Enservco Corporation Provides Further Update on Plan to Regain Compliance with NYSE American Listing Standards

14 June 2024 - 7:07AM

Enservco Corporation (NYSE American: ENSV) (“Enservco”, or the

“Company”), a diversified national provider of specialized

well-site services to the domestic onshore conventional and

unconventional oil and gas industries, today provided a further

update on its plan to regain compliance with NYSE American listing

standards, including the status of its previously announced planned

resolution of its equity deficit (the “Updated Plan”). The

Company’s management believes that timely completion of the Updated

Plan will satisfy the stockholders’ equity requirement and allow

Enservco to retain its listing on the NYSE American exchange.

KEY HIGHLIGHTS & STATUS OF UPDATED

PLAN

The Updated Plan incorporates a strategic shift

from substantial reliance upon seasonal frac water heating to less

volatile hot oiling and energy logistics services through the

acquisition of Buckshot Trucking combined with the addition of new

equity and other components to be announced in the coming weeks.

The initial components of the Updated Plan and related status,

include:

- Secure

$10 million equity line of credit: On June 11, 2024,

Enservco entered into a Common Stock Purchase Agreement (the

“Purchase Agreement”) with an institutional investor (the

“Purchaser”), whereby the Company may elect, in its sole

discretion, to sell to the Purchaser upon the satisfaction of

certain conditions, up to the lesser of: (1) $10 million of newly

issued shares of Enservco’s common stock, and (2) 7,310,000 shares

of Common Stock, representing 19.99% of the total number of shares

of Common Stock outstanding immediately prior to the execution of

the Purchase Agreement. The 19.99% limitation will not apply if we

obtain stockholder approval to issue additional shares of Common

Stock.

- Convert

$2.2 million of debt to equity: On June 7, 2024, Rich

Murphy and Cross River Partners, L.P., converted their $1.2 million

November 2022 convertible note and the aggregate of $1.0 million of

September and October 2023 convertible notes into equity.

- Issue

$1.25 million of equity to close Buckshot acquisition: The

Company remains focused on the near-term completion of its

previously announced acquisition of Buckshot Trucking LLC

(“Buckshot”), which includes, amongst other terms, the issuance of

$1.25 million of equity.

- Further

asset rationalization and reduction in seasonality: The

Company is continuing to explore strategic initiatives to

rationalize its assets and reduce reliance upon the seasonal frac

heating business.

MANAGEMENT COMMENTARY

Rich Murphy, Enservco’s CEO and Chairman,

stated, “We are working closely with the NYSE American through

their formal appeals process to cure our deficit and bring

Enservco’s stockholder’s equity to a minimum of $6.0 million

through execution of the Updated Plan we will provide to the NYSE

American. We have made important progress on the components in

support of our plans, including recently securing a $10 million

equity line of credit. This infusion complements the $2.2 million

of debt that I and Cross River Partners recently converted into

equity as a demonstration of our confidence in the Company, and the

$1.25 million of proposed new equity to be included as

consideration for completing the transformative Buckshot

acquisition in the third quarter. We are committed to returning to

full compliance with NYSE American and will continue to inform

shareholders of the completion of additional steps in the weeks

ahead.”

Mr. Murphy, concluded, “The enhancement of our

capital structure represents another important step in our

continued efforts to rationalize our asset base, prudently manage

and enhance our cost structure, and improve our financial position.

Our focus has been on executing opportunities designed to drive the

long-term health and sustainability of our business. This includes

the Buckshot acquisition that will expand our service offering into

energy logistics offering year-round cash flow and earnings

visibility, as well as the opportunity for growth in new markets

and an expanded customer base. We will continue to look closely for

strategic transactions that provide our business with increased

financial visibility and potential growth prospects, while we also

explore strategic initiatives to further rationalize our assets and

reduce reliance upon our seasonal frac heating business.”

BACKGROUND & NEXT STEPS

On June 10, 2024, the Company announced that the

staff of NYSE Regulation had determined to commence proceedings to

delist the common stock of Enservco from the Exchange. NYSE

Regulation has determined that the Company is no longer suitable

for listing pursuant to Section 1009(a) of the NYSE American

Company Guide (the “Company Guide”) as the Company had not yet

completed its refinancing plan to attain a minimum of $6.0 million

of stockholders’ equity by June 9, 2024.

The Company has the right to a review of staff’s

determination to delist the common stock by the Listings

Qualifications Panel of the Committee for Review of the Board of

Directors of the Exchange (the “Panel”).

Enservco is requesting a hearing to appeal the

staff’s determination with the Panel and plans to submit its plan

to cure its equity deficit on or before the expected hearing date.

The hearing date will be set by the Panel and the Company will

communicate that date to stockholders when established. Following

such appeal, a decision by the Panel will be made and announced by

NYSE Regulation regarding either proceeding with suspension and

delisting or continued trading in the Company’s common stock.

During the appeal review period, the Company’s

stock will continue to be listed and traded on the NYSE American

exchange. However, there can be no assurance that the Company will

successfully execute all of the elements of the Updated Plan and

thus regain compliance with all applicable NYSE American listing

standards. In such event, Enservco’s common stock will be delisted

from the NYSE American.

ABOUT ENSERVCO

Enservco provides a range of oilfield services

through its various operating subsidiaries, including hot oiling,

acidizing, frac water heating, and related services. The Company

has a broad geographic footprint covering major domestic oil and

gas basins across the United States. Additional information is

available at www.enservco.com. On March 20, 2024, the Company

announced an agreement to purchase Buckshot Trucking LLC, an energy

logistics provider in multiple key oil and gas basins (the

“Buckshot Acquisition”). The Buckshot Acquisition is scheduled to

close in the third quarter of 2024. When closed, the Buckshot

Acquisition would provide Enservco with a growing business that is

not weather dependent, allow the Company to enter steady year-round

logistics, provide an expanded operating footprint, and improve

cash flow visibility.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This news release contains information that is

“forward-looking” in that it describes events and conditions

Enservco reasonably expects to occur in the future. Expectations

for the future performance of Enservco are dependent upon a number

of factors, and there can be no assurance that Enservco will

achieve the results as contemplated herein. Certain statements

denoting future possibilities, are forward-looking statements. The

accuracy of these statements cannot be guaranteed as they are

subject to a variety of risks, which are beyond Enservco's ability

to predict, or control and which may cause actual results to differ

materially from the projections or estimates contained herein.

Among these risks are those set forth in Enservco’s annual report

on Form 10-K for the year ended December 31, 2023, and subsequently

filed documents with the Securities and Exchange Commission

(“SEC”). Forward-looking statements in this news release that are

subject to risks related to, among other things, closing of the

Buckshot Acquisition on anticipated terms and timing, and the

ability of Enservco to successfully integrate Buckshot’s market

opportunities, personnel and operations and to achieve expected

benefits. Enservco disclaims any obligation to update any

forward-looking statement made herein.

CONTACT

Mark PattersonChief Financial OfficerEnservco

Corporationmpatterson@enservco.com

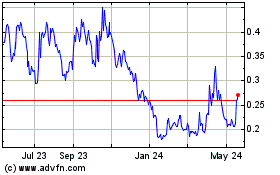

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Jan 2025 to Feb 2025

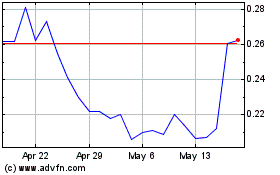

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Feb 2024 to Feb 2025