false

0001389545

0001389545

2024-10-16

2024-10-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event reported: October 16, 2024

|

NovaBay Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

| |

|

Delaware

(State of Other Jurisdiction of Incorporation)

|

001-33678

(Commission File Number)

|

68-0454536

(I.R.S. Employer Identification No.)

|

| |

|

2000 Powell Street, Suite 1150, Emeryville, CA 94608

(Address of Principal Executive Offices) (Zip Code)

|

| |

|

(510) 899-8800

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

Common Stock, par value $0.01 per share

|

Trading Symbol(s)

NBY

|

Name of Each Exchange On

Which Registered

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Conditions.

As previously announced on September 20, 2024, NovaBay Pharmaceuticals, Inc., a Delaware corporation (the “Company”) anticipates hosting a special meeting of stockholders (the “Special Meeting”) on November 22, 2024 for stockholders to approve: (1) the Company’s sale to PRN Physician Recommended Nutriceuticals, LLC of the Company’s eyecare products sold under the Avenova brand and the related assets, which will constitute substantially all of the Company’s operating assets (the “Asset Sale Transaction”), and (2) the potential voluntary liquidation and dissolution of the Company (the “Dissolution”), subject to the discretion of the Company’s Board of Directors to proceed with the Dissolution.

The Company expects to report its financial results for the quarter ended September 30, 2024 when filing its Quarterly Report on Form 10-Q. However, in connection with the filing of its definitive proxy statement on Schedule 14A for the Special Meeting on October 16, 2024 (the “Proxy Statement”) and the proposal related to the Dissolution, the Company reported its preliminary unaudited cash and cash equivalents of $776 thousand as of September 30, 2024.

This preliminary unaudited estimated consolidated financial information was prepared by the Company’s management and represents an estimate based on information currently available to the Company and is subject to change. The Company has provided estimates (and in certain cases, ranges of estimates) because the Company has not yet completed its normal review procedures for this period. The actual, reported financial information may differ materially from the estimate presented. In particular, the actual, reported financial information remains subject to the completion of the Company’s other quarterly closing procedures and the review of the Company’s unaudited condensed consolidated financial statements by the Company’s independent registered public accounting firm, WithumSmith+Brown, PC (“Withum”).

As a result, investors should exercise caution in relying on this information and should not draw any inferences from this information regarding financial or operating data not provided. This preliminary unaudited consolidated financial information should not be viewed as a substitute for full interim financial information prepared in accordance with GAAP. The preliminary unaudited information is not necessarily indicative of the results or financial position that may be achieved for the rest of the 2024 fiscal year or any future period. Withum has not audited, reviewed, compiled or performed any procedures with respect to any of the estimates contained herein. Accordingly, Withum does not express an opinion or any other form of assurance with respect thereto. As a result of the foregoing considerations and limitations, investors are cautioned not to place undue reliance on this preliminary unaudited condensed consolidated financial information.

Item 7.01 Regulation FD Disclosure.

The information contained in Item 2.02 of this Current Report on Form 8-K is incorporated herein by reference and is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Additional Information and Where to Find It

In connection with the solicitation of proxies, on October 16, 2024, the Company filed the Proxy Statement with the Securities and Exchange Commission (the “SEC”) with respect to the Special Meeting to be held on November 22, 2024 in connection with the Asset Sale Transaction and the Dissolution. Promptly after filing the Proxy Statement with the SEC, the Company will mail the Proxy Statement and a proxy card to each stockholder entitled to vote at the Special Meeting to consider the Asset Sale Transaction and the Dissolution. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS, INCLUDING IN CONNECTION WITH THE ASSET SALE TRANSACTION AND THE DISSOLUTION, THAT THE COMPANY HAS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, THE ASSET SALE TRANSACTION AND THE DISSOLUTION. Stockholders may obtain, free of charge, the Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection with the Asset Sale Transaction and the Dissolution at the SEC’s website (http://www.sec.gov) or at the Company’s investor relations website (https://novabay.com/investors/) or by writing to NovaBay Pharmaceuticals, Inc., Investor Relations, 2000 Powell Street, Suite 1150, Emeryville, CA 94608. Our website address is provided as an inactive textual reference only. The information provided on, or accessible through, our website is not part of this Current Report on Form 8-K, and, therefore, is not incorporated herein by reference.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed Asset Sale Transaction and the proposed Dissolution. A list of the names of the directors and executive officers of the Company and information regarding their interests in the Asset Sale Transaction and the Dissolution, including their respective ownership of the Company’s common stock and securities is contained in the Proxy Statement for the proposed Asset Sale Transaction and the proposed Dissolution. In addition, information about the Company’s directors and executive officers and their ownership in the Company is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and filed with the SEC on March 26, 2024, as amended on March 29, 2024 and as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing.

Cautionary Language Concerning Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 with respect to the Asset Sale Transaction, the Dissolution and other related matters. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These forward-looking statements are based upon the Company’s and its management’s current expectations, assumptions, estimates, projections and beliefs. Such statements include, but are not limited to, statements regarding the Asset Sale Transaction, statements regarding the Dissolution, the Company’s financial condition and its available capital resources to fund ongoing operations, the Company’s product offerings, marketing efforts, customers and suppliers and the impact of that the Asset Sale Transaction and the Dissolution may have. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in, or implied by, these forward-looking statements. Other risks relating to the Company’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in the Company’s latest Form 10-K, subsequent Forms 10-Q and/or Form 8-K filings with the SEC, especially under the heading “Risk Factors.” The forward-looking statements in this release speak only as of this date, and the Company disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NovaBay Pharmaceuticals, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Justin M. Hall

|

|

|

|

|

Justin M. Hall

|

|

|

|

|

Chief Executive Officer and General Counsel

|

|

Dated: October 16, 2024

v3.24.3

Document And Entity Information

|

Oct. 16, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NovaBay Pharmaceuticals, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 16, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33678

|

| Entity, Tax Identification Number |

68-0454536

|

| Entity, Address, Address Line One |

2000 Powell Street

|

| Entity, Address, Address Line Two |

Suite 1150

|

| Entity, Address, City or Town |

Emeryville

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94608

|

| City Area Code |

510

|

| Local Phone Number |

899-8800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

NBY

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001389545

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

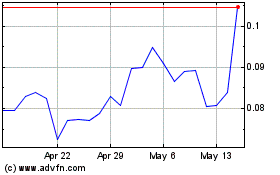

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Dec 2023 to Dec 2024