3 ETFs to Play on Ukraine Turmoil - ETF News And Commentary

14 March 2014 - 5:00AM

Zacks

The global stock markets are seeing choppy trading thanks to the

tension between Ukraine and Russia. All eyes are currently on

Europe and the whole world is watching the impact of any

development in the worst East-West standoff since the Cold War.

Ukraine Crisis in Focus

The tensions in Ukraine have flared up ahead of the referendum to

be held on March 16 that will decide the fate of Ukraine's Crimean

peninsula region. The referendum will tell whether the debated

peninsula will move to Russia or will stay with Ukraine. The

lawmakers may vote for independence and might agree to its becoming

a Russia state (read: How Russia ETFs Have Performed in the Ukraine

Crisis).

The G7 group of nations - the U.K., Canada, France, Germany, Italy,

Japan and the U.S. – along with EU leaders warned Russia over

Crimea annexation and asked Russia to stop the referendum from

taking place. The G7 views the referendum as illegal and a clear

violation of international law.

Further, if Russia does not cease its effort to annex Crimea or

pull Russian troops out of the region then Moscow will be penalized

and hit by tough sanctions such as asset freezes and travel bans.

However, Russia has not yet abandoned its ambitions in Crimea and

has tightened its control on the peninsula.

The Ukraine-Russia dispute aggravated when the Ukrainian president

Viktor Yanukovych was ousted in late February and Russian President

Vladimir Putin started doubting that the new Ukrainian government

might cancel the Russian Navy's lease. As a result, Putin wants

Crimea to be under Russian roof. This is especially true as the

region is home to Russia's Black Sea fleet and its main port is on

lease to Russia.

The geopolitical tension might heighten further in the near term if

Russia does not back out or if the referendum is presented this

weekend. Given this turbulence, investors are dumping riskier

securities and are turning to any safe haven play (read: 3 Energy

ETFs to Buy on the Ukraine Crisis).

ETFs to Consider

For those investors, we have highlighted three ETFs that will

likely benefit from the crisis and would be in focus in the weeks

ahead.

SPDR Gold Trust ETF (GLD)

This is the ultra-popular gold ETF with AUM of over $35.1 billion

and heavy volume of more than 8.2 million shares a day. It charges

40 bps in fees per year from investors (read: Palladium ETF Surging

on Tensions in Ukraine).

The fund tracks the price of gold bullion measured in U.S. dollars,

and kept in London under the custody of HSBC Bank USA. Each share

represents about 1/10th of an ounce of gold at current prices. The

ETF added about 6% over the past one month and has a Zacks ETF Rank

of 3 or ‘Hold’ rating.

iShares 20+ Year Treasury Bond ETF (TLT)

This fund provides exposure to the long-term Treasury bonds by

tracking the Barclays Capital U.S. 20+ Year Treasury Bond Index. It

is one of the most popular and liquid ETFs in the bond space having

amassed over $2.8 billion in its asset base and more than 7.7

million shares in average daily volume. Expense ratio came in at

0.15%.

Holdings 23 securities in its basket, the fund focuses on the top

credit rating bonds (AA+ and higher). The average maturity comes in

27.28 years and the effective duration is 16.46 years. The product

gained just 1.32% in the past one month and has a Zacks ETF Rank of

3 or ‘Hold’ rating (read: 3 Bond ETFs Surging as Interest Rates

Tumble).

CurrencyShares Japanese Yen Trust (FXY)

This product appears a great way to play a future rise in the yen

relative to the U.S. dollar. It tracks the movement of the yen

relative to the U.S. dollar, net of the Trust expenses, which are

expected to be paid from the interest earned on the deposited

Japanese yen (see: more Currency ETFs here).

The fund charges 40 bps a year in fees. Additionally, the ETF sees

a good volume of roughly 257,000 shares per day and has accumulated

$189.1 million in its asset base. The ETF lost 0.24% in the

trailing one-month period and has a Zacks ETF Rank of 4 or ‘Sell’

rating. While long-term trend is negative due to Abenomics, the

short term looks promising as investors are currently riding high

on Japanese yen due to uncertainty in Ukraine.

Bottom Line

It seems that the political unrest in Ukraine might turn into a

cold war if Russia does not stay away from military escalation.

This would continue to roil global markets, making the

above-mentioned ETFs solid ways to play the trend.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

CRYSHS-JAP YEN (FXY): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-20+YTB (TLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

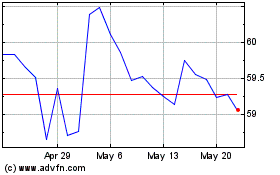

Invesco CurrencyShares J... (AMEX:FXY)

Historical Stock Chart

From Jan 2025 to Feb 2025

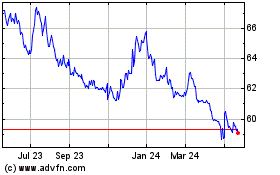

Invesco CurrencyShares J... (AMEX:FXY)

Historical Stock Chart

From Feb 2024 to Feb 2025