There are many ways to invest in the gold market, such as buying gold ETFs, stocks in gold mining stocks, or gold futures. However, one of the most attractive ways is to buy some of the precious metal, in the form of coins or bars.

There are a number of benefits to buying physical gold:

| Diversification | Physical gold can be a good way to diversify your portfolio. |

| Inflation hedge | Unlike paper currency, gold has held its value over time, and it doesn’t corrode or wear out. |

| Hedge against economic uncertainty | Gold often appreciates in value during times of economic slowdowns. |

| Tangible asset | Physical gold is an asset you can see and touch; and it has a beauty of its own. |

| Geopolitical hedge | The value of gold often rises during times of geopolitical tension or conflict which makes it a ‘crisis commodity’ and a safe-haven asset. |

| Industrial applications | Gold has applications in many industrial sectors which contributes to its long-term stability as an investment. |

Sponsor message – Download your free gold investor guide

In this free investor guide we look at why the price of gold has continued to hit new highs and review the best gold opportunities available to private investors.

How to Buy Physical Gold

You can buy gold from a precious metals dealer, a bank, or an online retailer. Do your research and make sure you buy from a reputable source.

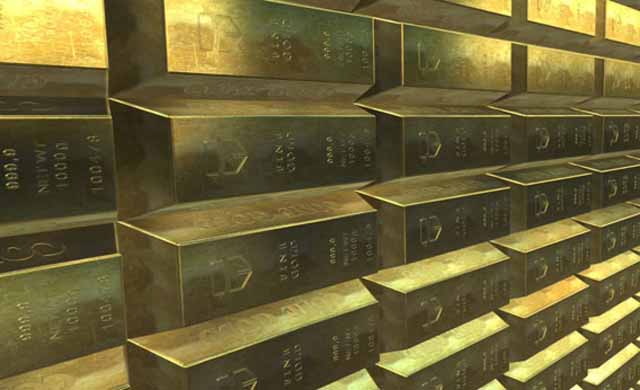

When you buy physical gold (or bullion), it will usually be in the form of gold bars or ingots, or gold coins.

There are fraudulent schemes offering access to gold in various forms, such as digital certificates representing ownership of gold, or gold coins stamped with icons from popular culture. Beware of high-pressure sales tactics with claims of limited supply adding a false urgency to the deal.

Sponsor message – Download your free gold investor guide

In this free investor guide we look at why the price of gold has continued to hit new highs and review the best gold opportunities available to private investors.

How to Store Physical Gold

When you buy physical gold you have a choice about where to store it, to ensure it stays safe and secure: at home, in a safety deposit box, or in a secure vault.

Storing Gold at Home

Gold that is stored in your home can be accessed any time you want – to resell quickly, or just to admire your collection. You don’t have to rely on third parties to keep your gold safe; it is under your control. You avoid paying storage fees if the gold is in your own home.

However, you will need to invest in a secure vault or safe, and you will need to take out adequate insurance coverage, to protect against security risks.

Storing Gold in a Safety Deposit Box

You can choose to store your gold in a safety deposit box in a bank. This is a locked, secure container inside the bank’s vault or safe. This provides high-level security for your gold – so long as your bank doesn’t go bankrupt. (Unlikely, but it does happen!)

You will still need to take out insurance because banks don’t usually insure the items kept in safety deposit boxes. You will also have to pay the bank a fee to use the storage.

The disadvantage of using a safety deposit box is that it limits your access to the gold – you can only access it during bank opening hours.

Storing Gold in a Storage Vault

Storage vaults are highly secure facilities designed to keep valuable items, including precious metals such as gold, safe. They are designed with advanced security measures to keep your gold safe from theft or damage.

Many storage vaults offer insurance cover which adds extra protection to your gold.

The disadvantages of using a storage vault are the high cost, the lack of control, and the limit to accessibility.

Sponsor message – Download your free gold investor guide

In this free investor guide we look at why the price of gold has continued to hit new highs and review the best gold opportunities available to private investors.

FAQs

1. Are there any disadvantages to buying physical gold?

There is always a risk of theft with physical gold so you need to store it in a safe place, which can be expensive and inconvenient. Physical gold doesn’t generate interest or dividends, unlike buying gold mining stocks or gold ETFs.

2. Is the gold price tied to the US dollar?

No, not any more. It has been decoupled from its traditional correlations with the US dollar. In fact, historically the gold and the dollar have shared an inverse relationship: when the dollar is strong, the gold price often declines, and vice versa.

3. What does gold carat mean?

The carat is a unit that measures the purity of the gold, with a carat representing 1/24th (or 4.1667%) of the whole. Therefore, pure gold is 24 carats, which means it is 100% gold with no additional metals. A 22 carat gold coin is made up of 22 parts of gold and 2 parts of another metal, forming an alloy with 91.6% of pure gold.

Hot Features

Hot Features