Daily analysis of USD/CHF for May 21, 2018

USD/CHF

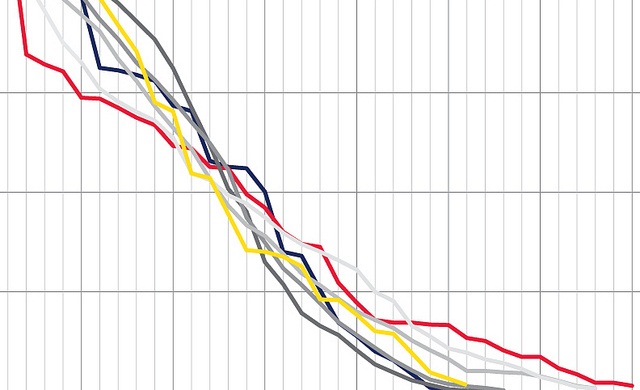

The USD/CHF is bullish in the long-term, but neutral in the short-term. Price has been consolidating in the past two weeks; whereas that is not strong enough to render the recent bullish bias useless. There is going to be a breakout at last, but the movement to the upside will no longer be a serious thing.

While USDCHF is supposed to go upwards, there would be a challenge to the upwards move, because CHF is expected to gain serious stamina this week (major currencies will drop versus it). This means that the coming strength in CHF may hinder USDCHF from getting seriously pushed further northwards.

Daily analysis of USD/JPY for May 21, 2018

USD/JPY

The bias on the pair is still bullish. The bullish movement that was witnessed last week has saved the ongoing bullish bias in the market. The bullish movement started in March 2018 and it has held out till now. The supply level at 111.00 was tested before price closed below it on Friday. The JPY may be weakened further this week.

There is a Bullish Confirmation Pattern in the market, which makes short trades not yet advisable. This week, there is a high probability that the market would continue going upwards, reaching the supply levels at 111.00, 111.50 and 112.00.

Daily analysis of EUR/JPY for May 21, 2018

EUR/JPY

The EUR/JPY has failed to go seriously upwards like its USD/JPY counterpart. The bias on this cross is bearish, but it is a precarious bias. What the market did last week was a zigzag movement without a clear directional propensity (although the general outlook still remains bearish).

Price moved upwards, downwards, and upwards again, within the supply zone at 131.50 and the demand zone at 129.50. A 200 –pip movement to the upside or to the downside would easily change the bias to bullish or bearish, and that is exactly what is expected this week.

Trading realities: Trading realities

Hot Features

Hot Features