Besides riding the US equity market bull train higher this year,

there is a triplet of trades I've had some success with as interest

rates rise. I am back in all three of these trades.

The following is my rationale and a chart for each.

And they are also listed in order of conviction.

1) Short US Treasury Bonds via the ProShares

UltraShort 20+ Year Treasury ETF (TBT)

This is my best and easiest way to play the

"normalization" of interest rates as the Fed plans to phase out of

the bond-buying business eventually. Just ask yourself, what's

normal about the US 10-year yield at 2.5% when the economy is

growing at 1.5% and inflation is over 1%?

Maybe that is acceptable in a distorted and

artificial QE world. But growth and inflation should only

accelerate from here, albeit slowly. And this should force the

10-year to yield closer to 3% if not 3.5% in the next 6-12

months.

Regardless of big theories about a "great rotation"

out of bonds and into equities by both individuals and conservative

bond-loving pension funds, we are beginning to see the signs of a

"small rotation" as money leaves bond funds and enters equity funds

in the past few months.

This trickle will only accelerate as investors

realize they will never regain that principal and stand to lose

more.

In Market Timer, we've traded TBT swings five times

since September 2012 and all were profitable. We are long again and

looking for the 10-year to move above 3% before it hits 2%.

Risks to this trade: The Fed leans toward a "later

taper" of QE3 bond-buying -- say Q1 of 2014 -- and/or the stock

market enters a hard correction both of which could cause bonds to

rally and the 10-year to go back toward 2%.

I believe the risk from our average entry point in

TBT at $75.83 (16.82% cash position*) is under 10%, while the

potential reward is north of 20%. My conviction in this trade is

very high because I don't see US long rates going back under 2% in

any likely scenarios.

2) Short Gold via the DB Gold Double Short ETN

(DZZ)

As interest rates rise, even while disinflation

persists, gold has no where to hide. It offers no static return and

is therefore worse than cash in many respects because you are

charged for storage and insurance directly or indirectly. And these

costs only go up in a higher interest rate environment.

Sure, if you caught the bull trend in the last

decade, you more than covered the 0.4% annual expense ratio of GLD

(probably the cheapest charge for owning physical gold indirectly

you will find anywhere). But how many investors could stay in that

bubble, or trade in and out of it, for ten years vs the thousands

of stocks to choose from in the US equity markets?

My soundbite question to people is this question:

What would you rather hold... an ounce of a shiny yellow metal that

pays you nothing despite its rich mythology, or $1300 you can use

to invest in equities, high-grade corporate bonds, or real

estate?

Yes, gold is "supposed to" continue trending higher

because of Federal Reserve money printing, which devalues the US

dollar and makes gold a "safe haven" and "store of value."

I just think these cliches are worn out now. The

dollar and US equity markets have proven their worth to the entire

world recently. And while there is still risk that our currency

could depreciate against the euro, the pound, the yen, or a dozen

other markets we trade with and like to vacation in, the fact is

that there are many other better ways of beating natural

inflation.

Risks to this trade: Central bank appetite for gold

resumes and/or fall seasonal buying from India and China ramps up

in August and September.

I believe the risk from our average entry point in

DZZ at $6.85 (5.92% cash position*) is under 15%, while the

potential reward is about the same allowing for a lot of back in

forth in a big range for gold between $1400 and $1200 in the next

3-6 months before new lows are made below $1180. This 1-to-1

risk-reward ratio could entice me to trade in-and-out around a core

short position.

In Market Timer, we made nearly 35% in DZZ from

late April to late June as gold fell from $1475 to $1225, a 17%

decline.

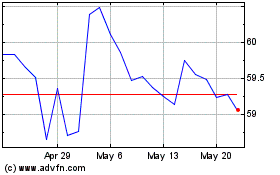

3) Short Japanese Yen vs US Dollar via the

ProShares UltraShort Yen ETF (YCS)

With the giant Bank of Japan stimulus operations

launched this year, their Nikkei stock index soared 40% in the

first half of the year. These central bank liquidity actions were

also designed to weaken their currency and that plan worked too,

sending the USD/JPY exchange rate surging from 87 to 103, a move of

over 18% which is pretty steep in FX in only 5 months.

The Japanese want a weaker yen and they are willing

to do almost whatever it takes in terms of monetary policy to make

that happen. We didn't catch the first big move up earlier this

year, but we did buy the drop back to 94 and ride that bounce to

100 USD/JPY.

In YCS that meant buying the ETF at $59 and taking

profits above $65. We just re-entered the trade near $63 because it

appeared like USD/JPY was finding support near 98 and I am looking

for a continued move above the recent highs of 103.

But there is risk that USD/JPY could go all the way

back down and test 94 or lower before making its longer term

expected move to the 105-110 region.

So in this trade we have the least edge and

therefore I have the least conviction of the three higher interest

rates-higher US dollar trades. The equivalent of USD/JPY going to

92-94 would be YCS going to $55-57.

I believe the risk from our entry point at $63.25

(6.8% cash position*) is under 15%, while the potential reward is

over 20%. Since this position is large for a volatile currency pair

in which I have the least conviction, my stop will be flexible

based on changing conditions.

*A few words are in order about position sizes with

leveraged ETFs. All positions above are noted as a percentage of

total portfolio value. "Cash" simply means that I am not

acknowledging the true leverage and "speed" with which these

positions could move in (or against) my favor.

For a more conservative view of using

double-leveraged ETFs (as all 3 of the above are), one could

multiply the position size by 2. This should be considered a

mandatory practice when using leveraged equity ETFs, where total

combined positions can give you net long (or short) equity exposure

that is greater than 100%.

Balancing Risk & Reward When Taking on

Bigger, Smarter Money

Obviously in this short article, I have not given

an in-depth technical view of each trade rationale. To me, these

are all techno-fundamental trades that I see an edge in to one

degree (TBT = strong conviction) or another (YCS = lesser

conviction).

I could be very wrong about these

closely-correlated one-way trades. An economic shock could send TBT

and YCS against me harshly and quickly. Strong Asia or central bank

demand for gold could push the yellow metal to $1500 or higher

again.

And while global investment banks and hedge funds

track each other's moves closely, I scramble to pick up bits and

pieces of what they are doing so that I do not get run over.

I read as much research as I can and that means I

know I am going against some bigger and smarter money in some

cases, especially in the gold and yen trades.

But I am willing to take a shot in each trade, with

varying degrees of risk, right here, right now. I don't want to

chase them later and simply wish I had followed my best sense of

global-macro currents and the big trends they create.

I will provide an update on these trades before

Labor Day. Until then, please feel free to leave your comments or

questions below.

Kevin Cook is a Senior Stock Strategist with

Zacks.com where he manages both the Market Timer and Follow the

Money portfolios.

CRYSHS-JAP YEN (FXY): ETF Research Reports

MKT VEC-GOLD MI (GDX): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

ISHARS-20+YTB (TLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Invesco CurrencyShares J... (AMEX:FXY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Invesco CurrencyShares J... (AMEX:FXY)

Historical Stock Chart

From Feb 2024 to Feb 2025