Unemployment: Is Resilience an Illusion? - Analyst Blog

16 May 2013 - 11:58PM

Zacks

After sinking to a five-year low last week, jobless claims have

now jumped to a seasonally adjusted level of 360,000. This is the

highest in six weeks, an increase of 32,000 over last week’s

revised figure of 328,000. Last week’s claims numbers were

originally reported at 323,000, the lowest level recorded since Jan

2008.

The more representative figure for jobless claims, the four-week

moving average, increased by only 1,250 to 339,250. This lightens

the impact of weekly volatility and indicates that claims numbers

are largely headed southward. Despite problems with key areas of

the economy such as manufacturing, retrenchments have been largely

contained. It seems that the economy has largely managed to stave

off prospects of a summer swoon.

Some economists believe that the labor market may be showing

internal resilience. This is backed up by the employment report for

April released during the first week of the month. Nonfarm payrolls

increased by 165,000 in April.

Meanwhile the unemployment rate declined to 7.5% from 7.6% in

March, the lowest recorded figure since December 2008. From an

average of 181,000 for the entire year of 2012, the number of job

additions has gone up to an average of 196,000 per month this

year.

Even more significant was the fact that employment numbers for

previous months were revised upwards. Jobs added in February

increased from an initially recorded 268,000 to 332,000.

Additionally, employment numbers in March were revised upwards from

88,000 to 138,000, another substantial increase.

Immediately after monthly employment numbers were released on the

third, exchange traded funds linked to volatility saw their values

tumble. The iPath S&P 500 VIX Short-Term Futures Index

ETN (VXX) declined 2.5% and the ProShares Ultra

VIX Short-Term Futures (UVXY) dropped 5%. These products

are constructed in a manner which will mimic the returns of futures

based on the CBOE Volatility Index, the Street’s fear gauge.

At the same time, the SPDR S&P 500 (SPY)

jumped 1% after its tracking index moved above a crucial

psychological level. Meanwhile, the iShares 20+ Year

Treasury Bond (TLT) declined 1.5%. Domestic

government debt yields increased, implying that investors were now

considering investing in more exciting areas. Again, the

CurrencyShares Japanese Yen Trust (FXY) fell by

1.2%, reflecting that the dollar had moved up against the yen.

The VXX has now declined by 7.2% over the last 10 days, whereas the

UVXY has fallen 14.1%. The TLT has declined by 5.4% over the same

period, whereas the FXY has slipped 4.9%. Meanwhile, the SPY has

risen by 5%, reflecting continued strength in the markets.

Actually, the underlying strength in the labor market has gone

against conventional logic. Despite the fact that Congress remains

deadlocked in a never-ending battle over the budget, the private

sector has continued to hire. Over the last two years, government

spending has been reduced at a rate faster than that experienced at

the end of the Vietnam war. And this year will be impacted by the

end of a payroll tax break on one hand and spending cuts related to

the sequester on the other.

These issues are also reflected in government job cuts in April,

which amount to 11,000. On the other hand, the private sector added

176,000 jobs with retail adding 30,000 jobs while a similar number

were added by temp agencies. All this points toward brighter

prospects for hiring in the future.

Wages remain a matter of specific concern. Average hourly earnings

have risen by just 1.9% over the last year, falling well behind

inflation. Meanwhile, conservatives have continued to blame

President Obama for labor-market weaknesses. They believe small

businesses are wary of ramping up hiring because of health care

reform and other new regulations.

In fact, President Obama’s support base has been grievously

affected. Compared to 5.4% in 2007, the unemployment rate for those

who are aged 25 and have a bachelor’s degree is now 8.2%. The

figure for African-American workers is 13.6%, while it is 9.5% for

Latin-Americans. This compares most unfavorably to the overall

average quarterly figure of 7.7%.

The president has recently announced specific measures to address

these problems. Firstly, three new manufacturing innovation

institutes will be created and partnerships between the private

sector and public universities will be fostered. Secondly, large

amounts of government data will be made available online in an

attempt to encourage innovation and aid startups.

Manufacturing is clearly an area which the administration believes

holds out hope. Gene Sperling, director of the National Economic

Council has credited the Obama administration with a boost in

employment in the automobile sector. It is now to be seen whether

sectors such as advanced manufacturing can create new avenues of

employment and provide a long-term basis for jobs growth.

CRYSHS-JAP YEN (FXY): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

ISHARS-BR 20+ (TLT): ETF Research Reports

PRO-ULT VIX STF (UVXY): ETF Research Reports

IPATH-SP5 VX ST (VXX): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

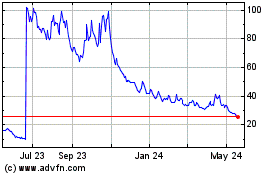

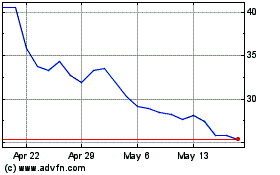

ProShares Ultra VIX Shor... (AMEX:UVXY)

Historical Stock Chart

From Feb 2025 to Mar 2025

ProShares Ultra VIX Shor... (AMEX:UVXY)

Historical Stock Chart

From Mar 2024 to Mar 2025