false

0001823587

0001823587

2024-12-20

2024-12-20

0001823587

skyh:ClassACommonStockParValue00001PerShareCustomMember

2024-12-20

2024-12-20

0001823587

skyh:WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShareCustomMember

2024-12-20

2024-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) December 20, 2024

Sky Harbour Group Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-39648

|

|

85-2732947

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

136 Tower Road, Suite 205

Westchester County Airport

White Plains, NY

|

|

10604

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(212) 554-5990

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Class A common stock, par value $0.0001 per share

|

|

SKYH

|

|

NYSE American LLC

|

|

Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

|

SKYH WS

|

|

NYSE American LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02. Unregistered Sales of Equity Securities

The information in Item 8.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.02.

The Second Closing PIPE Shares (as defined below) were offered and sold in transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on Section 4(a)(2) thereof and Rule 506 of Regulation D thereunder. Each of the Investors (as defined below) represented that it was an “accredited investor,” as defined in Regulation D, and acquired the Second Closing PIPE Shares for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof in violation of applicable securities laws. The Second Closing PIPE Shares have not been registered under the Securities Act and such Second Closing PIPE Shares may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

Neither this Current Report on Form 8-K nor any of the exhibits attached hereto is an offer to sell or the solicitation of an offer to buy the Second Closing PIPE Shares, shares of Class A common stock, par value $0.0001 per share (the “Common Stock”) or any other securities of Sky Harbour Group Corporation (the “Company”).

Item 7.01. Regulation FD Disclosure.

On December 23, 2024, the Company issued a press release announcing the Second Closing (as defined below). A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 7.01 of this Current Report on Form 8-K, including the information in the presentation attached as Exhibit 99.1 to this Current Report on Form 8-K, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Furthermore, the information in Item 7.01 of this Current Report on Form 8-K, including the information in the presentation attached as Exhibit 99.1 to this Current Report on Form 8-K, shall not be deemed to be incorporated by reference in the filings of the Company under the Securities Act.

Item 8.01. Other Events.

On December 20, 2024, pursuant to the terms of the Securities Purchase Agreement, dated September 16, 2024 (the “Purchase Agreement”), by and among the Company and certain investors (collectively, the “Investors”), the Company sold and issued to the Investors an aggregate of 3,955,790 shares of Common Stock (the “Second Closing PIPE Shares”) for an aggregate purchase price of $37,580,005.00 (the “Second Closing”). Inclusive of the initial closing that occurred on October 25, 2024, the Company issued and sold an aggregate of 7,911,580 shares of Common Stock for an aggregate purchase price of $75,160,010.00 pursuant to the Purchase Agreement.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

EXHIBIT INDEX

|

Exhibit

Number

|

|

Exhibit Title

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 23, 2024

| |

SKY HARBOUR GROUP CORPORATION

|

|

| |

|

|

|

| |

By:

|

/s/ Tal Keinan

|

|

| |

Name:

|

Tal Keinan

|

|

| |

Title:

|

Chief Executive Officer

|

|

Exhibit 99.1

Sky Harbour Announces Second Closing of Equity Raise, with Additional Participation of Existing and New Long-Term Investors

WEST HARRISON, N.Y.--(BUSINESS WIRE)--Sky Harbour Group Corporation (NYSE American: SKYH, SKYH WS) (“SHG” or the “Company”), an aviation infrastructure company building the first nationwide network of Home-Basing campuses for business aircraft, announced it has completed the second closing of its previously announced equity raise. The Company issued an additional 3,955,790 PIPE shares of its Class A Common Stock in connection with the exercise of all the rights to purchase additional shares provided to PIPE investors who participated in the first closing for net proceeds of approximately $37.6 million, at a sale price of $9.50 per share. Aggregate proceeds from both closings were approximately $75.2 million, representing the full capacity of the equity raise.

As previously disclosed, the Company plans to issue approximately $150 million in new private activity debt financing in the first half of 2025. The combined proceeds of both financings and existing cash on hand, approximately $240 million, is intended to support phase-1 development projects at 6-7 new airport campuses (approximately 800,000 rentable square feet), beyond the approximately one million rentable square feet already funded. As recently announced, the Company expects seven new ground leases by the end of 2025, which would bring the portfolio to 23 airports.

PIPE Participants included affiliates of Altai Capital and Raga Partners, Boulderado, the family office of SHG Board member Alex Rozek and new long-term investors.

Tal Keinan, Sky Harbour CEO, commented: “Sky Harbour has had the good fortune to attract truly strategic investors to its shareholder community. We are grateful for our new partners, and for existing partners who have increased their stakes in Sky Harbour.”

Francisco Gonzalez, Sky Harbour CFO, commented: “We are pleased to have been oversubscribed in the investor interest of this equity financing. We will continue with our policy of conservative and deliberate management of our liquidity and capital formation.”

Rishi Bajaj, Managing Principal from Altai Capital also commented: “We are excited to be joined by an excellent group of new long-term investors who are equally enthusiastic about Sky Harbour's progress and future pipeline.”

For additional information, to request an invitation, or to schedule a one-on-one meeting, please email Sky Harbour Investor Relations at investors@skyharbour.group.

About Sky Harbour Group Corporation

Sky Harbour Group Corporation is an aviation infrastructure company developing the first nationwide network of Home-Basing campuses for business aircraft. The company develops, leases and manages general aviation hangars across the United States. Sky Harbour’s Home-Basing offering aims to provide private and corporate customers with the best physical infrastructure in business aviation, coupled with dedicated service tailored to based aircraft, offering the shortest time to wheels-up in business aviation. To learn more, visit www.skyharbour.group.

About Altai Capital

Altai Capital is a technology-focused investment firm founded in 2009 by Rishi Bajaj. Altai Capital makes long-term investments across a diverse range of financial instruments, including debt, private equity, venture capital, and publicly traded securities. To learn more, visit www.altai.com.

Forward Looking Statements

Certain statements made in this release are "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995, including statements about the expectations regarding future operations at Sky Harbour Corporation and its subsidiaries. When used in this press release, the words “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of Sky Harbour Group Corporation (the “Company”) as applicable and are inherently subject to uncertainties and changes in circumstances. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. For more information about risks facing the Company, see the Company’s annual report on Form 10-K for the year ended December 31, 2023, and other filings the Company makes with the SEC from time to time. The Company’s statements herein speak only as of the date hereof, and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts

SKYH Investor Relations:

investors@skyharbour.group

Attn: Francisco X. Gonzalez, CFO

v3.24.4

Document And Entity Information

|

Dec. 20, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Sky Harbour Group Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 20, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39648

|

| Entity, Tax Identification Number |

85-2732947

|

| Entity, Address, Address Line One |

136 Tower Road

|

| Entity, Address, Address Line Two |

Suite 205

|

| Entity, Address, Address Line Three |

Westchester County Airport

|

| Entity, Address, City or Town |

White Plains

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

10604

|

| City Area Code |

212

|

| Local Phone Number |

554-5990

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001823587

|

| ClassACommonStockParValue00001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

SKYH

|

| Security Exchange Name |

NYSE

|

| WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

SKYH WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=skyh_ClassACommonStockParValue00001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=skyh_WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

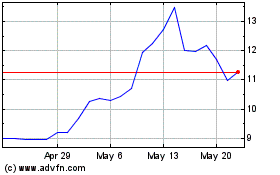

Sky Harbour (AMEX:SKYH)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sky Harbour (AMEX:SKYH)

Historical Stock Chart

From Jan 2024 to Jan 2025