First Trust Launches Senior Loan ETF - ETF News And Commentary

03 May 2013 - 10:37PM

Zacks

Senior Loan ETFs are becoming increasingly popular with

investors as they provide high yields with protection against

interest rate risk.

Recent ETF fund flows show that investors are getting

increasingly worried about the interest rate risk in their bond

portfolios. While more interest rate sensitive ETFs lost assets

under management, funds with less interest rate sensitivity/shorter

duration gathered assets.

The statement released after the recent Fed meeting indicated

that they are prepared to increase or reduce the pace of asset

purchases as the outlook for the labor market or inflation changes.

(Read: Why I hate Volatility ETFs and why you should too)

However minutes from the last couple of FOMC meetings revealed

that there is a growing debate within the committee about

continuation of asset purchases at current levels. Once the Fed

slows down its purchases, interest rates will start to rise. In

fact, the ten-year note did break the psychological barrier of 2%

earlier this year but the yield declined later on account of

renewed concerns about economic growth. Within the fixed income

space, junk bonds appear to be at highest risk, in the event of an

interest rate rise.

Investors looking for higher yields, but concerned about the

potential rise in interest rates should look at Senior Loan ETFs.

(Read: 3 Excellent REIT ETFs you should not ignore)

What are Senior Loans?

Senior loans are secured by company’s assets and are thus lower

in risk structure, even though these loans are mostly issued by

companies with below investment grade credit. These are floating

rate loans so they usually pay a spread over some benchmark rate

like LIBOR. Thus, in the event of rise in interest rates, coupons

on senior loans increase while the value of the investment remains

stable. (Read: Buy these ETFs to profit from Japan’s massive

easing)

On the other hand, bonds lose value if the interest rates go up.

So, investors in senior loans or in senior loans ETFs get the

benefit of high yields with protection against any interest rate

rise. Further, they carry lower credit risk compared with most

other assets with similar level of yield. Additionally senior loans

have low correlations with other asset classes

FTSL in Focus

The First Trust Senior Loan Fund (FTSL) that began trading

yesterday is First Trust’s fourth actively managed ETF.

According to First Trust press release-- the Fund attempts to

outperform the S&P/LSTA U.S. Leveraged Loan 100 Index and the

Markit iBoxx USD Leveraged Loan Index. It seeks to generate high

current income and preserve capital by investing primarily in a

diversified portfolio of first-lien senior floating rate bank

loans.

Can it succeed?

FTSL is the fourth product in the Senior Loan ETFs space and

second actively managed product.

Per First Trust, “While an index-based senior loan ETF

principally considers the market value of the debt issuance

outstanding in its selection methodology, an actively managed ETF

gives us the latitude to utilize our rigorous credit process in

evaluating an individual company’s ability to repay its debt, which

we believe is paramount to driving attractive risk-adjusted and

absolute returns over the long term”.

The first product in this space PowerShares Senior Loan

Portfolio (BKLN), which was launched in March 2011 has been quite

popular with investors, attracting about $3.8 billion in assets so

far.

Other two products are relatively new-- Pyxis/iBoxx Senior Loan

ETF ( (SNLN) launched in November last year and SPDR

Blackstone / GSO Senior Loan ETF (SRLN) launched last month.

It remains to be seen whether actively managed products will

become more successful in this specialized space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-SNR LN PR (BKLN): ETF Research Reports

HILND/IBX-SR LN (SNLN): ETF Research Reports

SPDR-BS GSO SL (SRLN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

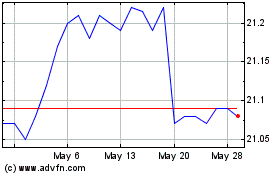

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Nov 2024 to Dec 2024

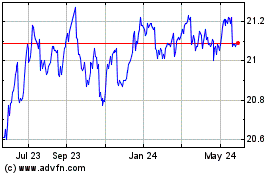

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Dec 2023 to Dec 2024