Comstock Inc. (NYSE: LODE) (“Comstock” and the “Company”) is

pleased to announce it has retired its existing Equity Purchase

Agreement and entered into a securities purchase agreement with an

investor for an 8.0% Convertible Promissory Note due October 31,

2025 (the “Convertible Note”).

The Convertible Note was issued with an original

aggregate principal amount of $2,717,500 (the “Principal Amount”),

purchased by the investor for $2,500,000, reflecting an 8% original

issue discount. A portion of the proceeds will be used to redeem

$500,000 of existing convertible debt, reducing the Company’s

outstanding obligations.

“We are very pleased to receive this $2.5

million investment, which allows us to extend maturities, retire

certain other debt obligations, and secure a solid bridge to our

near-term asset sales,” said Corrado De Gasperis, Executive

Chairman and CEO of Comstock Inc. “This transaction closes out our

only existing equity line and prohibits further use until this debt

is substantially all repaid. The funding enables our businesses to

continue commercializing on plan while being responsive to investor

feedback and acting to support our stock price in the

near-term.”

The Convertible Note accrues interest at annual

rate of 8% and is redeemable for cash 30 days after closing at 125%

of the principal amount plus accrued interest. Additionally, it can

be converted into common stock of the Company at a price equal to

the lower of 150% of the closing price on the closing date or 80%

of the lowest volume-weighted average price (VWAP) of the 10

trading days prior to the conversion notice.

Comstock Metals is currently operating its first

commercial demonstration facility in Silver Springs, NV, and has

begun preliminary design and engineering for its next 3 industry

scale facilities and related storage sites. Comstock Metals has

already secured the lease and received the first permit for its

first industry scale facility, which includes expanded storage

capabilities. This zero-landfill solution enables the recycling and

reuse of 100% of materials that would otherwise become waste.

Comstock Fuels is commercially ready,

demonstrating growth-enabling performance to prospective customers.

Comstock Fuels is engaged in commercial discussions, including

joint development and licensing agreements, and has completed the

preliminary engineering for its first commercial

demonstration-scale facility.

About Comstock Inc.Comstock

Inc. (NYSE: LODE) commercializes innovative technologies that

contribute to global decarbonization by efficiently converting

under-utilized natural resources, primarily, woody biomass into net

zero renewable fuels, end-of-life metal extraction, and generative

AI-enabled advanced materials synthesis and mineral discovery. To

learn more, please visit www.comstock.inc.

Comstock Social Media

PolicyComstock Inc. has used, and intends to continue

using, its investor relations link and main website at

www.comstock.inc in addition to its Twitter, LinkedIn and YouTube

accounts, as means of disclosing material non-public information

and for complying with its disclosure obligations under Regulation

FD.

CONTACTS:For investor

inquiries: RB Milestone Group LLCTel (203)

487-2759ir@comstockinc.com

For media inquiries or

questions: Comstock Inc., Zach SpencerTel (775)

847-7532questions@comstockinc.com

Forward Looking StatementsThis

press release and any related calls or discussions may include

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements, other

than statements of historical facts, are forward-looking

statements. The words “believe,” “expect,” “anticipate,”

“estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,”

“would,” “potential” and similar expressions identify

forward-looking statements but are not the exclusive means of doing

so. Forward-looking statements include statements about matters

such as: future market conditions; future explorations or

acquisitions; future changes in our research, development and

exploration activities; future financial, natural, and social

gains; future prices and sales of, and demand for, our products and

services; land entitlements and uses; permits; production capacity

and operations; operating and overhead costs; future capital

expenditures and their impact on us; operational and management

changes (including changes in the Board of Directors); changes in

business strategies, planning and tactics; future employment and

contributions of personnel, including consultants; future land and

asset sales; investments, acquisitions, joint ventures, strategic

alliances, business combinations, operational, tax, financial and

restructuring initiatives, including the nature, timing and

accounting for restructuring charges, derivative assets and

liabilities and the impact thereof; contingencies; litigation,

administrative or arbitration proceedings; environmental compliance

and changes in the regulatory environment; offerings, limitations

on sales or offering of equity or debt securities, including asset

sales and associated costs; business opportunities, growth rates,

future working capital, needs, revenues, variable costs, throughput

rates, operating expenses, debt levels, cash flows, margins, taxes

and earnings. These statements are based on assumptions and

assessments made by our management in light of their experience and

their perception of historical and current trends, current

conditions, possible future developments and other factors they

believe to be appropriate. Forward-looking statements are not

guarantees, representations or warranties and are subject to risks

and uncertainties, many of which are unforeseeable and beyond our

control and could cause actual results, developments, and business

decisions to differ materially from those contemplated by such

forward-looking statements. Some of those risks and uncertainties

include the risk factors set forth in our filings with the SEC and

the following: adverse effects of climate changes or natural

disasters; adverse effects of global or regional pandemic disease

spread or other crises; global economic and capital market

uncertainties; the speculative nature of gold or mineral

exploration, and lithium, nickel and cobalt recycling, including

risks of diminishing quantities or grades of qualified resources;

operational or technical difficulties in connection with

exploration, metal recycling, processing or mining activities;

costs, hazards and uncertainties associated with precious and other

metal based activities, including environmentally friendly and

economically enhancing clean mining and processing technologies,

precious metal exploration, resource development, economic

feasibility assessment and cash generating mineral production;

costs, hazards and uncertainties associated with metal recycling,

processing or mining activities; contests over our title to

properties; potential dilution to our stockholders from our stock

issuances, recapitalization and balance sheet restructuring

activities; potential inability to comply with applicable

government regulations or law; adoption of or changes in

legislation or regulations adversely affecting our businesses;

permitting constraints or delays; challenges to, or potential

inability to, achieve the benefits of business opportunities that

may be presented to, or pursued by, us, including those involving

battery technology and efficacy, quantum computing and generative

artificial intelligence supported advanced materials development,

development of cellulosic technology in bio-fuels and related

material production; commercialization of cellulosic technology in

bio-fuels and generative artificial intelligence development

services; ability to successfully identify, finance, complete and

integrate acquisitions, joint ventures, strategic alliances,

business combinations, asset sales, and investments that we may be

party to in the future; changes in the United States or other

monetary or fiscal policies or regulations; interruptions in our

production capabilities due to capital constraints; equipment

failures; fluctuation of prices for gold or certain other

commodities (such as silver, zinc, lithium, nickel, cobalt,

cyanide, water, diesel, gasoline and alternative fuels and

electricity); changes in generally accepted accounting principles;

adverse effects of war, mass shooting, terrorism and geopolitical

events; potential inability to implement our business strategies;

potential inability to grow revenues; potential inability to

attract and retain key personnel; interruptions in delivery of

critical supplies, equipment and raw materials due to credit or

other limitations imposed by vendors; assertion of claims, lawsuits

and proceedings against us; potential inability to satisfy debt and

lease obligations; potential inability to maintain an effective

system of internal controls over financial reporting; potential

inability or failure to timely file periodic reports with the

Securities and Exchange Commission; potential inability to list our

securities on any securities exchange or market or maintain the

listing of our securities; and work stoppages or other labor

difficulties. Occurrence of such events or circumstances could have

a material adverse effect on our business, financial condition,

results of operations or cash flows, or the market price of our

securities. All subsequent written and oral forward-looking

statements by or attributable to us or persons acting on our behalf

are expressly qualified in their entirety by these factors. Except

as may be required by securities or other law, we undertake no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise. Neither this press release nor any related calls or

discussions constitutes an offer to sell, the solicitation of an

offer to buy or a recommendation with respect to any securities of

the Company, the fund, or any other issuer. Neither this press

release nor any related calls or discussions constitutes an offer

to sell, the solicitation of an offer to buy or a recommendation

with respect to any securities of the Company, the fund, or any

other issuers.

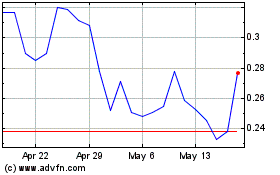

Comstock (AMEX:LODE)

Historical Stock Chart

From Nov 2024 to Dec 2024

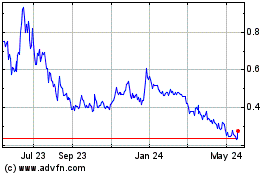

Comstock (AMEX:LODE)

Historical Stock Chart

From Dec 2023 to Dec 2024