UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of August 2024

Commission

File Number 001-40099

GOLD

ROYALTY CORP.

(Registrant’s

name)

1188

West Georgia Street, Suite 1830

Vancouver,

BC V6E 4A2

(604)

396-3066

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GOLD

ROYALTY CORP. |

| |

|

|

| Date:

August 13, 2024 |

By: |

/s/

Andrew Gubbels |

| |

Name: |

Andrew

Gubbels |

| |

Title: |

Chief

Financial Officer |

EXHIBIT

INDEX

Exhibit

99.1

GOLD

ROYALTY ReportS Second Quarter 2024 Results; Continued growth in operating Cash flow

Vancouver,

British Columbia – August 13, 2024 – Gold Royalty Corp. (“Gold Royalty” or the “Company”)

(NYSE American: GROY) is pleased to announce the filing of its operating and financial results for the three and six months ended June

30, 2024. All amounts are expressed in U.S. dollars unless otherwise noted.

David

Garofalo, Chairman and CEO of Gold Royalty, commented: “The second quarter of 2024 was transformational for Gold Royalty as we

meaningfully enhanced our growth outlook through the Vares Copper Stream transaction. We are now on the cusp of several key development

stage assets ramping up to full capacity such as Côté, which recently achieved commercial production, Vares which is set

to achieve commercial production in the fourth quarter, and Borborema, which is on track for initial production in the first quarter

of 2025. Our strategic acquisitions over the past twelve months and effective cost management have reinforced our robust financial outlook

and resulted in our second consecutive quarter of positive operating cash flow. Beyond this exceptional portfolio performance, we also

published our second annual Asset Handbook and Sustainability Report during the quarter, highlighting Gold Royalty as one of the lowest

carbon intensity portfolios in the royalty and streaming sector.”

Second

Quarter 2024 Results Summary:

The

following table sets forth selected financial information for the three and six months ended June 30, 2024:

| | |

For the three months ended

June 30 | | |

For the six months ended

June 30 | |

| (in thousands of dollars, except per share | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| amounts) | |

($) | | |

($) | | |

($) | | |

($) | |

| Revenue | |

| 1,794 | | |

| 468 | | |

| 4,688 | | |

| 1,235 | |

| General, administrative and project evaluation costs | |

| 2,133 | | |

| 2,666 | | |

| 5,008 | | |

| 6,090 | |

| Net loss | |

| (2,236 | ) | |

| (2,496 | ) | |

| (3,641 | ) | |

| (5,579 | ) |

| Net loss per share, basic and diluted | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.02 | ) | |

| (0.04 | ) |

| Cash provided by (used in) operating activities | |

| 987 | | |

| (1,337 | ) | |

| 1,323 | | |

| (3,398 | ) |

| Non-IFRS and Other Measures | |

| | | |

| | | |

| | | |

| | |

| Total Revenue, Land Agreement Proceeds and Interest(1) | |

| 2,215 | | |

| 557 | | |

| 6,400 | | |

| 2,527 | |

| Cash Operating Expenses(1) | |

| (1,655 | ) | |

| (1,822 | ) | |

| (3,915 | ) | |

| (4,345 | ) |

| Adjusted Net Loss(1) | |

| (1,737 | ) | |

| (2,487 | ) | |

| (2,667 | ) | |

| (3,805 | ) |

| Adjusted Net Loss Per Share, basic and diluted(1) | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.02 | ) | |

| (0.03 | ) |

| Total Gold Equivalent Ounces (“GEOs”)(1) | |

| 947 | | |

| 282 | | |

| 2,967 | | |

| 1,324 | |

(1)

Total Revenue, Land Agreement Proceeds and Interest, Cash Operating Expenses, Adjusted Net Loss, Adjusted Net Loss Per Share, basic and

diluted and Total GEOs are each non-IFRS measures and do not have a standardized meaning under IFRS. See “Non-IFRS Measures”

for further information.

For

further detailed information, please refer to the Company’s unaudited condensed interim consolidated financial statements and management’s

discussion and analysis for the three and six months ended June 30, 2024, copies of which are available under the Company’s profile

at www.sedarplus.ca and www.sec.gov.

Second

Quarter 2024 Highlights:

| ● | Quarterly

revenue of $1.8 million and Total Revenue, Land Agreement Proceeds and Interest of $2.2 million

(947 GEOs), represented an approximate 300% increase compared to the same period of 2023.

In the second quarter of 2024, the Company recorded its first royalty payment from IAMGOLD’s

Côté Gold Mine and continued to benefit from its existing cash flowing royalties

at the Borborema Project and the Canadian Malartic, Cozamin, and Borden Mines. |

| | | |

| ● | The

Company remains on track to achieve its annual guidance of between 6,500 and 7,000 GEOs,

which equates to approximately $13 million to $14 million in forecasted Total Revenue, Land

Agreement Proceeds and Interest. |

| | | |

| ● | Achieved

a second consecutive quarter of positive cash flows from operations of $1.0 million, which

does not include an additional $0.2 million of land agreement proceeds credited against mineral

properties. |

| | | |

| ● | Ongoing

cost management initiatives resulted in a continued trend of decreased Cash Operating Expenses.

Cash Operating Expenses decreased by 9% compared to the same period of 2023. |

| | | |

| ● | Completed

the acquisition of a copper stream (the “Stream”) on the Vares Silver

Project (“Vares”) from Orion Mine Finance for $50 million, a portion of

which was funded by a bought deal equity financing completed by the Company for gross proceeds

of $34.5 million. |

| | | |

| ● | Publication

of the Company’s second annual Asset Handbook and Sustainability Report, which outlined

Gold Royalty had one of the lowest carbon intensity portfolios in the royalty and streaming

sector. |

Portfolio

Update:

Odyssey

Mine (3.0% NSR over the northern portion of the mine): Agnico Eagle Mines Limited (“Agnico Eagle”) owns and operates

the Canadian Malartic Complex which is one of the world’s largest gold mining operations and is comprised of the open-pit Canadian

Malartic mine and the underground Odyssey mine. The Canadian Malartic complex is progressively transitioning from open pit to underground

mining between 2023 and 2028.

On

July 31, 2024, Agnico Eagle announced its results for the second quarter of 2024, outlining record quarterly mining rates and gold production

at Odyssey South of approximately 3,750 tonnes per day and 22,300 ounces of gold, respectively. Ramp development continued to exceed

Agnico Eagle’s target, reaching the third production level at East Gouldie at a depth of 832 metres while shaft sinking advanced

and reached a depth of 680 metres as at June 30, 2024.

Based

on positive results from the exploration program near the Odyssey mine during the first half of 2024, Agnico Eagle has approved a supplemental

exploration budget near-mine drilling and regional exploration drilling during the second half of the year. The objective is to further

expand the mineral resource footprint laterally and add inferred mineral resources in support of a potential future Shaft #2 and the

broader “Fill the Mill” strategy at the Canadian Malartic complex.

For

further information see Agnico Eagle’s news release dated July 31, 2024, available under its profile on www.sedarplus.ca.

Vares

Silver Project (100% Copper Stream with ongoing payments of 30% LME spot copper price): On July 30, 2024, Adriatic Metals plc (“Adriatic”)

announced its second quarter activities report with highlights including initial concentrate sales during the quarter and the ongoing

ramp-up of production with nameplate production expected in the fourth quarter of 2024. Underground development rates increased by 31%

quarter over quarter while exploration activities continue to advance targeting the northern and southern extensions of the Rupice deposit.

Additionally, Adriatic has commenced studies with Ausenco to increase plant throughput to up to 1.3 Mtpa from 0.8 Mtpa with a detailed

report expected in the fourth quarter of 2024.

With

the regards to an earlier ruling made by the Constitutional Court of Bosnia & Herzegovina that impacted the removal of trees at Adriatic’s

planned extended tailings storage facility, Adriatic noted “No impact is anticipated on production as Adriatic will continue to

use the current tailing storage facility and is progressing alternative tailings storage facilities, with initial design work underway

at an alternate location.”

For

further information see Adriatic’s ASX Announcements dated July 15, 2024 and July 30, 2024.

Côté

Gold Mine (0.75% NSR royalty over the southern portion of the mine): On May 9, 2024, IAMGOLD Corporation (“IAMGOLD”)

announced their first quarter results including an update at the Côté Gold Mine where IAMGOLD reiterated their production

guidance for the year and estimate of achieving commercial production in the third quarter of 2024.

On

May 24, 2024, IAMGOLD announced the completion of a $300 million bought deal financing, positioning the company to be well-funded during

the Côté Gold Mine ramp-up. IAMGOLD also confirmed that they intend to use the net proceeds of the financing towards the

repurchase of the 9.7% interest in the Côté Gold Mine from Sumitomo Metal Mining Co. Ltd., in order to return to its full

70% interest in the Côté Gold Mine.

Additionally,

IAMGOLD announced on August 2, 2024, that it had achieved commercial production at the Côté Gold Mine with the mill operating

at an average of 60% of nameplate throughput for 30 consecutive days. Ramp-up of the plant continues to progress as IAMGOLD aims to achieve

90% of nameplate throughput by the end of the year.

On

August 8, 2024 IAMGOLD announced its second quarter results including initial production results and gold sales from Côté.

IAMGOLD also noted production guidance at Côté Gold is expected to be on the lower end of the guidance range of 220,000

to 290,000 ounces, as improvements to mill availability are made during the ramp-up of operations towards 90% of nameplate capacity.

For

further information see IAMGOLD’s news releases dated May 9, 2024, May 24, 2024, August 2, 2024, and August 8, 2024, available

under its profile on www.sedarplus.ca.

Borborema

Gold Project (2.0% NSR royalty and gold-linked royalty-convertible loan): On August 5, 2024, Aura Minerals Inc. (“Aura”)

announced its second quarter 2024 financial and operating results, including an update on the Borborema project where it outlined construction

was 40% complete, with construction capex 80% already committed and 39% already disbursed. Aura also added that the road relocation which

is expected to increase minable mineral reserves is pending approval by the National Infrastructure Agency, and approval is expected

in 2024 and licensing in early 2025.

For

further information see Aura’s news release dated August 5, 2024, available under its profile on www.sedarplus.ca.

Ren

Project (1.5% NSR royalty and 3.5% NPI): In its management’s discussion and analysis for the year ended December 31, 2023,

Barrick Gold Corporation (“Barrick”) highlighted continued exploration success at the Ren deposit. The step-out surface

drilling program intercepted the targeted Corona dike at a depth of approximately 900 meters downhole and returned 4.7 meters at 24.90

g/t Au, which it stated confirmed the continuity of high-grade mineralization and paving the way for underground platform development

in the future to convert more material to the west.

In

its management’s discussion and analysis for the three months ended March 31, 2024, Barrick included an update on growth and exploration

projects. At Carlin, underground conversion drilling commenced across all sites in the first quarter, with step-out growth drilling expected

to commence early in the second quarter at a few key project areas.

In

its management’s discussion and analysis for the three and six months ended June 30, 2024, Barrick outlined that project capital

expenditures had increased during the quarter due to the continuation of dewatering and detailed engineering at the Ren Project.

For

further information see Barrick’s management’s discussion and analysis for the year ended December 31, 2023 and management’s

discussion and analysis for the three months ended March 31, 2024, and for the three and six months ended June 30, 2024, each available

under its profile on www.sedarplus.ca.

Granite

Creek Mine Project (10.0% NPI): On May 1, 2024, i-80 Gold (“i-80”) announced the closing of a C$115 million bought

deal public offering which is expected to provide funding for the continued development of their hub-and-spoke complex in Nevada and

the ramp-up of mining rates at the Granite Creek Mine.

Additionally,

on May 7, 2024 i-80 provided an update on planned programs for Granite Creek in 2024. The work being conducted in 2024 is expected to

include definition and expansion drilling, underground development and test mining of the South Pacific Zone, and a Feasibility Study

On

May 14, 2024, i-80 released results from the 2024 exploration program at Granite Creek, from drilling meant to define mineralization

in the upper portion of the South Pacific Zone including 22.0 g/t Au over 29.0 meters, 18.4 g/t Au over 14.4 meters and 60.5 g/t Au over

4.1 meters.

For

further information see i-80’s news releases dated May 1, 2024, May 7, 2024, and May 14, 2024, available under its profile on www.sedarplus.ca.

Cozamin

Mine (1.0% NSR over a portion of the mine): On May 2, 2024, Capstone Copper Corp. (“Capstone”) announced its first

quarter 2024 results which outlined that first quarter 2024 production was 15% higher than the first quarter 2023 due to higher grades

consistent with the mine plan. Throughput and recoveries were consistent with the same period last year.

On

August 1, 2024, Capstone announced its second quarter 2024 results which outlined that second quarter 2024 production was 7% lower than

the second quarter 2023 due to lower mill throughput driven by mine sequencing. Grades and recoveries were consistent with the same period

last year.

For

further information see Capstone’s news release dated May 2, 2024, and August 1, 2024 available under its profile on www.sedarplus.ca.

Royalty

Generator Model Update

Our

Royalty Generator Model continues to generate positive results with one new royalty added in the three months ended June 30, 2024. We

have generated 43 royalties since the acquisition of Ely Gold Royalties Inc. in 2021 through this model.

We

currently have 31 properties subject to land agreements and 6 properties under lease generating land agreement proceeds. The model continues

to incur low operating costs with only $0.02 million spent on maintaining the mineral interests in the first quarter and second quarter

of 2024.

2024

Outlook

As

previously disclosed, the company expects to see further growth in Revenue in the second half of 2024 with strong commodity prices, the

expected ramp up of Côté towards 90% of nameplate capacity by the end of the year, and the commencement of commercial production

at the Vares Project in the fourth quarter of 2024.

The

Company remains on track to meet its previously disclosed updated forecast for 2024 of between approximately 6,500 and 7,000 GEOs, which

equates to approximately $13 million to $14 million in forecasted Total Revenue, Land Agreement Proceeds and Interest.

The

2024 foregoing outlook is based on an assumed gold price of $2,000 per ounce and copper price of $4.25 per pound and on public forecasts,

expected development timelines and other disclosure by the owners and operators of the properties underlying our interests and our assessment

thereof.

Investor

Webcast

An

investor webcast will be held on Wednesday, August 14, 2024, starting at 11:00 am ET (8:00 am PT) to discuss these results. Management

will be providing an update to interested stakeholders on the Company’s quarterly results including key recent catalysts that have

been announced on the assets underlying the Company’s royalties. The presentation will be followed by a question-and-answer session

where participants will be able to ask any questions they may have of management.

To

register for the investor webcast, please click the link below: https://www.bigmarker.com/vid-conferences/GROY-Q2-Results

A

replay of the event will be available on the Gold Royalty website following the presentation.

About

Gold Royalty Corp.

Gold

Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission

is to invest in high-quality, sustainable, and responsible mining operations to build a diversified portfolio of precious metals royalty

and streaming interests that generate superior long-term returns for our shareholders. Gold Royalty’s diversified portfolio currently

consists primarily of net smelter return royalties on gold properties located in the Americas.

Gold

Royalty Corp. Contact

Peter

Behncke

Director,

Corporate Development & Investor Relations

Telephone:

(833) 396-3066

Email:

info@goldroyalty.com

Qualified

Person

Alastair

Still, P.Geo., Director of Technical Services of the Company, is a “qualified person” as such term is defined under Canadian

National Instrument 43-101 (“NI 43-101”) and has reviewed and approved the technical information disclosed in this

news release.

Notice

to Investors

For

further information regarding the project updates regarding properties underlying the Company’s royalties, stream and other interests,

please refer to the disclosures of the operators thereof, including the news releases referenced herein and the other disclosures of

such operators. Disclosure relating to properties in which Gold Royalty holds interests is based on information publicly disclosed by

the owners or operators of such properties. The Company generally has limited or no access to the properties underlying its interests

and is largely dependent on the disclosure of the operators of its interests and other publicly available information. The Company generally

has limited or no ability to verify such information. Although the Company does not have any knowledge that such information may not

be accurate, there can be no assurance that such third-party information is complete or accurate.

Unless

otherwise indicated, the technical and scientific disclosure contained or referenced in this news release, including any references to

mineral resources or mineral reserves, was prepared by the project operators in accordance with Canadian National Instrument 43-101,

which differs significantly from the requirements of the U.S. Securities and Exchange Commission (“SEC”) applicable

to domestic issuers. Accordingly, the scientific and technical information contained or referenced in this news release may not be comparable

to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

Forward-Looking

Statements:

Certain

of the information contained in this news release constitutes “forward-looking information” and “forward-looking statements”

within the meaning of applicable Canadian and U.S. securities laws (collectively, “forward-looking statements”), including

but not limited to statements regarding: estimated future total GEOs, Total Revenues and Land Agreement Proceeds, expected future cash

flows; expectations regarding the operations and/or development of the projects underlying the Company’s royalties, stream and

other interests, including the estimates of the operators thereof their timing and ability to achieve production; and expectations regarding

the Company’s growth and statements regarding the Company’s plans and strategies. Such statements can be generally identified

by the use of terms such as “may”, “will”, “expect”, “intend”, “believe”,

“plans”, “anticipate” or similar terms. Forward-looking statements are based upon certain assumptions and other

important factors, including assumptions of management regarding the accuracy of the disclosure of the operators of the projects underlying

the Company’s interests, their ability to achieve disclosed plans and targets, macroeconomic conditions, commodity prices, and

the Company’s ability to finance future growth and acquisitions. Forward-looking statements are subject to a number of risks, uncertainties

and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking

statements including, among others, any inability to any inability of the operators of the properties underlying the Company’s

royalties, stream and other interests to execute proposed plans for such properties or to achieved planned development and production

estimates and goals, risks related to the operators of the projects in which the Company holds interests, including the successful continuation

of operations at such projects by those operators, risks related to exploration, development, permitting, infrastructure, operating or

technical difficulties on any such projects, the influence of macroeconomic developments, the ability of the Company to carry out its

growth plans and other factors set forth in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023 and its

other publicly filed documents under its profiles at www.sedarplus.ca and www.sec.gov. Although the Company has attempted to identify

important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may

be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will

prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements,

except in accordance with applicable securities laws.

Non-IFRS

Measures

The

Company has included in this document, certain performance measures, including: (i) Adjusted Net Loss and Adjusted Net Loss Per Share;

(ii) total GEOs; (iii) Total Revenue, Land Agreement Proceeds and Interest; and (iv) Cash Operating Expenses which are each non-IFRS

measures. The presentation of such non-IFRS measures is intended to provide additional information and should not be considered in isolation

or as a substitute for measures of performance prepared in accordance with IFRS. These non-IFRS measures do not have any standardized

meaning prescribed by IFRS, and other companies may calculate these measures differently.

Adjusted

Net Loss and Adjusted Net Loss Per Share

Adjusted

Net Loss is calculated by adding back land agreement proceeds credited against mineral properties, loan interest earned on the gold-linked

loan, convertible debentures-accretion, transaction related and non-recurring general administrative expenses* and share of loss and

deducting the following from net loss: dilution income in associate, changes in fair value of derivative liabilities, embedded derivatives,

short-term investments and gold-linked loan, gain on loan modification, foreign exchange gain (loss) and other income (expense). Adjusted

Net Loss Per Share, basic and diluted have been determined by dividing the Adjusted Net Loss by the weighted average number of common

shares for the applicable period. Management believes that they are useful measures of performance as they adjust for items which are

not always reflective of the underlying operating performance of our business and/or are not necessarily indicative of future operating

results. The following is a reconciliation of net loss to Adjusted Net Loss, Per Share, basic and diluted for the periods indicated:

| | |

For the three months ended

June 30 | | |

For the six months ended

June 30 | |

| (in thousands of dollars, except per share | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| amounts) | |

($) | | |

($) | | |

($) | | |

($) | |

| Net loss | |

| (2,236 | ) | |

| (2,496 | ) | |

| (3,641 | ) | |

| (5,579 | ) |

| Land agreement proceeds credited against mineral properties | |

| 163 | | |

| 89 | | |

| 1,213 | | |

| 1,292 | |

| Loan interest | |

| 258 | | |

| — | | |

| 499 | | |

| — | |

| Convertible debentures - accretion | |

| 426 | | |

| — | | |

| 821 | | |

| — | |

| Transaction related and non-recurring expenses | |

| 180 | | |

| 176 | | |

| 275 | | |

| 635 | |

| Share of gain in associate | |

| (152 | ) | |

| (350 | ) | |

| (100 | ) | |

| (222 | ) |

| Dilution gain in associate | |

| — | | |

| (12 | ) | |

| (9 | ) | |

| (12 | ) |

| Change in fair value of derivative liabilities | |

| — | | |

| (9 | ) | |

| — | | |

| (239 | ) |

| Change in fair value of gold-linked loan | |

| (311 | ) | |

| — | | |

| (950 | ) | |

| — | |

| Change in fair value of short-term investments | |

| 52 | | |

| 135 | | |

| (49 | ) | |

| 77 | |

| Change in fair value of embedded derivatives | |

| (179 | ) | |

| — | | |

| (370 | ) | |

| — | |

| Foreign exchange loss | |

| 100 | | |

| 59 | | |

| 13 | | |

| 107 | |

| Loan modification (gain) loss | |

| — | | |

| — | | |

| (310 | ) | |

| 249 | |

| Other income | |

| (38 | ) | |

| (79 | ) | |

| (59 | ) | |

| (113 | ) |

| Adjusted Net Loss | |

| (1,737 | ) | |

| (2,487 | ) | |

| (2,667 | ) | |

| (3,805 | ) |

| Weighted average number of common shares | |

| 153,412,808 | | |

| 144,560,621 | | |

| 149,595,753 | | |

| 144,425,846 | |

| Adjusted Net Loss Per Share, basic and diluted | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.02 | ) | |

| (0.03 | ) |

*

Transaction related, and non-recurring general administrative expenses comprised of operating expenses that are not expected to be incurred

on an ongoing basis. During the six months ended June 30, 2024, transaction related and non-recurring professional fees primarily related

to an ongoing tax review.

Total

GEOs

Total

GEOs are determined by dividing Total Revenue, Land Agreement Proceeds and Interest by the average gold prices for the applicable period:

| (in thousands of dollars, except Average Gold Price/oz and GEOs) | |

Average Gold Price/oz | | |

Total Revenue, Land Agreement Proceeds and Interest | | |

GEOs | |

| For three months ended June 30, 2024 | |

| 2,338 | | |

| 2,215 | | |

| 947 | |

| For three months ended June 30, 2023 | |

| 1,978 | | |

| 557 | | |

| 282 | |

| For six months ended June 30, 2024 | |

| 2,157 | | |

| 6,400 | | |

| 2,967 | |

| For six months ended June 30, 2023 | |

| 1,908 | | |

| 2,527 | | |

| 1,324 | |

Total

Revenue, Land Agreement Proceeds and Interest

Total

Revenue, Land Agreement Proceeds and Interest are determined by adding land agreement proceeds credited against mineral properties and

interest received under the gold-linked loan. The Company has included this information as management believes certain investors use

this information to evaluate our performance in comparison to other gold royalty companies in the precious metal mining industry. The

following is a reconciliation of Total Revenue, Land Agreement Proceeds and Interest to total revenue for the three months ended March

31, 2024 and 2023, respectively:

| | |

For the three months ended

June 30 | | |

For the six months ended

June 30 | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| (in thousands of dollars) | |

($) | | |

($) | | |

($) | | |

($) | |

| Royalty | |

| 943 | | |

| 399 | | |

| 2,005 | | |

| 633 | |

| Advance minimum royalty and pre-production royalty | |

| 613 | | |

| 25 | | |

| 1,443 | | |

| 356 | |

| Land agreement proceeds | |

| 401 | | |

| 133 | | |

| 2,453 | | |

| 1,538 | |

| Loan interest | |

| 258 | | |

| — | | |

| 499 | | |

| — | |

| Total Revenue, Land Agreement Proceeds and Interest | |

| 2,215 | | |

| 557 | | |

| 6,400 | | |

| 2,527 | |

| Land agreement proceeds credited against mineral properties | |

| (163 | ) | |

| (89 | ) | |

| (1,213 | ) | |

| (1,292 | ) |

| Loan interest | |

| (258 | ) | |

| — | | |

| (499 | ) | |

| — | |

| Revenue | |

| 1,794 | | |

| 468 | | |

| 4,688 | | |

| 1,235 | |

Cash

Operating Expenses

Cash

Operating Expenses are determined by deducting depreciation and share-based compensation from general, administrative and project evaluation

costs. The Company has included this information as management believes certain investors use this information to evaluate our performance

in comparison to other gold royalty companies in the precious metal mining industry. The following is a reconciliation of Cash Operating

Expenses to general, administrative and project evaluation costs.

| | |

For the three months ended

June 30 | | |

For the six months ended

June 30 | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| (in thousands of dollars) | |

($) | | |

($) | | |

($) | | |

($) | |

| General and administrative costs | |

| (2,120 | ) | |

| (2,590 | ) | |

| (4,976 | ) | |

| (5,841 | ) |

| Project evaluation costs | |

| (13 | ) | |

| (76 | ) | |

| (32 | ) | |

| (249 | ) |

| General, administrative and project evaluation costs | |

| (2,133 | ) | |

| (2,666 | ) | |

| (5,008 | ) | |

| (6,090 | ) |

| Depreciation | |

| 19 | | |

| 16 | | |

| 39 | | |

| 37 | |

| Share-based compensation | |

| 459 | | |

| 828 | | |

| 1,054 | | |

| 1,708 | |

| Cash Operating Expenses | |

| (1,655 | ) | |

| (1,822 | ) | |

| (3,915 | ) | |

| (4,345 | ) |

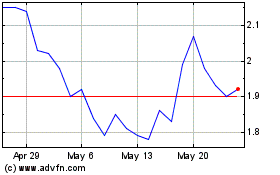

Gold Royalty (AMEX:GROY)

Historical Stock Chart

From Dec 2024 to Dec 2024

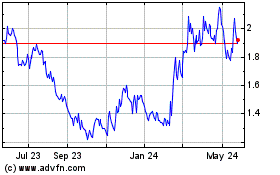

Gold Royalty (AMEX:GROY)

Historical Stock Chart

From Dec 2023 to Dec 2024