false

0001358190

CN

0001358190

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August

12, 2024

IT TECH PACKAGING, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

| 001-34577 |

|

20-4158835 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

Science Park, Juli Road

Xushui District, Baoding City

Hebei

Province, People’s Republic of China |

|

072550 |

| (Address of principal executive offices) |

|

(Zip Code) |

(86)

312-8698215

(Registrant’s telephone number, including area

code)

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ITP |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR

§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On August 12, 2024, IT Tech Packaging, Inc. (the “Company”)

issued a press release announcing its unaudited financial results for the six and three months ended June 30, 2024. A copy of the press

release making the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant

to this Item 2.02, including Exhibit 99.1, shall not be deemed as “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended

(the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

IT TECH PACKAGING, INC. |

| |

|

|

|

| Date: August 13, 2024 |

By: |

/s/ Zhenyong Liu |

| |

|

Name: |

Zhenyong Liu |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 99.1

IT Tech Packaging,

Inc. Announces Second Quarter 2024 Unaudited Financial Results

BAODING, China, August

12, 2024 /PRNewswire/ -- IT Tech Packaging, Inc. (NYSE American: ITP) (“IT Tech Packaging” or the “Company”),

a leading manufacturer and distributor of diversified paper products in North China, today announced its unaudited financial results

for the second quarter ended June 30, 2024.

Second Quarter 2024

Unaudited Financial Results

| | |

For the Three Months Ended June

30, | |

| ($ millions) | |

2024 | | |

2023 | | |

% Change | |

| Revenues | |

| 26.25 | | |

| 30.02 | | |

| -12.56 | % |

| Regular Corrugating Medium Paper (“CMP”)* | |

| 21.98 | | |

| 21.93 | | |

| 0.24 | % |

| Light-Weight CMP** | |

| 4.23 | | |

| 4.54 | | |

| -6.93 | % |

| Offset Printing Paper | |

| - | | |

| 3.16 | | |

| n/a | |

| Tissue Paper Products | |

| - | | |

| 0.34 | | |

| n/a | |

| Face Masks | |

| - | | |

| 0.04 | | |

| n/a | |

| | |

| | | |

| | | |

| | |

| Gross profit (loss) | |

| 3.27 | | |

| 1.18 | | |

| 176.75 | % |

| Gross profit margin | |

| 12.44 | % | |

| 3.93 | % | |

| 8.51

pp | **** |

| Regular Corrugating Medium Paper (“CMP”)* | |

| 12.22 | % | |

| 6.81 | % | |

| 5.41

pp | **** |

| Light-Weight CMP** | |

| 12.82 | % | |

| 7.14 | % | |

| 5.68

pp | **** |

| Offset Printing Paper | |

| - | | |

| 2.42 | % | |

| n/a | |

| Tissue Paper Products*** | |

| - | | |

| -206.06 | % | |

| n/a | |

| Face Masks | |

| - | | |

| -8.06 | % | |

| n/a | |

| | |

| | | |

| | | |

| | |

| Operating income (loss) | |

| 0.55 | | |

| -0.52 | | |

| 205.60 | % |

| Net income (loss) | |

| -0.08 | | |

| -1.25 | | |

| 93.80 | % |

| EBITDA | |

| 3.93 | | |

| 2.83 | | |

| 38.87 | % |

| Basic and Diluted earnings (loss) per share | |

| -0.01 | | |

| -0.12 | | |

| -93.33 | % |

| *** | Products

from PM8 and PM9 |

| **** | pp

represents percentage points |

| ● | Revenue

decreased by 12.56% to approximately $26.25 million, mainly due to the production suspension

of offset printing paper and tissue paper products in the second quarter of 2024. |

| ● | Gross

profit was approximately $3.27 million, compared with gross profit of $1.18 for the

same period of last year. Total gross profit margin increased by 8.51 percentage point to

12.44%. |

| ● | Income

from operations was approximately $0.55 million, compared to loss from operations of approximately

$0.52 million for the same period of last year. |

| ● | Net

loss was approximately $0.08 million, or loss per share of $0.01, compared to net loss

of approximately $1.25 million, or loss per share of $0.12, for the same period of last

year. |

| ● | Earnings

before interest, taxes, depreciation and amortization (“EBITDA”) was approximately

$3.93 million, compared to $2.83 million for the same period of last year. |

Revenue

For the second quarter

of 2024, total revenue decreased by 12.56%, to approximately $26.25 million from approximately $30.02 million for

the same period of last year. This was mainly due to the production suspension of offset printing paper and tissue paper products in

the second quarter of 2024.

The following table

summarizes revenue, volume and ASP by product for the second quarter of 2024 and 2023, respectively:

| | |

For the Three Months Ended June

30, | |

| | |

2024 | | |

2023 | |

| | |

Revenue

($’000) | | |

Volume

(tonne) | | |

ASP

($/tonne) | | |

Revenue

($’000) | | |

Volume

(tonne) | | |

ASP

($/tonne) | |

| Regular CMP | |

| 21,984 | | |

| 62,813 | | |

| 350 | | |

| 21,931 | | |

| 60.063 | | |

| 365 | |

| Light-Weight CMP | |

| 4,229 | | |

| 12,552 | | |

| 337 | | |

| 4,544 | | |

| 12,877 | | |

| 353 | |

| Offset Printing Paper | |

| - | | |

| - | | |

| - | | |

| 3,156 | | |

| 5,403 | | |

| 584 | |

| Tissue Paper Products | |

| - | | |

| - | | |

| - | | |

| 344 | | |

| 293 | | |

| 1,175 | |

| Total | |

| 26,213 | | |

| 75,365 | | |

| 348 | | |

| 29,976 | | |

| 78,636 | | |

| 381 | |

| | |

Revenue

($’000) | | |

Volume

(thousand

pieces) | | |

ASP

($/thousand

pieces) | | |

Revenue

($’000) | | |

Volume

(thousand

pieces) | | |

ASP

($/thousand

pieces) | |

| Face Masks | |

| - | | |

| - | | |

| - | | |

| 44 | | |

| 1,411 | | |

| 31 | |

Revenue from CMP, including both regular CMP

and light-Weight CMP, decreased by 0.99%, to approximately $26.21 million and accounted for 99.86% of total revenue for the

second quarter of 2024, compared to approximately $26.48 million, or 88.19% of total revenue for the same period of last year. The

Company sold 75,365 tonnes of CMP at an ASP of $348/tonne in the second quarter of 2024, compared to 72,940 tonnes at an ASP

of $363/tonne in the same period of last year.

Of the total CMP sales, revenue from regular

CMP increased by 0.24%, to approximately $21.98 million for the second quarter of 2024, compared to revenue of approximately

$21.93 million for the same period of last year. The Company sold 62,813 tonnes of regular CMP at an ASP of $350/tonne during the

second quarter of 2024, compared to 60,063 tonnes at an ASP of $365/tonne for the same period of last year. Revenue from light-weight

CMP decreased by 6.93%, to approximately $4.23 million for the second quarter of 2024, compared to revenue of approximately

$4.54 million for the same period of last year. The Company sold 12,552 tonnes of light-weight CMP at an ASP of $337/tonne for the

second quarter of 2024, compared to 12,877 tonnes at an ASP of $353/tonne for the same period of last year.

Revenue from offset printing paper was $nil and

$3.16 million for the second quarter of 2024 and 2023. Production of offset printing products was suspended during the second quarter

of 2024.

Revenue from tissue

paper products was $nil and $0.34 million for the three months ended June 30, 2024 and 2023, respectively. Production of tissue paper

products was suspended during the second quarter of 2024.

Revenue generated from

selling face mask were $nil and $0.04 million for the three months ended June 30, 2024 and 2023, respectively.

Gross Profit (Loss)

and Gross Margin

Total cost of sales decreased by 20.30%, to approximately

$22.98 million for the second quarter of 2024 from approximately $28.84 million for the same period of last year. due

to the decrease in sales quantity of offset printing paper and tissue paper products and the decrease of the unit material cost of CMP

products.

Total gross profit was approximately $3.27

million for the second quarter of 2024, compared to the gross profit of approximately $1.18 million for the same period

of last year as a result of factors described above. Overall gross profit margin was 12.44% for the second quarter of 2024, compared

to gross profit margin of 3.93% for the same period of last year. Gross profit (loss) margins for regular CMP, light-weight CMP, offset

printing paper, tissue paper products and face mask products were 12.22%, 12.82%, nil%, nil% and nil%, respectively, for the second quarter

of 2024, compared to 6.81%, 7.14%, 2.42%, -206.06% and -8.06%, respectively, for the same period of last year.

Selling, General

and Administrative Expenses

Selling, general and

administrative expenses (“SG&A”) increased by 105.35%, to approximately $2.72 million for the second quarter

of 2024 from approximately $1.32 million for the same period of last year. The increase was mainly due to the increase in depreciation

of idle fixed assets during production suspension.

Income (Loss) from

Operations

Income from operations

was approximately $0.55 million for the second quarter of 2024, an increase of 205.60%, from loss from operations of $0.52

million for the same period of last year. Operating margin was 2.09% for the second quarter of 2024, compared to operating loss

margin was 1.73% for the same period of last year.

Net Loss

Net loss was approximately

$0.08 million, or loss per share of $0.01 for the second quarter of 2024, compared to net loss of $1.25 million, or loss per share of

$0.12 for the same period of last year.

EBITDA

EBITDA was approximately

$3.93 million for the second quarter of 2024, compared to $2.83 million for the same period of last year.

Note 1: Non-GAAP Financial

Measures

In addition to our U.S.

GAAP results, this press release includes a discussion of EBITDA, a non-GAAP financial measure as defined by the Securities and Exchange

Commission (“SEC”). The Company defines EBITDA as net income before interest, income taxes, depreciation and amortization.

EBITDA is a key measure used by management to evaluate our results and make strategic decisions. Management believes this measure is

useful to investors because it is an indicator of operational performance. Because not all companies use identical calculations, the

Company’s presentation of EBITDA may not be comparable to similarly titled measures of other companies, and should not be viewed as an

alternative to measures of financial performance or changes in cash flows calculated in accordance with the U.S. GAAP.

Reconciliation of

Net Income to EBITDA

(Amounts expressed

in US$)

| | |

For the Three Months Ended

June 30, | |

| ($ millions) | |

2024 | | |

2023 | |

| Net income (loss) | |

| -0.08 | | |

| -1.25 | |

| Add: Income tax | |

| 0.42 | | |

| 0.35 | |

| Net interest expense | |

| 0.21 | | |

| 0.27 | |

| Depreciation and amortization | |

| 3.38 | | |

| 3.46 | |

| EBITDA | |

| 3.93 | | |

| 2.83 | |

First Half of 2024 Unaudited

Financial Results

| | |

For the Six Months Ended June 30, | |

| ($ millions) | |

2024 | | |

2023 | | |

% Change | |

| Revenues | |

| 33.11 | | |

| 49.81 | | |

| -33.52 | % |

| Regular Corrugating Medium Paper (“CMP”)* | |

| 27.73 | | |

| 38.40 | | |

| -27.77 | % |

| Light-Weight CMP** | |

| 5.31 | | |

| 7.60 | | |

| -30.23 | % |

| Offset Printing Paper | |

| - | | |

| 3.16 | | |

| n/a | |

| Tissue Paper Products | |

| - | | |

| 0.57 | | |

| n/a | |

| Face Masks | |

| - | | |

| 0.08 | | |

| n/a | |

| | |

| | | |

| | | |

| | |

| Gross profit (loss) | |

| 3.66 | | |

| 0.90 | | |

| 305.87 | % |

| Gross profit (loss) margin | |

| 11.07 | % | |

| 1.81 | % | |

| 9.26 pp | **** |

| Regular Corrugating Medium Paper (“CMP”)* | |

| 10.86 | % | |

| 4.71 | % | |

| 6.15

pp | **** |

| Light-Weight CMP** | |

| 10.90 | | |

| 5.86 | % | |

| 5.04

pp | **** |

| Offset Printing Paper | |

| - | | |

| 2.42 | % | |

| n/a | |

| Tissue Paper Products*** | |

| - | | |

| -249.58 | % | |

| n/a | |

| Face Masks | |

| - | | |

| -8.02 | % | |

| n/a | |

| | |

| | | |

| | | |

| | |

| Operating income (loss) | |

| -2.95 | | |

| -3.29 | | |

| -10.24 | % |

| Net income (loss) | |

| -3.82 | | |

| -3.99 | | |

| -4.07 | % |

| EBITDA | |

| 3.91 | | |

| 4.03 | | |

| -2.98 | |

| Basic and Diluted loss per share | |

| -0.38 | | |

| -0.40 | | |

| -5.00 | % |

| *** | Products from PM8 and

PM9 |

| **** | pp represents percentage

points |

Revenue

For the first half of

2024, total revenue decreased by 33.52%, to approximately $33.11 million from approximately $49.81 million for the same period of last

year. The increase in total revenue was mainly due to the production suspension of CMP in January and February of 2024, and production

suspension of offset printing paper and tissue paper products in the first half of 2024.

The following table summarizes revenue, volume and ASP by product

for the first half of 2024 and 2023, respectively:

| | |

For the Six Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

Revenue

($’000) | | |

Volume

(tonne) | | |

ASP

($/tonne) | | |

Revenue

($’000) | | |

Volume

(tonne) | | |

ASP

($/tonne) | |

| Regular CMP | |

| 27,734 | | |

| 78,452 | | |

| 354 | | |

| 38,399 | | |

| 101,726 | | |

| 377 | |

| Light-Weight CMP | |

| 5,305 | | |

| 15,582 | | |

| 340 | | |

| 7,604 | | |

| 20,896 | | |

| 364 | |

| Offset Printing Paper | |

| - | | |

| - | | |

| - | | |

| 3,156 | | |

| 5,403 | | |

| 584 | |

| Tissue Paper Products | |

| - | | |

| - | | |

| - | | |

| 567 | | |

| 484 | | |

| 1,172 | |

| Total | |

| 33,040 | | |

| 94,034 | | |

| 351 | | |

| 49,726 | | |

| 128,509 | | |

| 387 | |

| | |

Revenue

($’000) | | |

Volume

(thousand

pieces) | | |

ASP

($/thousand

pieces) | | |

Revenue

($’000) | | |

Volume

(thousand

pieces) | | |

ASP

($/thousand

pieces) | |

| Face Masks | |

| - | | |

| - | | |

| - | | |

| 79 | | |

| 2,516 | | |

| 32 | |

Revenue from CMP, including

both regular CMP and light-Weight CMP, decreased by 28.18%, to approximately $33.04 million and accounted for 99.78% of total revenue

for first half of 2024, compared to approximately $46.00million, or 92.36% of total revenue for the same period of last year. The Company

sold 94,034tonnes of CMP at an ASP of $351/tonne in first half of 2024, compared to 122,622 tonnes at an ASP of $375/tonne in the same

period of last year.

Of the total CMP sales,

revenue from regular CMP decreased by 27.77%, to approximately $27.73 million for first half of 2024, compared to revenue of approximately

$38.40 million for the same period of last year. The Company sold 78,452 tonnes of regular CMP at an ASP of $354/tonne during the first

half of 2024, compared to 101,726 tonnes at an ASP of $377/tonne for the same period of last year. Revenue from light-weight CMP decreased

by 30.23%, to approximately $5.31 million for the first half of 2024, compared to revenue of approximately $7.60 million for the same

period of last year. The Company sold 15,582 tonnesof light-weight CMP at an ASP of $340/tonne for the first half of 2024, compared to

20,896 tonnes at an ASP of $364/tonne for the same period of last year.

Revenue from offset

printing paper was $nil for the first half of 2024.

Revenue from tissue

paper products was $nil for the first half of 2024,from approximately $0.57 million for the same period of last year. The Company sold

nil tonnes of tissue paper products for the first half of 2024, compared to 484 tonnes at an ASP of $1,172/tonne for the same period

of last year.

Revenue from face masks

was $nil for the first half of 2024, from $0.08 million for the same period of last year. The Company sold nil thousand pieces of face

masks for the first half of 2024, compared to 2,516 thousand pieces of face masks for the same period of last year.

Gross Profit and Gross

Margin

Total cost of sales

decreased by 39.79%, to approximately $29.45 million for the first half of 2024 from approximately $48.91million for the same period

of last year. The increase was mainly a result of the decrease in sales quantity and the decrease in the unit material costs of CMP.

Costs of sales per tonne for regular CMP, light-weight CMP, offset printing paper, and tissue paper products were $315, $303,$nil

and $nil, respectively, for the first half of 2024, compared to $360, $343, $570 and $4,097, respectively, for the same period of last

year.

Total gross profit was

approximately $3.66 million for the first half of 2024, compared to the gross profit of approximately $0.90 million for the same period

of last year as a result of factors described above. Overall gross margin was 11.07% for the first half of 2024, compared to 1.81% for

the same period of last year. Gross profit(loss) margins for regular CMP, light-weight CMP, offset printing paper, tissue paper products

and face mask products were 10.86%, 10.90%, nil%, nil% and nil%, respectively, for the first half of 2024, compared to 4.71%, 5.86%,

2.42%, -249.58% and -8.02%, respectively, for the same period of last year.

Selling, General and

Administrative Expenses

Selling, general and

administrative expenses (“SG&A”) increased by 73.31%, to approximately $6.62 million for the first half of 2024 from approximately

$3.82 million for the same period of last year.

Income (Loss) from Operations

Loss from operations

was approximately $2.95 million for the first half of 2024, representing a decrease of 10.24%, from loss from operations of approximately

$3.29 million for the same period of last year. Operating loss margin was 8.92% for the first half of 2024, compared to operating loss

margin of 6.61% for the same period of last year.

Net Income (Loss)

Net loss was approximately

$3.82 million, or loss per share of $0.38, for the first half of 2024, compared to net loss of approximately $3.99 million, or loss per

share of $0.40, for the same period of last year.

EBITDA

EBITDA was approximately

$3.91 million for the first half of 2024, compared to approximately $4.03 million for the same period of last year.

Note 1: Non-GAAP Financial

Measures

In addition to our U.S.

GAAP results, this press release includes a discussion of EBITDA, a non-GAAP financial measure as defined by the Securities and Exchange

Commission (“SEC”). The Company defines EBITDA as net income before interest, income taxes, depreciation and amortization.

EBITDA is a key measure used by management to evaluate our results and make strategic decisions. Management believes this measure is

useful to investors because it is an indicator of operational performance. Because not all companies use identical calculations, the

Company’s presentation of EBITDA may not be comparable to similarly titled measures of other companies, and should not be viewed as an

alternative to measures of financial performance or changes in cash flows calculated in accordance with the U.S. GAAP.

Reconciliation of Net Income to EBITDA

(Amounts expressed in US$)

| | |

For the Six Months Ended

June 30, | |

| ($ millions) | |

2024 | | |

2023 | |

| Net income (loss) | |

| -3.82 | | |

| -3.99 | |

| Add: Income tax | |

| 0.45 | | |

| 0.35 | |

| Net interest expense | |

| 0.42 | | |

| 0.52 | |

| Depreciation and amortization | |

| 6.86 | | |

| 7.15 | |

| EBITDA | |

| 3.91 | | |

| 4.03 | |

Cash, Liquidity and

Financial Position

As of June 30, 2024, the Company had cash and

bank balances, short-term debt (including bank loans, current portion of long-term loans from credit union and related party loans),

and long-term debt (including related party loans) of approximately $5.14 million, $8.39 million and $4.49 million, respectively, compared

to approximately $3.92 million, $8.03 million and $4.50 million, respectively, as of December 31, 2023.

Net accounts receivable

was approximately $2.64 million as of June 30, 2024, compared to approximately $0.58 million as of December 31, 2023. Net inventory

was approximately $5.28 million as of June 30, 2024, compared to approximately $3.56 million as of December 31, 2023. As of June 30,

2024, the Company had current assets of approximately $33.43 million and current liabilities of approximately $22.92 million, resulting

in a working capital of approximately $10.51 million. This was compared to current assets of approximately $28.36 million and current

liabilities of approximately $21.42 million, resulting in a working capital of approximately $6.94 million as of December 31, 2023.

Net cash provided by operating activities was

approximately $1.35 million for the second quarter of 2024, compared to approximately $5.75 million for the same period of last year.

Net cash used in investing activities was approximately $0.06 million for the second quarter of 2024, compared to approximately $5.57

million for the same period of last year. Net cash provided by financing activities was approximately $0.42 million for the second

quarter of 2024, compared to approximately $2.82 for the same period of last year.

About IT Tech Packaging,

Inc.

Founded in 1996, IT

Tech Packaging, Inc. is a leading manufacturer and distributor of diversified paper products and single-use face masks in North

China. Using recycled paper as its primary raw material (with the exception of its tissue paper products), ITP produces and distributes

three categories of paper products: corrugating medium paper, offset printing paper and tissue paper products. With production based

in Baoding and Xingtai in North China’s Hebei Province, ITP is located strategically close to the Beijing and Tianjin region, home

to a growing base of industrial and manufacturing activities and one of the largest markets for paper products consumption in the country.

ITP has been listed on the NYSE American since December 2009. For more information, please visit: http://www.itpackaging.cn/.

Safe Harbor Statements

This press release may

contain forward-looking statements. These forward-looking statements involve inherent risks and uncertainties that could cause actual

results to differ materially from those projected or anticipated, including risks outlined in the Company’s public filings with the Securities

and Exchange Commission, including the Company’s latest annual report on Form 10-K. All information provided in this press release speaks

as of the date hereof. Except as otherwise required by law, the Company undertakes no obligation to update or revise its forward-looking

statements.

For more information,

please contact:

At the Company

Email: ir@itpackaging.cn

Tel: +86 312 8698215

IT TECH PACKAGING, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF JUNE 30, 2024 AND DECEMBER 31, 2023

(unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and bank balances | |

$ | 5,144,414 | | |

$ | 3,918,938 | |

| Restricted cash | |

| 899,508 | | |

| 472,983 | |

| Accounts receivable (net of allowance for doubtful accounts

of $61,000 and $11,745 as of June 30, 2024 and December 31, 2023, respectively) | |

| 2,638,219 | | |

| 575,526 | |

| Inventories | |

| 5,282,420 | | |

| 3,555,235 | |

| Prepayments and other current assets | |

| 18,246,164 | | |

| 18,981,290 | |

| Due from related parties | |

| 1,219,553 | | |

| 853,929 | |

| Total current assets | |

| 33,430,278 | | |

| 28,357,901 | |

| | |

| | | |

| | |

| Operating lease right-of-use assets, net | |

| 476,771 | | |

| 528,648 | |

| Property, plant, and equipment, net | |

| 155,624,752 | | |

| 163,974,022 | |

| Value-added tax recoverable | |

| 1,830,425 | | |

| 1,883,078 | |

| Deferred tax asset non-current | |

| - | | |

| - | |

| | |

| | | |

| | |

| Total Assets | |

$ | 191,362,226 | | |

$ | 194,743,649 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Short-term bank loans | |

$ | 841,893 | | |

$ | 423,567 | |

| Current portion of long-term loans | |

| 6,817,927 | | |

| 6,874,497 | |

| Lease liability | |

| 103,568 | | |

| 100,484 | |

| Accounts payable | |

| - | | |

| 4,991 | |

| Advance from customers | |

| 73,386 | | |

| 136,167 | |

| Notes payable | |

| 429,451 | | |

| - | |

| Due to related parties | |

| 731,486 | | |

| 728,869 | |

| Accrued payroll and employee benefits | |

| 369,565 | | |

| 237,842 | |

| Other payables and accrued liabilities | |

| 13,135,687 | | |

| 12,912,517 | |

| Income taxes payable | |

| 415,635 | | |

| - | |

| Total current liabilities | |

| 22,918,598 | | |

| 21,418,934 | |

| | |

| | | |

| | |

| Long-term loans | |

| 4,490,094 | | |

| 4,503,932 | |

| Lease liability - non-current | |

| 498,718 | | |

| 483,866 | |

| Derivative liability | |

| 5 | | |

| 54 | |

| | |

| | | |

| | |

| Total liabilities (including amounts of the consolidated

VIE without recourse to the Company of $21,006,676 and $20,084,995 as of June 30, 2024 and December 31, 2023, respectively) | |

| 27,907,415 | | |

| 26,406,786 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Common stock, 50,000,000 shares authorized, $0.001 par value per share,

10,065,920 shares issued and outstanding as of June 30, 2024 and December, 31, 2023. | |

| 10,066 | | |

| 10,066 | |

| Additional paid-in capital | |

| 89,172,771 | | |

| 89,172,771 | |

| Statutory earnings reserve | |

| 6,080,574 | | |

| 6,080,574 | |

| Accumulated other comprehensive loss | |

| (11,613,303 | ) | |

| (10,555,534 | ) |

| Retained earnings | |

| 79,804,703 | | |

| 83,628,986 | |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 163,454,811 | | |

| 168,336,863 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’

Equity | |

$ | 191,362,226 | | |

$ | 194,743,649 | |

T TECH PACKAGING, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

AND COMPREHENSIVE INCOME

FOR THE THREE AND SIX MONTHS ENDED JUNE 30,

2024 AND 2023

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 26,249,788 | | |

$ | 30,019,914 | | |

$ | 33,113,629 | | |

$ | 49,810,791 | |

| Cost of sales | |

| (22,984,488 | ) | |

| (28,840,056 | ) | |

| (29,449,216 | ) | |

| (48,907,932 | ) |

| Gross Profit | |

| 3,265,300 | | |

| 1,179,858 | | |

| 3,664,413 | | |

| 902,859 | |

| Selling, general and administrative expenses | |

| (2,717,548 | ) | |

| (1,323,405 | ) | |

| (6,618,331 | ) | |

| (3,818,767 | ) |

| Loss on impairment of assets | |

| - | | |

| (375,136 | ) | |

| - | | |

| (375,136 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (Loss) from Operations | |

| 547,752 | | |

| (518,683 | ) | |

| (2,953,918 | ) | |

| (3,291,044 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 2,807 | | |

| 53,637 | | |

| 4,990 | | |

| 189,905 | |

| Interest expense | |

| (211,551 | ) | |

| (270,681 | ) | |

| (421,841 | ) | |

| (519,850 | ) |

| Gain (Loss) on derivative liability | |

| 15 | | |

| (166,506 | ) | |

| 49 | | |

| (14,409 | ) |

| Income (Loss) before Income Taxes | |

| 339,023 | | |

| (902,233 | ) | |

| (3,370,720 | ) | |

| (3,635,398 | ) |

| Provision for Income Taxes | |

| (416,770 | ) | |

| (351,260 | ) | |

| (453,563 | ) | |

| (351,260 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (77,747 | ) | |

| (1,253,493 | ) | |

| (3,824,283 | ) | |

| (3,986,658 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Comprehensive Loss | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (756,150 | ) | |

| (9,063,695 | ) | |

| (1,057,769 | ) | |

| (6,560,939 | ) |

| Total Comprehensive Loss | |

$ | (833,897 | ) | |

$ | (10,317,188 | ) | |

$ | (4,882,052 | ) | |

$ | (10,547,597 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Losses Per Share: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted Losses per Share | |

$ | (0.008 | ) | |

$ | (0.12 | ) | |

$ | (0.38 | ) | |

$ | (0.40 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Outstanding – Basic and Diluted | |

| 10,065,920 | | |

| 10,065,920 | | |

| 10,065,920 | | |

| 10,065,920 | |

IT TECH PACKAGING, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND

2023

(Unaudited)

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash Flows from Operating Activities: | |

| | |

| |

| Net income | |

$ | (3,824,283 | ) | |

$ | (3,986,658 | ) |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 6,862,883 | | |

| 7,150,057 | |

| (Gain) Loss on derivative liability | |

| (49 | ) | |

| 14,409 | |

| Loss from disposal and impairment of property, plant and equipment | |

| - | | |

| 501,934 | |

| (Recovery from) Allowance for bad debts | |

| 49,462 | | |

| (830,847 | ) |

| Allowances for inventories, net | |

| (2,948 | ) | |

| - | |

| Deferred tax | |

| - | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (2,121,357 | ) | |

| (1,674,665 | ) |

| Prepayments and other current assets | |

| 660,470 | | |

| 7,634,922 | |

| Inventories | |

| (1,751,011 | ) | |

| (3,940,417 | ) |

| Accounts payable | |

| (4,974 | ) | |

| 127,215 | |

| Advance from customers | |

| (62,107 | ) | |

| 10,567 | |

| Notes payable | |

| 430,624 | | |

| - | |

| Related parties | |

| (369,287 | ) | |

| (90,617 | ) |

| Accrued payroll and employee benefits | |

| 133,504 | | |

| 154,398 | |

| Other payables and accrued liabilities | |

| 928,640 | | |

| 743,936 | |

| Income taxes payable | |

| 416,770 | | |

| (67,515 | ) |

| Net Cash Provided by Operating Activities | |

| 1,346,337 | | |

| 5,746,719 | |

| | |

| | | |

| | |

| Cash Flows from Investing Activities: | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| (62,640 | ) | |

| (5,565,713 | ) |

| Proceeds from sale of property, plant and equipment | |

| - | | |

| - | |

| Acquisition of land | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net Cash Used in Investing Activities | |

| (62,640 | ) | |

| (5,565,713 | ) |

| | |

| | | |

| | |

| Cash Flows from Financing Activities: | |

| | | |

| | |

| Proceeds from issuance of shares and warrants, net | |

| - | | |

| - | |

| Proceeds from short term bank loans | |

| 844,191 | | |

| 860,919 | |

| Proceeds from long term loans | |

| - | | |

| 2,582,756 | |

| Repayment of bank loans | |

| (422,095 | ) | |

| (507,942 | ) |

| Payment of capital lease obligation | |

| - | | |

| (112,136 | ) |

| Loan to a related party (net) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net Cash Provided by Financing Activities | |

| 422,096 | | |

| 2,823,597 | |

| | |

| | | |

| | |

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | |

| (53,792 | ) | |

| (548,712 | ) |

| | |

| | | |

| | |

| Net Increase in Cash and Cash Equivalents | |

| 1,652,001 | | |

| 2,455,891 | |

| | |

| | | |

| | |

| Cash, Cash Equivalents and Restricted Cash - Beginning of

Period | |

| 4,391,921 | | |

| 9,524,868 | |

| | |

| | | |

| | |

| Cash, Cash Equivalents and Restricted Cash - End of Period | |

$ | 6,043,922 | | |

$ | 11,980,759 | |

| | |

| | | |

| | |

| Supplemental Disclosure of Cash Flow Information: | |

| | | |

| | |

| Cash paid for interest, net of capitalized interest cost | |

$ | 278,188 | | |

$ | 199,014 | |

| Cash paid for income taxes | |

$ | 36,793 | | |

$ | 418,775 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Cash and bank balances | |

| 5,144,414 | | |

| 11,980,759 | |

| Restricted cash | |

| 899,508 | | |

| - | |

| Total cash, cash equivalents and restricted cash shown in the

statement of cash flows | |

| 6,043,922 | | |

| 11,980,759 | |

v3.24.2.u1

Cover

|

Aug. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 12, 2024

|

| Entity File Number |

001-34577

|

| Entity Registrant Name |

IT TECH PACKAGING, INC.

|

| Entity Central Index Key |

0001358190

|

| Entity Tax Identification Number |

20-4158835

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

Science Park, Juli Road

|

| Entity Address, Address Line Two |

Xushui District

|

| Entity Address, Address Line Three |

Baoding City

|

| Entity Address, City or Town |

Hebei

Province

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

072550

|

| City Area Code |

86

|

| Local Phone Number |

312-8698215

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ITP

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

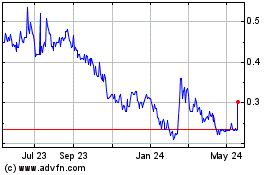

IT Tech Packaging (AMEX:ITP)

Historical Stock Chart

From Dec 2024 to Jan 2025

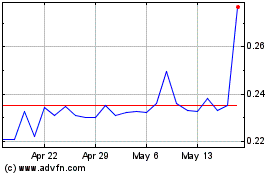

IT Tech Packaging (AMEX:ITP)

Historical Stock Chart

From Jan 2024 to Jan 2025