UK retail investors favour trading and investing in stocks and shares online over low-interest savings accounts; and they prefer to do it themselves rather than use an IFA

According to the findings of a recent survey, people in the UK are choosing to trade and invest in stocks and shares online rather than receive potential returns from savings accounts with all-time low interest rates. The poll of 2,000 people across the UK, commissioned by Capital.com and conducted by OnePoll, also reveals that people in the UK are choosing to trade online themselves because they cannot afford to use an IFA and believe that banks charge too much to manage investments.

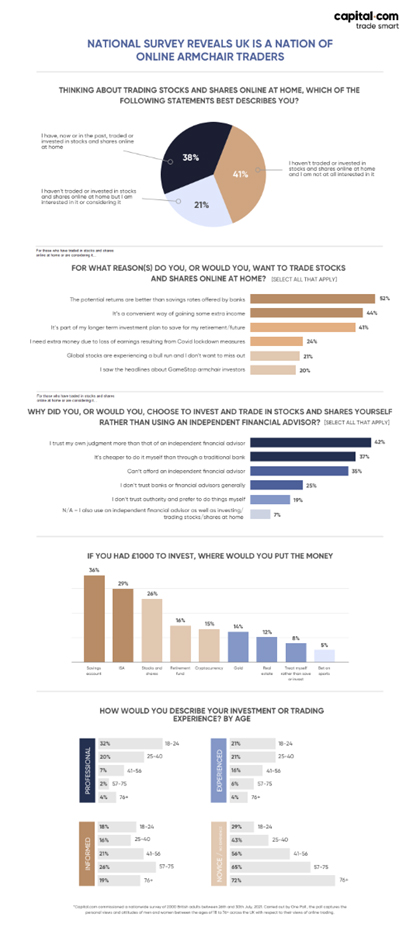

Four in ten respondents (38%) are trading or investing in stocks and shares online at home or have done so in the past, and a fifth (21%) are considering it, according to the survey. More than half (52%) of those respondents say that they decided to do this because the potential returns are better than savings rates offered by banks.

A further 44% believe that online trading is a convenient way to make some extra income.

The main reasons given for choosing to trade online are that it is cheaper to do it themselves than to go through a traditional bank (37%) and they cannot afford an IFA (35%).

Respondents’ reasons for choosing to trade stocks and shares online include planning for the longer term and saving for retirement or their future (41%) and trying to make up for lost earnings due to covid-19 (24%). Also, some have chosen to do this because global stocks are experiencing a bull run and they do not want to miss out (21%) and others took the plunge because they saw the headlines about GameStop armchair investors (20%).

Asked to choose how they would invest £1,000, trading in stocks and shares featured in the top three choices for 26% of respondents, just behind ISAs (29%) and savings accounts (36%).

Jonathan Squires, CEO of Capital.com, said: “This independent national survey reveals people’s genuine concern about their financial futures. But even as savings rates remain low and questions persist about how they can make their money grow, it is important that people understand the different risks associated with online trading versus a savings account. Savings shouldn’t replace trading and people should only trade what they can afford to lose and even then, they should invest with the long-term in mind.

“The survey also raises the important question about whether traditional sources of financial management are offering value for money. There is a clear willingness for people to take matters into their own hands by trading and investing in stocks and shares directly online, themselves. The internet has broken down barriers to education and investing, making it easier for people to find information online.”

The survey also reveals a stark age divide in online trading experience levels. Respondents from the Gen Z cohort (18-24) indicated that they feel they are the most experienced when it comes to trading, with 32% describing their investing or trading experience as professional, followed closely by 20% of millennials (25-40).

But only 7% of Gen X aged people (41-56) and just 2% of baby boomers (57-75) think that they have a professional level of trading experience. The oldest respondents aged 76 plus state they have novice-level or zero trading experience (72%), followed by 65% of baby boomers, 56% of Gen X, 43% of millennials and 29% of Gen Z.

Mr Squires added: “Long gone are the days when trading was the sole preserve of pinstriped suites in the square mile – technology is allowing ever more people the chance to trade. As a mobile-first generation, millennials and Gen Z are likely to hone their skills using trading tools and resources that are easily accessible via apps and websites. Education remains key to ensuring safe and responsible trading, especially if you are young and just starting out.”

The survey also reveals a gender divide, with 47% of male respondents either currently trading in stock or shares or having done so in the past, compared with 29% of women. However, the same number (21% of men and 20% of women) are considering doing so in the future.

Among those who said that they would not trade stocks and shares online, 48% said that they did not know enough about online trading to do it themselves while 20% said they were afraid of being charged a lot of fees to trade online. Only 7% said they wouldn’t trade online themselves because they only trust IFAs or banks to do so and 59% said they don’t trade online themselves because they consider it too risky.

About the survey

Capital.com commissioned a nationwide survey of 2000 British adults between 26th and 30th July, 2021. Carried out by OnePoll , the poll captures the personal views and attitudes of men and women between the ages of 18 to 76+ across the UK with respect to their views of online trading.

About Capital.com

Capital.com is a high-growth investment trading fintech group of companies empowering people to participate in financial markets through secure, low-friction, innovative platforms that take the complexity out of investing. Its intuitive, award-winning platform, available on web and app, offers investors a seamless trading experience to over 3400 world-renowned markets. To help investors trade with confidence, the platform is enabled with robust risk management controls and transparent pricing while its all-in-one Investmate app delivers extensive financial lessons and educational content to support clients in their investment journey.

Capital.com has clients in over 180 countries with offices located in the UK, Gibraltar, Australia, Cyprus and Singapore. In 2020, the platform reported a 700 per cent growth in its client base, making it one of Europe’s fastest growing investment trading platforms with more than 2 million clients.

Capital Com (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA). Capital Com SV Investments Limited is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 319/17.Capital Com Australia Limited is authorised and regulated by the Australian Securities and Investments Commission (ASIC) under AFSL Number 513393.

To find out more, please visit: www.capital.com

Hot Features

Hot Features