TIDMBOOT

RNS Number : 5491A

Boot(Henry) PLC

25 May 2023

25 May 2023

HENRY BOOT PLC

('Henry Boot' or 'the Group')

AGM TRADING UPDATE

Tim Roberts, Chief Executive Officer, commented:

"We have started the year well and following the uncertain

economic backdrop to the final quarter of 2022, there are growing

signs of recovery in our three key markets. We expect this to

continue, and for us to have a busy second half of the year. We

also continue to make progress against our medium-term strategic

targets".

Henry Boot has started the year well, trading in line with

expectations*, whilst making continued progress against its

medium-term strategic objectives. The Group's three key markets,

Industrial & Logistics (I&L), Residential and Urban

Development are showing signs of recovery. The I&L market

remains resilient, supported by rental growth, and housebuilders

are selectively buying land, with the Group recently selling, and

receiving offers for a number of sites. House buyers are returning

to the market after a downturn in demand from Q4 22, although the

selling season through Spring and Summer remains important.

Hallam Land Management (HLM) has begun the year well, selling

1,900 plots. Following a pause from buying land at the end of 2022,

there are signs of housebuilders returning to the market, with

selective acquisitions and encouraging levels of interest in HLM's

portfolio of prime plots. Key disposals so far in the year

include:

-- 612 plots (HLM Share) in Milton Keynes, Buckinghamshire to Taylor Wimpey;

-- 471 plots in Kilmarnock, East Ayrshire, to Barratt David Wilson;

-- 250 plots in Eastern Green, Coventry, to Countryside Partnerships; and

-- 81 plots in Tonbridge, Kent, to Cala Homes.

In addition to plots sold, HLM have various sites under offer,

which are likely to contribute towards both sales targets and

profit in 2023 and 2024. HLM continues to replenish its land bank,

which remains stable at 95,478 plots, of which 12,288 plots are

awaiting planning determination. Unfortunately, delays within the

UK planning system continue, with the business achieving planning

permission on 379 plots. Whilst this is frustrating, it does mean

our 7,910 plots with planning will be in demand.

Anticipating slower markets in the spring of 2022, HBD reduced

development activity. However, there has continued to be occupier

demand in the I&L market, coupled with stabilising yields and

investors returning to the market. The Build-to-Rent (BtR) market

remains strong in terms of customer demand and investors are again

looking to fund development.

As a result of market conditions and the completion of the

426,000 sq ft I&L scheme, Power Park, in Nottingham (GDV:

GBP54m), the committed development programme has marginally

reduced, but remains on time and budget, with 57% of the schemes

pre-let or pre-sold. The Group has also continued to replenish its

committed programme by adding two new projects at Airport Business

Park, its 52 acre I&L scheme in Southend, to develop a combined

c.156,000 sq ft of warehouse space (GDV: GBP19m). Both projects

have been pre-sold.

Within the GBP1.25bn development pipeline there are a number of

I&L schemes that HBD expects to commit to over the course of

2023, where healthy occupier demand is anticipated. HBD also

continues to replenish the development pipeline, and in the year

has acquired a 62-acre site in Preston, in a 50:50 Joint Venture.

HBD will continue to selectively secure further opportunities.

At Golden Valley, Cheltenham, HBD is preparing to submit a

planning proposal for the first phase of the scheme (HBD share:

GBP50m GDV), which comprises the delivery of a mixed-use campus

clustered around 150,000 sq ft of innovation space. After securing

planning approval at Neighbourhood, Birmingham (GDV: GBP140m), in

Q1 23 for a 414-unit BtR development, the aim is to secure funding

for this scheme over the Summer.

In relation to the GBP106m investment portfolio, values are

beginning to stabilise. After making well timed accretive sales in

2022, the Group will be patient in growing the portfolio to the

strategic target of GBP150m. This will primarily be achieved by

retaining completed developments that meet the investment criteria

and by acquiring investments with future redevelopment

potential.

Stonebridge Homes (SH) has already secured 71% of its 2023

delivery target of 250 homes, achieving a sales rate of 0.52 houses

per week per outlet in the first 18 weeks of the year, with house

prices remaining relatively firm. Cost inflation remains a

challenge but is beginning to moderate, and there are early signs

of an improvement in key trade availability, material delivery lead

times and general cost pressures.

Against a backdrop of economic uncertainty and increased

mortgage costs, house prices have remained resilient. There

continues to be customer interest and this, along with improved

mortgage rate affordability and product availability, leaves SH

encouraged by the start of the year. However, SH will rely on

achieving marginally higher sales rates in the important Spring and

Summer selling season. SH will also look to take advantage of

current market conditions by selectively securing sites that will

grow its land bank and further support its medium-term growth

target of delivering 600 homes per annum.

Henry Boot Construction has secured 72% of its 2023 order book

and remains focused on securing the remainder of the targeted

budget. Despite experiencing delays and challenges with the supply

chain and material deliveries, work on both the GBP42m urban

development scheme in the Heart of Sheffield, and the GBP47m BtR

residential scheme, Kangaroo Works in Sheffield, is heading towards

a summer 23 completion. The Cocoa Works, a GBP47m residential

development in York, remains on time and budget.

Both Banner Plant and Road Link (A69) are trading in line with

budget.

Finally, the Group is making good progress against its

Responsible Business Strategic objectives, and this month launched

a new mental health campaign, which forms part of Henry Boot's

Health and Wellbeing Programme. The campaign provides people with

direct access to mental health experts, as well as more information

on the resources available to support them with their own and

others' mental health.

In addition, the Group's new head office, Isaacs Building in

Sheffield City Centre, has now achieved practical completion. The

building offers strong ESG credentials and will provide people with

a more open and collaborative workspace. Fit out works have

commenced, with the aim to move into the new office by Autumn

2023.

Outlook

There are encouraging signs within our three key markets,

particularly within the I&L and Residential markets, where

signs of early momentum are building. The Group remains cautious in

light of the current economic environment and expects that activity

in 2023 will continue to improve, which will contribute towards

2024 performance and beyond.

Looking ahead, the Group is well placed, supported by a solid

balance sheet and a store of opportunities, placing the business in

a strong position to achieve its medium-term strategic objectives

and growth targets.

*Market expectations being the average of current analyst

consensus of GBP37.8m profit before tax, comprising three forecasts

from Numis, Peel Hunt and Panmure Gordon.

For further information, please contact:

Enquiries:

Henry Boot PLC

Tim Roberts, Chief Executive Officer

Darren Littlewood, Chief Financial Officer

Daniel Boot, Group Communications Manager

Tel: 0114 255 5444

www.henryboot.co.uk

Numis Securities Limited

Joint Corporate Broker

Ben Stoop / Will Rance

Tel: 020 7260 1000

Peel Hunt LLP

Joint Corporate Broker

Harry Nicholas

Tel: 020 7418 8900

FTI Consulting

Financial PR

Giles Barrie/ Richard Sunderland

020 3727 1000

henryboot@fticonsulting.com

About Henry Boot PLC

Henry Boot PLC (BOOT.L) was established over 135 years ago and

is one of the UK's leading and long-standing property investment

and development, land promotion and construction companies. Based

in Sheffield, the Group is comprised of the following three

segments:

Land Promotion:

Hallam Land Management Limited

Property Investment and Development:

HBD (Henry Boot Developments Limited), Stonebridge Homes

Limited

Construction:

Henry Boot Construction Limited , Banner Plant Limited , Road

Link (A69) Limited

The Group possess a high-quality strategic land portfolio, an

enviable reputation in the property development market backed by a

substantial investment property portfolio and an expanding, jointly

owned, housebuilding business. It has a construction specialism in

both the public and private sectors, a long-standing plant hire

business, and generates strong cash flows from its PFI contract

through Road Link (A69) Limited.

www.henryboot.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMPPUQAAUPWGWC

(END) Dow Jones Newswires

May 25, 2023 02:00 ET (06:00 GMT)

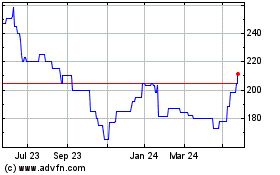

Henry Boot (AQSE:BOOT.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

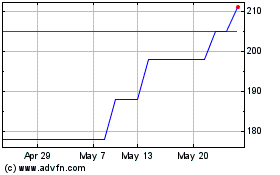

Henry Boot (AQSE:BOOT.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025