Current Report Filing (8-k)

19 July 2022 - 6:13AM

Edgar (US Regulatory)

0001532619

false

0001532619

2022-07-18

2022-07-18

0001532619

PW:CommonSharesMember

2022-07-18

2022-07-18

0001532619

PW:Sec7.75SeriesCumulativeRedeemablePerpetualPreferredStockLiquidationPreference25PerShareMember

2022-07-18

2022-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): July 18, 2022

POWER

REIT

(Exact

name of registrant as specified in its charter)

Maryland

(State

or other jurisdiction of incorporation)

001-36312

(Commission

File Number)

45-3116572

(IRS

Employer Identification No.)

301

Winding Road

Old

Bethpage, NY 11804

(Address

of principal executive offices and Zip Code)

Registrant’s

telephone number, including area code: (212) 750-0371

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Shares |

|

PW |

|

NYSE

(American) |

| |

|

|

|

|

| 7.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, Liquidation Preference $25 per Share |

|

PW.A |

|

NYSE

(American) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01. Other Events –

Update

Regarding Marengo Township, Michigan Greenhouse Cultivation Facility

Power

REIT, through a wholly owned subsidiary, PW MI CanRE Marengo, (“PW Marengo”) owns a 556,000 square foot high-tech greenhouse

located in Marengo Township, Michigan (the “Property”). Power REIT believes that once operational, this will be the largest

cannabis cultivation facility in Michigan and one of the largest greenhouse cannabis cultivation facilities in the United States. Power

REIT also believes that given the scale combined with the fact that the Property is a greenhouse will position our tenant, Marengo Cannabis

LLC (the “Tenant”), to compete favorably as a low-cost producer of high-quality cannabis. This is especially important

as prices for cannabis in most markets have compressed recently. Power REIT’s Tenant is a wholly owned subsidiary of Millennium

Sustainable Ventures Corp. (ticker: MILC).

As

part of securing cannabis licenses from the Michigan Cannabis Regulatory Agency (“CRA”), a Certificate of Occupancy (“CO”)

must be submitted where applicable. Pursuant to the Marengo Township zoning map, the Property is zoned Agricultural and was given a Marijuana

Overlay, which according to the Marengo Township Ordinance does not change the underlying zoning. As such, the Property does not require

a CO and the CRA agreed in writing to accept a simple two sentence letter (the “CO Letter”) as an alternative to providing

a CO. PW Marengo pursued the agreed upon CO Letter from Marengo Township which was initially unwilling to cooperate which ultimately

led PW Marengo to initiate litigations against Marengo Township.

On

July 8, 2022, PW Marengo ultimately secured the CO Letter from the Marengo Township Supervisor confirming that the property is currently

zoned Agricultural and does not need a CO. The CO Letter is in the form that the CRA previously agreed to accept. Based on the receipt

of the CO Letter, the complete licensing application has now been submitted to the CRA. While the submission of the of the licensing

application to CRA has been significantly delayed due to the issues with Marengo Township, we have now overcome a significant hurdle

in the licensing process. Nevertheless, there is no certainty as to the ability to ultimately secure the licenses from

the CRA as well as how long the process will take which will allow our Tenant to commence operations.

As

previously announced, PW Marengo amended the lease with its Tenant, to push out rent to Q1 2023 to reflect the uncertainty around the

timing of licensing. The amendment was structured to maintain the same level of straight-line accounting for rent for Power REIT.

However, given the uncertainty around licensing, Power REIT currently is not recognizing rental income associated with the Property.

Once there is more certainty around the timing of the ability of the tenant to pay rent, Power REIT expects to resume recognition of

revenue for the Property. The Property represents the largest single asset within our portfolio in terms of income. The annual straight-line

rent based on the amended lease is $5,119,943 which translates to incremental Core FFO per share of approximately $0.38 per quarter and

$1.52 per year on a per share basis based on 3,367,261 shares outstanding. This represents dramatic incremental FFO per share relative

to the $0.40 reported for Q1 2022.

In

terms of the Michigan cannabis market, wholesale prices to date do not appear to have compressed as significantly as other states such

as California, Colorado, and Oklahoma. We continue to believe that we acquired this property at an attractive basis and that our Tenant

can be a high quality, low-cost producer in the developing Michigan market.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

POWER

REIT |

| |

|

| Date:

July 18, 2022 |

By |

/s/

David H. Lesser |

| |

|

David

H. Lesser

Chairman

of the Board, Chief Executive Officer & Chief Financial Officer |

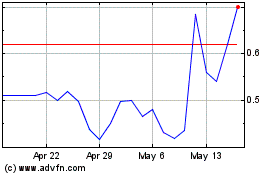

Power REIT (AMEX:PW)

Historical Stock Chart

From Nov 2024 to Dec 2024

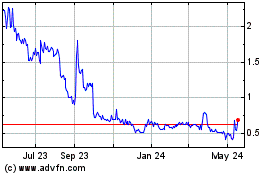

Power REIT (AMEX:PW)

Historical Stock Chart

From Dec 2023 to Dec 2024