BLOK ETF Surpasses $1 Billion in Assets

19 February 2021 - 1:00AM

Amplify ETFs is thrilled to announce the Amplify Transformational

Data Sharing ETF (NYSE: BLOK) has surpassed $1 billion in assets

under management. BLOK is an actively-managed ETF comprised of

companies involved in blockchain technology. The ETF also currently

holds a position in the Bitcoin Investment Trust.

“Just over three years ago we launched the first

actively-managed ETF focused on the dynamic market segment of

blockchain-related stocks,” said Amplify CEO Christian Magoon.

“BLOK has provided investors with additional portfolio

diversification through its unique portfolio makeup that includes

the Bitcoin Investment Trust. Blockchain technology is primarily

known for one application today: cryptocurrency. However, there is

a fast-growing universe of applications for blockchain technology.

We believe the growth of crypto is a case study on the values

blockchain technology delivers when it comes to trust, data

sharing, efficiency and transparency.”

BLOK is actively-managed by ETF sub-adviser Toroso Investments,

LLC (Emerita Capital and EQM Indexes act as strategic research

providers). In pursuing BLOK’s investment strategy, Toroso seeks

investments in companies across a wide variety of industries that

are leading in the research, development, utilization and funding

of blockchain technologies. In addition, the portfolio managers may

invest indirectly in bitcoin or other cryptocurrencies through

other indirect investment vehicles.

Investors can learn more at https://amplifyetfs.com/BLOK.

Also, Amplify is hosting a webcast covering the topic of

blockchain on Wednesday, February 24 at 2p ET. This webcast is for

registered investment professionals only; register here:

https://bit.ly/2YWIOAA

About Amplify ETFs

Amplify ETFs, sponsored by Amplify Investments, has over $4.7

billion in assets across its suite of ETFs (as of 2/17/2021).

Amplify believes the ETF structure empowers investors through

efficiency, transparency and flexibility. Amplify ETFs deliver

expanded investment opportunities for growth, capital preservation,

and income-focused investors.

Sales Contact:Amplify

ETFs855-267-3837info@amplifyetfs.comorMedia

Contact: Gregory FCA for Amplify ETFsKerry

Davis610-228-2098amplifyetfs@gregoryfca.com

| BLOK

PerformanceQuarter End as of 12/31/20 |

Fund Inception Date: 1/17/2018 |

|

Cumulative (%) |

Annualized (%) |

|

|

1 Mo. |

3 Mo. |

6 Mo. |

YTD |

Since Inception |

1 Yr. |

Since Inception |

|

Fund NAV |

17.10 |

% |

45.12 |

% |

75.15 |

% |

88.18 |

% |

83.16 |

% |

88.18 |

% |

22.72 |

% |

|

Closing Price |

17.68 |

% |

45.40 |

% |

76.60 |

% |

90.07 |

% |

84.13 |

% |

90.07 |

% |

22.94 |

% |

The performance data quoted represents past performance.

Past performance does not guarantee future results. The investment

return and principal value of an investment will fluctuate so that

an investor's shares, when sold or redeemed, may be worth more or

less than their original cost and current performance may be lower

or higher than the performance quoted. Short-term performance, in

particular, is not a good indication of the fund’s future

performance, and an investment should not be made based solely on

returns. For performance data current to the most recent month-end

please call 855-267-3837 or visit

BLOKETF.com. Brokerage commissions will

reduce returns. The Fund’s gross expense ratio is 0.90%, with a

0.20% fee waiver1 that makes the

net expense ratio 0.70%.

1Pursuant to a contractual agreement, the Fund’s investment

adviser has agreed to waive management fees of 0.20% of average

daily net assets until March 1, 2021.

Carefully consider the Fund’s investment objectives,

risk factors, charges and expenses before investing. This and

additional information can be found in the Fund’s statutory and

summary prospectus, which may be obtained by calling 855-267-3837

or by visiting AmplifyETFs.com.

Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of

principal. Shares of any ETF are bought and sold at market price

(not NAV), may trade at a discount or premium to NAV and are not

individually redeemed from the Fund. The Fund's return may not

match or achieve a high degree of correlation with the return of

the underlying Index.

The Fund is subject to management risk because it is actively

managed. Narrowly focused investments typically exhibit higher

volatility. A portfolio concentrated in a single industry, such as

companies actively engaged in blockchain technology, makes it

vulnerable to factors affecting the companies. The Fund may face

more risks than if it were diversified broadly over numerous

industries or sectors. Blockchain technology may never develop

optimized transactional processes that lead to realized economic

returns for any company in which the Fund invests. The Fund will

invest at least 80% of the Fund’s net assets in equity securities

of companies actively involved in the development and utilization

of blockchain technologies. Such investments may be subject to the

following risks: the technology is new and many of its uses may be

untested; theft, loss or destruction; competing platforms and

technologies; cybersecurity incidents; developmental risk; lack of

liquid markets; possible manipulation of blockchain-based assets;

lack of regulation; third party product defects or vulnerabilities;

reliance on the Internet; and line of business risk. The investable

universe may include companies that partner with or invest in other

companies that are engaged in transformational data sharing or

companies that participate in blockchain industry consortiums. The

Fund will invest in the securities of foreign companies. Securities

issued by foreign companies present risks beyond those of

securities of U.S. issuers.

The Fund may have exposure to cryptocurrencies such as bitcoin

indirectly through investment funds, including through an

investment in the Bitcoin Investment Trust (“GBTC”), a privately

offered, open-end investment vehicle. Even when held indirectly,

investment vehicles like GBTC may be affected by the high

volatility associated with cryptocurrency exposure. Holding a

privately offered investment vehicle in its portfolio may cause the

Fund to trade at a premium or discount to NAV. Many significant

aspects of the U.S. federal income tax treatment of investments in

cryptocurrencies are uncertain and such investments, even

indirectly, may produce non-qualifying income for purposes of the

favorable U.S. federal income tax treatment generally accorded to

regulated investment companies.

Amplify Investments LLC is the Investment Adviser to the Fund,

and Toroso Investments, LLC serves as the Investment

Sub-Adviser.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

A video accompanying this announcement is available

at: https://www.globenewswire.com/NewsRoom/AttachmentNg/5e18df09-e910-4448-92ea-9df3b4aba3e7

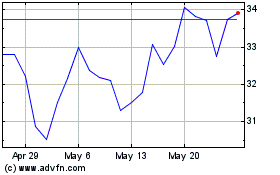

Amplify Transformational... (AMEX:BLOK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Amplify Transformational... (AMEX:BLOK)

Historical Stock Chart

From Feb 2024 to Feb 2025