Canadian Dollar Slides As Oil Prices Decline

19 May 2015 - 9:41PM

RTTF2

The Canadian dollar fell against most major counterparts in

European deals on Tuesday, as oil prices fell amid a strong dollar

and on worries over supply glut coupled with weak demand.

Crude for July delivery fell $0.46 to $59.78 a barrel.

A strong dollar normally discourages buying dollar-denominated

commodities such as crude oil since they become more expensive to

holders of foreign currencies.

Saudi Arabia, the world's largest exporter of oil, increased its

crude oil production to 10.308 million barrels per day in April,

compared to 10.29 million barrels in March, data showed

yesterday.

Indications that OPEC is not willing to reduce oil production at

its next month meeting sparked concerns over supply outlook.

Meanwhile, Kuwait OPEC Governor Nawal al-Fuzaia on Monday told

the excess supply in oil market is being led by increase in shale

oil production and slow demand, and not from OPEC.

The currency showed mixed trading in the previous session. The

loonie held steady against the aussie but rose against the yen and

the euro. Against the greenback, the loonie declined.

The loonie depreciated to 98.38 against the yen, its lowest

since May 7, and was down by 0.52 percent from an early high of

98.89. The loonie-yen pair may find support around the 97.5 mark.

At yesterday's close, the pair was quoted at 98.64.

The loonie slipped to 1.2197 against the greenback, a level not

seen since May 1. The pair finished yesterday's deals at 1.2157.

The loonie is likely to challenge support near the 1.23 area.

Reversing from an early high of 0.9681 against the aussie, the

loonie edged down to 0.9723. The loonie is seen finding support

around the 0.98 level. The pair was valued at 0.9711 at Monday's

close.

On the flip side, the loonie held steady against the euro, after

rising to a 5-day high of 1.3578. The euro-loonie pair ended

Monday's trading at 1.3753.

Looking ahead, U.S. building permits and housing starts for

April are set to be published in the New York session.

Bretton Woods Committee 2015 Annual Meeting will be conducted in

Washington D.C. at 8:30 am ET, in which World Bank Managing

Director Sri Mulyani Indrawati, U.S. Treasury Secretary Jacob Lew

and International Monetary Fund head Christine Lagarde are to

deliver speeches.

At 11:30 am ET, Bank of Canada Governor Stephen Poloz will

address the Greater Charlottetown Area Chamber of Commerce in

Prince Edward Island, followed by a news conference.

Half-an-hour later, Swiss National Bank director Jean-Pierre

Danthine will deliver a speech titled "Swiss Monetary Policy Facts

and Fictions", in Geneva.

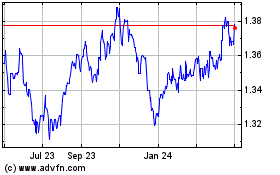

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

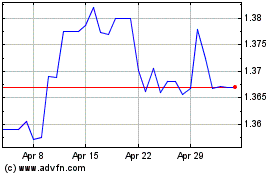

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024