TIDMBOOT

RNS Number : 5114A

Boot(Henry) PLC

23 January 2024

23 January 2024

HENRY BOOT PLC

('Henry Boot' or 'the Group')

TRADING UPDATE FOR THE YEARED 31 DECEMBER 2023

Henry Boot PLC, a Company engaged in land promotion, property

investment and development, and construction, is today issuing a

trading update for the year ended 31 December 2023 ahead of the

announcement of its full year results on 25 March 2024.

Tim Roberts, Chief Executive Officer commented:

"Despite challenging market conditions for our three key

markets, our ongoing focus on high quality land and development in

prime locations resulted in a resilient performance in 2023. We

therefore expect profit before tax for the year to be in line with

current market consensus(1). Furthermore, we have maintained a

strong financial position and continued to invest in the business

to ensure we are well placed as our markets begin to recover.

While the housebuilding sector has seen slowing sales rates, our

land business is experiencing continued demand for strategic sites

with planning in premium locations, as highlighted by the recently

announced sale in Swindon, and we continue to selectively grow our

land bank. Our development business has performed ahead of

expectations, while the investment portfolio is on track to

outperform the wider market, helped by the sale of five properties,

at an average premium of 23% to December 2022 valuations. The

Group's premium housebuilder has also grown, having increased its

output by 43% during the year.

With a path to lower inflation and improved interest rates,

whilst there will undoubtedly be bumps along the way, the economy

and our markets have turned a corner, but we expect our results for

2024 to be impacted by these factors. We continue to firmly believe

that Henry Boot remains well placed to achieve its medium term

growth and return objectives."

Trading update for the year ended 31 December 2023

Henry Boot has performed well against the backdrop of a slowing

economy, and higher interest rates, generating robust sales within

its property development and strategic land businesses. Despite

activity reducing in our three key markets of Industrial &

Logistics, Residential and Urban Development, our focus on high

quality land and development in prime locations has meant the

business has performed resiliently. Consequently, the Group expects

profit before tax for the year ended 31 December 2023 to be in line

with current market consensus(1).

Throughout 2023, the Group maintained its focus on investing in

its prime land portfolio, building out its high quality committed

development programme and continuing to grow its premium

housebuilder, Stonebridge Homes (SH). Progress has also been made

against our medium term objectives, which focus on growing the

business and driving sustained returns. This strategic focus,

alongside continued investment to support our long term ambitions

(including the head office relocation, people, marketing, digital

and technological upgrades) resulted in an increase in net debt to

c.GBP77m (2022: GBP48.6m). The Group remains in a strong financial

position with a robust balance sheet, although gearing at year end

was towards the top end of the optimum stated range of 10-20%.

Hallam Land Management (HLM) traded well, selling 1,944 plots

(2022: 3,869). Although the number of plots sold in 2023 reduced,

average gross profit per plot increased due to the significant

disposal of freehold land at Tonbridge, Kent.

There continues to be demand for HLM's strategically located

premium sites as shown by our recent significant sale in Swindon,

which is contracted for completion in two phases during H2 2024 and

H1 2026. Over 20 years ago HLM, in partnership with Taylor Wimpey,

secured an option on the site which in August 2021 received outline

planning consent for a total of 2,380 plots. In December 2023 a

contract was exchanged to acquire the land whilst simultaneously

exchanging to sell 759 plots (HLM's share) to Vistry, generating an

IRR of 10% p.a. The scheme includes local community benefits such

as a new primary school, community and sport buildings as well as

woodlands and green infrastructure. HLM will retain 304 plots for

future sale.

HLM continued to grow its land bank and during the year secured

18 new sites which have the potential to deliver c.7,212 plots. The

total land portfolio has increased to 100,972 plots (2022: 95,704

plots) of which 8,501 plots have planning. HLM remains on course to

achieve its medium term target of disposing an average of 3,500

plots p.a.

HBD has performed ahead of expectations, with continued growth

of its completed schemes to a Gross Development Value (GDV) of

GBP126m (HBD share GBP111m, 2022: HBD share GBP83m), of which 100%

have been pre-let or pre-sold. In the year, HBD completed on:

-- Three industrial schemes totalling 661,000 sq ft with a

combined GDV of GBP104m (HBD share: GBP89m).

-- The Disabilities Trust, York (HBD share: GBP22m GDV), a

54,000 sq ft scheme with state of the art care facilities. The

building is low carbon and has achieved a BREEAM Excellent

assessment rating.

The committed development programme now totals a GDV of GBP299m

(HBD share: GBP159m) and is currently 48% pre-let or pre-sold with

98% of development costs fixed. The three high quality speculative

schemes; Setl, Momentum and Island are expected to generate

interest from occupiers as they progress toward completion during

2024. Whilst the committed development programme has reduced in

value, HBD has optionality on a significant near-term pipeline of

occupier-led schemes with a combined GDV of over GBP200m which,

subject to market conditions, have the potential to start on site

over the next twelve months.

In December 2023, following the buyout of its JV partner, HBD

became the sole developer of Cheltenham, Golden Valley, a GBP1bn

GDV mixed-use campus, including the new National Cyber Innovation

Centre. A GBP95m funding agreement with Cheltenham Borough Council

for the delivery of phase one has now been secured as well as a

GBP20m pledge from the Department for Levelling Up, Housing and

Communities. Following planning, construction of phase one is

expected to commence in 2025.

The total value of the investment portfolio (including share of

JVs) has increased to c.GBP113m (December 2022: GBP106m). In 2023,

four investment properties were sold, along with Banner Cross Hall,

the Group's former HQ, for a total value of GBP12.7m, at an average

23% premium to December 2022 valuations. In addition to the sales,

two completed developments at Luton and Markham Vale with a total

value of GBP18m were retained. Whilst the CBRE UK Monthly Index

showed commercial property capital values fell by 3.9% in 2023, the

investment portfolio is expected to have outperformed the wider

market. The Group will continue to retain selective developments

from its committed programme, in line with its strategic aim to

grow the investment portfolio to GBP150m.

SH has continued to grow, increasing its output by 43% in 2023,

completing 251 homes (2022: 175), in line with its medium term

target of delivering 600 units. The UK housing market was

relatively subdued throughout last year, however the focus on

premium homes in prime locations allowed SH to achieve its annual

sales target. With the stabilisation of mortgage rates toward the

end of the year, SH reservations rate improved to 0.46 homes per

site per week in Q4 2023, up from 0.36 in Q4 2022. Supply chain

availability and cost pressures moderated throughout last year,

with discussions with both suppliers and subcontractors ongoing to

mitigate further cost inflation. SH total owned and controlled land

bank now comprises 1,513 plots (2022: 1,094) - of which 923 plots

have detailed or outline planning.

The construction segment traded below expectations in 2023 but

remained profitable. Along with the wider market, Henry Boot

Construction (HBC) experienced difficult operating conditions, with

performance on two significant projects impacted by the

availability of materials and the resultant delays. HBC begins 2024

with 46% of its order book secured and is actively pursuing an

encouraging number of new opportunities. Banner Plant traded

slightly below budget in 2023 and in response has adjusted its

sales strategy. Road Link has traded in line with expectations.

Outlook

Looking ahead, we remain confident in the structural growth of

our markets, and our ability to achieve Henry Boot's medium term

objectives. Aside from the small increase in inflation in December,

the outlook for both inflation and interest rates are improving,

and with mortgage rates falling, it feels as though the UK economy

has turned a corner. With this in mind, plus cautious signs of

recovery in our three key markets, there is optionality to grow our

commitments and sales.

The Group is well positioned to benefit when our end markets

recover, however we expect there will be a lag in performance due

to the time it takes for projects and sales to complete. Whilst it

is encouraging that sales rates have improved within SH, and we

expect this trend to continue, we are now more conservative with

our estimates of completions for 2024 and anticipate the impact

from a recovery in residential sales will be more weighted to

2025.

Due to extended payment profiles with major housebuilders on

strategic land sales, we anticipate gearing to remain towards the

upper end of our optimum range of 10-20% through 2024, and given

the higher interest rate environment, we anticipate this will also

impact profit for the year ahead.

Taking these factors into consideration, the Board now expects

profitability for 2024 to be significantly below current market

consensus(2). Notwithstanding this the Board continue to believe

that Henry Boot remains well placed to achieve its medium term

growth and return objectives.

(1) Company compiled market consensus for 2023 profit before tax

is GBP37.2m, comprising the average of three forecasts from

Deutsche Numis, Peel Hunt and Panmure Gordon.

(2) Company compiled market consensus for 2024 profit before tax

is GBP37.2m, comprising the average of three forecasts from

Deutsche Numis, Peel Hunt and Panmure Gordon.

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014), as it forms part of domestic law by

virtue of the European Union (Withdrawal) Act 2018) ("MAR") prior

to its release as part of this announcement and is disclosed in

accordance with the Company's obligations under Article 17 of those

Regulations.

-ends-

The person responsible for making this announcement on behalf of

Henry Boot is Amy Stanbridge, Company Secretary.

Enquiries:

Henry Boot PLC

Tim Roberts, Chief Executive Officer

Darren Littlewood, Chief Finance Officer

Daniel Boot, Senior Corporate Communications Manager

Tel: 0114 255 5444

www.henryboot.co.uk

Deutsche Numis

Joint Corporate Broker

Ben Stoop

Tel: 020 7260 1000

Peel Hunt LLP

Joint Corporate Broker

Ed Allsopp/Charles Batten

Tel: 020 7418 8900

FTI Consulting

Financial PR

Giles Barrie/Richard Sunderland

Tel: 020 3727 1000

henryboot@fticonsulting.com

About Henry Boot PLC

Henry Boot PLC (BOOT.L) was established over 135 years ago and

is one of the UK's leading and long-standing property investment

and development, land promotion and construction companies. Based

in Sheffield, the Group is comprised of the following three

segments:

Land Promotion:

Hallam Land Management Limited

Property Investment and Development:

Henry Boot Developments Limited (HBD) , Stonebridge Homes

Limited

Construction:

Henry Boot Construction Limited , Banner Plant Limited , Road

Link (A69) Limited

The Group possesses a high-quality strategic land portfolio, a

proven reputation in the property development market for creating

places with purpose, backed by a substantial investment property

portfolio and an expanding, jointly owned, housebuilding business.

It has a construction specialism in both the public and private

sectors, a plant hire business, and generates strong cash flows

from its PFI contract, Road Link (A69) Limited.

www.henryboot.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKFAALALEFA

(END) Dow Jones Newswires

January 23, 2024 02:00 ET (07:00 GMT)

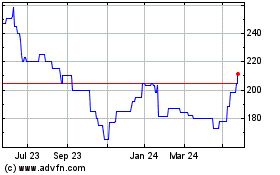

Henry Boot (AQSE:BOOT.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

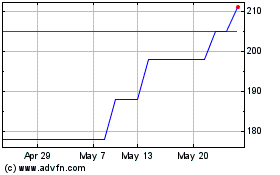

Henry Boot (AQSE:BOOT.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025