A blind man with a stick can see that Europe is a mess. The present global chaos cycle which is reaching its climax in the coming years is bringing everything to the surface that has reached the end of its life cycle. This is an unpalatable fact we all have to learn to live with if we wand to survive and prosper in our trading and investing over the coming years.

There is nothing wrong with this since life is cyclical and traders and investors are well advised to understand how these cycles unfold, so that they can position accordingly.

No mater how hard we try to tweak and correct the system to suit our preferred views, cycles are stronger than human desire for stability.

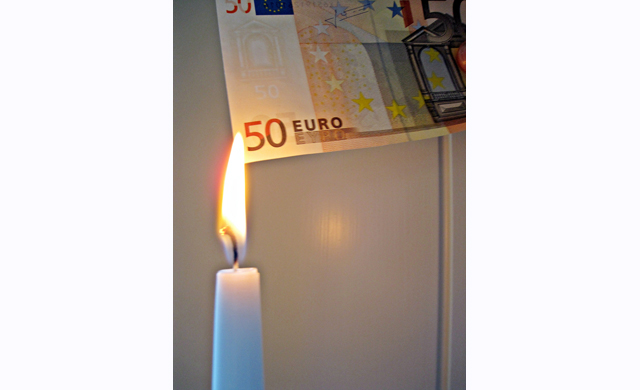

Hence I can say with a large degree of certainty: The demise of the Euro is not over by a long stretch and those who foolishly proclaim the next bull market in the Euro had better think again:

Currency cycles tend to extend and last a long time.

They reflect the collective belief structure and psychology of a country, or countries much more than stocks and shares. Whether we like it or not, everyone deals in currency in their daily lives. Currency movements impact on everything, from the price of oil, to the cost of living, and the cost of your next holiday.

In the case of Europe the big issue is a deeply rooted value conflict that was never addressed when the Euro came into being. This value conflict points to a deep discomfort and unease within the individual countries about the structure of Europe.

The issue is this: The Euro was a farce from the day it was created

While the Euro is the trading currency used in Europe every individual country still has its own bonds. This effectively means that if I do not like what is going on in Greece, or France or Germany, I can short these countries’ bonds. Bond markets are huge and they have a massive impact in on the long term health of any economy.

When an economy reaches the end of its life cycle, old established structures begin to collapse. There comes a point when governments are powerless to kit the broken pot. The pot will collapse off its own weight.

I am not a believer of spreading doom and gloom. On the contrary. However, I am an impassive observer of facts unfolding. As a trader and investor I position myself in line with my observations to protect my capital and income as best as I can.

Since WW2 we have not seen such wide spread restructuring.

It is a global issue and ultimately there are no real hiding places. Globalization means that if one part of the pot has yet another crack it affects the structure of the pot in other areas too, further weakening the already weak structure.

Most investors and traders have never experienced what we are experiencing now. The skirmishes that have sent ripples of fear every 10 years or so around the world were mere signals of a very large degree cycle coming to an end bringing the final chaos phase into play. The cycle we are dealing with has lasted hundreds of years and is part of a much bigger cycle that has lasted thousands of years.

In times like this the old rules must be understood extremely well to allow you to bend them efficiently merging the old with the new

You simply cannot apply the logic that seems to have worked for centuries when the very essence of the structure upon which those rules where based is disintegrating.

This is why understanding the fabric of life and how it pertains to economic cycles, emotional cycles and universal cycles globally is absolutely vital.

The saying: “Rules are made for fools and the guidance of wise men” is hugely relevant today.

I have discussed the need to be very aware of risk in today’s world before. You might want to read my recent article here on ADVFN on the issue.

Given the present global cycle we are dealing with, Europe right now is a wild cart

There is much distrust in government and the currency among the European populations. The machinations of the ECB are effectively suppressing the economic cycles of the individual member states causing much resentment. What’s more the average person may have no idea about money flows and how to hedge appropriately, but they know at some level that they are being hoodwinked. We are at this level.

The collective consciousness is shifting at the realization of global power games and centralization attempts by financial and political authorities.

It has been muted that property investment is the only investment that is sound and will provide a safe heaven for investors.

I beg to differ: Property assets are illiquid and at a time of massive migration you might suddenly get stuck with your property portfolio when liquidity of assets is becoming the prime consideration of risk.

Put simply: In times of upheaval liquidity and diversification are king

As for the Euro, I favor more downside to come. The dollar is the preferred play for the moment. Until we gain clarity of what is going to unfold in Greece, and Germany plays its hand more openly we are tapping in the dark. Markets, like humans, dislike uncertainty. There is no doubt about this and this abhorrence for change and uncertainty has not changed for thousands of years.

The nimble investor will appreciate this and tread cautiously. Participating in the currency markets is an important part of any well managed portfolio. If you are placed correctly you are reducing risk exposure while at the same time potentially locking in nice gains.

I have been a dollar bull for some time, as those who know me better, will know. I am not saying that the dollar is a sound currency. Far from it. They all have their problems, because the system upon which they function is outdated and overextended. However, the dollar still has street cred and is not going to disappear over night. The chances of the Euro disappearing are much larger by comparison. The issue is a matter of timing first and foremost.

We cannot ignore the manoeuvrings to create a world currency. The possibility is there and investors and traders have to be aware of it. Again, scaremongering, conspiracy theory is not my bag. Heightened awareness though is.

To sum it all up: Having exposure to the dollar right now is my preferred play

The Euro will have a tradable bounce at some point. Alas, I am not willing to step in front of the freight train on this one. Great caution is advised here. Make sure that you do have several trading (investment) accounts serving your needs. And don’t place big currency bets without proper hedging.

The Euro looks cheap right now, alas it might look a lot cheaper in 12 months’ time

As always do your homework. Above all, educate yourself in understanding the human psyche, what makes people panic, and how you can weather the storms with greater inner certainty and confidence.

###

Mercedes Oestermann van Essen is a trader, trading psychology coach and author of “The Buddhist Trader” and other books on trading psychology. Sign up for my free course: 7 Little Known Secrets To Trading Success & Happiness HERE.

Hot Features

Hot Features