false

0001334933

0001334933

2024-08-13

2024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

August 13, 2024

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

500 North Shoreline, Ste. 800,

Corpus Christi, Texas, U.S.A.

|

78401

|

|

(U.S. corporate headquarters)

|

(Zip Code)

|

| |

|

|

1830 – 1188 West Georgia Street

Vancouver, British Columbia, Canada

|

V6E 4A2

|

|

(Canadian corporate headquarters)

|

(Zip Code)

|

(Address of principal executive offices)

(361) 888-8235

(Registrant’s telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure

|

On August 13, 2024, Uranium Energy Corp. (the “Company” or “UEC”) issued a news release to announce the successful startup of uranium production at its past-producing Christensen Ranch In-Situ Recovery (“ISR”) operations in Wyoming.

Production commenced in the previously operated Mine Unit 10 at Christensen Ranch on August 6th. To date, uranium concentrations in the initial production patterns are meeting expectations and are anticipated to rise in the coming weeks. All planned startup milestones, including the hiring and training of the initial restart personnel for both the Irigaray Central Processing Plant (“CPP”) and Christensen Ranch, have been achieved to ensure a successful ramp-up of uranium production. Approximately 40% of the total workforce is from Johnson County, with other employees originating from Campbell, Converse, Carbon, Laramie and Natrona Counties in Wyoming.

The first shipment of yellowcake is anticipated to occur in November or December 2024. This coincides with the Company’s fiscal Q2 ending January 31, 2025.

Uranium recovered from Christensen Ranch will be processed at the Irigaray CPP, located approximately 15 miles northwest of Christensen Ranch. Irigaray has a current licensed capacity of 2.5 million pounds U3O8 per year, with a license amendment currently under regulatory review that is expected to increase capacity to 4.0 million pounds annually. The Irigaray CPP is the hub, central to four fully permitted ISR projects in the Powder River Basin of Wyoming, including Christensen Ranch.

Donna Wichers, Vice President of Wyoming Operations, stated: “The Christensen Ranch ISR Mine has successfully restarted and we are in full growth mode with initial recoveries from Mine Unit 10 to be followed with Mine Units 7 and 8 in the coming months. Additionally, we have drilled, cased and completed 55 wellfield patterns to extend Mine Unit 10 that will commence production in 2025. Further production growth is being developed with delineation drilling and monitor well planning at Mine Unit 11. We have filled all our initial personnel requirements, resulting in a total workforce of 40 employees. Hiring is expected to continue into 2025 with an additional 20 positions to meet plans for future wellfield development and expanded production.”

Amir Adnani, President and CEO, stated: “I am very proud of the Wyoming team who have executed as planned to achieve the restart of production. This is the moment we have been working towards for over a decade, having acquired and further developed leading U.S. and Canadian assets with an exceptional, deeply experienced operations team. Global uranium market fundamentals are solid, with prospects for extraordinary growth in nuclear power and uranium demand.”

Mr. Adnani continued: “The U.S. nuclear utility fleet produces almost 20% of the country’s electricity and is the world’s largest uranium consumer with purchases of over 50 million pounds last year. U.S. production has been virtually non-existent for many years, suffering from price insensitive imports via foreign state-owned enterprises that undermined domestic mining and investment. This situation is changing by way of successive and unprecedented bipartisan U.S. government programs designed to stimulate growth of domestic uranium production as the foundation of a robust nuclear fuel supply chain.”

Scott Melbye, Executive Vice President, stated: “Production from stable jurisdictions is valued in today’s volatile world and has become a renewed priority in utility purchasing strategies. The special nature of U.S. origin uranium carries a unique demand profile, not only applicable for U.S. and Western utilities security of supply but also for U.S. national security. Unobligated U.S. origin uranium is required to fuel the U.S. nuclear navy, and the government inventories feeding this demand have been drawn down over several decades. The U.S. Department of Energy’s recent Strategic Uranium Reserve purchases being the clearest example of a domestic priority.”

A copy of the news release is attached as Exhibit 99.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

URANIUM ENERGY CORP. |

|

|

|

|

|

|

| DATE: August 13, 2024. |

By:

|

/s/ Pat Obara

|

|

|

|

|

Pat Obara, Secretary and |

|

|

|

|

Chief Financial Officer |

|

Exhibit 99.1

Uranium Energy Corp Announces Restart of

ISR Uranium Production in Wyoming

Casper, Wyoming, August 13, 2024 - Uranium Energy Corp (NYSE American: UEC, the “Company” or “UEC”) is pleased to announce the successful startup of uranium production at its past-producing Christensen Ranch In-Situ Recovery (“ISR”) operations in Wyoming.

Production commenced in the previously operated Mine Unit 10 at Christensen Ranch on August 6th. To date, uranium concentrations in the initial production patterns are meeting expectations and are anticipated to rise in the coming weeks. All planned startup milestones, including the hiring and training of the initial restart personnel for both the Irigaray Central Processing Plant (“CPP”) and Christensen Ranch, have been achieved to ensure a successful ramp-up of uranium production. Approximately 40% of the total workforce is from Johnson County, with other employees originating from Campbell, Converse, Carbon, Laramie and Natrona Counties in Wyoming.

The first shipment of yellowcake is anticipated to occur in November or December 2024. This coincides with the Company’s fiscal Q2 ending January 31, 2025.

Uranium recovered from Christensen Ranch will be processed at the Irigaray CPP, located approximately 15 miles northwest of Christensen Ranch. Irigaray has a current licensed capacity of 2.5 million pounds U3O8 per year, with a license amendment currently under regulatory review that is expected to increase capacity to 4.0 million pounds annually. The Irigaray CPP is the hub, central to four fully permitted ISR projects in the Powder River Basin of Wyoming, including Christensen Ranch.

Donna Wichers, Vice President of Wyoming Operations, stated: “The Christensen Ranch ISR Mine has successfully restarted and we are in full growth mode with initial recoveries from Mine Unit 10 to be followed with Mine Units 7 and 8 in the coming months. Additionally, we have drilled, cased and completed 55 wellfield patterns to extend Mine Unit 10 that will commence production in 2025. Further production growth is being developed with delineation drilling and monitor well planning at Mine Unit 11. We have filled all our initial personnel requirements, resulting in a total workforce of 40 employees. Hiring is expected to continue into 2025 with an additional 20 positions to meet plans for future wellfield development and expanded production.”

Amir Adnani, President and CEO, stated: “I am very proud of the Wyoming team who have executed as planned to achieve the restart of production. This is the moment we have been working towards for over a decade, having acquired and further developed leading U.S. and Canadian assets with an exceptional, deeply experienced operations team. Global uranium market fundamentals are solid, with prospects for extraordinary growth in nuclear power and uranium demand.”

Mr. Adnani continued: “The U.S. nuclear utility fleet produces almost 20% of the country’s electricity and is the world’s largest uranium consumer with purchases of over 50 million pounds last year. U.S. production has been virtually non-existent for many years, suffering from price insensitive imports via foreign state-owned enterprises that undermined domestic mining and investment. This situation is changing by way of successive and unprecedented bipartisan U.S. government programs designed to stimulate growth of domestic uranium production as the foundation of a robust nuclear fuel supply chain.”

Scott Melbye, Executive Vice President, stated: “Production from stable jurisdictions is valued in today’s volatile world and has become a renewed priority in utility purchasing strategies. The special nature of U.S. origin uranium carries a unique demand profile, not only applicable for U.S. and Western utilities security of supply but also for U.S. national security. Unobligated U.S. origin uranium is required to fuel the U.S. nuclear navy, and the government inventories feeding this demand have been drawn down over several decades. The U.S. Department of Energy’s recent Strategic Uranium Reserve purchases being the clearest example of a domestic priority.”

About Uranium Energy Corp

Uranium Energy Corp is the fastest growing supplier of the fuel for the green energy transition to a low carbon future. UEC is the largest, diversified North American focused uranium company, advancing the next generation of low-cost, environmentally friendly ISR mining uranium projects in the United States and high-grade conventional projects in Canada. The Company has two production-ready ISR hub and spoke platforms in South Texas and Wyoming. These two production platforms are anchored by fully operational CPPs and served by seven U.S. ISR uranium projects with all their major permits in place. Additionally, the Company has diversified uranium holdings including: (1) one of the largest physical uranium portfolios of U.S. warehoused U3O8; (2) a major equity stake in Uranium Royalty Corp., the only royalty company in the sector; and (3) a Western Hemisphere pipeline of resource stage uranium projects. The Company's operations are managed by professionals with decades of hands-on experience in the key facets of uranium exploration, development and mining.

For additional information, please contact:

Uranium Energy Corp Investor Relations

Toll Free: (866) 748-1030

Fax: (361) 888-5041

E-mail: info@uraniumenergy.com

X (formerly known as Twitter): @UraniumEnergy

Stock Exchange Information:

NYSE American: UEC

WKN: AØJDRR

ISN: US916896103

Safe Harbor Statement

Except for the statements of historical fact contained herein, the information presented in this news release constitutes “forward-looking statements” as such term is used in applicable United States and Canadian securities laws. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as “forward-looking statements”. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the actual results of exploration activities, variations in the underlying assumptions associated with the estimation or realization of mineral resources, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labor disputes and other risks of the mining industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, title disputes or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Many of these factors are beyond the Company’s ability to control or predict. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company's filings with the Securities and Exchange Commission. For forward-looking statements in this news release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities.

v3.24.2.u1

Document And Entity Information

|

Aug. 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

URANIUM ENERGY CORP.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 13, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-33706

|

| Entity, Tax Identification Number |

98-0399476

|

| Entity, Address, Address Line One |

500 North Shoreline

|

| Entity, Address, Address Line Two |

Ste. 800

|

| Entity, Address, City or Town |

Corpus Christi

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78401

|

| City Area Code |

361

|

| Local Phone Number |

888-8235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

UEC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001334933

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

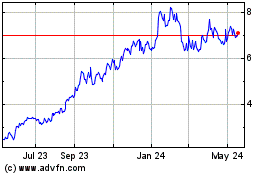

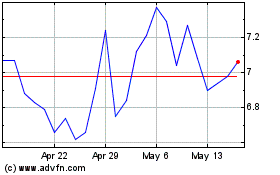

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Nov 2023 to Nov 2024