While the global economic picture may not be that bright, the

conditions tend to be very different when one takes a look at

specific nations. For this reason, a look to certain areas of the

world could lead to outperformance, especially in this uncertain

time where diversification is more necessary than ever.

Due to this market rockiness, investment in fast growing

emerging market economies has become a very popular tool among many

investors. Yet, when it comes to investment in emerging market

economies, investors usually look to the mega economies like China

or India. But beyond these, there are still many more options

existing for investors that can still provide great exposure to

developing nations.

In this article we would like to highlight the emerging market

of Latin America. Of late, the commodity rich region has been in

the limelight when it comes to investing in the emerging markets

(Latin America ETFs: beyond Brazil).

In Latin America investing, the first thought which comes to

mind is usually Brazil. In fact, half of the ETFs tracking Latin

America invest a major portion of their asset base in the large

South American nation.

However, this might mean that investors are overlooking several

other nations in the region, specifically those in the Andean area,

which have outperformed Brazil, but never receive the same level of

attention from investors (Brazil ETFs: More Trouble On the

Horizon?)

This often overlooked region is composed of the fast-growing

economies of Peru, Colombia and Chile. Though these economies have

had a bad history, in recent times they have turned out to be a

relatively better option for ETF investors.

After all, these nations have higher GDP growth than Brazil with

moderate inflation levels, suggesting steady growth in the near

term (Three Overlooked Emerging Market ETFs). Additionally, they

are commodity rich regions which add to their advantage at a time

when commodity prices are rising.

Also, stable political situations and rising consumer market

make these destinations an ideal choice for investors seeking to

put in their money in this part of the world but beyond the

behemoth of Brazil (Top Three Emerging Market Consumer ETFs). Below

we discuss the ETFs available in the market to play this slice of

the economy.

Chile

The Chilean economy is an intriguing choice for investors

seeking to invest in Latin America. Chile has turned out to be one

of the strongest economies outperforming Brazil and Argentina

(Forget the BRIC ETFs, Focus on the PICKs). The International

Monetary Fund (IMF) expects the Chilean economy to grow at the rate

of 4.3% in 2012.

Chile is also known for its abundance in minerals and is the

largest producer and exporter of copper. The tie ups with Asian

economies may help the region to set off the losses incurred due to

the weak European market.

However, investors should note that after a strong recovery, the

growth momentum in Chile has been slow in recent times attributable

to the deepening global woes. Copper prices have slowed down and

unemployment level has seen an increase.

Despite some gloomy factors, the region remains an interesting

choice for investors. Investors seeking to tap this corner of the

market in an ETF form, the iShares MSCI Chile Index

Fund (ECH) looks to be the top choice.

The product tracks the MSCI Chile Investable Market Index which

produces a fund that holds about 40 securities in its basket. The

fund appears to be concentrated in the top 10 holdings with asset

investment of 62%.

Among sector allocation, Utilities, Industrials, Financials and

Materials are the top four choices for the fund with double-digit

allocation. The fund charge investors a fee of 59 basis points and

generates a yield of 1.55% in the process.

Peru

Investors should note that Peru is also one of the interesting

options in the catalog of Latin America ETF investing. Recent data

shows that the Peruvian economy expanded at the rate of 5.3% and,

according to International Monetary Fund, the region is expected to

grow at the rate of 5.9% in 2012. The growth of the economy is

being driven by strong external and domestic demand. Additionally,

Peru is one of the largest producers of gold and silver (Peru ETF

Investing 101).

The recent downturn in the U.S. has impacted commodity prices

worldwide which also slowed down the growth of the Peruvian

economy. However, with the announcement of Q3 by the Fed, commodity

prices were on the rise once more, which once again gave a boost to

the economy (Commodity ETFs in Focus as Fed Unleashes QE3).

Investors seeking to tap this attractive economy in ETF form

could do so by investing in iShares MSCI All Peru Capped

ETF (EPU). EPU is the only ETF offering a pure play in

Peru. The fund tracks the MSCI All Peru Capped Index and holds a

very small basket of 28 stocks. Materials and Financial stocks play

a dominant role in the holdings profile as the two sectors combine

to make up 77.86% of assets.

The top 10 holdings also take away a major chunk of the asset

base of $336.2 million. In this asset base, the top 10 holdings get

a share of more than 70%. The fund charges a fee of 59 basis points

from the investors and has a yield of 2.42% per

year.

Colombia

The Colombian economy has also turned out to be extremely

popular when it comes to investing in the emerging markets of Latin

America. Colombia is a region which has immense unexploited natural

resources, especially in the areas of oil and coal. The region also

has close U.S. ties and a strong fiscal position.

Earlier, the country was politically not very stable but things

have changed and there has been a vast improvement. Another factor

which in the past led investors to stay away from investing in this

country is the historically high rate of inflation. Fortunately,

the scenario is different right now with inflation well under

control thanks to sound government policies (Colombia ETFs

Head-to-Head).

Investors seeking to invest in this part of the Latin American

region have two choices available, the Global X FTSE

Colombia 20 ETF (GXG) and the Market Vectors

Colombia ETF (COLX). Both these funds offer a pure play in

the Colombian economy. But investors should note that GXG was first

implemented to tap the economy and COLX was launched in 2011.

With that being said, GXG manages a somewhat higher asset base

with a higher trading volume compared to COLX. While GXG has an

advantage over AUM and volume, COLX has an edge in expenses and

boasts of a greater number of holdings.

COLX provides exposure to 27 Colombian stocks, 3 more than GXG.

COLX charges a fee of 75 basis points annually which is also 3

basis points lower than GXG. Financials, Energy and Materials are

the top three choices among sectors for both the fund.

Andean Broad Based

Investors who seek to cover the three emerging market through

one basket of stocks have Global X FTSE Andean 40

ETF (AND) available. This ETF specializes in providing

exposure to the Andean economies instead of pure play in any single

economy. This produces a fund which tracks the FTSE Andean 40 Index

and provides exposure to 41 largest stocks from all the three

Andean nation-states, Chile, Peru and Colombia

Despite being the only ETF available for investors to have a

broad play in the Andean economies, the ETF does not seem to be

popular among investors as implied by its trading volume of just

500 shares a day. Additionally, since its inception, in early 2011,

the fund has been able to accumulate AUM of just $8.7 million.

From a country exposure perspective, Chile gets the first spot

in the list with a share of 39% while Colombia takes the second

position with 30% allocation. Peru holds the last position with a

share of 11%.

In terms of sector allocations, 76% of the fund is allocated to

these four sectors: Basic Materials and Financials each make up

about 24% of the fund while Energy (15%) and Utilities (13%) round

out the next two quarters of the total exposure profile.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

GLBL-XF ANDN 40 (AND): ETF Research Reports

MKT VEC-COLUMB (COLX): ETF Research Reports

ISHARS-MSCI CHL (ECH): ETF Research Reports

ISHARS-MSCI PER (EPU): ETF Research Reports

GLBL-X/F COL 20 (GXG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

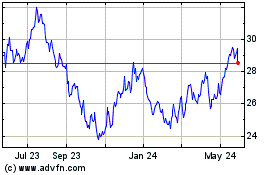

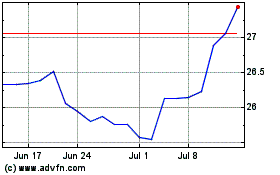

iShares MSCI Chile ETF (AMEX:ECH)

Historical Stock Chart

From Nov 2024 to Dec 2024

iShares MSCI Chile ETF (AMEX:ECH)

Historical Stock Chart

From Dec 2023 to Dec 2024