UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934 (Amendment

No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

DecisionPoint Systems, Inc.

(Name of Registrant as Specified

In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

This Schedule 14A filing consists of frequently

asked questions (the “FAQs”) regarding the proposed acquisition of DecisionPoint Systems, Inc. (“we”, “our”,

“us”, “DecisionPoint” or the “Company”) by Barcoding Derby Buyer, Inc., a Delaware corporation (“Parent”),

and Derby Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“MergerCo”), pursuant to the terms

of an Agreement and Plan of Merger, dated April 30, 2024, by and among Parent, MergerCo, and the Company. The FAQs were distributed to

employees of the Company on May 17, 2024.

Employee FAQ’s

Q: Why has the company entered into an agreement to be sold?

A: Over the past seven years,

we have transformed the Company into a leader in its field. Our growth has occurred through the strong efforts of our team and a disciplined

acquisition strategy funded with debt. Our ability to obtain the financing for future growth is challenged by higher interest rates. Our

board believes that under the ownership of a well-resourced partner, we will be better positioned to enhance our acquisition strategy.

By combining our strengths and resources, we can better compete in the marketplace and achieve greater success together.

Moreover, Graham Partners has recognized the considerable value and potential synergies of our services business and strategic approach.

Q: What will happen to our previous owners?

A: As a public company we have many shareholders. Upon completion of

the acquisition, all shareholders will receive $10.22 per share in cash, and Graham Partners will assume ownership. At closing, any stock

options you hold will be converted into the right to receive cash in an amount equal to the difference between $10.22 and the exercise

price of the options you hold, less applicable withholding taxes.

Q: Will office locations or headquarters change?

A: Not at this time.

Q: Will there be layoffs? What are areas of potential redundancy?

A: Our goal is to minimize disruptions and prioritize the well-being

of our employees throughout the merger process. While there may be some organizational changes to streamline operations and improve efficiency,

we’re committed to treating all employees fairly and respectfully. Any decisions regarding staffing will be made thoughtfully and communicated

transparently by the new owner.

Q: Will my benefits change?

A: Current base salaries will remain in place for all employees with

the company at closing of the merger. The merger agreement contemplates that continuing employees will participate in benefit plans offered

by the combined company following the closing. We expect that these benefits will be determined as part of the integration strategy.

Q: Will our work processes change?

A: We expect everything will remain status quo through the end of the

year.

Q: Will my job responsibilities change?

A: During this transition period, our expectation is that your role

and responsibilities will remain largely unchanged. We value your ability and contributions, and our priority is to ensure a smooth integration

process, which likely won’t start until early 2025. Our goal is for Any changes or adjustments to be communicated to you promptly,

and we’re here to support you every step of the way.

Q: What do I say to customers with concerns due to the deal?

A: See customer communication

Q: How long will the integration take?

A: That is TBD, but planning will begin as soon as the deal closes

and will likely start to be implemented in 2025.

Q: What will our company name be?

A: We will continue to operate under DecisionPoint Systems Inc. Potential

rebranding would be discussed as part of the integration planning.

Q: How will the merger affect my role and responsibilities?

A: During this transition period, your role and responsibilities will

remain largely unchanged. We value your ability and contributions, and our priority is to ensure a smooth integration process. Any changes

or adjustments will be communicated to you promptly, and we’re here to support you every step of the way.

Q:Am I subject to additional obligations as

a result of the transaction?

A: The applicable securities laws of the United

States and other jurisdictions prohibit persons who have received material non-public information concerning DecisionPoint (which you

may receive as we work to integrate DecisionPoint and Barcoding between now and the closing of the transaction) from purchasing or selling

securities of DecisionPoint with knowledge of or in reliance upon such information or from communicating such information to any other

person, except as expressly permitted by applicable law. As a result, you should abstain from purchasing or selling any DecisionPoint

securities.

Q: How can I contribute to the success of the merger?

Your dedication and ability are invaluable as we navigate this merger.

We encourage you to stay engaged, remain flexible, and continue to focus on delivering exceptional results in your role. Your input and

collaboration will play a crucial role in shaping our collective future success.

Should you have more questions over the coming months regarding the

merger, the company has setup an email to submit your questions; projectderby@decisionpt.com

Cautionary Statement Regarding Forward-Looking

Statements

This communication may contain forward-looking

statements, which include all statements that do not relate solely to historical or current facts, such as statements regarding the pending

acquisition of the Company and the expected timing of the closing of the Merger. In some cases, you can identify forward-looking statements

by the following words: “believe,” “anticipate,” “expect,” “plan,” “intend,”

“estimate,” “target” or the negative of these terms or other similar expressions, although not all forward-looking

statements contain these words. These forward-looking statements are based on the Company’s beliefs, as well as assumptions made

by, and information currently available to, the Company. Because such statements are based on expectations as to future financial and

operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number

of known and unknown risks and uncertainties, including, but not limited to: (i) the risk that the Merger may not be completed; (ii) the

failure to satisfy any of the conditions to the consummation of the Merger, including the receipt of approval by the Company’s stockholders

to adopt the Merger Agreement; (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the

termination of the merger agreement which govern the terms of the Merger, including in circumstances requiring the Company to pay a termination

fee; (iv) the effect of the announcement or pendency of the Merger on the Company’s business relationships, operating results and

business generally; (v) risks that the Merger disrupts the Company’s current plans and operations; (vi) the Company’s ability

to retain and hire key personnel and maintain relationships with key business partners and customers, and others with whom it does business;

(vii) risks related to diverting management’s or employees’ attention during the pendency of the Merger from the Company’s

ongoing business operations; (viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential litigation

relating to the Merger; (x) uncertainty as to the Merger and the ability of each party to consummate the Merger; (xi) risks that the benefits

of the Merger are not realized when or as expected; (xii) the risk that the price of the Company’s common stock may fluctuate during

the pendency of the Merger and may decline significantly if the Merger is not completed; and (xiii) other risks described in the Company’s

filings with the U.S. Securities and Exchange Commission (the “SEC”), such as the risks and uncertainties described under

the headings “Note Regarding Forward-Looking Statements,” “Risk Factors,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and other sections of the Company’s Annual Report on Form 10-K,

the Company’s Quarterly Reports on Form 10-Q, and in the Company’s other filings with the SEC. While the list of risks and

uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the proxy statement on Schedule 14A

that the Company will file with the SEC relating to its special meeting of stockholders will be, considered representative, no such list

or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant

additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with

those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial

loss, legal liability to third parties and/or similar risks, any of which could have a material adverse effect on the completion of the

Merger and/or the Company’s consolidated financial condition. The forward-looking statements speak only as of the date they are

made. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements,

whether as a result of new information, future events or otherwise.

The information that can be accessed through

hyperlinks or website addresses included in this communication is deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find It

This communication is being made in respect of

the Merger. In connection with the proposed Merger, the Company will file with the SEC a proxy statement on Schedule 14A relating to its

special meeting of stockholders and may file or furnish other documents with the SEC regarding the Merger. When completed, a definitive

proxy statement will be made available to the Company’s stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT

REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER

RELEVANT DOCUMENTS FILED OR FURNISHED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE MERGER. The Company’s stockholders may obtain free copies of the documents the Company files with the SEC from the SEC’s

website at www.sec.gov or through the Company’s website at decisionpt.com under the link “Investors” and then under

the link “SEC Filings”. Alternatively, these documents, when available, can be obtained free of charge from the Company upon

written request to the Company’s Secretary at 1615 South Congress Avenue, Suite 103, Delray Beach, FL 33445.

Participants in the Solicitation

The Company and its directors and executive officers

may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the Merger. Additional

information regarding the identity of the participants, and their respective direct and indirect interests in the Merger, by security

holdings or otherwise, will be set forth in the proxy statement for the Company’s special meeting of stockholders and other relevant

materials to be filed with the SEC in respect of the Merger when they become available. These documents can be obtained free of charge

from the sources indicated above.

4

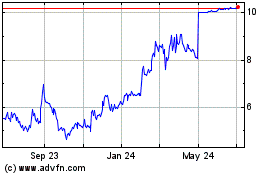

DecisionPoint Systems (AMEX:DPSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

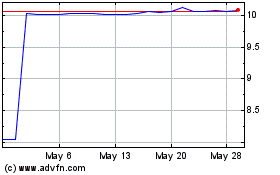

DecisionPoint Systems (AMEX:DPSI)

Historical Stock Chart

From Jan 2024 to Jan 2025