Which Asset Class will Outperform in 2013? - Real Time Insight

21 December 2012 - 1:16AM

Zacks

Treasury Bonds had another impressive

year, with the 10-year Treasury note returning about 4.4%

year-to-date, despite several gurus talking about the bond bubble

burst. Bond yields may finally rise in 2013 as the macroeconomic

situation improves, even though the Fed will maintain the rates

near zero at least until the unemployment rate drops to 6.5% or

inflation exceeds 2.5%. They will also continue massive purchases

of bonds.

On the other hand, no deal or a bad deal on the fiscal cliff

front may push the investors towards “safer” assets again.

Stock Market is up about 15% year-to-date.

Economy will probably continue to muddle through for most part of

2013, though unemployment may not come down significantly.

Considering the situation in most other parts of the developed

world and historical valuations, U.S. stocks look pretty

attractive. And if the policy makers strike a nice deal on the

fiscal cliff front, the stocks will continue their uptrend.

Gold: Gold is on track to gain about 7%

this year, yielding positive returns for the twelfth year in a row.

Though the precious metal lost some of its shine recently, many

view the decline as a buying opportunity. As the Government

printing presses continue to run overtime, gold may benefit as an

inflation hedge. Also the central banks of the emerging countries

are likely to continue their gold purchases in 2013.

Emerging Markets- While the broader MSCI

emerging markets index is up about 16% year-to-date, some of the

ETFs tracking smaller emerging markets like Turkey, Philippines,

Egypt, Mexico and Thailand have returned more than 30% this year so

far. Further China and India now seem to be bottoming out and may

post a much better performance in 2013.

Which of these will shine in 2013? Please share your

thoughts.

A) Bonds

B) US Stocks

C) Gold

D) Emerging Markets

PIMCO-TOT RETRN (BOND): ETF Research Reports

ISHARS-EMG MKT (EEM): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

ISHARS-BR 20+ (TLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

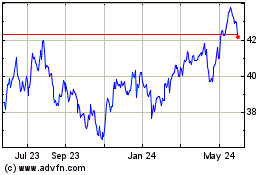

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Mar 2025 to Apr 2025

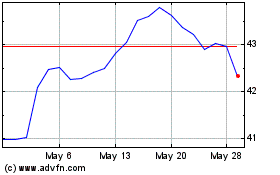

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Apr 2024 to Apr 2025