0001880343

false

--12-31

true

true

0001880343

2025-03-07

2025-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March

7, 2025

FRESH

VINE WINE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41147 |

|

87-3905007 |

(State or Other

Jurisdiction

of Incorporation) |

(Commission File Number) |

|

(I.R.S.

Employer

Identification

No.) |

P.O.

Box 78984

Charlotte,

NC 28271

(Address

of Principal Executive Offices) (Zip Code)

(855)

766-9463

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☑ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on

which registered |

| Common stock, par value

$0.001 per share |

|

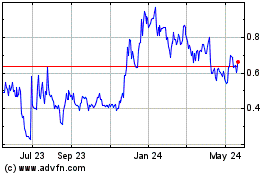

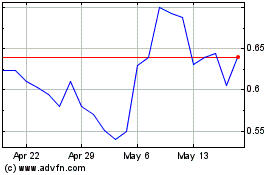

VINE |

|

NYSE American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☑

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement.

Agreement and Plan of

Merger

On

March 7, 2025, Fresh Vine Wine, Inc., a Nevada corporation (“Fresh Vine”), Amaze Holdings Inc., a Delaware corporation and

wholly owned subsidiary of Fresh Vine (“Merger Sub”), Amaze Software, Inc., a Delaware corporation (“Amaze”),

the stockholders of Amaze listed on Schedule I thereto (each, a “Holder” and together the “Holders”), and Aaron

Day, solely in his capacity as the Holders’ Representative (the “Holders’ Representative”), entered into an Amended

and Restated Agreement and Plan of Merger (the “Merger Agreement”). On March 7, 2025 Fresh Vine completed the acquisition

of Amaze. Amaze is an end-to-end, creator-powered commerce platform offering tools for seamless product creation, advanced e-commerce

solutions, and scalable managed services.

Pursuant

to the Merger Agreement, (i) Merger Sub merged with and into Amaze (the “Merger”) with Amaze as the surviving company and

a wholly owned subsidiary of Fresh Vine, and (ii) the aggregate merger consideration paid by Fresh Vine in connection with the acquisition

included 750,000 shares of Fresh Vine’s Series D Convertible Preferred Stock, par value $0.001 per share (“Series D Preferred

Stock”), plus warrants (the “Merger Warrants”) to purchase an aggregate of 8,750,000 shares of Fresh Vine’s common

stock, par value $0.001 per share (the “Common Stock”).

The

Merger Agreement contains various covenants of the parties, including covenants providing for (a) Fresh Vine to prepare and a file with

the Securities and Exchange Commission (SEC) a proxy statement related to the solicitation of stockholder votes to approve the Fresh Vine

Stockholder Matters (as defined in the Merger Agreement), including the issuance of shares of Common Stock in excess of the Exchange Share

Cap and Individual Holder Share Cap (as defined in the Certificate) and the resulting change in control of Fresh Vine; and (b) for Fresh

Vine to prepare and file with the SEC a registration statemen for the purpose of registering for resale the shares of Common Stock issuable

upon conversion of the Series D Preferred Stock and exercise of the Merger Warrants.

The

Merger Agreement contains representations, warranties, and covenants that the respective parties made to each other as of the date of

such agreement or other specific dates. The assertions embodied in those representations, warranties and covenants were made for purposes

of the contract among the respective parties and are subject to important qualifications and limitations agreed to by the parties in connection

with negotiating the Merger Agreement. It is not intended to provide any other factual information about the parties to the Merger Agreement.

In particular, the representations, warranties, covenants and agreements contained in the Merger Agreement, which were made only for purposes

of the Merger Agreement and as of specific dates, were solely for the benefit of the parties to the Merger Agreement, may be subject to

limitations agreed upon by the contracting parties (including being qualified by confidential disclosures made for the purposes of allocating

contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts) and may be subject to standards

of materiality applicable to the contracting parties that differ from those applicable to investors and reports and documents filed with

the SEC. Investors should not rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations

of the actual state of facts or condition of any party to the Merger Agreement. In addition, the representations, warranties, covenants

and agreements and other terms of the Merger Agreement may be subject to subsequent waiver or modification. Moreover, information concerning

the subject matter of the representations and warranties and other terms may change after the date of the Merger Agreement, which subsequent

information may or may not be fully reflected in Fresh Vine’s public disclosures

Series

D Preferred Stock

On

March 7, 2025, Fresh Vine filed a Certificate of Designation of the of Preferences, Rights and Limitations of Series D Convertible Preferred

Stock (the “Certificate”) with the Secretary of State of the State of Nevada, designating 750,000 shares of preferred stock

as Series D Preferred Stock.

Stated

Value. Each share of Series D Preferred Stock has a stated value of $100.00 (the “Stated Value”).

Rank;

Liquidation Preference. The Series D Preferred Stock ranks junior to Fresh Vine’s Series A convertible preferred stock and Series

B convertible preferred stock and ranks senior to Fresh Vine’s Common Stock. Upon any liquidation, dissolution or winding-up of

Fresh Vine, the holders of Series D Preferred Stock will be entitled to be paid an amount equal to the Stated Value, plus any accrued

but unpaid dividends, before any distribution or payment will be made to the holders of Common Stock. Any remaining assets of Fresh Vine

available for distribution to its stockholders will be distributed among the holders of Series A Convertible Preferred Stock, holders

of Series B Convertible Preferred Stock, holders of Series D Preferred Stock and holders of Common Stock, pro rata based on the number

of shares held by each such holder on an as-if converted basis.

Dividends.

Holders of Series D Preferred Stock are entitled to receive dividends (on an as-if converted basis) equal to and in the same form as dividends

actually paid on shares of the Common Stock when, as and if such dividends are paid on shares of the Common Stock.

Conversion.

Each share of Series D Preferred Stock is convertible at any time at the option of the holder into the number of shares of Common Stock

(“Conversion Shares”) calculated by dividing the Stated Value by the conversion price (the “Conversion Ratio”),

subject to the limitations described below. In addition, upon Fresh Vine’s stockholders approving the conversion of the Series D

Preferred Stock into shares of Common Stock in accordance with the listing rules of the NYSE American LLC Company Guide, each share of

Series D Preferred Stock will automatically convert into a number of shares of Common Stock equal to the Conversion Ratio. The conversion

price is equal to $0.80 per share and is subject to standard weighted average anti-dilution protection.

Each

holder of Series D Preferred Stock is prohibited from converting shares of Series D Preferred Stock if, after giving effect to the issuance

of such Conversion Shares, such holder together with the holder’s affiliates would beneficially own more than 4.99% of the outstanding

Common Stock (the “Beneficial Ownership Limitation”). A holder of Series D Preferred Stock may increase such Beneficial Ownership

Limitation to 9.99% upon notice to Fresh Vine.

Voting.

The Series D Preferred Stock will vote with the Common Stock as a single class on an as-converted basis on all matters submitted to a

vote of stockholders of Fresh Vine (taking into account the conversion limitations resulting from the Exchange Share Cap and the Individual

Holder Share Cap as described below). However, the Series D Preferred Stock is not entitled to vote on any proposal to approve the issuance

of shares of Common Stock upon the conversion of Series D Preferred Stock in excess of the Exchange Share Cap or the Individual Holder

Share Cap, in each case as required by NYSE American rules. In addition, solely for purposes of determining voting rights (and not the

Conversion Ratio), the conversion price will be equal to the most recent closing sale price of the Common Stock as of the date of entering

into the Merger Agreement pursuant to which such share of Series D Preferred Stock was initially issued.

Exchange

Share Cap and Individual Holder Share Cap. The holder’s ability to convert Series D Preferred Stock will be subject to an “Exchange

Share Cap” and an “Individual Holder Share Cap.” Under the Exchange Share Cap, the total number of Conversion Shares

issuable upon conversion of outstanding Series D Preferred Stock, when added to all Conversion Shares previously issued upon prior conversions

of the Series D Preferred Stock, may not exceed 19.9% of Fresh Vine’s issued and outstanding Common Stock as of the date of the

Merger Agreement. Under the Individual Holder Share Cap, the holder of Series D Preferred Stock may not acquire Conversion Shares upon

conversion of the Series D Preferred Stock if the total number of shares of Common Stock issuable to the converting holder would result

in such holder beneficially owning in excess of 19.9% of the number of shares of Common Stock outstanding immediately after giving effect

to the issuance. The Exchange Share Cap and the Individual Holder Share Cap will not apply if Fresh Vine obtains stockholder approval

to issue the shares of Common Stock in excess of the applicable cap as required by NYSE American LLC Company Guide Section 713.

Merger

Warrants

The

Merger Warrants are exercisable on or after the date on which Fresh Vine stockholder’s approve the conversion of the Series D Preferred

Stock into shares of Common Stock in accordance with the listing rules of the NYSE American LLC Company Guide (the “Stockholder

Approval Date”). The exercise price is $0.80 per share and is subject to standard weighted average anti-dilution protection. The

Merger Warrants may not be exercised on a cashless basis. The Merger Warrants will expire on the earlier of (x) 5th anniversary of the

Stockholder Approval Date and (y) the date fixed for the redemption of the Merger Warrants. A holder of the Merger Warrant (together with

the holder’s affiliates) may not exercise any portion of the Merger Warrant to the extent that the holder would own more than 9.99%

of the outstanding shares of Common Stock immediately after exercise. Fresh Vine may not issue any shares of Common Stock upon exercise

of the Merger Warrant to the extent the issuance of such shares would exceed the Exchange Share Cap (as defined in the Certificate). The

Merger Warrants are redeemable by Fresh Vine at a redemption price of $0.01 per share, upon 30 days’ notice, if at any time after

180 days following the issuance date, the volume weighted average price of the Common Stock for any 20 consecutive trading days is equal

to or greater than $1.60 per share.

The

foregoing description of the Merger Agreement, the Certificate and the Merger Warrant are qualified in their entirety by the full text

of the Merger Agreement, the Certificate and Merger Warrant, which are filed as Exhibits 10.1, 3.1 and 10.2, respectively, and are incorporated

herein by reference.

Stockholder

Support Agreement and Lock-Up Agreement

Concurrently

with the execution of the Merger Agreement, officers, directors and certain stockholders of Fresh Vine entered into stockholder support

agreements (each, a “Support Agreement”) with Fresh Vine and Amaze to vote all of their respective shares of Fresh Vine capital

stock, among other things, (a) in favor of the issuance of shares of Common Stock in excess of the “Exchange Share Cap” and

“Individual Holder Share Cap” limitations upon conversion of the Series D Preferred Stock and upon exercise of the Merger

Warrants; (b) for the election of the Fresh Vine director nominees, and (c) against any action, proposal, transaction, or agreement that

could reasonably be expected to impede, interfere with, delay, discourage, adversely affect, or inhibit the elimination of the “Exchange

Share Cap” and “Individual Holder Share Cap” limitations and/or fulfillment of Fresh Vine’s obligations under

the Merger Agreement with respect to the issuance of Common Stock upon conversion of the Series D Preferred Stock and/or exercise of the

Merger Warrants.

In

addition, concurrently with the execution of the Merger Agreement, officers and directors of Fresh Vine entered into lock-up agreements

(each, a “Lock-Up Agreement”) pursuant to which, subject to specified exceptions, they agreed not to transfer their shares

of Common Stock for a period beginning on the date of the Merger Agreement and ending on the earlier of (x) the six (6) month anniversary

of the closing, and (y) the first date after the closing on which the last sale price of Common Stock equals or exceeds $2.00 per share

(as adjusted for share splits, share capitalizations, share consolidations, rights issuances, subdivisions, reorganizations, recapitalizations

and the like) for any 20 trading days within any 30 trading day period commencing at least 150 days after the closing.

The

foregoing description of the Support Agreement and Lock-Up Agreement do not purport to be complete and are qualified in their entirety

by reference to the full text of the form of Support Agreement and form of Lock-Up Agreement, which are filed as Exhibit 10.3 and 10.4,

respectively, and are incorporated herein by reference.

Item

1.02 Termination of a Material Definitive Agreement.

As

previously disclosed, on November 3, 2024, Fresh Vine entered into entered into a Business Combination Agreement (the “Business

Combination Agreement”) with (i) Amaze Holdings Inc., a Delaware corporation and wholly owned subsidiary of Vine (“Pubco”),

(ii) VINE Merger Sub Inc., a Delaware corporation and wholly subsidiary of Pubco (“VINE Merger Sub”), (iii) Adifex Merger

Sub LLC, a Delaware limited liability company and wholly owned subsidiary of Pubco (“Adifex Merger Sub”), and (iv) Adifex

Holdings LLC, a Delaware limited liability company (“Adifex”).

On

March 7, 2025, Fresh Vine and Adifex entered into a Termination Agreement (the “Termination Agreement”) pursuant to which

the parties mutually agreed to terminate the Business Combination Agreement effective immediately upon execution of the Termination Agreement.

No termination fees are payable by either party in connection with the termination of the Business Combination Agreement.

The

foregoing description of the Termination Agreement does not purport to be complete and is qualified in its entirety by the full text of

the Termination Agreement, which is filed as Exhibit 10.5 and incorporated by reference herein.]

Item 2.01 Completion

of Acquisition or Disposition of Assets.

The information set forth

under “Agreement and Plan of Merger” in Item 1.01 is incorporated herein by reference.

Item 3.02 Unregistered

Sales of Equity Securities.

The information set forth

in Item 1.01 is incorporated herein by reference. The shares of Series D Preferred Stock, the Merger Warrants and the shares of Common

Stock issuable upon conversion or exercise of the Series D Preferred Stock and Merger Warrants, as applicable, were offered and sold in

reliance upon exemptions from registration pursuant to Section 4(a)(2) under the Securities Act of 1933, as amended, and/or Rule 506(b)

of Regulation D promulgated thereunder, as transactions by an issuer not involving any public offering.

Item 5.02 Departure of

Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective March 7, 2025,

pursuant to the Merger Agreement, Fresh Vine’s board of directors expanded the size of the board from 4 to 5 directors and filled

the newly created vacancy by appointing Aaron Day, the Chief Executive Officer of Amaze, to serve on the board. Mr. Day’s term will

expire at Fresh Vine’s next annual meeting of stockholders or until his earlier resignation or removal. At the time of this Current

Report on Form 8-K, the board has not yet determined board committee assignments for Mr. Day.

Other

than as provided for in the Merger Agreement, there are no arrangements or understandings between Mr. Day and any other person pursuant

to which he was selected as a director.

Since the beginning of the

last fiscal year, there have been no related party transactions between Fresh Vine and Mr. Day that would be reportable under Item 404(a)

of Regulation S-K.

Item 5.03

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Years.

The information set forth under “Series

D Preferred Stock” in Item 1.01 is incorporated herein by reference.

Effective

upon entry into the Merger Agreement, Fresh Vine’s board of directors adopted an amendment to Fresh Vine’s bylaws. The amendment

inserts a new Article XI that states that the “Acquisition of Controlling Interest” statutes set forth in Sections 78.378

through 78.3793, inclusive, of the Nevada Revised Statutes shall not apply to any “acquisition” of a “controlling interest”

(as each term is defined therein) in Fresh Vine resulting from the Merger Agreement. The foregoing description of the amendment to Fresh

Vine’s bylaws is qualified in its entirety by reference to Amendment No. 2 to Bylaws, which is filed as Exhibit 3.2, and is incorporated

herein by reference.

Item

7.01 Regulation FD Disclosure.

On

March 10, 2025, Fresh Vine issued a press release announcing the Merger and the termination of the Business Combination Agreement. The

press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference, except that the information

contained on any websites referenced in the press release is not incorporated by reference.

The

information furnished in this Item 7.01 and Exhibit 99.1 attached shall not be deemed to be “filed” for the purposes of Section

18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of

such section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired.

The audited consolidated financial statements of

Amaze as of and for the years ended December 31, 2023 and 2022 and unaudited consolidated financial statements of Amaze for the nine months

ended September 30, 2024 and 2023 are attached as Exhibits 99.2 and 99.3, respectively, and incorporated herein by reference.

The audited consolidated financial statements of

Amaze as of and for the year ended December 31, 2024 will be filed by amendment to this Current Report on Form 8-K no later than 71 calendar

days after the date on which this Current Report on Form 8-K is required to be filed.

(b) Pro Forma Financial Information.

The pro forma financial information required to be filed under Item 9.01(b)

of this Current Report on Form 8-K will be filed by amendment to this Current Report on Form 8-K no later than 71 calendar days after

the date on which this Current Report on Form 8-K is required to be filed.

(d) Exhibits.

| Exhibit No. |

|

Description |

| 3.1 |

|

Certificate of Designation of Preferences, Rights, and Limitations of Series D Convertible Preferred Stock |

| 3.2 |

|

Amendment

No. 2 to Bylaws |

| 10.1 |

|

Amended

and Restated Agreement and Plan of Merger dated as of March 7, 2025 by and among Fresh Vine Wine, Inc., Amaze Holdings, Inc., Amaze

Software, Inc. (“Amaze”), the Stockholders of Amaze listed on Schedule I and signatory thereto, and Aaron Day, solely in

his capacity as the Holders’ Representative |

| 10.2 |

|

Form of Merger Warrant |

| 10.3 |

|

Form of Stockholder Support Agreement |

| 10.4 |

|

Form of Lock-Up Agreement |

| 10.5 |

|

Termination Agreement dated as of March 7, 2025 by and between Fresh Vine Wine, Inc. and Adifex Holdings LLC |

| 99.1 |

|

Press Release dated March 10, 2025 |

| 99.2 |

|

Audited consolidated

financial statements of Amaze Software, Inc. as of and for the years ended December 31, 2023 and 2022 |

| 99.3 |

|

Unaudited consolidated

financial statements of Amaze Software, Inc. as of and for the nine months ended September 30, 2024 and 2023 |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FRESH VINE WINE, INC. |

| |

|

|

| Date: March 10, 2025 |

By: |

/s/ Michael Pruitt |

| |

|

Michael Pruitt |

| |

|

Chairman and Chief Executive Officer |

Exhibit 3.1

FRESH VINE WINE, INC.

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES D CONVERTIBLE PREFERRED STOCK

PURSUANT TO THE

NEVADA REVISED STATUTES

The undersigned, Michael Pruitt, does hereby certify that:

1.

He is the Chief Executive Officer of Fresh Vine Wine, Inc., a Nevada corporation (the “Corporation”).

2.

The Corporation is authorized to issue 25,000,000 shares of preferred stock.

3.

The following resolutions were duly adopted by the board of directors of the Corporation (the “Board

of Directors”):

WHEREAS, the Articles of Incorporation of the

Corporation (the “Articles of Incorporation”) authorize the issuance of up to 25,000,000 shares of preferred stock,

par value $0.001 per share, of the Corporation in one or more series, the shares of each series to have such voting powers, and such designations,

preferences and relative, participating, optional or other special rights and qualifications, limitations or restrictions as are specified

in resolutions adopted by the Board of Directors providing for the issue thereof.

WHEREAS, it is the desire of the Board of Directors

to establish and fix the number of shares to be included in a new series of Preferred Stock, entitled “Series D Convertible Preferred

Stock,” and the designation, rights, preferences, and limitations of the shares of such new series.

NOW, THEREFORE, BE IT RESOLVED, that the Board

of Directors does hereby provide for the issuance of a series of Preferred Stock entitled “Series D Convertible Preferred Stock,”

and does hereby in this Certificate of Designation (this “Certificate of Designation”) establish and fix and herein

state and express the designation, rights, preferences, powers, restrictions, and limitations of such series of Preferred Stock as set

forth below:

TERMS OF PREFERRED STOCK

Section 1. Definitions.

For the purposes hereof, the following terms shall have the following meanings:

“Affiliate”

means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control

with a Person, as such terms are used in and construed under Rule 405 of the Securities Act.

“Alternate Consideration”

shall have the meaning set forth in Section 7(e).

“Beneficial Ownership

Limitation” shall have the meaning set forth in Section 6(d).

“Business Day”

means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking

institutions in the State of New York are authorized or required by law or other governmental action to close.

“Buy-In” shall

have the meaning set forth in Section 6(c)(iv).

“Commission”

means the United States Securities and Exchange Commission.

“Common Stock”

means the Corporation’s common stock, par value $0.001 per share, and stock of any other class of securities into which such securities

may hereafter be reclassified or changed.

“Common Stock Equivalents”

means any securities of the Corporation or its subsidiaries which would entitle the holder thereof to acquire at any time Common Stock,

including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is at any time convertible

into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Conversion Amount”

means the sum of the Stated Value of shares of Preferred Stock at issue.

“Conversion Date”

shall have the meaning set forth in Section 6(a).

“Conversion Price”

means $0.80.

“Conversion Shares”

means, collectively, the shares of Common Stock issuable upon conversion of the shares of Preferred Stock in accordance with the terms

hereof.

“Exchange Share Cap”

shall have the meaning set forth in Section 5(e)(i).

“Excess Conversion Shares”

shall have the meaning set forth in Section 5(e)(i).

“Exchange Act”

means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Fundamental Transaction”

shall have the meaning set forth in Section 7(e).

“Holder” shall

have the meaning given such term in Section 2.

“Individual Holder Share

Cap” shall have the meaning set forth in Section 5(e)(ii).

“Individual Excess Conversion

Shares” shall have the meaning set forth in Section 5(e)(ii).

“Junior Securities”

means the Common Stock and any other class or series of capital stock of the Corporation other than those securities which are explicitly

senior or pari passu to the Preferred Stock liquidation preference.

“Market Price”

means the closing sale price of the Common Stock on the Trading Market on the applicable date.

“Notice of Conversion”

shall have the meaning set forth in Section 6(a).

“Original Issue Date”

means the date of the first issuance of any shares of the Preferred Stock regardless of the number of transfers of any particular shares

of Preferred Stock and regardless of the number of certificates which may be issued to evidence such Preferred Stock.

“Parity Securities”

means any class or series of capital stock of the Corporation hereinafter created that expressly ranks pari passu with the Preferred Stock

in liquidation preference.

“Person” means

an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company,

joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Preferred Shares”

means share of Preferred Stock.

“Preferred Stock”

shall have the meaning set forth in Section 2.

“Securities Act”

means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Merger Agreement”

means the Amended and Restated Agreement and Plan of Merger dated as of March 7, 2025 by and among the Corporation, Amaze Holdings,

Inc., a Delaware corporation and wholly owned subsidiary of the Corporation (“Merger Sub”), and Amaze Software, Inc., a Delaware

corporation (“Amaze”).

“Senior Securities”

means the Series A Convertible Preferred Stock, Series B Convertible Preferred Stock and any other class or series of capital stock of

the Corporation hereinafter created that expressly ranks senior to the Preferred Stock in liquidation preference.

“Share Delivery Date”

shall have the meaning set forth in Section 6(c).

“Stated Value”

shall have the meaning set forth in Section 2.

“Successor Entity”

shall have the meaning set forth in Section 7(e).

“Trading Day”

means a day on which the principal Trading Market is open for business.

“Trading Market”

means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the

NYSE, NYSE American, Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, (or any successors to any of the

foregoing).

Section 2. Designation,

Amount and Par Value. The series of preferred stock shall be designated as its Series D Convertible Preferred Stock (the “Preferred

Stock”) and the number of shares so designated shall be up to 750,000 (which shall not be subject to increase without the written

consent of the holders of at least a majority of the outstanding Preferred Shares (each, a “Holder” and collectively,

the “Holders”)). Each share of Preferred Stock shall have a par value of $0.001 per share and a stated value equal

to $100.00 (the “Stated Value”).

Section 3. Dividends. Except

for stock dividends or distributions for which adjustments are to be made pursuant to Section 7, Holders shall be entitled to receive,

and the Corporation shall pay, dividends on shares of Preferred Stock equal (on an as-if-converted-to-Common-Stock basis) to and in the

same form as dividends actually paid on shares of the Common Stock when, as and if such dividends are paid on shares of the Common Stock.

No other dividends shall be paid on shares of Preferred Stock.

Section 4. Voting Rights.

Except as otherwise provided herein or as otherwise required by law, the Holders of Preferred Stock shall vote as a single class with

the holders of the Common Stock (and any other class or series of capital stock of the Corporation that votes as a single class with the

holders of the Common Stock) on an “as converted” basis on all matters submitted to a vote of stockholders of the Corporation

(taking into account, for the avoidance of doubt, the conversion restrictions in paragraphs 6(e) resulting from the Exchange Share Cap

and the Individual Holder Share Cap, if and as applicable); provided, however, that (i) the Preferred Stock is not entitled to vote on

any proposal to approve the issuance of Common Stock pursuant to this Certificate of Designation in excess of the Exchange Share Cap or

the Individual Holder Share Cap, in each case as required by the NYSE American LLC Company Guide (it being further acknowledged that Conversion

Shares outstanding on the record date for such approval, if any, will not be taken into account in tabulating the results of such vote),

and (ii) solely for purposes of determining the voting rights of the Holders of Preferred Stock under this Section 4 (and not for purposes

of determining the actual Conversion Ratio under Section 6), the Conversion Price with respect to each share of Preferred Stock shall

be equal to the most recent closing sale price of the Common Stock as of the date of entering into the Merger Agreement pursuant to which

such share of Preferred Stock was initially issued by the Company. As long as any shares of Preferred Stock are outstanding, the Corporation

shall not, without the affirmative vote of the Holders of at least a majority of the of the then-outstanding shares of the Preferred Stock,

(a) alter, amend or repeal this Certificate of Designation, (b) increase the number of authorized shares of Preferred Stock, or (c) enter

into any agreement with respect to any of the foregoing.

Section 5. Ranking; Liquidation.

(a)

The Preferred Stock shall, with respect to distributions of assets and rights upon the occurrence

of any liquidation, dissolution or winding-up of the Corporation (“Liquidation”), rank: (i) junior to the Senior Securities,

if any; (ii) pari passu with the Parity Securities; and (iii) senior to the Junior Securities. Upon any Liquidation, after the satisfaction

in full of the debts of the Corporation and payment of the liquidation preference to any Senior Securities, the Holders of Preferred Stock

shall be entitled to be paid, on a pari passu basis with the payment of any liquidation preference afforded to holders of any Parity Securities,

for each share of Preferred Stock held thereby, out of (but only to the extent) the assets of the Corporation are legally available for

distribution to its stockholders, an amount equal to the Stated Value (as adjusted for stock splits, stock dividends, combinations or

other recapitalizations of the Preferred Stock), plus any accrued but unpaid dividends, before any distribution or payment shall be made

to the holders of any Junior Securities. If the assets of the Corporation available for distribution to Holders of shares of Preferred

Stock shall be insufficient to permit payment in full to such Holders of the sums which such Holders are entitled to receive in such case

and of any liquidation preference afforded to holders of any Parity Securities, then all of the assets available for distribution to holders

of the Preferred Stock and the Parity Securities shall be distributed among and paid to such holders ratably in proportion to the amounts

that would be payable to such holders if such assets were sufficient to permit payment in full.

(b)

After the Holders of all shares of Preferred Stock shall have been paid in full the amounts to which

they are entitled pursuant to Section 5(a), the remaining assets of the Corporation available for distribution to its stockholders shall

be distributed among the holders of shares of Series A Convertible Preferred Stock, holders of shares of Series B Convertible Preferred

Stock, Holders of the shares of Preferred Stock and holders of Common Stock, pro rata based on the number of shares held by each such

holder, treating for this purpose all such Series A Convertible Preferred Stock, Series B Convertible Preferred Stock and Preferred Stock

as if they had been fully converted into Common Stock disregarding for such purposes any conversion limitations hereunder) pursuant to

the terms of the Series A Certificate of Designations, the Series B Certificate of Designations and this Certificate of Designations,

as applicable, each as in effect immediately prior to such Liquidation.

(c)

All the preferential amounts to be paid to the Holders under this Section 5 shall be paid or set

apart for payment before the payment or setting apart for payment of any amount for, or the distribution of any Liquidation funds of the

Corporation to the holders of shares of Junior Stock in connection with a Liquidation as to which this Section 5 applies.

Section 6. Conversion.

(a)

Conversion at Option of Holder. Each share of Preferred Stock shall be convertible, at any

time and from time to time from and after the Original Issue Date at the option of the Holder thereof, into the number of shares of Common

Stock calculated by dividing the Stated Value by the Conversion Price (the “Conversion Ratio”) (subject to the limitations

set forth in Section 6(d) and Section 6(e)). Holders shall effect conversions by providing the Corporation with the form of conversion

notice attached hereto as Annex A (a “Notice of Conversion”). Each Notice of Conversion shall specify

the number of shares of Preferred Stock to be converted, the number of shares of Preferred Stock owned prior to the conversion at issue,

the number of shares of Preferred Stock owned subsequent to the conversion at issue and the date on which such conversion is to be effected,

which date may not be prior to the date the applicable Holder delivers by facsimile such Notice of Conversion to the Corporation (such

date, the “Conversion Date”). If no Conversion Date is specified in a Notice of Conversion, the Conversion Date shall

be the date that such Notice of Conversion to the Corporation is deemed delivered hereunder. No ink-original Notice of Conversion shall

be required, nor shall any medallion guarantee (or other type of guarantee or notarization) of any Notice of Conversion form be required.

The calculations and entries set forth in the Notice of Conversion shall control in the absence of manifest or mathematical error. To

effect conversions of shares of Preferred Stock, a Holder shall not be required to surrender the certificate(s) representing the shares

of Preferred Stock to the Corporation unless all of the shares of Preferred Stock represented thereby are so converted, in which case

such Holder shall deliver the certificate representing such shares of Preferred Stock promptly following the Conversion Date at issue.

Shares of Preferred Stock converted into Common Stock or redeemed in accordance with the terms hereof shall be canceled and shall not

be reissued.

(b)

Automatic Conversion on Stockholder Approval. Effective immediately upon the Corporation’s

stockholders approving the conversion of the Preferred Stock into shares of Common Stock in accordance with the listing rules of the NYSE

American LLC Company Guide (such approvals, collectively the “Stockholder Approval” and such date, the “Automatic

Conversion Deadline”), each share of Preferred Stock then outstanding shall automatically convert into a number of shares of

Common Stock equal to the Conversion Ratio (the “Automatic Conversion”). The Corporation shall (i) inform each Holder

of the occurrence of the Stockholder Approval and (ii) confirm to each Holder the effective date of the Automatic Conversion, in each

case, within one (1) Business Day following such Stockholder Approval. The shares of Preferred Stock that are converted in the Automatic

Conversion are referred to as the “Converted Stock”. The Conversion Shares shall be issued shall be automatically cancelled

upon the Automatic Conversion and converted into the corresponding Conversion Shares, which shares shall be issued in book entry form

and without any action on the part of the Holders and shall be delivered to the Holders within two (2) Trading Days of the effectiveness

of the Automatic Conversion.

(c)

Mechanics of Conversion.

i.

Delivery of Conversion Shares Upon Conversion. Not later than two (2) Trading Days after each

Conversion Date (the “Share Delivery Date”), the Corporation shall deliver, or cause to be delivered, to the converting

Holder the number of Conversion Shares being acquired upon the conversion of the Preferred Stock, which Converting Shares shall be issued

in book-entry form. The Corporation shall deliver the Conversion Shares electronically through the Depository Trust Company or another

established clearing corporation performing similar functions..

ii.

Failure to Deliver Conversion Shares. If, in the case of any Notice of Conversion, such Conversion

Shares are not delivered to or as directed by the applicable Holder by the Share Delivery Date, the Holder shall be entitled to elect

by written notice to the Corporation at any time on or before its receipt of such Conversion Shares, to rescind such Conversion, in which

event the Corporation shall promptly return to the Holder any original Preferred Stock certificate delivered to the Corporation and the

Holder shall promptly return to the Corporation the Conversion Shares issued to such Holder pursuant to the rescinded Conversion Notice.

iii.

Obligation Absolute. The Corporation’s obligation to issue and deliver the Conversion

Shares upon conversion of Preferred Stock in accordance with the terms hereof are absolute and unconditional, irrespective of any action

or inaction by a Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment

against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach

or alleged breach by such Holder or any other Person of any obligation to the Corporation or any violation or alleged violation of law

by such Holder or any other person, and irrespective of any other circumstance which might otherwise limit such obligation of the Corporation

to such Holder in connection with the issuance of such Conversion Shares; provided, however, that such delivery shall not operate as a

waiver by the Corporation of any such action that the Corporation may have against such Holder.

iv.

[Reserved.]

v.

Reservation of Shares Issuable Upon Conversion. The Corporation covenants that it will at

all times reserve and keep available out of its authorized and unissued shares of Common Stock for the sole purpose of issuance upon conversion

of the Preferred Stock and payment of dividends on the Preferred Stock, each as herein provided, free from preemptive rights or any other

actual contingent purchase rights of Persons other than the Holder (and the other holders of the Preferred Stock), not less than such

aggregate number of shares of the Common Stock as shall be issuable (taking into account the adjustments and restrictions of Section 7)

upon the conversion of the then outstanding shares of Preferred Stock; provided, however, if at any time the number of authorized but

unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Preferred Stock,

the Corporation shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to

such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in reasonable best efforts to

obtain the requisite stockholder approval of any necessary amendment to the Articles of Incorporation. The Corporation covenants that

all shares of Common Stock that shall be so issuable shall, upon issue, be duly authorized, validly issued, fully paid and nonassessable.

vi.

Fractional Shares. No fractional shares or scrip representing fractional shares shall be issued

upon the conversion of the Preferred Stock. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon

such conversion, the Corporation shall round up to the next whole share.

vii.

Transfer Taxes and Expenses. The issuance of Conversion Shares on conversion of this Preferred

Stock shall be made without charge to any Holder for any documentary stamp or similar taxes that may be payable in respect of the issue

or delivery of such Conversion Shares, provided that the Corporation shall not be required to pay any tax that may be payable in respect

of any transfer involved in the issuance and delivery of any such Conversion Shares upon conversion in a name other than that of the Holders

of such shares of Preferred Stock and the Corporation shall not be required to issue or deliver such Conversion Shares unless or until

the Person or Persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established

to the satisfaction of the Corporation that such tax has been paid. The Corporation shall pay all transfer agent fees required for same-day

processing of any Notice of Conversion and all fees to the Depository Trust Company (or another established clearing corporation performing

similar functions) required for same-day electronic delivery of the Conversion Shares.

(d)

Beneficial Ownership Limitation. The Corporation shall not effect any conversion of the Preferred

Stock, and a Holder shall not have the right to convert any portion of the Preferred Stock, to the extent that, after giving effect to

the conversion set forth on the applicable Notice of Conversion, such Holder (together with such Holder’s Affiliates, and any Persons

acting as a group together with such Holder or any of such Holder’s Affiliates (such Persons, “Attribution Parties”))

would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the

number of shares of Common Stock beneficially owned by such Holder and its Affiliates and Attribution Parties shall include the number

of shares of Common Stock issuable upon conversion of the Preferred Stock with respect to which such determination is being made, but

shall exclude the number of shares of Common Stock which are issuable upon (i) conversion of the remaining, unconverted Preferred Stock

beneficially owned by such Holder or any of its Affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or

unconverted portion of any other securities of the Corporation (including, without limitation, any other Common Stock Equivalents)]subject

to a limitation on conversion or exercise analogous to the limitation contained herein (including, without limitation, the Preferred Stock)

beneficially owned by such Holder or any of its Affiliates or Attribution Parties. Except as set forth in the preceding sentence, for

purposes of this Section 6(d), beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the rules

and regulations promulgated thereunder. To the extent that the limitation contained in this Section 6(d) applies, the determination of

whether the Preferred Stock is convertible (in relation to other securities owned by such Holder together with any Affiliates and Attribution

Parties) and of how many shares of Preferred Stock are convertible shall be in the sole discretion of such Holder, and the submission

of a Notice of Conversion shall be deemed to be such Holder’s determination of whether the shares of Preferred Stock may be converted

(in relation to other securities owned by such Holder together with any Affiliates and Attribution Parties) and how many shares of the

Preferred Stock are convertible, in each case subject to the Beneficial Ownership Limitation. In addition, a determination as to any group

status as contemplated above shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated

thereunder. For purposes of this Section 6(d), in determining the number of outstanding shares of Common Stock, a Holder may rely on the

number of outstanding shares of Common Stock as stated in the most recent of the following: (i) the Corporation’s most recent periodic

or annual report filed with the Commission, as the case may be, (ii) a more recent public announcement by the Corporation or (iii) a more

recent written notice by the Corporation or the Corporation’s transfer agent setting forth the number of shares of Common Stock

outstanding. Upon the written or oral request (which may be via email) of a Holder, the Corporation shall within two Trading Days confirm

orally and in writing to such Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares

of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Corporation, including the

Preferred Stock, by such Holder or its Affiliates or Attribution Parties since the date as of which such number of outstanding shares

of Common Stock was reported. The “Beneficial Ownership Limitation” shall be 4.99% of the number of shares of the Common

Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon conversion of Preferred Stock

held by the applicable Holder. A Holder, upon notice to the Corporation, may increase or decrease the Beneficial Ownership Limitation

in this Section 6(d), provided that the Beneficial Ownership Limitation in no event exceeds 9.99% of the number of shares of the Common

Stock outstanding immediately after giving effect to the issuance of shares of Common Stock upon exercise of this Preferred Stock held

by the Holder and the provisions of this Section 6(d) shall continue to apply. Any increase in the Beneficial Ownership Limitation will

not be effective until the 61st day after such notice is delivered to the Corporation. The provisions of this paragraph shall be construed

and implemented in a manner otherwise than in strict conformity with the terms of this Section 6(d) to correct this paragraph (or any

portion hereof) which may be defective or inconsistent with the intended Beneficial Ownership Limitation contained herein or to make changes

or supplements necessary or desirable to properly give effect to such limitation. The limitations contained in this paragraph shall apply

to a successor holder of Preferred Stock.

(e)

Compliance with Securities Laws and Principal Market Rules.

i.

Exchange Share Cap. Notwithstanding anything in this Certificate of Designation to the contrary,

if on any Conversion Date, the total number of Conversion Shares issuable upon any conversion of outstanding shares of Preferred Stock,

when added to all Conversion Shares previously issued upon prior conversions of Preferred Stock (if any) previously issued under Section

3 hereof, exceeds 19.9% of the Corporation’s issued and outstanding Common Stock as of the date of the Merger Agreement (the “Exchange

Share Cap”) (such excess, the “Excess Conversion Shares”), then (i) only shares of Preferred Stock will be

converted that results in the issuance of Conversion Shares that does not exceed the Exchange Share Cap (rounded down to the nearest whole

share). The limitation in this Section 6(e)(i) will not apply if the Corporation obtains stockholder approval to issue the Excess Conversion

Shares as required by the NYSE American LLC Company Guide, provided that such approval is in accordance with NYSE Company Guide Section

713 (or its successor).

ii.

Individual Holder Share Cap. Notwithstanding anything in this Certificate of Designation to

the contrary, no Holder shall have the right to acquire Conversion Shares upon conversion of Preferred Stock, and the Corporation shall

not be required or permitted to issue Conversion Shares to such Holder, in excess of such Holder’s Individual Holder Share Cap.

If on any Conversion Date, the total number of Conversion Shares issuable to a converting Holder would result in such Holder beneficially

owning in excess of 19.9% of the number of shares of Common Stock outstanding immediately after giving effect to the issuance of such

Conversion Shares (the “Individual Holder Share Cap”) (such excess, the “Individual Excess Conversion Shares”),

then only shares of Preferred Stock will be converted that results in the issuance of Conversion Shares that that will not result in such

Holder exceeding the applicable Individual Holder Share Cap. The limitation in this Section 6(e)(ii) will not apply if the Corporation

obtains stockholder approval to issue the Excess Conversion Shares as required by the NYSE American LLC Company Guide, provided that such

approval is in accordance with NYSE Company Guide Section 713 (or its successor). If the conversion limitation contained in this Section

6(e)(ii) applies, the determination of whether and the extent to which such limitation applies to a particular Holder shall be in the

discretion of such Holder, and the delivery of a Notice of Conversion shall be deemed to be the Holder’s determination of the extent

to which such Holder’s Preferred Stock may be converted. For purposes of this this Section 6(e)(ii), in determining the number of

outstanding shares of Common Stock, a Holder may rely on the number of outstanding shares of Common Stock as reflected in (A) the Corporation’s

most recent periodic or annual report filed with the Securities and Exchange Commission, as the case may be, (B) a more recent public

announcement by the Corporation or (C) a more recent written notice by the Corporation or its transfer agent setting forth the number

of shares of Common Stock outstanding. Upon the written or oral request of a Holder, the Corporation shall promptly confirm orally and

in writing to the Holder the number of shares of Common Stock then outstanding.

Section 7. Certain Adjustments.

(a)

Stock Dividends and Stock Splits. If the Corporation, at any time while the Preferred Stock

is outstanding: (i) pays a stock dividend or otherwise makes a distribution or distributions payable in shares of Common Stock on shares

of Common Stock or any other Common Stock Equivalents (which, for avoidance of doubt, shall not include any shares of Common Stock issued

by the Corporation upon conversion of, or payment of a dividend on, this Preferred Stock); (ii) subdivides outstanding shares of Common

Stock into a larger number of shares; (iii) combines (including by way of a reverse stock split) outstanding shares of Common Stock into

a smaller number of shares; or (iv) issues, in the event of a reclassification of shares of the Common Stock, any shares of capital stock

of the Corporation, then the Conversion Ratio shall be multiplied by a fraction of which the numerator shall be the number of shares of

Common Stock (excluding any treasury shares of the Corporation) outstanding immediately before such event, and of which the denominator

shall be the number of shares of Common Stock outstanding immediately after such event. Any adjustment made pursuant to this Section 7(a)

shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution

and shall become effective immediately after the effective date in the case of a subdivision, combination or reclassification.

| (b) | Adjustments to Preferred Stock Conversion Price for Diluting Issues. |

i.

Special Definitions. For purposes of this Section 7, the following definitions shall apply:

(A) “Additional

Shares of Common Stock” means all shares of Common Stock issued (or, pursuant to Section 7(b)(iii) below, deemed to be issued)

by the Corporation after the Original Issue Date (as defined below), other than the following shares of Common Stock and shares of Common

Stock deemed issued pursuant to the following Options and Convertible Securities (collectively, “Exempted Securities”):

(1) as to any class

or series of Preferred Stock, shares of Common Stock, Options or Convertible Securities issued as a dividend or distribution on such class

or series of Preferred Stock (including dividends payable in connection with dividends on other classes or series of stock);

(2) shares of Common

Stock, Options or Convertible Securities issued by reason of a dividend, stock split, split-up or other distribution on shares of Common

Stock that is covered by Sections 7(a), 7(c), 7(d) and 7(e );

(3) shares of Common

Stock, Options or Convertible Securities issued to banks, equipment lessors or other financial institutions, or to real property lessors,

pursuant to a debt financing, equipment leasing or real property leasing transaction approved by the Board of Directors;

(4) shares of Common

Stock or Options issued to employees or directors of, or consultants or advisors to, the Corporation or any of its subsidiaries pursuant

to a plan, agreement or arrangement approved (i) prior to the Original Issue Date or (ii) by the Board of Directors

(5) shares of Common

Stock or Convertible Securities actually issued upon the exercise of Options or shares of Common Stock actually issued upon the conversion

or exchange of Convertible Securities, in each case provided such issuance is pursuant to the terms of such Option or Convertible Security;

(6) shares of Common

Stock, Options or Convertible Securities issued to suppliers or third party service providers in connection with the provision of goods

or services pursuant to transactions approved by the Board of Directors;

(7) shares of Common

Stock, Options or Convertible Securities issued as acquisition consideration pursuant to the acquisition of another corporation by the

Corporation by merger, purchase of substantially all of the assets or other reorganization or to a joint venture agreement, provided that

such issuances are approved by the Board of Directors; or

(8) shares of Common

Stock, Options or Convertible Securities issued in connection with sponsored research, collaboration, technology license, development,

OEM, marketing or other similar agreements or strategic partnerships approved by the Board of Directors; or

(9) shares of Common

Stock, Options or Convertible Securities issued for capital-raising purposes in connection with the transactions contemplated by the Merger

Agreement, as approved by the Board of Directors, including without limitation issuances of any new class or series of preferred stock

of the Corporation in a PIPE transaction .

(B) “Convertible

Securities” means any evidences of indebtedness, shares or other securities directly or indirectly convertible into or exchangeable

for Common Stock, but excluding Options.

(C) “Option”

means any rights, options or warrants to subscribe for, purchase or otherwise acquire Common Stock or Convertible Securities.

ii. No

Adjustment of Preferred Stock Conversion Price. No adjustment in the Conversion Price of the Preferred Stock shall be made as the

result of the issuance or deemed issuance of Additional Shares of Common Stock if the Corporation receives written notice from the holders

of a majority of the then outstanding shares of such Preferred Stock, agreeing that no such adjustment shall be made as the result of

the issuance or deemed issuance of such Additional Shares of Common Stock.

iii.

Deemed Issue of Additional Shares of Common Stock.

(A) If

the Corporation at any time or from time to time after the Original Issue Date shall issue any Options or Convertible Securities (excluding

Options or Convertible Securities which are themselves Exempted Securities) or shall fix a record date for the determination of holders

of any class of securities entitled to receive any such Options or Convertible Securities, then the maximum number of shares of Common

Stock (as set forth in the instrument relating thereto, assuming the satisfaction of any conditions to exercisability, convertibility

or exchangeability but without regard to any provision contained therein for a subsequent adjustment of such number) issuable upon the

exercise of such Options or, in the case of Convertible Securities and Options therefor, the conversion or exchange of such Convertible

Securities, shall be deemed to be Additional Shares of Common Stock issued as of the time of such issue or, in case such a record date

shall have been fixed, as of the close of business on such record date.

(B) If

the terms of any Option or Convertible Security, the issuance of which resulted in an adjustment to the Conversion Price of the Preferred

Stock pursuant to the terms of Section 7(b)(iv), are revised as a result of an amendment to such terms or any other adjustment pursuant

to the provisions of such Option or Convertible Security (but excluding automatic adjustments to such terms pursuant to anti-dilution

or similar provisions of such Option or Convertible Security) to provide for either (1) any increase or decrease in the number of shares

of Common Stock issuable upon the exercise, conversion and/or exchange of any such Option or Convertible Security or (2) any increase

or decrease in the consideration payable to the Corporation upon such exercise, conversion and/or exchange, then, effective upon such

increase or decrease becoming effective, the Conversion Price of such Preferred Stock computed upon the original issue of such Option

or Convertible Security (or upon the occurrence of a record date with respect thereto) shall be readjusted to such Conversion Price for

such Preferred Stock as would have obtained had such revised terms been in effect upon the original date of issuance of such Option or

Convertible Security. Notwithstanding the foregoing, no readjustment pursuant to this Section 7(b)(iii) shall have the effect of increasing

the Conversion Price applicable to the Preferred Stock to an amount which exceeds the lower of (i) the Conversion Price for such Preferred

Stock in effect immediately prior to the original adjustment made as a result of the issuance of such Option or Convertible Security,

or (ii) the Conversion Price for such Preferred Stock that would have resulted from any issuances of Additional Shares of Common Stock

(other than deemed issuances of Additional Shares of Common Stock as a result of the issuance of such Option or Convertible Security)

between the original adjustment date and such readjustment date.

(C) If

the terms of any Option or Convertible Security (excluding Options or Convertible Securities which are themselves Exempted Securities),

the issuance of which did not result in an adjustment to the Conversion Price of the Preferred Stock pursuant to the terms of Section

7(b)(iv) (either because the consideration per share (determined pursuant to Section 7(b)(v)) of the Additional Shares of Common Stock

subject thereto was equal to or greater than the applicable Conversion Price then in effect, or because such Option or Convertible Security

was issued before the Original Issue Date), are revised after the Original Issue Date as a result of an amendment to such terms or any

other adjustment pursuant to the provisions of such Option or Convertible Security (but excluding automatic adjustments to such terms

pursuant to anti-dilution or similar provisions of such Option or Convertible Security) to provide for either (1) any increase in the

number of shares of Common Stock issuable upon the exercise, conversion or exchange of any such Option or Convertible Security or (2)

any decrease in the consideration payable to the Corporation upon such exercise, conversion or exchange, then such Option or Convertible

Security, as so amended or adjusted, and the Additional Shares of Common Stock subject thereto determined in the manner provided in Section7(b)(iii)(A)

shall be deemed to have been issued effective upon such increase or decrease becoming effective.

(D) Upon

the expiration or termination of any unexercised Option or unconverted or unexchanged Convertible Security (or portion thereof) which

resulted (either upon its original issuance or upon a revision of its terms) in an adjustment to the Conversion Price of the Preferred

Stock pursuant to the terms of Section 7(b)(iv), the Conversion Price of such Preferred Stock shall be readjusted to such Conversion Price

for such Preferred Stock as would have obtained had such Option or Convertible Security (or portion thereof) never been issued.

(E) If

the number of shares of Common Stock issuable upon the exercise, conversion and/or exchange of any Option or Convertible Security, or

the consideration payable to the Corporation upon such exercise, conversion and/or exchange, is calculable at the time such Option or

Convertible Security is issued or amended but is potentially subject to adjustment based upon subsequent events, any adjustment to the

Conversion Price of the Preferred Stock provided for in this Section 7(b)(iii) shall be effected at the time of such issuance or amendment

based on such number of shares or amount of consideration without regard to any provisions for subsequent adjustments (and any subsequent

adjustments shall be treated as provided in clauses (B) and (C) of this Section 7(b)(iii)). If the number of shares of Common Stock issuable

upon the exercise, conversion and/or exchange of any Option or Convertible Security, or the consideration payable to the Corporation upon

such exercise, conversion and/or exchange, cannot be calculated at all at the time such Option or Convertible Security is issued or amended,

any adjustment to the Conversion Price of the Preferred Stock that would result under the terms of this Section 7(b)(iii) at the time

of such issuance or amendment shall instead be effected at the time such number of shares and/or amount of consideration is first calculable

(even if subject to subsequent adjustments), assuming for purposes of calculating such adjustment to the Conversion Price for such Preferred

Stock that such issuance or amendment took place at the time such calculation can first be made. In the event an Option or Convertible

Security contains alternative conversion terms, such as a cap on the valuation of the Corporation at which such conversion will be effected,

or circumstances where the Option or Convertible Security may be repaid in lieu of conversion, then the number of shares of Common Stock

issuable upon the exercise, conversion and/or exchange of such Option or Convertible Security shall be deemed not calculable until such

time as the applicable conversion terms are determined.

iv.

Adjustment of Conversion Price Upon Issuance of Additional Shares of Common Stock. In the

event the Corporation shall at any time after the Original Issue Date issue Additional Shares of Common Stock (including Additional Shares

of Common Stock deemed to be issued pursuant to Section 7(b)(iii)), without consideration or for a consideration per share less than the

Conversion Price of the Preferred Stock in effect immediately prior to such issuance or deemed issuance, then the Conversion Price for

such Preferred Stock shall be reduced, concurrently with such issue, to a price (calculated to the nearest one-hundredth of a cent) determined

in accordance with the following formula:

CP2 = CP1* (A + B) / (A + C).

For purposes of the foregoing formula, the

following definitions shall apply:

“CP2” shall mean the Conversion

Price of the Preferred Stock in effect immediately after such issuance or deemed issuance of Additional Shares of Common Stock.

“CP1”

shall mean the Conversion Price of the Preferred Stock in effect immediately prior to such issuance or deemed issuance of Additional Shares

of Common Stock;

“A” shall

mean the number of shares of Common Stock outstanding immediately prior to such issuance or deemed issuance of Additional Shares of Common

Stock (treating for this purpose as outstanding all shares of Common Stock issuable upon exercise of Options outstanding immediately prior

to such issuance or deemed issuance or upon conversion or exchange of Convertible Securities (including the Preferred Stock) outstanding

(assuming exercise of any outstanding Options therefor) immediately prior to such issue);

“B” shall mean the number of

shares of Common Stock that would have been issued if such Additional Shares of Common Stock had been issued or deemed issued at a price

per share equal to CP1 (determined by dividing the aggregate consideration received by the Corporation in respect of such issue by CP1);

and

“C” shall mean the number of

such Additional Shares of Common Stock issued in such transaction.

v.

Determination of Consideration. For purposes of this Section 7(b), the consideration received

by the Corporation for the issuance or deemed issuance of any Additional Shares of Common Stock shall be computed as follows:

(A) Cash

and Property. Such consideration shall:

(1) insofar

as it consists of cash, be computed at the aggregate amount of cash received by the Corporation, excluding amounts paid or payable for

accrued interest;

(2) insofar

as it consists of property other than cash, be computed at the fair market value thereof at the time of such issue, as determined in good

faith by the Board of Directors; and

(3) in

the event Additional Shares of Common Stock are issued together with other shares or securities or other assets of the Corporation for

consideration which covers both, be the proportion of such consideration so received, computed as provided in clauses (i) and (ii) above,

as determined in good faith by the Board of Directors.

(B) Options

and Convertible Securities. The consideration per share received by the Corporation for Additional Shares of Common Stock deemed to

have been issued pursuant to Section 7(b)(iii), relating to Options and Convertible Securities, shall be determined by dividing:

(1) The

total amount, if any, received or receivable by the Corporation as consideration for the issue of such Options or Convertible Securities,

plus the minimum aggregate amount of additional consideration (as set forth in the instruments relating thereto, without regard to any

provision contained therein for a subsequent adjustment of such consideration) payable to the Corporation upon the exercise of such Options

or the conversion or exchange of such Convertible Securities, or in the case of Options for Convertible Securities, the exercise of such

Options for Convertible Securities and the conversion or exchange of such Convertible Securities, by

(2) the

maximum number of shares of Common Stock (as set forth in the instruments relating thereto, without regard to any provision contained

therein for a subsequent adjustment of such number) issuable upon the exercise of such Options or the conversion or exchange of such Convertible

Securities, or in the case of Options for Convertible Securities, the exercise of such Options for Convertible Securities and the conversion

or exchange of such Convertible Securities.

vi.

Multiple Closing Dates. In the event the Corporation shall issue on more than one date Additional

Shares of Common Stock that are a part of one transaction or a series of related transactions and that would result in an adjustment to

the Conversion Price of the Preferred Stock pursuant to the terms of Section 7(b)(iv), and such issuance dates occur within a period of

no more than 180 days from the first such issuance to the final such issuance, then, upon the final such issuance, the Conversion Price

for the Preferred Stock shall be readjusted to give effect to all such issuances as if they occurred on the date of the first such issuance

(and without giving effect to any additional adjustments as a result of any such subsequent issuances within such period).

(c)

Subsequent Rights Offerings. In addition to any adjustments pursuant to Section 7(a) above,

if at any time the Corporation grants, issues or sells any Common Stock Equivalents or rights to purchase stock, warrants, securities

or other property pro rata to all of the record holders of any class of shares of Common Stock (the “Purchase Rights”),

then the Holder of will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which

the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete conversion of such

Holder’s Preferred Stock (without regard to any limitations on exercise hereof, including without limitation, the Beneficial Ownership

Limitation) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no

such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale

of such Purchase Rights (provided, however, to the extent that the Holder’s right to participate in any such Purchase Right would

result in the Holder exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled to participate in such Purchase

Right to such extent (or beneficial ownership of such shares of Common Stock as a result of such Purchase Right to such extent) and such

Purchase Right to such extent shall be held in abeyance for the Holder until such time, if ever, as its right thereto would not result

in the Holder exceeding the Beneficial Ownership Limitation).

(d)

Pro Rata Distributions. During such time as this Preferred Stock is outstanding, if the Corporation

shall declare or make any dividend or other distribution of its assets (or rights to acquire its assets) to holders of shares of Common

Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property

or options by way of a dividend, spin off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction)

(a “Distribution”), at any time after the issuance of this Preferred Stock, then, in each such case, the Holder shall

be entitled to participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held

the number of shares of Common Stock acquirable upon complete conversion of this Preferred Stock (without regard to any limitations on

conversion hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date of which a record is

taken for such Distribution, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to

be determined for the participation in such Distribution (provided, however, to the extent that the Holder’s right to participate

in any such Distribution would result in the Holder exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled

to participate in such Distribution to such extent (or in the beneficial ownership of any shares of Common Stock as a result of such Distribution

to such extent) and the portion of such Distribution shall be held in abeyance for the benefit of the Holder until such time, if ever,

as its right thereto would not result in the Holder exceeding the Beneficial Ownership Limitation).

(e)

Fundamental Transaction. If, at any time while this Preferred Stock is outstanding, (i) the

Corporation, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Corporation with or

into another Person, (ii) the Corporation, directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance

or other disposition of all or substantially all of its assets in one or a series of related transactions, (iii) any, direct or indirect,

purchase offer, tender offer or exchange offer (whether by the Corporation or another Person) is completed pursuant to which holders of

Common Stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the