NetworkNewsWire

Editorial Coverage: Every president wants a legacy and

President Joe Biden wants to put his stamp on climate change. Only

a few months into his term, President Biden has pledged to

slash U.S. greenhouse gas emissions by a minimum of 50–52 percent

by 2030, an undertaking that doubles the nation’s prior promise

under the 2015 Paris Climate Agreement. Further out, the target is

net zero carbon emissions by 2050. These aggressive goals require

immediate action, including addressing the fact that almost 40

percent all carbon dioxide pollution is created by power plants

burning fossil fuels. The International Energy Agency ("IEA")

recently published its comprehensive

plan to cap the global temperature rise to 1.5°C by 2050, which

includes a combination of wind, solar and nuclear to phase out

fossil fuels. Today, the world is at a tipping point for the energy

sector, presenting opportunities to capitalize on the epic

transformation. In the United States, Uranium Energy Corp.

(NYSE American: UEC) (Profile) is a leading player in low-cost and

environmentally friendly in-situ recovery

("ISR") mining of uranium, the essential element that fuels

nuclear energy. There are also investing strategies directed

at the electric vehicle market, including Blink

Charging (NASDAQ: BLNK) and top solar companies like

Canadian

Solar (NASDAQ: CSIQ) or more diversified approaches,

such as The

Global X Uranium ETF (NYSE: URA) and Energy

Select Sector SPDR Fund (NYSE: XLE).

- Research indicates that more than 20% of all energy worldwide

could come from nuclear by 2050.

- Texas-based UEC is a pure-play American uranium company.

- UEC has the largest resource base of fully permitted ISR

projects of any U.S. based producer

- UEC also owns or has contracted for 2.305 million pounds of

U.S. warehoused uranium; also has a large stake in Uranium Royalty

Corp.

Click here to view

the custom infographic of Uranium

Energy Corp editorial.

IEA Game Plan Shows Goals Achievable with Nuclear,

Renewables

While it’s certainly a challenging task to reshape the entire

energy industry, the IEA sees a clear pathway to attaining the

global goal of net zero emissions by prioritizing events to

diminish reliance on fossil fuels. In the next three decades, the

world’s population will approach 10 billion people. This will

require setting new standards for decarbonization and implementing

actions through concerted efforts among countries investment and

energy policies.

The IEA strategy envisions about 70% of the world’s electricity

coming from renewable sources such as solar and wind by 2050.

Nuclear energy could contribute more than 20% by mid-century.

Nuclear is critical to infrastructure for the global fleet of

electric vehicles, which are expected to spike from about 8.5

million cars on the road in 2020 to 116 million by 2030. To keep up

with charging demand, the World Nuclear Association sees the need

for 25 additional

nuclear reactors exclusively for the boom in EVs.

A Spate of Diversified Uranium Assets

With the writing on the wall, interest in uranium has

understandably risen, and shares of Uranium Energy

Corp. (NYSE American: UEC) have garnered attention. Texas-based

UEC stands out as a pure-play American uranium company that

includes a portfolio of near-production ISR

projects and hub-and-spoke operations anchored by its fully

licensed Hobson Processing Facility in Texas. The portfolio also

contains Reno Creek, the U.S.’s biggest permitted, preconstruction

ISR uranium project and a pipeline of resource-stage uranium

project across Arizona, New Mexico, Colorado and Paraguay.

Further, UEC owns a large equity position in Uranium Royalty

Corp. and a growing inventory of physical uranium warehoused in

America that it is stockpiling at low prices for what is expected

to be strong future demand. In the heart of South America, UEC’s

Alto Parana project in Paraguay is considered one of the

highest-grade and largest ferro-titanium deposits in the world.

Savvy Spending to Build Value

Uranium Energy holds 15 million

shares of Uranium Royalty Corp., the only public uranium

royalty company. Uranium Royalty trades on both the NASDAQ and

TSX-Venture exchanges, with its market capitalization currently

around C$250 million, based upon QuoteMedia data and a stock price

of C$3.19. UEC was in on the company early and has an average cost

basis of just C$1.09 per share.

As for its physical uranium initiative, UEC reported owning or

having contracts with delivery dates out to June 2023 for 2.305

million pounds of uranium at the end of the most recent completed

quarter, ended April 30, 2021. Management

estimates the current inventory in UEC’s possession to be

valued at approximately $26.2 million. Even assuming no

appreciation in uranium pricing, the complete inventory once all

delivery is taken will be approaching $50 million. In the quarterly

report disclosing this information, the company stated that the

total of its cash on hand, equity in Uranium Royalty and physical

uranium position was worth about $123.4 million at the end of

April.

UEC: Ahead of the Emerging U.S. Market

The United States is set up to be a thriving uranium market.

Uranium is well documented to be safe and reliable nuclear energy

feedstock. Nuclear energy already is the largest source of

carbon-free power generation in the U.S. and the second biggest

source of electricity in the country, period. No other country in

the world has more nuclear reactors operating than the United

States.

Almost amazingly, however, the U.S. has effectively no domestic

uranium production today. Almost all of the country’s supply is

imported or coming from inventory. State-owned enterprises in the

former Soviet Union countries, including Russia, are flooding the

market with cheap uranium and distorting global markets. China is

also making inroads into the U.S. market with uranium that free

market companies cannot compete with.

The U.S. government has recognized the threat to American energy

and national security and addressed the problem in a Department of

Energy report: Restoring America’s Competitive Nuclear Energy

Advantage. The result will be implementation of a Strategic Uranium

Reserve program that was recently passed by Congress to stimulate

growth in the domestic uranium mining industry.

When that faucet is turned on, UEC will be instrumental with its

fully permitted, near-production projects (Palangana, Goliad, Burke

Hollow and Reno Creek) that host 32.6 million pounds in the

Measured and Indicated category and 11 million pounds in the

Inferred category. UEC has the largest resource base of fully

permitted ISR projects of any U.S. based producer. It bears

repeating that these are ISR projects, widely recognized to be less

expensive to operate and environmentally friendly, qualities that

make them quite attractive compared to hard-rock mining.

This goes without mentioning the integrated nature of UEC with

its permitted, state-of-the-art Hobson Processing facility that has

capacity of 2 million pounds per annum. In total, UEC has a

production profile of 4 million pounds of production annually.

Looking Beyond Uranium

With its infrastructure and assets, UEC is in an enviable

position when it comes to uranium miners in the U.S. That said,

there are a number of other companies that have emerged as leaders

in clean energy areas that are positioned to capitalize on the

global goal of drastically reducing carbon emissions.

Blink Charging

(NASDAQ: BLNK) is a leading owner, operator and

provider of electric vehicle ("EV") charging equipment and

networked EV charging services. Blink has thousands of EV chargers

deployed across the U.S. at an impressive array of locations and

also has a proprietary cloud-based software that operates,

maintains, and tracks all the Blink EV charging stations and the

associated charging data; EV charging equipment; and EV-related

services. This month, Blink deployed 10 IQ

200 2 EV charging stations at three locations of AtlantiCare

Integrated Healthcare System, the largest healthcare organization

in Southern New Jersey, representing the first into the AtlantiCare

ecosystem.

Canadian

Solar (NASDAQ: CSIQ) has been around for 20 years,

growing into one of the world's largest solar technology and

renewable energy companies in that time. A leading manufacturer of

solar photovoltaic ("PV") modules, provider of solar energy and

battery storage solutions, and developer of utility-scale solar

power and battery storage projects, Canadian Solar has successfully

delivered over 55 GW of premium-quality, solar PV modules to

customers in over 150 countries. During Q1 2021, the company

shipped 3.1 GW

of solar PV modules, helping revenue to surge 32%

year-over-year to $1.1 billion.

The

Global X Uranium ETF (NYSE: URA) provides investors

access to a broad range of companies involved in uranium mining and

the production of nuclear components, including those in

extraction, refining, exploration, or manufacturing of equipment

for the uranium and nuclear industries. As of June 21, 2021, the

fund has 38 holdings spanning 10 countries with net assets of

$741.5 million. The fund also provides research, such as insights

on why the uranium market is “primed for

growth.”

Energy

Select Sector SPDR Fund (NYSE: XLE) is the oldest

exchange-traded

fund focused on the energy business. It is also currently the

largest energy ETF with approximately $25 billion in assets under

management. The fund seeks to provide investment results that,

before expenses, correspond generally to the price and yield

performance of the Energy Select Sector Index. Under normal market

conditions, the fund generally invests substantially all, but at

least 95%, of its total assets in the securities comprising the

Index.

Leaders worldwide know that changes have to be made to fight

climate change. Up until now it has been a bit of a slow roll,

though. With 2030 and 2050 right around the corner, the pace has to

be accelerated starting right now and the IEA nailed it by calling

for the redirection of investment capital away from fossil fuels

and into greener technologies. It appears that leaders everywhere

recognize that it is time to act — and act swiftly.

For more information about Uranium Energy Corp (NYSE

American: UEC), please visit Uranium Energy

Corp.

About NetworkNewsWire

NetworkNewsWire

(“NNW”) is a financial news and content distribution company, one

of 50+ brands within the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to

reach all target markets, industries and demographics in the most

effective manner possible; (2) article and

editorial syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a full

array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

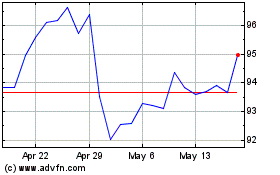

Energy Select Sector SPDR (AMEX:XLE)

Historical Stock Chart

From Oct 2024 to Nov 2024

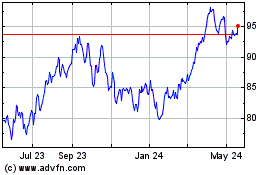

Energy Select Sector SPDR (AMEX:XLE)

Historical Stock Chart

From Nov 2023 to Nov 2024