) (224) (221)

Financial crime control framework review

and remediation (note c) - 595

Client redress and associated costs

(note d) - 650

Operating exceptional items 112 1,540

-------------------------------------------- ------------------------------ -----------------------------

Other exceptional items

Profit on disposal of associate investment

(note e) - (103)

Total exceptional items 112 1,437

-------------------------------------------- ------------------------------ -----------------------------

During the year to 31 March 2022, the following items were

classified as exceptions due to their materiality and non-recurring

nature.

a) Completion of the Group's restructuring and redundancy activity commenced during the pandemic;

b) The Group received compensation under a confidential

settlement agreement, without admission of liability by either

party in relation to a dispute;

c) The estimated costs of an independent review and resulting

actions to remediate and enhance the Group's financial crime

framework;

d) The estimated costs for redress and related costs resulting from the actions of an associate.

e) The Group disposed of its 33.33% interest in its associate,

Walker Crips Property Income Limited ("WCPIL").

11. Tax

Tax is charged at 19% for the six months ended 30 September 2022

(2021: 19%) representing the best estimate of the average annual

effective tax rate expected to apply for the full year, applied to

the pre-tax income of the six-month period.

12. Non-current investments - fair value through profit or loss

Investments at

fair value through

profit or loss Total

GBP'000 GBP'000

At 30 September 2021 37 37

------------------------------- -------------------------- --------------------------

Change in value in the period (37) (37)

At 31 March 2022 - -

------------------------------- -------------------------- --------------------------

At 30 September 2022 - -

------------------------------- -------------------------- --------------------------

In the year to 31 March 2022, the Group's investment in

unregulated collective investment schemes ("UCIS") was written down

to GBPnil.

13. Current investments - fair value through profit or loss

As at As at As at

30 September 30 September 31 March

2022 2021 2022

GBP'000 GBP'000 GBP'000

---------------------------------- --------------- --------------- -----------------------

Trading investments

Investments - fair value through

profit or loss 1,413 1,011 1,647

---------------------------------- --------------- --------------- -----------------------

Financial assets at fair value through profit or loss represent

investments in equity securities and collectives that present the

Group with an opportunity for a return through dividend income,

interest and trading gains. The fair values of these securities are

based on quoted market prices.

14. Fair values

The following provides an analysis of financial instruments that

are measured subsequent to initial recognition at fair value,

grouped into Levels 1 to 3 based on the degree to which the fair

value is observable:

- Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets or

liabilities. The majority of trading investments fall within this

category;

- Level 2 fair value measurements are those derived from inputs

other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived from prices). The Group does

not hold financial instruments in this category; and

- Level 3 fair value measurements are those derived from

valuation techniques that include inputs for the asset or liability

that are not based on observable market data (unobservable inputs).

A small population of trading investments fall within this

category.

The following tables analyse within the fair value hierarchy to

the Group's investments measured at fair value.

Level 1 Level 3 Total

GBP'000 GBP'000 GBP'000

---------------------- -------------------------------- ------------------------------- ---------------------------

At 30 September 2022

Financial assets held

at fair

value through profit

and loss 1,381 32 1,413

---------------------- -------------------------------- ------------------------------- ---------------------------

1,381 32 1,413

---------------------- -------------------------------- ------------------------------- ---------------------------

At 30 September 2021

Financial assets held

at fair value

through profit and

loss 1,011 37 1,048

---------------------- -------------------------------- ------------------------------- ---------------------------

1,011 37 1,048

---------------------- -------------------------------- ------------------------------- ---------------------------

At 31 March 2022

Financial assets held

at fair value

through profit and

loss 1,647 - 1,647

---------------------- -------------------------------- ------------------------------- ---------------------------

1,647 - 1,647

---------------------- -------------------------------- ------------------------------- ---------------------------

Further IFRS 13 disclosures have not been presented here as the

balance represents 2.550% (2021: 1.922%) of total assets.

15. Cash generated from operations

Unaudited Unaudited Audited

September September March

2022 2021 2022

GBP'000 GBP'000 GBP'000

Operating profit for

the period 162 120 326

Adjustments for:

Amortisation of

intangibles 374 397 862

Net change in fair

value of financial

instruments at fair

value through

profit

or loss 454 (152) (347)

Share of associate

profit - (43) (57)

Depreciation of

property, plant

and equipment 186 166 303

Depreciation of

right-of-use assets 408 493 873

Decrease /

(increase) in

debtors

* 19,736 19,085 (915)

(Decrease) /

increase in

creditors

* (21, 295) (19,853) 3,172

Net generated from

operations 25 213 4,217

--------------------- -------------------------------- ----------------------------------- --------------------

* GBP1,559,000 cash outflow from working capital movement (30

September 2021: GBP768,000 outflow; 31 March 2022: GBP2,257,000

inflow).

16. Contingent liability

From time to time, the Group receives complaints or undertakes

past business reviews, the outcomes of which remain uncertain

and/or cannot be reliably quantified based upon information

available and circumstances falling outside the Group's control.

Accordingly, contingent liabilities arise, the ultimate impact of

which may also depend upon availability of recoveries under the

Group's indemnity insurance and other contractual arrangements.

Other than the complaints deemed to be probable, the Directors

presently consider a negative outcome to be remote or a reliable

estimate of the amount of a possible obligation cannot be made.

17. Subsequent events

There are no material events arising after 30 September 2022,

which have an impact on these unaudited financial statements.

Directors' responsibility statement

The Directors confirm that to the best of their knowledge:

(a) The condensed set of financial statements contained within

the half yearly financial report has been prepared in accordance

with IAS 34 'Interim Financial Reporting' as adopted by the EU;

(b) The half-year Chairman's Statement (constituting the interim

management report) includes a fair review of the information

required by DTR 4.2.7R; and

(c) The half-year Chairman's Statement includes a fair review of

the information required by DTR 4.2.8R as far as applicable.

On behalf of the Board

Sean Lam

Chief Executive Officer

23 December 2022

Walker Crips Group plc

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFVAFTLVFIF

(END) Dow Jones Newswires

December 23, 2022 05:00 ET (10:00 GMT)

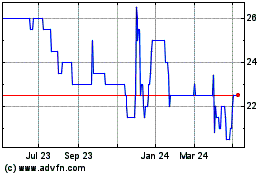

Walker Crips (LSE:WCW)

Historical Stock Chart

From Jan 2025 to Feb 2025

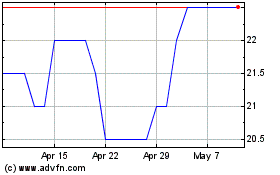

Walker Crips (LSE:WCW)

Historical Stock Chart

From Feb 2024 to Feb 2025