Oil ETFs in Focus Ahead of Iran Talks - ETF News And Commentary

25 September 2013 - 10:00PM

Zacks

Oil prices were under pressure, falling over 3% last week despite

the Fed’s decision to keep its monetary stimulus intact. The

bearish trend is likely to continue this week as well on receding

fears of the Middle East supply disruption, reduced prospect of the

U.S. led military strike against Syria and the Iran talks (read:

Oil ETFs Jump on Syria Turmoil).

Production in Libya is back on track and recovered to nearly 40% of

its pre-war capacity. Oil production is expected to reach 700,000

barrels per day, up from the current level of 243,000 barrels per

day.

Iran Talks Ahead?

The world leaders will gather at the UN general assembly in New

York this week. Speculations over direct talks between the

President of the U.S. and Iran at the meeting are mounting. The

possible meeting would be the first since the 1979 revolution, and

could ease the decade-long diplomatic tension between the two

nations.

Iranian President Hassan Rouhani is seeking smoother relations with

the West. In an interview last week, the President signaled that

Iran would not develop any nuclear weapons if the U.S. offers some

relief on international sanctions that has curtailed its oil

exports and upset the economy for quite some time (read: 3 Country

ETFs to Buy on an Oil Surge).

The possible talks could be a turning point in the U.S.-Iranian

relations and help to ease the tension in the Middle East. However,

major questions remain on whether Iran would accept the U.S.

proposal of curbing uranium enrichment and closing down the

underground Fordo nuclear facility.

As such, investors should closely monitor the movements in the oil

funds irrespective of whether the crisis in Iran leads to

meaningful negotiations or comes up with a new story. Below, we

highlighted the three ETFs that would be impacted most by the

U.S.-Iran talks (see: all the energy ETFs here):

United States Oil Fund

(USO)

This is the most popular and liquid ETF in the oil space with AUM

of over $1.4 billion and average daily volume of over 6.1 million

shares. The fund seeks to match the performance of the spot price

of light sweet crude oil West Texas Intermediate (WTI). The ETF has

0.74% in annual expenses.

The ETF lost over 1.4% in the last five trading sessions but is up

nearly 11.7% so far this year.

United States Brent Oil Fund

(BNO)

This fund provides direct exposure to the spot price of Brent crude

oil on a daily basis through future contracts. It has amassed $42.7

million in its asset base and trades in moderate volume of roughly

64,000 shares a day (see more in the Zacks ETF Center).

The ETF charges 96 bps in annual fees and expenses. BNO lost about

2.3% in the trailing five days while it is up over 3% in the

year-to-date period.

PowerShares DB Oil Fund

(DBO)

This product provides exposure to crude oil through WTI futures

contracts and follows the DBIQ Optimum Yield Crude Oil Index Excess

Return. The fund sees solid average daily volume of more than

235,000 shares and AUM of $366.3 million. It charges an expense

ratio of 79 bps.

DBO lost less than 1% in the past five trading sessions while it is

up around 6% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

US BRENT OIL FD (BNO): ETF Research Reports

PWRSH-DB OIL FD (DBO): ETF Research Reports

US-OIL FUND LP (USO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

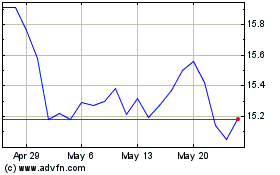

Invesco DB Oil (AMEX:DBO)

Historical Stock Chart

From Nov 2024 to Dec 2024

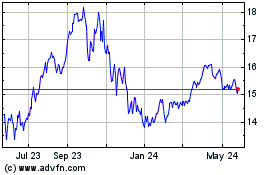

Invesco DB Oil (AMEX:DBO)

Historical Stock Chart

From Dec 2023 to Dec 2024