TIDMWOSG

RNS Number : 1360A

Watches of Switzerland Group PLC

18 January 2024

18 January 2024

Watches of Switzerland Group PLC

Trading Update

Despite a positive start to the early part of Q3 FY24, WOSG then

experienced a volatile trading performance in the run-up to and

beyond Christmas, as the challenging macro-economic conditions

impacted consumer spending in the luxury retail sector. We now

expect these challenging conditions to remain for the balance of

our fiscal year.

Across the UK and US, demand for our key brands continues to be

strong with net increases to Registration of Interest lists. By

market, sales in the US remained strong with continued double-digit

growth. The UK was more challenged, and this impacted a broad range

of luxury watch brands and non-branded jewellery. There was an

unusually high level of promotional activity in non-branded

jewellery.

In light of the recent challenging trading conditions and based

on a more cautious view of the outlook for the remainder of the

fiscal year, management is now providing revised full year guidance

for FY24, which assumes no recovery in consumer demand and reflects

discussions with key brands.

Brian Duffy, Chief Executive Officer, said:

"The festive period was particularly volatile this year for the

luxury sector, with consumers allocating spend to other categories

such as fashion, beauty, hospitality and travel. Whilst we are

disappointed with this trend, we are encouraged by our market share

gains in both the US and UK.

"I would like to thank our colleagues for continuing to provide

high quality service and support to our clients against this

challenging backdrop.

"We remain confident in the markets in which we operate, our

model and the delivery of our Long Range Plan announced to the

market in November 2023."

FY24 Guidance

Organic on a pre-IFRS Previous Guidance Revised Guidance

16 basis

Revenue GBP1.65 - GBP1.70 GBP1.53 - GBP1.55

billion billion

-------------------------- ----------------------

Constant currency

revenue growth 8-11% 2-3%

-------------------------- ----------------------

EBIT margin % In line with FY23 8.7% to 8.9%

-------------------------- ----------------------

Total finance costs c.GBP5 million c.GBP6 million

-------------------------- ----------------------

Underlying tax rate 27% - 28% reflecting c28%

the increase in UK

corporation tax

-------------------------- ----------------------

Capex GBP70 - GBP80 million GBP70 - GBP80 million

-------------------------- ----------------------

Operating cash conversion c70% weighted towards c50%

H2 in line with seasonal

pattern

-------------------------- ----------------------

This announcement contains information which is deemed by the

Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No.596/2014. Upon the publication of

this announcement via the Regulatory Information Service, the

inside information is now considered to be in the

public domain.

The person responsible for arranging the release of this

information on behalf of the Company is Laura Battley, Company

Secretary and General Counsel.

Conference call

A conference call for analysts and investors will be held at

9.00am (UK time) today. To join the call, please use the following

details:

Dial-in: +44 800 358 1035

Conference access code: 236695

Q3 Trading Update

The Group will announce a Q3 Trading Update for the 13 and 39

weeks ended 28 January 2024 on Thursday 8 February 2024.

A conference call for analysts and investors on the Group's Q3

Trading Update will be held at 9.00am (UK time) on 8 February,

details for which will be provided in the announcement.

Contacts

The Watches of Switzerland Group

Anders Romberg, CFO +44 (0) 207 317 4600

Caroline Browne, Group Finance Director

+44 (0) 1162 817 420

investor.relations@thewosgroup.com

Headland

Lucy Legh / Rob Walker / Joanna Clark +44 (0) 20 3805 4822

wos@headlandconsultancy.com

About the Watches of Switzerland Group

The Watches of Switzerland Group is the UK's largest luxury

watch retailer, operating in the UK, US and Europe comprising five

prestigious brands; Watches of Switzerland (UK and US), Mappin

& Webb (UK), Goldsmiths (UK), Mayors (US) and Betteridge (US),

with a complementary jewellery offering.

As at 29 October 2023, the Watches of Switzerland Group had 211

showrooms across the UK, US and Europe including 97 dedicated

mono-brand boutiques in partnership with Rolex, OMEGA, TAG Heuer,

Breitling, TUDOR, Audemars Piguet, Longines, Grand Seiko, BVLGARI

and FOPE and has a leading presence in Heathrow Airport with

representation in Terminals 2, 3, 4 and 5 as well as seven retail

websites.

The Watches of Switzerland Group is proud to be the UK's largest

retailer for Rolex, OMEGA, Cartier, TAG Heuer and Breitling

watches.

www.thewosgroupplc.com

Disclaimer

This announcement has been prepared by Watches of Switzerland

Group PLC (the 'Company'). It includes statements that are, or may

be deemed to be, "forward-looking statements". These

forward-looking statements can be identified by the use of

forward-looking terminology, including the terms "believes",

"estimates", "anticipates", "expects", "intends", "plans", "goal",

"target", "aim", "may", "will", "would", "could" or "should" or, in

each case, their negative or other variations or comparable

terminology. They appear in a number of places throughout this

announcement and the information incorporated by reference into

this announcement and may include statements regarding the

intentions, beliefs or current expectations of the Company

Directors or the Group concerning, amongst other things: (i) future

capital expenditures, expenses, revenues, earnings, synergies,

economic performance, indebtedness, financial condition, dividend

policy, losses and future prospects; (ii) business and management

strategies, the expansion and growth of the Group's business

operations; and (iii) the effects of government regulation and

industry changes on the business of the Company or the Group.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future and may be

beyond the Company's ability to control or predict. Forward-looking

statements are not guarantees of future performance. The Group's

actual results of operations, financial condition, liquidity, and

the development of the industry in which it operates may differ

materially from the impression created by the forward-looking

statements contained in this announcement and/or the information

incorporated by reference into this announcement.

Any forward-looking statements made by or on behalf of the

Company or the Group speak only as of the date they are made and

are based upon the knowledge and information available to the

Directors on the date of this announcement, and are subject to

risks relating to future events, other risks, uncertainties and

assumptions relating to the Company's operations and growth

strategy, and a number of factors that could cause actual results

and developments to differ materially from those expressed or

implied by the forward-looking statements. Undue reliance should

not be placed on any forward-looking statements and, except as

required by law or regulation, the Company undertakes no obligation

to update these forward-looking statements. No statement in this

announcement should be construed as a profit forecast or profit

estimate.

Before making any investment decision in relation to the Company

you should specifically consider the factors identified in this

document, in addition to the risk factors that may affect the

Company or the Group's operations as detailed above.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEVLBFZFLZBBL

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

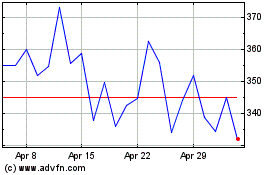

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Feb 2024 to Feb 2025