Macro Indicators Will Move the S&P 500 Index This Week

12 September 2022 - 7:03AM

Finscreener.org

The equity markets in the United

States snapped a three-week losing streak after rising for a third

straight session on Friday. The advance in stock prices was driven

by outsized gains across sectors. While the

Dow Jones Industrial Average rose 2.7%, the S&P

500 (AMEX:

SPY) and Nasdaq Composite Index gained 3.7% and 4%, respectively, last

week.

Comparatively, the

10-year treasury yield

surged over 3.5% on Tuesday and closed the week at 3.32%. Finally,

prices of the West Texas Intermediate (WTI) crude fell below $82 per barrel last week before

rising to $86 per barrel on Friday. It was the lowest level for

crude oil prices since January 2022, but it gained pace after

Russia’s President Vladimir Putin threatened to cut

supplies.

The upcoming week will be quite

eventful, given the plethora of economic reports that will be

released in the U.S., Europe, and the United Kingdom. Let’s take a

look at each of them closely to gauge what the market expects from

the economy right now.

Consumer Price Index data

The Bureau of Labor Statistics

will release the CPI or Consumer Price Index data on Tuesday.

Inflation numbers for August are expected to accelerate to 8.7% in

August from 8.5% in July. Additionally, core inflation which

excludes fuel and food costs, is forecast to rise to 6.1% in

August, up from 5.9% in July.

The pace of inflation has

moderated in recent months after touching a 40-year high of 9.1% in

June. Due to a slowdown in energy costs, prices across other

commodities and services continue to rise on the back of lower

unemployment rates and supply chain disruptions.

Data for the Producer Price Index

(PPI) will be released on Wednesday. This metric tracks inflation

from the standpoint of producers and wholesalers. The PPI fell by

0.5% in July after it rose 1% in June. In fact, the PPI’s annual

gain decelerated to 8.9%, which was its lowest level since last

October. A lower rate in August would indicate an easing of price

pressures.

Retail sales data for August

The U.S. Census Bureau will

release August retail sales data on Thursday, an indicator of

consumer spending. In August, retail sales data might experience a

slowdown after the metric was unchanged in July. But due to red hot

inflation numbers, the purchasing power of individuals has been

impacted, which should also stagnate retail numbers of the last

month.

U.K. inflation

The U.K. inflation numbers for

July will be released on Wednesday. In July, inflation in the U.K.

stood at 10.1%, which was the highest rate of rising prices among

G-7 countries for 40 years. Analysts expect the annual inflation

rate in the U.K. to range around 10.2% in July as energy prices

have soared.

Russia is threatening to cut

supplies to Europe in opposition to the sanctions imposed against

the country by the Western block. Due to the limited supply of

energy and rising demand, Bank of England expects inflation to

surge over 13% in early 2023.

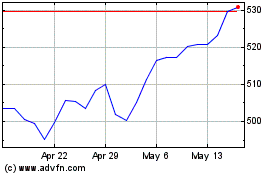

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Oct 2024 to Nov 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Nov 2023 to Nov 2024