Power REIT Receives Notice of Non-Compliance with NYSE American Continued Listing Standards

05 September 2024 - 7:20AM

Power REIT (NYSE-AMEX: PW and PW.PRA) (“Power REIT” or the

“Trust”), today announced that on September 3, 2024, Power REIT

(the “Trust”) received a written notice from the NYSE Regulation

(the “NYSE Notice”) of NYSE American LLC (the “Exchange”)

stating that the Trust is not in compliance with the continued

listing standards of the Exchange because the Trust is below

compliance with Section 1003(a)(i) of the NYSE American Company

Guide (the “Company Guide”), requiring a stockholders’ equity of

$2.0 million or more if it has reported losses from continuing

operations and/or net losses in two of its three most recent fiscal

years, as a result of the Trust’s reported stockholders’ equity of

$322,626 at June 30, 2024 and losses from continuing operations

and/or net losses in two of its three most recent fiscal years

ended December 31, 2023. The Trust is also not currently eligible

for any exemption in Section 1003(a) of the Company Guide from the

stockholders’ equity requirements.

In connection with its non-compliance with

Section 1003(a)(i), the Trust must submit a plan (the “Plan”) to

NYSE Regulation of the Exchange by October 3, 2024, advising of

actions it has taken or will take to regain compliance with the

continued listing standards by March 3, 2026. If NYSE Regulation

determines to accept the Plan, the Trust will be notified in

writing and will be subject to periodic reviews including quarterly

monitoring for compliance with the Plan. If the Trust does not

submit a plan or if the Plan is not accepted, the Exchange will

commence delisting proceedings. Furthermore, if the Plan is

accepted but the Trust is not in compliance with the continued

listing standards by March 3, 2026 or if the Trust does not make

progress consistent with the Plan, the Exchange will initiate

delisting proceedings as appropriate. The Trust may appeal a staff

delisting determination in accordance with Section 1010 and Part 12

of the Company Guide.

The Notice has no immediate impact on the

listing of the Trust’s shares of common stock, par value $0.0001

per share (the “Common Stock”), and of the Trust shares of Series A

Preferred 7.75% Cumulative Redeemable Perpetual Preferred Stock

(the “Preferred Stock”) which will continue to be listed and traded

on the NYSE American during this period, subject to the Trust’s

compliance with the other listing requirements of the NYSE

American. The Common Stock and Preferred Stock will continue to

trade under the symbol “PW”, but will have an added designation of

“.BC” to indicate the status of the Common Stock and Preferred

Stock are “below compliance”. The notice does not affect the

Trust’s ongoing business operations or its reporting requirements

with the Securities and Exchange Commission.

ABOUT POWER REIT

Power REIT, with a focus on the “Triple Bottom

Line” and a commitment to people, planet and profit, is a

specialized real estate investment trust (REIT) that owns

sustainable real estate related to infrastructure assets including

properties for Controlled Environment Agriculture, Renewable Energy

and Transportation.

Additional information about Power REIT can be

found on its website: www.pwreit.com

Cautionary Statement About

Forward-Looking Statements

This document includes forward-looking

statements within the meaning of the U.S. securities laws.

Forward-looking statements are those that predict or describe

future events or trends and that do not relate solely to historical

matters. You can generally identify forward-looking statements as

statements containing the words "believe," "expect," "will,"

"anticipate," "intend," "estimate," "project," "plan," "assume",

"seek" or other similar expressions, or negatives of those

expressions, although not all forward-looking statements contain

these identifying words. All statements contained in this document

regarding our future strategy, future operations, future prospects,

the future of our industries and results that might be obtained by

pursuing management's current or future plans and objectives are

forward-looking statements. You should not place undue reliance on

any forward-looking statements because the matters they describe

are subject to known and unknown risks, uncertainties and other

unpredictable factors, many of which are beyond our control. Our

forward-looking statements are based on the information currently

available to us and speak only as of the date of the filing of this

document. Over time, our actual results, performance, financial

condition or achievements may differ from the anticipated results,

performance, financial condition or achievements that are expressed

or implied by our forward-looking statements, and such differences

may be significant and materially adverse to our security

holders.

CONTACT:

|

David H. Lesser, Chairman & CEO |

|

dlesser@pwreit.com |

|

212-750-0371 |

|

|

|

301 Winding RoadOld Bethpage, NY 11804 |

|

www.pwreit.com |

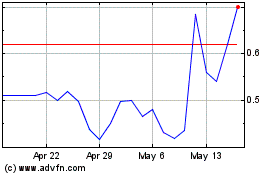

Power REIT (AMEX:PW)

Historical Stock Chart

From Jan 2025 to Feb 2025

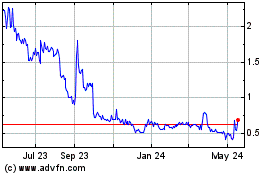

Power REIT (AMEX:PW)

Historical Stock Chart

From Feb 2024 to Feb 2025