First Trust Energy Income and Growth Fund (the "Fund") (NYSE

American: FEN) has declared its final common share distribution

rate in the amount of $0.30 per share, which as previously

announced on April 19, 2024, will be payable on May 2, 2024, to

shareholders of record as of April 29, 2024. The ex-dividend date

is expected to be April 26, 2024. The final distribution

information for the Fund appears below.

First Trust Energy

Income and Growth Fund (FEN):

Distribution per share:

$0.30

Distribution Rate based on the April 23,

2024 NAV of $16.36:

7.33%

Distribution Rate based on the April 23,

2024 closing market price of $16.16:

7.43%

The final distribution is attributable to the Fund’s remaining

estimated accumulated earnings and profits, which are required to

be distributed in connection with the previously approved

merger.

The distribution will be paid entirely in cash, with no option

for dividend reinvestment.

It is anticipated that, due to the tax treatment of cash

distributions made by the publicly-traded master limited

partnerships ("MLPs") in which the Fund invests, a portion of the

distribution the Fund makes to Common Shareholders may consist of a

tax-deferred return of capital. The final determination of the

source and tax status of all distributions paid in 2024 will be

made after the end of 2024 and will be provided on Form

1099-DIV.

The Fund is a non-diversified, closed-end management investment

company that seeks a high level of after-tax total return with an

emphasis on current distributions paid to shareholders. The Fund

focuses on investing in MLPs and related public entities in the

energy sector which the Fund's investment sub-advisor believes

offer opportunities for income and growth. The Fund is treated as a

regular corporation, or a "C" corporation, for United States

federal income tax purposes and, as a result, is subject to

corporate income tax to the extent the Fund recognizes taxable

income.

First Trust Advisors L.P. ("FTA") is a federally registered

investment advisor and serves as the Fund's investment advisor. FTA

and its affiliate First Trust Portfolios L.P. ("FTP"), a FINRA

registered broker-dealer, are privately-held companies that provide

a variety of investment services. FTA has collective assets under

management or supervision of approximately $226 billion as of March

28, 2024 through unit investment trusts, exchange-traded funds,

closed-end funds, mutual funds and separate managed accounts. FTA

is the supervisor of the First Trust unit investment trusts, while

FTP is the sponsor. FTP is also a distributor of mutual fund shares

and exchange-traded fund creation units. FTA and FTP are based in

Wheaton, Illinois.

Energy Income Partners, LLC ("EIP") serves as the Fund's

investment sub-advisor and provides advisory services to a number

of investment companies and partnerships for the purpose of

investing in energy, utility, and other energy infrastructure

securities. EIP is one of the early investment advisors

specializing in this area. As of March 31 2024, EIP managed or

supervised approximately $5.4 billion in client assets.

Principal Risk Factors: Risks are inherent in all investing.

Certain risks applicable to the Fund are identified below, which

includes the risk that you could lose some or all of your

investment in the Fund. The principal risks of investing in the

Fund are spelled out in the Fund's annual shareholder reports. The

order of the below risk factors does not indicate the significance

of any particular risk factor. The Fund also files reports, proxy

statements and other information that is available for

review.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost. There can be no assurance that the Fund's investment

objectives will be achieved. The Fund may not be appropriate for

all investors.

The Fund is subject to risks, including the fact that it is a

non-diversified closed-end management investment company.

Market risk is the risk that a particular investment, or shares

of a fund in general may fall in value. Investments held by the

Fund are subject to market fluctuations caused by real or perceived

adverse economic conditions, political events, regulatory factors

or market developments, changes in interest rates and perceived

trends in securities prices. Shares of a fund could decline in

value or underperform other investments as a result. In addition,

local, regional or global events such as war, acts of terrorism,

market manipulation, government defaults, government shutdowns,

regulatory actions, political changes, diplomatic developments, the

imposition of sanctions and other similar measures, spread of

infectious disease or other public health issues, recessions,

natural disasters or other events could have significant negative

impact on a fund and its investments.

Current market conditions risk is the risk that a particular

investment, or shares of the fund in general, may fall in value due

to current market conditions. As a means to fight inflation, the

Federal Reserve and certain foreign central banks have raised

interest rates and expect to continue to do so, and the Federal

Reserve has announced that it intends to reverse previously

implemented quantitative easing. Recent and potential future bank

failures could result in disruption to the broader banking industry

or markets generally and reduce confidence in financial

institutions and the economy as a whole, which may also heighten

market volatility and reduce liquidity. Ongoing armed conflicts

between Russia and Ukraine in Europe and among Israel, Hamas and

other militant groups in the Middle East, have caused and could

continue to cause significant market disruptions and volatility

within the markets in Russia, Europe, the Middle East and the

United States. The hostilities and sanctions resulting from those

hostilities have and could continue to have a significant impact on

certain fund investments as well as fund performance and liquidity.

The COVID-19 global pandemic, or any future public health crisis,

and the ensuing policies enacted by governments and central banks

have caused and may continue to cause significant volatility and

uncertainty in global financial markets, negatively impacting

global growth prospects.

Because the Fund is concentrated in securities issued by energy

companies, energy sector MLPs and MLP-related entities, it will be

more susceptible to adverse economic or regulatory occurrences

affecting those industries, including high interest costs, high

leverage costs, the effects of economic slowdown, surplus capacity,

increased competition, uncertainties concerning the availability of

fuel at reasonable prices, the effects of energy conservation

policies and other factors.

The Fund's use of derivatives may result in losses greater than

if they had not been used, may require the fund to sell or purchase

portfolio securities at inopportune times, may limit the amount of

appreciation the Fund can realize on an investment, or may cause

the fund to hold a security that it might otherwise sell.

Investment in non-U.S. securities is subject to the risk of

currency fluctuations and to economic and political risks

associated with such foreign countries.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the fund are spelled out in the

shareholder report and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial professionals are responsible for evaluating investment

risks independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

The Fund’s daily closing NYSE American price and net asset value

per share as well as other information can be found at

https://www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424251723/en/

Press Inquiries: Ryan Issakainen, 630-765-8689 Analyst

Inquiries: Jeff Margolin, 630-915-6784 Broker Inquiries: Sales

Team, 866-848-9727

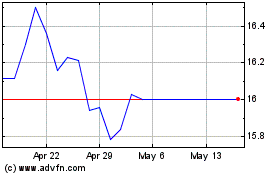

First Trust Energy Incom... (AMEX:FEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

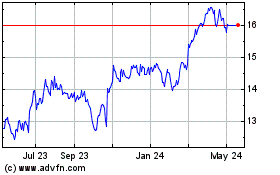

First Trust Energy Incom... (AMEX:FEN)

Historical Stock Chart

From Mar 2024 to Mar 2025