KULR Technology Group Reports Second Quarter 2024 Financial Results

13 August 2024 - 6:15AM

KULR Technology Group, Inc. (NYSE American: KULR)

(the "Company" or "KULR"), a global leader in sustainable energy

management, today reported results for the second quarter ended

June 30, 2024.

Second Quarter 2024 Financial

Results

Revenues: In the second

quarter that ended June 30, 2024, revenue was $2.43 million

compared to $2.70 million reported in the same period last year.

Contract Services revenue increased 75.7%, with revenue of

approximately $1.30 million versus approximately $738 thousand in

the same quarter last year.

Cash and Accounts Receivable: As of June

30, 2024, the Company had cash and accounts receivable combined of

$2.94 million.

Gross Margins: Gross margin was 24% in the

quarter ending June 30, 2024, compared to 37% in the same period

last year.

Selling, General and Administrative (SG&A)

Expenses: SG&A expenses decreased to $4.59

million in the second quarter of 2024 from $5.16 million in the

same period last year. The decrease in SG&A expenses was

primarily due to decreases in outsourced services and stock-based

compensation.

Research and Development (R&D)

Expenses: R&D expenses in the second quarter of

2024 decreased to $1.31 million from $1.92 million in the same

period last year. The lower investment in R&D reflects a

planned decrease in R&D consulting services.

Operating Loss: Loss from operations was

$5.33 million for the second quarter of 2024, compared to $6.08

million from the same period last year. Lower operating loss in the

second quarter was driven by a decrease in both SG&A expenses

and investment in R&D.

Net Loss: Net loss for the second quarter

of 2024 was $5.89 million, or a loss of $0.03 per share, compared

to a net loss of $6.33 million, or a loss of $0.05 per share from

the same period last year.

Management Commentary

KULR Chief Financial Officer Shawn Canter noted, “We continue to

make progress on our focus areas. Growing relevant KPIs, improving

our balance sheet, and streamlining operations. Contract services

revenue was up 75% against the same quarter last year, and as we

have said, service revenue can foreshadow product revenue to come

in the future. Our sales cycles are not necessarily measured in

weeks or even months so sometimes it can take a little longer to

see the product revenue that results from service contracts. KULR’s

balance sheet is getting stronger. Our cash plus accounts

receivables are up 40% and our liabilities are down 42% versus

December 31, 2023. We are streamlining operations. SG&A is down

11% and R&D is down 32% from the year ago same quarter. The

KULR team continues to execute on its plan, and we think it is

showing up in the numbers.”

Second Quarter 2024 and Recent Corporate

Highlights:

- KULR Lands Initial $400K NASA Contract for Automated

Battery Cell Testing, $2M in Total Orders Anticipated Over Several

Quarters. The Company was awarded a purchase order

exceeding $400,000 from the National Aeronautics and Space

Administration (“NASA”), an independent agency of the U.S. federal

government, as part of a $2M multi-phase agreement for its advanced

automated battery cell screening system. The battery safety

contract with NASA is to test lithium-ion cells going into future

battery packs designed for the Artemis Program, a series of United

States-led international human spaceflight programs. KULR will

perform the tests on cells in reserve for upcoming Artemis missions

as well as other pivotal manned space voyages. The cells used on

the missions are required to meet certification to NASA’s strict

specifications for manned flights, EP-WI-037. According to Straits

Research, the global battery cell testing market is anticipated to

grow at a CAGR of 4% between 2022–2030 and reach USD 7 billion by

2030.

- KULR Secures Test Engineering Contract with Bombardier

Recreational Products (“BRP”). The Company was awarded an

engineering contract with Bombardier Recreational Products for the

Company’s Fractional Thermal Runaway Calorimetry (FTRC) testing

services. This milestone underscores KULR's expanding influence and

commitment to advancing battery safety in the rapidly growing

electric recreational products sector. The partnership highlights

BRP’s proactive approach to thermal runaway management across all

its e-mobility market verticals – including National Fire

Protection Association (NFPA) 1192, while concurrently aligning

with KULR’s development of the KULR ONE Design Solutions (K1-DS)

platform, which focuses on regulatory compliance, including battery

cell testing, propagation-resistant materials, pack and module

level testing. The NFPA 1192 standard establishes fire and life

safety criteria for recreational vehicles to provide protection

from loss of life from fire and explosion.

- KULR Experiences Fast-Growing Demand for Next-Gen EV

Battery Safety and Testing Solutions with Order from Top Japanese

Automaker. The Company secured a contract from a top

Japanese multinational automaker (“Automaker”) for testing and

analysis of high-energy battery cells intended for their

next-generation electric vehicles. The Company will utilize its

KULR ONE Design Solutions (K1-DS) platform to expedite design

readiness for the Automaker’s future electric vehicle buildout.

Originally, K1-DS was developed to introduce customers to KULR

products, with the goal of transitioning to volume production.

While this remains the Company’s core objective, over time KULR has

expanded its testing services, projecting it to become an annual $8

to $10 million revenue standalone business starting in 2025,

without additional investment in testing capabilities. According to

last year’s International Energy Agency's projection, electric

vehicles, including fully electric and plug-in hybrid models, are

expected to account for 35 percent of new vehicle sales worldwide

by 2030. The Company expects the FTRC to remain widely used across

various industries for assessing both current and future cell

technologies.

- KULR CEO Michael Mo Reduces Cash Salary to Better Align

with Shareholder Value Creation. The Company announced

that, in keeping with the KULR's recent efforts to reduce its cash

consumption, the Company's compensation committee approved a

voluntary request by CEO Michael Mo to reduce the cash component of

his compensation by 33% and, believing in the future of KULR, to

instead grant him an equity incentive grant that does not vest for

12 months from such grant date. The strategic move ensures

one-third of Mr. Mo’s salary going forward is provided at market

value of the Company’s stock, further aligning his interests with

those of shareholders. With this revised compensation model, the

CEO's benefits will directly correlate with value creation as the

executive team drives the Company's transformation and industry

innovation.

- KULR Announces Expiration of SEPA Facility.

The Company announced its Standby Equity Purchase Agreement

(“SEPA”), with YA II PN, LTD. ("Yorkville"), was terminated on June

1, 2024. Furthermore, the Company confirmed that it had retired all

outstanding debt owed to Yorkville.

Conference CallThe Company has scheduled a

conference call for August 12, 2024, at 4:30 p.m. ET to discuss

these results. KULR management will provide a business update for

the Company followed by a question-and-answer period.

To access the call, please register using the following link:

KULR Second Quarter 2024 Earnings Call. After registering, an email

will be sent, including dial-in details with a conference call

access code required to join the call. The conference call will be

available for replay here via the Investor Relations section on

KULR’s website (www.kulrtechnology.com).

About KULR Technology Group Inc.KULR Technology

Group Inc. (NYSE American: KULR) is a leading energy management

platform company offering proven solutions that play a critical

role in accelerating the electrification of the circular economy.

Leveraging a foundation in developing, manufacturing, and licensing

next-generation carbon fiber thermal management technologies for

batteries and electronic systems, KULR has evolved its holistic

suite of products and services to enable its customers across

disciplines to operate with efficiency and sustainability in mind.

For more information, please visit www.kulrtechnology.com.

Safe Harbor Statement This press release

does not constitute an offer to sell or a solicitation of offers to

buy any securities of any entity. This release contains certain

forward-looking statements based on our current expectations,

forecasts and assumptions that involve risks and uncertainties.

Forward-looking statements in this release are based on information

available to us as of the date hereof. Our actual results may

differ materially from those stated or implied in such

forward-looking statements, due to risks and uncertainties

associated with our business, which include the risk factors

disclosed in our Form 10-K filed with the Securities and Exchange

Commission on April 12, 2024, as may be amended or supplemented by

other reports we file with the Securities and Exchange Commission

from time to time. Forward-looking statements include statements

regarding our expectations, beliefs, intentions, or strategies

regarding the future and can be identified by forward-looking words

such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“intend,” “may,” “should,” and “would” or similar words. All

forecasts are provided by management in this release are based on

information available at this time and management expects that

internal projections and expectations may change over time. In

addition, the forecasts are entirely on management’s best estimate

of our future financial performance given our current contracts,

current backlog of opportunities and conversations with new and

existing customers about our products and services. We assume no

obligation to update the information included in this press

release, whether because of new information, future events or

otherwise. Investor Relations:KULR

Technology Group, Inc.Phone: 858-866-8478 x 847Email:

ir@kulrtechnology.com

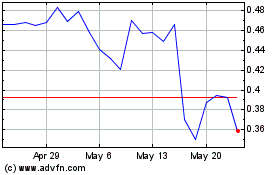

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Dec 2024 to Jan 2025

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Jan 2024 to Jan 2025