false

0001662684

0001662684

2025-01-06

2025-01-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 6, 2025

KULR

TECHNOLOGY GROUP, INC.

(Exact

name of the registrant as specified in its charter)

| Delaware |

|

001-40454 |

|

81-1004273 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

555

Forge River Road, Suite 100, Webster,

Texas 77598

(Address of principle executive offices) (Zip

code)

Registrant’s telephone number, including

area code: (408) 663-5247

N/A

(Former name or address if changed since last

report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14A-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14D-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered: |

| Common

Stock |

|

KULR |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure |

On January 6, 2025, KULR Technology

Group, Inc. (the “Company” or “KULR”) issued a press release announcing that the Company completed a purchase

of 213.43 bitcoin, on January 4, 2025, for approximately $21 million, at a weighted average price of $98,393.58 per bitcoin, inclusive

of fees and expenses. KULR also announced that its BTC Yield, a key performance indicator described below, from KULR’s initial bitcoin

purchase in December 2024 to January 4, 2025, was 93.7%.

BTC Yield as a Key Performance Indicator (KPI)

KULR uses BTC Yield as a KPI

to help assess the performance of its strategy of acquiring bitcoin in a manner KULR believes is accretive to stockholders. KULR believes

this KPI can be used to supplement an investor’s understanding of KULR’s decision to fund the purchase of bitcoin by issuing

additional shares of its common stock. As further described below, when KULR uses this KPI, management also takes into account the various

limitations of this metric.

Important Information about BTC Yield KPI

BTC Yield is a KPI that represents

the percentage change period-to-period of the ratio between KULR’s bitcoin holdings and its Assumed Diluted Shares Outstanding.

Assumed Diluted Shares Outstanding refers to the aggregate of KULR’s actual shares of common stock outstanding as of the end of

each period plus all additional shares that would result from the settlement of and exercise of all outstanding derivative securities.

Assumed Diluted Shares Outstanding is not calculated using the treasury method and does not take into account any vesting conditions or

the exercise price of any derivative securities.

Additionally, BTC Yield is

not, and should not be understood as, an operating performance measure or a financial or liquidity measure. In particular, BTC Yield is

not equivalent to a “yield” in the traditional financial context. It is not a measure of the return on investment KULR’s

stockholders may have achieved historically or can achieve in the future by purchasing stock of KULR, or a measure of income generated

by KULR’s operations or its bitcoin holdings, return on investment on its bitcoin holdings, or any other similar financial measure

of the performance of its business or assets.

The trading price of KULR’s

common stock is impacted by numerous factors in addition to the amount of bitcoins KULR holds and number of actual or potential shares

of its stock outstanding. As a result, the market value of KULR’s shares may trade at a discount or a premium relative to the market

value of the bitcoin KULR holds. BTC Yield is not indicative nor predictive of the trading price of KULR’s shares of common stock.

As noted above, this KPI is narrow in its purpose and is used by management to assist in assessing whether KULR is using equity capital

in a manner accretive to stockholders solely as it pertains to its bitcoin holdings.

In calculating this KPI, KULR

does not take into account the source of capital used for the acquisition of its bitcoin. KULR notes in particular, it could acquire bitcoin

using cash flow from operations, if any, as well as proceeds from external financings including, but not limited to, from the sale of

shares in its at-the-market (ATM) offering. Accordingly, this metric might overstate or understate the accretive nature of KULR’s

use of equity capital to buy bitcoin because not all bitcoin may be acquired using proceeds of equity offerings and not all issuances

of equity may involve the acquisition of bitcoin.

KULR’s ability to achieve

positive BTC Yield may depend on a variety of factors, including, but not limited to, its ability to generate cash from operations in

excess of its fixed charges and other expenses, as well as factors outside of its control, such as the availability of debt and equity

financing on favorable terms. Past performance is not indicative of future results. BTC Yield is a historical looking metric and indicates

no promise, guarantee, recommendation or advice regarding future performance of KULR common stock, operating performance, bitcoin holdings,

or the performance of bitcoin itself.

KULR has historically not

paid dividends on its shares of common stock, and by presenting this KPI, KULR makes no suggestion regarding its intent with respect to

paying dividends in the future. Ownership of common stock does not represent an ownership interest in the bitcoin KULR holds.

Investors should rely on the

financial statements and other disclosures contained in KULR’s SEC filings. This KPI is merely a supplement, not a substitute for

any information an investor may consider in seeking to understand the Company’s status, prospects, and potential. It should be used

with the indicated understanding of its limited purpose and many limitations.

This current report on Form

8-K shall not constitute an offer to sell or solicitation of an offer to buy KULR’s shares of common stock described herein, nor

shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities law of such state or jurisdiction.

By filing this Current Report

on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in

this report that is required to be disclosed solely by reason of Regulation FD. The Company uses, and will continue to use, its website,

press releases, and various social media channels, including its Twitter account (twitter.com/kulrtech), its LinkedIn account (linkedin.com/company/kulr-technology-corporation),

its Facebook account (facebook.com/KULRTechnology), its TikTok account (tiktok.com/Kulr_tech), its Instagram account (instagram.com/Kulr_tech),

and its YouTube account (youtube.com/channel/UC3wZBPINQd51N6p35Mo5uQg), as additional means of disclosing public information to

investors, the media and others interested in the Company. It is possible that certain information that the Company posts on its website,

disseminates in press releases and on social media could be deemed to be material information, and the Company encourages investors, the

media and others interested in the Company to review the business and financial information that the Company posts on its website, disseminates

in press releases and on the social media channels identified above, as such information could be deemed to be material information.

The information in this Item

7.01 disclosure, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section.

In addition, the information in this Item 7.01 disclosure, including Exhibit 99.1, shall not be incorporated by reference into the filings

of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

On January 6, 2025, the Company

issued a press release announcing that the Company completed a purchase of 213.43 bitcoin, on January 4, 2025, for approximately $21 million,

at a weighted average price of $98,393.58 per bitcoin, inclusive of fees and expenses.

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated January 6, 2025 |

| 104 |

|

Cover Page Interactive Data File - The cover page

interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf of the undersigned hereunto

duly authorized.

| |

KULR TECHNOLOGY GROUP, INC. |

| |

|

| Date: January 6, 2025 |

By: |

/s/ Michael Mo |

| |

|

Michael Mo |

| |

|

Chief Executive Officer |

Exhibit 99.1

KULR Increases Bitcoin Purchases to $42 Million,

Reports 93.7% BTC Yield

HOUSTON / January 06, 2025 / KULR

Technology Group, Inc. (NYSE American: KULR) (the "Company" or "KULR"), a leader in advanced energy management

platforms, today announced a significant expansion of its Bitcoin Treasury. The Company has increased its bitcoin purchases for its Bitcoin

Treasury by an additional $21 million to reach a total of $42 million in bitcoin acquisitions. The additional purchases were made at

a weighted average price of $98,393.58 per bitcoin, inclusive of fees and expenses.

This strategic move aligns with KULR’s

Bitcoin Treasury Strategy announced on December 4, 2024, wherein the Company committed up to 90% of its surplus cash reserves to be held

in bitcoin.

Adoption of BTC Yield as a Key Performance

Indicator

KULR has introduced "BTC Yield"

as a key performance indicator (KPI) for its Bitcoin Treasury strategy. This metric evaluates the Company’s ability to increase

its bitcoin holdings per share, offering investors a transparent measure of the per share accretive impact of its bitcoin acquisitions.

BTC Yield is calculated as the percentage

change period-to-period in the ratio of the Company’s bitcoin holdings to its Assumed Fully Diluted Shares Outstanding. This KPI

helps assess the effectiveness of KULR’s bitcoin acquisition strategy in driving shareholder value.

From its initial bitcoin purchase in December 2024 to January 4, 2025,

KULR achieved a BTC Yield of 93.7%, leveraging a combination of surplus cash and its At-The-Market (ATM) equity program to fund purchases.

Important Considerations Regarding

BTC Yield

BTC Yield is intended to provide insights

into KULR’s bitcoin acquisition strategy but should not be interpreted as a measure of operating performance, financial return,

or liquidity. It is not equivalent to traditional yield metrics, nor does it account for the Company’s liabilities or broader financial

position.

The trading price of KULR’s common

stock is influenced by multiple factors beyond bitcoin holdings, and BTC Yield does not predict or reflect the stock's market value.

Investors should consider this metric as a supplementary tool and refer to the Company’s financial statements and SEC filings for

additional information about the Company’s financial position.

KULR remains committed to its strategic

goals of advancing shareholder value while adhering to disciplined financial management.

For additional details, please visit

www.kulrtechnology.com.

No Offer

or Solicitation

This press

release does not and shall not constitute an offer to sell or a solicitation of an offer to buy any securities of KULR Technology Group

Inc., nor shall there be any offer, solicitation or sale of such securities, in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About KULR

Technology Group Inc.

KULR Technology

Group Inc. (NYSE American: KULR) delivers cutting edge energy storage solutions for space, aerospace, and defense by leveraging a foundation

of in-house battery design expertise, comprehensive cell and battery testing suite, and battery fabrication and production capabilities.

The Company’s holistic offering allows delivery of commercial-off-the-shelf and custom next generation energy storage systems in

rapid timelines for a fraction of the cost compared to traditional programs. On December 4, 2024, KULR announced that its Board of Directors

has agreed to include bitcoin as a primary asset in its treasury program and committed to allocating up to 90% of its surplus cash to

the acquisition of bitcoin. For more information, please visit www.kulrtechnology.com.

Safe Harbor Statement

This release contains certain forward-looking

statements based on our current expectations, forecasts and assumptions that involve risks and uncertainties. Forward-looking statements

in this release are based on information available to us as of the date hereof. Our actual results may differ materially from those stated

or implied in such forward-looking statements, due to risks and uncertainties associated with our business, which include the risk factors

disclosed in our Form 10-K filed with the Securities and Exchange Commission on April 12, 2024, as may be amended or supplemented by

other reports we file with the Securities and Exchange Commission from time to time. Forward-looking statements include statements regarding

our expectations, beliefs, intentions, or strategies regarding the future and can be identified by forward-looking words such as “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,”

and “would” or similar words. All forecasts are provided by management in this release are based on information available

at this time and management expects that internal projections and expectations may change over time. In addition, the forecasts are entirely

based on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities

and conversations with new and existing customers about our products and services. We assume no obligation to update the information

included in this press release, whether as a result of new information, future events or otherwise.

Investor Relations:

KULR Technology Group, Inc.

Phone: 858-866-8478 x 847

Email: ir@kulrtechnology.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

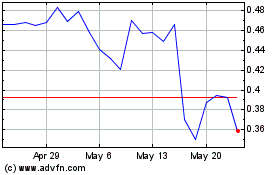

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Dec 2024 to Jan 2025

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Jan 2024 to Jan 2025