false

0001582554

0001582554

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): August 14, 2024

MATINAS

BIOPHARMA HOLDINGS, INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-38022 |

|

46-3011414 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

ID Number) |

|

1545 Route 206 South, Suite 302

Bedminster, New Jersey |

|

07921 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (908) 484-8805

Not Applicable

(Former name or former

address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock |

|

MTNB |

|

NYSE American |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition. |

On August 14, 2024, Matinas BioPharma

Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024.

The full text of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The information in

Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

| Item

7.01 |

Regulation FD Disclosure. |

The

Company updated its corporate presentation (the “Corporate Presentation”) which it intends to use at various conferences

and investor meetings. The Corporate Presentation is attached hereto as Exhibit 99.2 and incorporated herein by reference.

The

information in this Item 7.01 and Exhibit 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section,

nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

MATINAS BIOPHARMA HOLDINGS, INC. |

| |

|

|

| Dated: August 14, 2024 |

By: |

/s/ Jerome D. Jabbour |

| |

Name: |

Jerome D. Jabbour |

| |

Title: |

Chief Executive Officer |

Exhibit

99.1

Matinas

BioPharma Reports Second Quarter 2024 Financial Results and Provides a Business Update

Signs

non-binding term sheet granting global rights to develop and commercialize oral MAT2203 for invasive aspergillosis and potentially other

invasive fungal infections

31

patients have enrolled in the MAT2203 Compassionate/Expanded Use Access Program with 6 additional patients under evaluation

Additional

LNC platform work in inflammation and oncology completed; Company evaluating next steps

Conference

call begins at 4:30 p.m. Eastern time today

BEDMINSTER,

N.J. (August 14, 2024) – Matinas BioPharma Holdings, Inc. (NYSE American: MTNB), a clinical-stage biopharmaceutical

company focused on delivering groundbreaking therapies using its lipid nanocrystal (LNC) platform delivery technology, reports financial

results for the three and six months ended June 30, 2024 and provides a business update.

“We

continue to engage in constructive partnership dialogues for MAT2203 and are pleased to announce that we have signed a non-binding term

sheet for global licensing rights to this oral formulation of the potent, yet toxic antifungal amphotericin B,” said Jerome

D. Jabbour, Chief Executive Officer of Matinas. “Since June, seven additional patients have gained access to oral MAT2203 in

our Compassionate/Expanded Use Access Program with an additional six patients under evaluation. We are experiencing a dramatic increase

in requests by physicians seeking access for their patients who have limited or no treatment options, which we attribute to the consistently

positive clinical impact of MAT2203 in successfully treating a variety of deadly invasive fungal infections.

“Recent

studies have increased our understanding of the potential for our LNC platform in delivering both small oligonucleotides and small molecule

oncology drugs, including LNC cellular uptake and cargo delivery,” he added. “We continue to expand our knowledge base and

are evaluating the next best steps for this technology as we determine how to maximize return to shareholders. We expect to be in a better

position to provide additional guidance following the consummation of a MAT2203 partnership.”

Key

Program Updates

MAT2203

(Oral Amphotericin B)

| |

● |

Matinas

signed a non-binding term sheet with a single partner for global licensing rights to develop, manufacture and commercialize MAT2203

for all future treatment indications, including the intended initial indication of treatment for patients with invasive aspergillosis

with limited or no other treatment options. Preparations are ongoing to enable the initiation of the ORALTO Phase 3 registration

trial of MAT2203 to commence as soon as possible following a successful partnership announcement. |

| |

● |

Under

the Compassionate/Expanded Use Access Program, 31 patients with a variety of serious and even life-threatening invasive fungal infections

with limited or no other treatment options have been provided access to oral MAT2203, and 6 additional requests are under evaluation.

Importantly, 7 patients have been or are being treated for invasive aspergillosis, each with positive results. |

| |

|

|

| |

● |

Of

the 15 patients in the Compassionate/Expanded Use Access Program who have completed treatment with MAT2203 (median treatment of 16

weeks with a range of 2 to 49 weeks), 8 had a complete response and 7 were improved. Response to treatment was assessed by the treating

physician. Nine additional patients are continuing to receive longer-term treatment with positive ongoing effects and 5 have just

recently initiated treatment. To date, only 2 patients have discontinued MAT2203 in this program, both occurring during the first

week of treatment, with one due to an intolerance and the other due to a terminal condition not otherwise related to the underlying

fungal infection. |

LNC

Platform

| |

● |

Following

early success in melanoma, recent additional in vivo studies in animal breast, prostate and lung cancer models have demonstrated

varying degrees of tumor growth inhibition with daily oral dosing of LNC-docetaxel. Additionally, daily oral LNC-docetaxel in combination

with intravenous docetaxel demonstrated greater degrees of tumor inhibition, but also resulted in additional weight loss. Additional

studies are evaluating several strategies to potentially improve the therapeutic index of docetaxel. |

| |

|

|

| |

● |

An

LNC formulation of an additional chemotherapeutic agent, miriplatin, a highly toxic agent only approved outside the U.S. for intra-arterial

use, demonstrated strong cellular uptake and tumor cell-killing capabilities in vitro in testing conducted during the second

quarter. More recent in vivo testing showed the oral LNC formulation of miriplatin as very effective in reducing tumor sizes

with significant weight loss also observed. |

| |

|

|

| |

● |

A

series of in vitro studies was recently completed investigating potential relationships between the amount of surface phosphatidylserine

(PS) and the extent of LNC uptake into certain tumor cells. Based upon these studies, surface PS expression appears to be one, but

not the only, driving factor for cellular uptake. Additional work is ongoing to better understand and predict the efficacy of LNC-delivered

chemotherapeutics. |

| |

|

|

| |

● |

Following

early encouraging in vivo data demonstrating the successful oral delivery, biological activity, and potential therapeutic

efficacy of two different LNC-formulated small oligonucleotides targeting inflammatory cytokines IL-17A and TNFα, more recent

follow-up in vivo studies of orally administered LNC-formulated small oligonucleotides have been less consistent in showing

therapeutic efficacy in certain inflammatory conditions. Additional optimization is required prior to identifying a potential product

candidate. |

Second

Quarter Financial Results

The

Company reported no revenue for the second quarters of 2024 and 2023.

Total

costs and expenses for the second quarter of 2024 were $5.8 million, compared with $6.2 million for the second quarter of 2023. The decrease

was primarily due to lower clinical development expenses, personnel costs and administrative expenses.

The

net loss for the second quarter of 2024 was $5.7 million, or $0.02 per share, compared with a net loss for the second quarter of 2023

of $6.1 million, or $0.03 per share.

Six

Month Financial Results

The

Company reported no revenue for the six months ended June 30, 2024, compared with $1.1 million for the six months ended June 30, 2023,

which was generated from research collaborations with BioNTech SE and Genentech Inc.

Total

costs and expenses for the first six months of 2024 were $11.7 million, compared with $12.8 million for the first six months of 2023.

The

net loss for the first six months of 2024 was $11.5 million, or $0.05 per share, compared with a net loss for the first six months of

2023 of $11.6 million, or $0.05 per share.

Cash,

cash equivalents and marketable securities as of June 30, 2024, were $14.3 million, compared with $13.8 million as of December 31, 2023.

In April 2024, the Company raised gross proceeds of $10.0 million through a registered direct offering.

Conference

Call and Webcast

Matinas

will host a conference call and webcast today beginning at 4:30 p.m. Eastern time. To participate in the call, please dial (866) 682-6100

or (862) 298-0702. The live webcast will be accessible on the Investors section of the Company’s website and archived for

90 days.

About

Matinas BioPharma

Matinas

BioPharma is a biopharmaceutical company focused on delivering groundbreaking therapies using its lipid nanocrystal (LNC) platform delivery

technology.

Matinas’

lead LNC-based therapy is MAT2203, an oral formulation of the broad-spectrum antifungal drug amphotericin B, which although highly potent,

can be associated with significant toxicity. Matinas’ LNC platform provides oral delivery of amphotericin B without the significant

nephrotoxicity otherwise associated with IV-delivered formulations. Combining comparable fungicidal activity with targeted delivery results

in a lower risk of toxicity and potentially creates the ideal antifungal agent for the treatment of invasive fungal infections. MAT2203

was successfully evaluated in the completed Phase 2 EnACT study in HIV patients suffering from cryptococcal meningitis, meeting its primary

endpoint and achieving robust survival. MAT2203 will be further evaluated in a single Phase 3 registration trial (the “ORALTO”

trial) as an oral step-down monotherapy following treatment with AmBisome® (liposomal amphotericin B) compared with the

standard of care in patients with invasive aspergillosis who have limited treatment options.

In

addition to MAT2203, preclinical and clinical data have demonstrated that this novel technology can potentially provide solutions to

many challenges of achieving safe and effective intracellular delivery of both small molecules and larger, more complex molecular cargos

including small oligonucleotides such as ASOs and siRNA. The combination of its unique mechanism of action and flexibility with routes

of administration (including oral) positions Matinas’ LNC technology to potentially become a preferred next-generation orally available

intracellular drug delivery platform. For more information, please visit www.matinasbiopharma.com.

Forward-looking

Statements

This

release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,

including those relating to our business activities, our strategy and plans, the potential of our LNC platform technology, and the future

development of our product candidates, including MAT2203, the Company’s ability to identify and pursue development, licensing and

partnership opportunities for its products, including MAT2203, or platform delivery technologies on favorable terms, if at all, and the

ability to obtain required regulatory approval and other statements that are predictive in nature, that depend upon or refer to future

events or conditions. All statements other than statements of historical fact are statements that could be forward-looking statements.

Forward-looking statements include words such as “expects,” “anticipates,” “intends,” “plans,”

“could,” “believes,” “estimates” and similar expressions. These statements involve known and unknown

risks, uncertainties and other factors which may cause actual results to be materially different from any future results expressed or

implied by the forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, including,

but not limited to, our ability to continue as a going concern, our ability to obtain additional capital to meet our liquidity needs

on acceptable terms, or at all, including the additional capital which will be necessary to complete the clinical trials of our product

candidates; our ability to successfully complete research and further development and commercialization of our product candidates; the

uncertainties inherent in clinical testing; the timing, cost and uncertainty of obtaining regulatory approvals; our ability to protect

the Company’s intellectual property; the loss of any executive officers or key personnel or consultants; competition; changes in

the regulatory landscape or the imposition of regulations that affect the Company’s products; and the other factors listed under

“Risk Factors” in our filings with the SEC, including Forms 10-K, 10-Q and 8-K. Investors are cautioned not to place undue

reliance on such forward-looking statements, which speak only as of the date of this release. Except as may be required by law, the Company

does not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events. Matinas BioPharma’s product candidates are all in a

development stage and are not available for sale or use.

Investor

Contact:

LHA

Investor Relations

Jody

Cain

Jcain@lhai.com

310-691-7100

[Financial

Tables to Follow]

Matinas

BioPharma Holdings, Inc.

Condensed

Consolidated Balance Sheets

(in

thousands, except for share data)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| ASSETS: | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,216 | | |

$ | 4,787 | |

| Marketable debt securities | |

| 10,097 | | |

| 8,969 | |

| Restricted cash – security deposit | |

| 50 | | |

| 50 | |

| Prepaid expenses and other current assets | |

| 922 | | |

| 1,737 | |

| Total current assets | |

| 15,285 | | |

| 15,543 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Leasehold improvements and equipment – net | |

| 1,739 | | |

| 1,923 | |

| Operating lease right-of-use assets – net | |

| 2,770 | | |

| 3,064 | |

| Finance lease right-of-use assets – net | |

| 18 | | |

| 21 | |

| In-process research and development | |

| 3,017 | | |

| 3,017 | |

| Goodwill | |

| 1,336 | | |

| 1,336 | |

| Restricted cash – security deposit | |

| 200 | | |

| 200 | |

| Total non-current assets | |

| 9,080 | | |

| 9,561 | |

| Total assets | |

$ | 24,365 | | |

$ | 25,104 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 238 | | |

$ | 514 | |

| Accrued expenses | |

| 1,442 | | |

| 1,447 | |

| Operating lease liabilities – current | |

| 707 | | |

| 656 | |

| Financing lease liabilities – current | |

| 5 | | |

| 5 | |

| Total current liabilities | |

| 2,392 | | |

| 2,622 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Deferred tax liability | |

| 341 | | |

| 341 | |

| Operating lease liabilities – net of current portion | |

| 2,514 | | |

| 2,877 | |

| Financing lease liabilities – net of current portion | |

| 15 | | |

| 18 | |

| Total non-current liabilities | |

| 2,870 | | |

| 3,236 | |

| Total liabilities | |

| 5,262 | | |

| 5,858 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock par value $0.0001 per share, 500,000,000 shares authorized at June 30, 2024 and December 31, 2023; 250,816,164 and 217,264,526 issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 25 | | |

| 22 | |

| Additional paid-in capital | |

| 206,245 | | |

| 195,018 | |

| Accumulated deficit | |

| (187,116 | ) | |

| (175,573 | ) |

| Accumulated other comprehensive loss | |

| (51 | ) | |

| (221 | ) |

| Total stockholders’ equity | |

| 19,103 | | |

| 19,246 | |

| Total liabilities and stockholders’ equity | |

$ | 24,365 | | |

$ | 25,104 | |

Matinas

BioPharma Holdings, Inc.

Condensed

Consolidated Statements of Operations and Comprehensive Loss

(in

thousands, except for share and per share data)

Unaudited

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Contract revenue | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 1,096 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 3,371 | | |

| 3,559 | | |

| 6,817 | | |

| 7,530 | |

| General and administrative | |

| 2,468 | | |

| 2,600 | | |

| 4,925 | | |

| 5,311 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total costs and expenses | |

| 5,839 | | |

| 6,159 | | |

| 11,742 | | |

| 12,841 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (5,839 | ) | |

| (6,159 | ) | |

| (11,742 | ) | |

| (11,745 | ) |

| Other income, net | |

| 120 | | |

| 99 | | |

| 199 | | |

| 172 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (5,719 | ) | |

$ | (6,060 | ) | |

$ | (11,543 | ) | |

$ | (11,573 | ) |

| Net loss per share – basic and diluted | |

$ | (0.02 | ) | |

$ | (0.03 | ) | |

$ | (0.05 | ) | |

$ | (0.05 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 249,350,963 | | |

| 217,264,526 | | |

| 233,354,524 | | |

| 217,264,526 | |

| Other comprehensive gain, net of tax | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain on securities available-for-sale | |

| 83 | | |

| 81 | | |

| 170 | | |

| 310 | |

| Other comprehensive gain, net of tax | |

| 83 | | |

| 81 | | |

| 170 | | |

| 310 | |

| Comprehensive loss | |

$ | (5,636 | ) | |

$ | (5,979 | ) | |

$ | (11,373 | ) | |

$ | (11,263 | ) |

#

# #

Exhibit

99.2

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

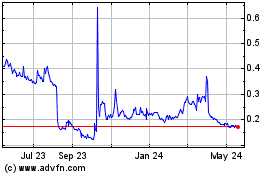

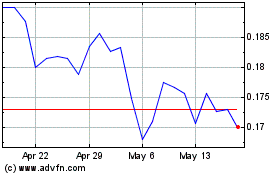

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Jan 2024 to Jan 2025