false

0001616543

0001616543

2025-01-08

2025-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 8, 2025

| SENSEONICS

HOLDINGS, INC. |

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware |

|

001-37717 |

|

47-1210911 |

(State or Other

Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

20451 Seneca Meadows Parkway

Germantown, MD 20876-7005 |

| (Address of Principal Executive Office) (Zip Code) |

Registrant's telephone number, including

area code: (301) 515-7260

Not Applicable

Former name or former address, if changed

since last report

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2 below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

SENS |

NYSE American |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and

Financial Condition.

On January 8, 2025, Senseonics Holdings, Inc. (the

“Company”) issued a press release announcing, among other things, business updates, including certain preliminary, unaudited

financial information for the year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report

on Form 8-K and incorporated by reference herein.

The information set forth in this Item 2.02 and

contained in the press release furnished as Exhibit 99.1 shall not be deemed "filed" for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and is not incorporated by reference into any of the Company's filings

under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly

set forth by specific reference in any such filing.

Item 8.01 Other Events.

On January 8, 2025, the Company announced

its decision to cancel the Special Meeting of Stockholders, which had been scheduled for January 10, 2025, for the purpose of seeking

stockholder approval of a proposed reverse stock split within the range of 25:1 to 50:1.

On January 8, 2025, the Company also reported

the following preliminary unaudited financial information:

| · | The

Company generated preliminary unaudited revenue of approximately $8.3 million for the fourth quarter of 2024, and preliminary unaudited

revenue of approximately $22.5 million for the year ended December 31, 2024 |

| · | Total

unaudited operating expenses and associated cash utilization for the fourth quarter of 2024 and full year 2024 were consistent with the

Company’s previously provided guidance |

| · | The

Company’s unaudited balance of cash, cash equivalents and restricted cash as of December 31, 2024, is expected to be approximately $74.9

million |

The Company also reported the following operational information:

| · | The

Company’s patient base increased 56% in 2024 over 2023 to approximately 6,000 global patients |

Forward Looking Statements

Any statements in this report about future expectations, plans and

prospects for the Company, including the anticipated level of fourth quarter 2024 and full year 2024 revenue and cash, cash equivalents

and restricted cash as of December 31, 2024 constitute forward-looking statements within the meaning of The Private Securities Litigation

Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various

important factors, including: uncertainties inherent in the financial close process in connection with the finalization of the Company’s

2024 financial statements, as well as the audit of such financial statements by the Company’s independent registered public accounting

firm and such other factors as are set forth in the risk factors detailed in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and

subsequent reports filed with the Securities and Exchange Commission under the heading "Risk Factors." The forward-looking

statements included in this report represent the Company’s views as of the date hereof. The Company anticipates that subsequent

events and developments will cause the Company’s views to change. However, while the Company may elect to update these forward-looking

statements at some point in the future, the Company specifically disclaims any obligation to do so except as required by law. These

forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof.

Preliminary Unaudited Financial Information

The preliminary financial information presented in this report are

estimates based on information available to management as of the date of this report, have not been reviewed or audited by the Company’s

independent registered public accounting firm and are subject to change. There can be no assurance that the Company’s actual audited

financial results as of and for the full year ended December 31, 2024 will not differ from the preliminary financial information presented

in this report. The preliminary financial information presented in this report should not be viewed as a substitute for full financial

statements prepared in accordance with GAAP and audited by the Company’s independent registered public accounting firm.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: January 13, 2025 |

SENSEONICS HOLDINGS, INC. |

| |

| |

By: |

/s/ Rick Sullivan |

| |

Name: |

Rick Sullivan |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Senseonics Holdings, Inc. Announces Business

Updates Including Preliminary 2024 Results, 365 Launch Update and Cancellation of Special Meeting

January 8, 2025 GERMANTOWN, Md.--(BUSINESS WIRE)-- Senseonics

Holdings, Inc. (NYSE American: SENS), a medical technology company focused on the development and manufacturing of long-term, implantable

continuous glucose monitoring (CGM) systems for people with diabetes, today announced operational, financial and other business updates.

Recent Highlights & Accomplishments

| · | Generated

preliminary unaudited fourth quarter revenue of approximately $8.3 million, and preliminary

unaudited full year 2024 total revenue of approximately $22.5 million |

| · | Received

FDA approval for Eversense® 365 Continuous Glucose Monitoring system and launched Eversense

365 with commercial partner, Ascensia. |

| · | Patient

base increased 56% in 2024 over 2023 to approximately 6,000 global patients |

| · | Reached

a milestone of over a 1,000 annual U.S. Eversense prescribers during 2024 |

| · | Continued

strong interest in Eversense 365, as evidenced by the following early U.S. launch performance

indicators: |

| o | Direct to Consumer (DTC) leads

have doubled in Q4 compared to the pre-launch third quarter |

| o | New patient shipments of approximately

600 in December were the highest monthly total in the Company’s history |

| o | The number of patients switching

to Eversense from competitive CGM’s has increased 49% since Eversense 365 launch |

| o | 118% increase in patient referrals

from physicians since launch |

| · | Following

recent appreciation in Company’s share price, determined not to proceed with previously

announced Special Meeting of stockholders to consider reverse stock split. |

“2024 was a tremendous year for Senseonics, achieving our long-term

goal of commercializing the Eversense 365 product, providing people with diabetes a convenient and accurate solution for monitoring blood

glucose for an entire year with a single sensor. Additionally, we’ve strengthened our position in the marketplace through the newly

created CGM division of our commercial partner, Ascensia, and our partnership with Mercy health system, targeted to proactively improve

health outcomes and decrease overall systemwide costs for people with diabetes,” said Tim Goodnow, PhD, President and Chief Executive

Officer of Senseonics. “Patient and provider leads, converstion rates, and interest from health systems have all increased significantly

since the U.S. 365 launch, culminating in the highest number of monthly new patient shipments in December 2024, and we expect to

see those numbers continue to accelerate in 2025. We also expect to provide updates on pump-connectivity, additional health care systems

and our ex-US launch over the course of the year.”

2024 Financial Results

The Company currently expects to report revenues of approximately $8.3

million for the fourth quarter 2024 and full year 2024 total revenue of approximately $22.5 million. Total unaudited operating

expenses and associated cash utilization for the fourth quarter 2024 and full year 2024 was consistent with the previously guided range.

The Company’s unaudited balance of cash, cash equivalents and restricted cash as of December 31, 2024, is expected to be approximately $74.9

million. The Company expects to report its full fourth quarter and fiscal year 2024 financial results later this quarter. The preliminary

financial results described in this update have not been audited and are subject to adjustment based on the Company’s completion

of year-end financial close processes.

Cancellation of Special Meeting of Stockholders

The Company has determined not to proceed with the Special Meeting,

scheduled for January 10, 2025, for the purpose of seeking shareholder approval of a proposed reverse stock split within the range

of 25:1 to 50:1. Since announcing the proposed stock split on November 19, 2024 in parallel with the ongoing launch of the 365-day

product the Company’s share price has increased. As of January 7, 2025, proxies had been received from sufficient stockholders

to constitute a quorum for the meeting, with a majority of such shares voting in favor of the proposed reverse stock split as of such

date. However, after assessing the pricing implications of a reverse split at the lowest end of the proposed range of stock splits, and

taking into consideration shareholder feedback regarding conducting a reverse split of at this time, the Company determined not to proceed

with the Special Meeting and the proposed reverse stock split.

Considerations for 2025 Growth Outlook

The Company also plans to provide financial guidance for 2025 in conjunction

with its reporting of full fiscal year 2024 financial results. The Company currently expects that the 2025 guidance will reflect positive

revenue growth in 2025 over 2024, taking into account the following factors, among others: (i) Ascensia’s completion of financial

forecasts for their fiscal year beginning on April 1st, 2025, (ii) plans with respect to spending on the DTC marketing

campaign to generate leads, (iii) the status of other sales and marketing initiatives, and (iv) refined visibility of the timeline

and specifications for the regulatory submission and the plans for commercial transition to Eversense 365 outside the United States.

About Senseonics

Senseonics Holdings, Inc. ("Senseonics") is a medical technology company focused on the development and manufacturing

of glucose monitoring products designed to transform lives in the global diabetes community with differentiated, long-term implantable

glucose management technology. Senseonics' CGM systems Eversense® 365 and Eversense® E3

include a small sensor inserted completely under the skin that communicates with a smart transmitter worn over the sensor. The glucose

data are automatically sent every 5 minutes to a mobile app on the user's smartphone.

About Eversense

The Eversense® Continuous Glucose Monitoring

(CGM) Systems are indicated for continually measuring glucose levels for up to 365 days for Eversense® 365

and 180 days for Eversense® E3 in persons with diabetes age 18 and older. The systems are indicated for use

to replace fingerstick blood glucose (BG) measurements for diabetes treatment decisions. Fingerstick BG measurements are still required

for calibration primarily one time per week after day 13 for Eversense® 365 and one time per day after day

21 for Eversense® E3, and when symptoms do not match CGM information or when taking medications of the tetracycline

class. The sensor insertion and removal procedures are performed by a health care provider. The Eversense CGM Systems are prescription

devices; patients should talk to their health care provider to learn more. For important safety information, see https://www.eversensediabetes.com/safety-info/.

About Ascensia Diabetes Care

Ascensia Diabetes Care is a global company focused entirely on

helping people with diabetes. Our mission is to empower those living with diabetes through innovative solutions that simplify and improve

their lives.

We are home to the world-renowned CONTOUR® portfolio

of blood glucose monitoring systems and the exclusive global distribution partner for the Eversense® Continuous

Glucose Monitoring Systems from Senseonics. These products combine advanced technology with user-friendly functionality to help

people with diabetes manage their condition and make a positive difference to their lives. As a trusted partner in the diabetes community,

we collaborate closely with healthcare professionals and other partners to ensure our products meet the highest standards of accuracy,

precision and reliability, and that we conduct our business compliantly and with integrity.

Ascensia is a member of PHC Group and was established in

2016 through the acquisition of Bayer Diabetes Care by PHC Holdings Corporation. Ascensia products are sold in more than 100 countries.

Ascensia has around 1,400 employees and operations in 29 countries.

For further information, please visit

the Ascensia Diabetes Care website at: http://www.ascensia.com.

About PHC Holdings Corporation

PHC Holdings Corporation (TSE 6523)

is a global healthcare company with a mission of contributing to the health of society through healthcare solutions that have a positive

impact and improve the lives of people. Its subsidiaries (referred to collectively as PHC Group) include PHC Corporation, Ascensia

Diabetes Care Holdings AG, Epredia Holdings Ltd., LSI Medience Corporation, Mediford Corporation, and Wemex. Together,

these companies develop, manufacture, sell and service solutions across diabetes management, healthcare solutions, life sciences and

diagnostics. PHC Group’s consolidated net sales in FY2023 were JPY 353.9 billion with global distribution of products

and services in more than 125 countries. www.phchd.com

©2024 Ascensia Diabetes Care Holdings AG. All right reserved.

Ascensia, the Ascensia Diabetes Care logo and Contour are trademarks and/or registered trademarks of Ascensia Diabetes

Care Holdings AG.

Forward Looking Statements

Any statements in this press release about future expectations, plans

and prospects for Senseonics, including the anticipated level of fourth quarter 2024 and full year 2024 revenue and cash, cash equivalents

and restricted cash as of December 31, 2024, and projected 2025 financial performance described in “Considerations for 2025

Growth Outlook,” statements regarding the expected acceleration of patient and provider leads, conversion rates, and interest from

health systems in 2025, statements regarding pump-connectivity, additional health care systems and the Company’s ex-US launch of

the 365-day system, and other statements containing the words "believe," “expect,” “intend,” “may,”

“projects,” “will,” “planned,” and similar expressions, constitute forward-looking statements within

the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such

forward-looking statements as a result of various important factors, including: uncertainties inherent in the financial close process

in connection with the finalization of the Company’s 2024 financial statements, as well as the audit of such financial statements

by the Company’s independent registered public accounting firm, the execution of the independent business unit of Ascensia

Diabetes Care, the Company’s commercialization partner for Eversense, and other commercial initiatives, uncertainties in insurer,

regulatory and administrative processes and decisions, uncertainties inherent in the development and registration and roll-out of new

technology and solutions, uncertainties inherent in finalizing integration and commercial terms and coordinations with health systems

and other new collaboration partners and third parties, uncertainties inherent in the ongoing commercialization of the Eversense product

and the expansion of the Eversense product and Senseonics’ activities, uncertainties relating to the current economic environment

and such other factors as are set forth in the risk factors detailed in Senseonics' Annual Report on Form 10-K for the

year ended December 31, 2023, Senseonics’ Quarterly Report on Form 10-Q for the quarter ended September 30,

2024, and subsequent reports filed with the SEC under the heading "Risk Factors."

The preliminary financial information and outlook presented in this

release are estimates based on information available to management as of the date of this release, have not been reviewed or audited

by the Company’s independent registered public accounting firm and are subject to change. There can be no assurance that the Company’s

actual audited financial results as of and for the full year ended December 31, 2024 will not differ from the preliminary financial

information presented in this release. The preliminary financial information presented in this release should not be viewed as a substitute

for full financial statements prepabed in accordance with GAAP and audited by the Company’s independent registered public accounting

firm. In addition, the forward-looking statements included in this press release represent Senseonics’ views as of the date hereof. Senseonics anticipates

that subsequent events and developments will cause Senseonics’ views to change. However, while Senseonics may elect to

update these forward-looking statements at some point in the future, Senseonics specifically disclaims any obligation to do

so except as required by law. These forward-looking statements should not be relied upon as representing Senseonics’ views as of

any date subsequent to the date hereof.

Senseonics Investor Contact

Jeremy Feffer

LifeSci Advisors

investors@senseonics.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

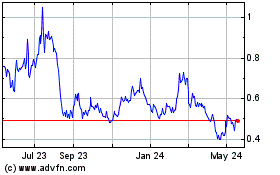

Senseonics (AMEX:SENS)

Historical Stock Chart

From Dec 2024 to Jan 2025

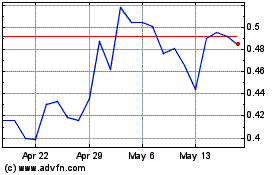

Senseonics (AMEX:SENS)

Historical Stock Chart

From Jan 2024 to Jan 2025