Weatherly International PLC Tschudi Operational Update and Kitumba Update (7820O)

22 May 2018 - 1:55AM

UK Regulatory

TIDMWTI

RNS Number : 7820O

Weatherly International PLC

21 May 2018

21 May 2018

This announcement includes release of inside information

Weatherly International plc (AIM:WTI)

("Weatherly" or the "Company")

Tschudi Operational Update and Kitumba Update

Tschudi Operational Update

Following a routine production blast earlier this month, the

Tschudi open pit has experienced a rapid and material increase in

groundwater inflow rates.

Accordingly, pumps and pipes inside the open pit have been

relocated, on-site standby pumping equipment and pipelines have

been installed, and additional pumps have been mobilised to

site.

Personnel safety was paramount during this time and at no time

were people or mobile equipment assets placed at risk.

Water levels in the pit are currently expected to stabilise in

the near term as additional pumps arrive and are progressively

installed. However, several of the main areas of the pit where ore

is exposed or available for mining are currently largely submerged.

There will be an unavoidable impact on copper production but this

cannot be quantified at this time. The Company continues to assess

how these water inflows will affect the economic life of the

mine.

Work has been ongoing for the last six months to upgrade the

infrastructure for managing water once it is pumped outside the

pit, and this work is expected to be complete in the next few

weeks.

Further updates will be provided in due course.

Kitumba Update

Further to the Company's announcement of 26 April 2018, Intrepid

Mines Limited (ASX:IAU) ("Intrepid") today announced that the

conditional approval granted by the Zambian Ministry of Mines and

Minerals Development for a subsidiary of Weatherly to purchase

Intrepid's Zambian assets has lapsed, effective 18 May 2018.

Orion Loan Repayments

Further to the Company's confirmation on 3 April 2018 that it

had rescheduled debt repayments that were due on 31 March 2018,

Weatherly confirms that it remains unlikely to generate sufficient

surplus cash to meet all loan repayments when due, particularly in

the near term, and continues to be involved in negotiations with

Orion to agree a long-term restructuring of the Company's secured

debt facilities, which includes instigating the strategic review

announced by the Company on 26 April 2018.

For further information please contact:

Weatherly International Plc +44 (0)1707 800 774

Craig Thomas, CEO

Kevin Ellis, CFO & Company Secretary

Strand Hanson Limited +44 (0) 20 7409 3494

(Nominated Adviser & Broker)

Rory Murphy / James Dance / Jack Botros

About Weatherly

Weatherly is an AIM listed copper mining company operating in

Namibia in southern Africa. Its principal assets are the Tschudi

Mine and the Otjihase Project. The Tschudi Mine is an operating

open pit mine producing refined copper cathode on site. The key

assets of the Otjihase Project are the Otjihase underground copper

mine and concentrator and the Matchless West underground copper

mine. The Otjihase Project assets are currently under care &

maintenance while in the Project Development stage. Weatherly also

owns 25% of China Africa Resources Namibia (CARN), a private

Namibian company which owns the high-grade Berg Aukas underground

zinc-lead-vanadium project. On 5 February 2018, the Company

announced that it had signed an agreement to purchase a further 65%

of CARN subject to regulatory approval.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDEASSFASDPEFF

(END) Dow Jones Newswires

May 21, 2018 11:55 ET (15:55 GMT)

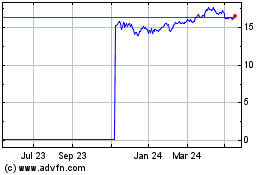

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Dec 2024 to Jan 2025

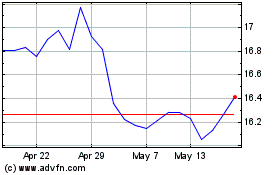

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Jan 2024 to Jan 2025