TIDMCCT

RNS Number : 4258W

Character Group PLC

12 December 2023

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

THE CHARACTER GROUP PLC

("Character", the "Company")

Designers, developers and international distributor of toys,

games, and giftware

Annual results for the year ended 31 August 2023

"Results in line with market expectations"

EXECUTIVE REVIEW

KEY PERFORMANCE INDICATORS

12 months 12 months ended

ended 31 August 2022

31 August

2023

----------- ----------------

Revenue GBP122.6m GBP176.4m

----------- ----------------

Operating profit before highlighted items

* GBP5.3m GBP11.4m

----------- ----------------

Profit before tax before highlighted items

* GBP5.2m GBP11.3m

----------- ----------------

Statutory profit before tax GBP4.7m GBP11.4m

----------- ----------------

EBITDA

(earnings before interest, tax, depreciation

and amortisation), before highlighted items GBP8.9m GBP14.2m

----------- ----------------

Basic earnings per share before highlighted

items* 20.15p 45.73p

----------- ----------------

Diluted earnings per share before highlighted

items* 20.00p 44.77p

----------- ----------------

Basic earnings per share after highlighted

items 18.08p 46.37p

----------- ----------------

Diluted earnings per share after highlighted

items 17.95p 45.39p

----------- ----------------

Dividends declared per share for the year 19.0p 17.0p

----------- ----------------

Net assets GBP39.4m GBP38.9m

----------- ----------------

Net cash GBP9.6m GBP20.0m

----------- ----------------

*Excludes: Mark to market (loss)/profit

adjustments on FX derivative positions GBP(0.5m) GBP0.2m

----------- ----------------

BUSINESS HIGHLIGHTS

* The resilience of the business to bounce back with an

anticipated stronger second half performance was

greatly assisted by the overall quality and depth of

our product portfolio delivering an overall gross

margin uplift and a profit before tax and highlighted

items of GBP5.2m

* Our enlarged merchandise portfolio, features exciting

and strong new toy product releases and brand

extensions including:

* Goo Jit Zu , Chill Factor , Teenage Mutant Ninja

Turtles , Fingerlings , Lankey Box and Aphmau - other

new ranges to be launched at the 2024 London Toy Fair

* Whilst the UK and Irish domestic markets will always

remain critical to Character, the Board recognises

that opportunities for significant sales and profit

growth lie in further developing the Group's

international markets

* Character Group continues to have a strong product

offering, a robust balance sheet, with a net cash

position cash and considerable unutilised working

capital facilities in place

* Despite a challenging macro-economic environment, the

business continues to trade satisfactorily, therefore

we expect to increase sales and profitability for the

current financial year as a whole, relative to FY

2023

INTRODUCTION

In May 2023 we reported that, although the first half of the

financial year had been disappointing owing to the challenging

trading conditions, we expected the second half to deliver a

significant improvement in the Group's revenue and profitability.

We are therefore pleased to report that the anticipated stronger H2

performance, with revenues up on H1 outturn by 12%, has enabled the

Group to deliver profit before tax and highlighted items in line

with market expectations.

We acknowledge that many of the challenging conditions, such as

the reduction in consumer spending and cost of living crisis,

affected the Group's trading performance throughout the year and

continue to impact the retail environment. Whist this has truly

tested the strength of the Character proposition, we are pleased

that the overall result endorsed the approach of our

management.

The resilience of the business to bounce back with a strong

second half performance was greatly assisted by the overall quality

and depth of our product portfolio delivering an overall gross

margin uplift and a profit before tax and highlighted items of

GBP5.2m.

OPERATIONAL PERFORMANCE

Group revenue in the year ended 31 August 2023 was GBP122.6m,

against GBP176.4m in the comparable 2022 period.

The gross profit margin was 26.7% (FY 2022: 23.4%). On an

absolute basis, gross profit reported is GBP32.8m compared to

GBP41.4m for the previous year. The profit before tax and

highlighted item was GBP5.2m (2022: GBP11.3m).

A significant proportion of the Group's purchases are made in US

dollars; therefore the business is exposed to foreign currency

fluctuations. It manages the associated risk through the purchase

of forward exchange contracts and derivative financial instruments.

Under International Financial Reporting Standards (IFRS), at the

end of each reporting period the Group is required to make an

adjustment in its financial statements to incorporate a "mark to

market" valuation of such financial instruments. The "mark to

market" adjustment for this financial period results in a notional

loss of GBP0.5m. This compares to a corresponding notional profit

of GBP0.2m reported in the year to 31 August 2022. These "mark to

market" adjustments are non-cash items calculated by reference to

unpredictable and sometimes volatile currency spot rates at the

relevant balance sheet dates. To present the results on a "normal"

basis, these "mark to market" profit adjustments on FX derivative

positions are excluded, although shown separately as "highlighted

items" to demonstrate the "underlying" position.

The Group is reporting a profit before tax in the period, after

highlighted items, of GBP4.7m (FY 2022: GBP 11.4 m). Underlying

earnings before interest, tax, depreciation and amortisation were

GBP8.9m (FY 2022: GBP14.2m).

Underlying basic earnings per share before highlighted items

amounted to 20.15p (FY 2022: 45.73 p). Diluted earnings per share,

on the same basis, were 20.0p (FY 2022: 44.77p).

Basic earnings per share after highlighted items were 18.08p (FY

2022: 46.37p). Diluted earnings per share, on the same basis, were

17.95p (FY 2022: 45.39p).

FINANCIAL POSITION, WORKING CAPITAL & CASH FLOW

The Group's net assets at 31 August 2023 totalled GBP39.4m (31

August 2022: GBP38.9m).

Inventories were c.GBP 8.2m lower at the end of the financial

period at GBP18.0m (31 August 2022: GBP26.2m).

During the period, the Group generated cash from operations of

GBP0.1m (FY 2022: GBP4.2m). Net interest charges on short-term use

of working capital facilities during the year amounted to GBP 0.1 m

(FY 2022: GBP 0.2 m).

At the end of the financial year, the Group had a net cash

position of GBP9.6m, compared to GBP20.0m at the end of the 2022

comparative period.

DIVID

The Directors will be recommending to shareholders a final

dividend of 11.0p (H2 2022: 10 .0 p per share). This, together with

the interim dividend of 8 .0 p per share paid in July 2023, will

bring the total dividend for the year to 19.0p per share (FY 2022:

17 .0 p), an increase of c.12%. The total dividend is covered

approximately 1.1 times by underlying annual earnings (2022: 2.7

times).

Subject to approval by shareholders at the Annual General

Meeting ("AGM") which is scheduled to be held at 11am on Friday, 19

January 2024, the following distribution timetable will apply:

Event Date

------------- ----------------

Ex-dividend 11 January 2024

date

Record date 12 January 2024

Payment date 26 January 2024

OUR PRODUCT PORTFOLIO

The second half rebound was supported by the roll out of our

enlarged 2023 spring/summer merchandise portfolio, featuring some

exciting and strong new toy product releases and brand extensions:

Goo Jit Zu , Chill Factor , Teenage Mutant Ninja Turtles ,

Fingerlings , Lankey Box and Aphmau .

The Group continues to develop its own products which allows it

to access international markets and is not merely dependent on

distribution within our original domestic markets in the UK and

Ireland.

Once again Character's products featured in the official 2023

Toy Retailers Association Dream listing. Selected by an independent

panel of toy retailers and toy experts the annual DreamToys bills

itself as the most authoritative prediction of what are expected to

be the hottest new toys on the high street this festive season.

We are delighted to have achieved triple success from our

portfolio in the Top 20 with:

* Teenage Mutant Ninja Turtles Pizza Fire Van

* Fingerlings Monkey ASST

* MINTiD Dog-E

The Group is launching several new product ranges at the London

Toy Fair in January 2024 and the customer reactions to previews so

far have been very encouraging.

The Group's current portfolio of products and brands can be

viewed at www.character-online.com .

PROXY

The Scandinavian markets have been subjected to very similar

conditions to our domestic market in the UK and the weakness of the

Swedish Krona against the US Dollar in particular resulted in the

Swedish Krona reaching all-time lows in currency markets. Despite

this, Proxy contributed to the Group's profit that was generated in

the second half of the financial year.

The integration of Proxy into the Group has been continuing with

the alignment of processes and procedures being achieved during the

year under review.

Proxy's existing stable of hero products, Pokémon ( from

Jazwares) and the extensive range of Funko collectable Pop!

figurines, have all sold well during the year. These solid brands

are being augmented as we move into 2024 by the addition of:

* Topps Trading Cards - based on the 2024 UEFA European

Football Championship; and

* Littlest Pet Shop - a well-known collectible toy

brand in Scandinavia

This should enable Proxy to continue to increase its

turnover.

SHARE BUY-BACK PROGRAMME

In the period under review, no ordinary shares in the Company

were acquired in exercise of the authority granted at the AGM in

January 2023, which authority will expire at the 2024 AGM.

It remains part of the Group's overall strategy to continue to

repurchase the Company's own shares, when considered appropriate.

The Board believes that it is in the Company's and investors'

interests to provide shareholders who wish to realise part or all

of their investment in the Company with an opportunity to access

liquidity that is not otherwise available in the market and to

return excess capital to shareholders. Therefore, the Board will be

seeking a new authority to buy back up to 2,890,000 ordinary shares

(representing approximately 15% of the total voting rights in the

Company) at the 2024 AGM. This authority will also allow the

Company to implement buybacks either by way of an announced buyback

programme or by way of tenders for its issued shares. Details of

any intention to exercise this authority will be announced and any

tender proposal(s) will be fully communicated to shareholders if

and when the Board chooses to implement such arrangements.

TOTAL VOTING RIGHTS

As at today's date, the Company has 21,465,929 ordinary shares

in issue, excluding shares held in treasury. The Company holds

2,100,159 ordinary shares in treasury, representing approximately

9.8 per cent. of the issued share capital. These treasury shares do

not carry voting or dividend rights. Therefore, the total number of

voting rights in the Company is 19,365,770 . This figure of

19,365,770 may be used by shareholders as the denominator for the

calculations by which they may determine if they are required to

notify their interest, or change to their notified interest, in the

Company under the Financial Conduct Authority's Disclosure Guidance

and Transparency Rules.

OUR PEOPLE

The Group employs approximately 209 permanent staff across its

locations in the UK, Scandinavia and Asia (FY 2022: 216),

supplemented by additional seasonal labour at its warehouses in

Oldham, Lancashire during peak demand periods. The longevity of

staff employment with the Group, many with over 15 years' service,

demonstrates the bond and loyalty that many of them feel towards

their colleagues and the business as a whole.

On behalf of our shareholders, the Board pays tribute to and

thanks all our personnel for their dedication and hard work in

delivering these results and for their continued support.

THE BOARD

The Company yesterday received and accepted Richard King's

notice of his intention to step down as the Company's Chairman and

to retire from the Board at the commencement of the 2024 AGM and,

therefore, not to offer himself for re-election.

Richard's management and leadership skills and entrepreneurial

flair were critical to the Group's fledgling business back at the

time of its formation in 1991. He, together with the other founding

Directors, quickly forged a place and reputation for the Group in

the toy market and the respect of many of the industry doyens, of

which, in time, he became one himself. This coupled with his

ability to identify, recruit, develop, promote and incentivise raw

talent had a considerable impact on the growth trajectory and

strategy of the Group. The industry's recognition of the Group's

achievements over the years culminated in a lifetime achievement

award being bestowed in 2016 on Richard King. Although Richard will

always emphasise the team effort that was recognised by that award,

there is little doubt that his leadership and drive motivated and

directed the efforts of that team in the formative stages of the

Group's history.

Whilst we are sad to see him depart from formal ties with the

Group, Richard has accepted the Company's offer of an appointment

to the new office within the Company as an "Honorary Adviser." This

will not be a Board position. It will not give Richard the burden

of responsibility of voting on matters along with Board members and

Richard has required that it can only be accepted by him as an

unpaid role. We are pleased that Richard has accepted this role and

that we will, accordingly, be assured of being granted continued

access to his wisdom and advice.

I am sure all shareholders will join me in thanking Richard for

his energy, leadership and friendship. We wish him well and whilst

we hope that he enjoys his formal retirement we look forward to

collaborating with him in his advisory capacity over the coming

years.

The Board is delighted to announce that, after due and careful

consideration, it has unanimously resolved that when Mr King

retires during the 2024 AGM, Carmel Warren (a non-executive

Director of the Company) will, subject to being re-elected at the

2024 AGM, succeed Richard as the Company Chair. Mrs Warren was

appointed to the Board in April 2021 and is Chair of the Audit

Committee and a member of each of the Remuneration and Nominations

Committees.

THE 2024 ANNUAL GENERAL MEETING (AGM)

The Company's 2024 AGM will take place as an in-person meeting

at 11:00 a.m. on Friday, 19 January 2024. The Meeting is to be held

at the Group's head office in New Malden, Surrey.

The formal Notice of the Meeting is set out in the Audited

Annual Report and Accounts published today. Explanatory notes in

relation to the resolutions to be proposed at the AGM are set out

at the end of the notice of meeting. Attendance can be in person or

by proxy or, in the case of a company or organisation, by

appointment of a corporate representative.

The Company is providing facilities which will enable

shareholders to:

Ø view the live meeting electronically. If you wish to attend in

this fashion, please email info@charactergroup.plc.uk (stating

"Character Group: 2024 AGM virtual attendance" in the subject line

of the email) by 11:00 a.m. on Wednesday, 17 January 2024 to ensure

the issue to you of a Microsoft Teams invitation. Invitations

enabling remote attendance will be issued by 6:00 p.m. on 18

January 2024. Please note, however, that joining remotely will not

constitute attendance at the meeting for the purposes of being

counted in the quorum for the AGM and that virtual attendees will

not be able to vote at the AGM. Shareholders wishing to attend the

meeting virtually in this fashion are, therefore, requested to

exercise their votes by submitting their forms of proxy appointing

the Chair of the AGM as their proxy, in accordance with the

instructions set out in the notes to the Notice of Meeting, by no

later than 11:00 a.m. on 17 January 2024. If the Chair of the AGM

is appointed as proxy to a shareholder, she will vote in accordance

with any instructions given to her. If the Chair of the meeting is

given discretion as to how to vote, she will vote in favour of each

of the resolutions to be proposed at the AGM; and

Ø submit written questions prior to the AGM. Any shareholder

that wishes to put questions to the Board is invited to submit

those questions in writing in advance of the meeting by sending

them to info@charactergroup.plc.uk (stating "Character Group: 2024

AGM Questions" in the subject line of the email) by 11:00 a.m. on

17 January 2024. The Board will seek to respond to questions which

are put forward in this way either in advance of the AGM, during

the AGM and/or by publishing written responses on the Company's

website after the AGM, together with results of voting. Although it

will be possible to take questions during the course of the meeting

itself, time may not permit responses to all of the questions to be

given at the meeting and, in those circumstances, written responses

will be published on the Company's website after the meeting.

OUTLOOK

The Group has a strong product offering for its all markets

going into Christmas 2023 and beyond, which is gaining support and

recognition from our UK customers and global distributors. Despite

this we have to recognise that trading conditions remain tough,

with reduced consumer spending and changed priorities being an

enduring effect of the cost-of-living crisis. Whilst we have

adapted our product range to target lower price points to respond

to consumer financial constraints, Christmas demand has been later

than usual and is clearly very sensitive to discounting.

Whilst the UK and Irish domestic markets will always remain

critical to Character, the Board recognises that opportunities for

significant sales and profit growth lie in further developing the

Group's international markets. We are focussing on this area of our

business and we are pleased to report at this early stage that,

following the r ecent previews and presentations of our 2024 ranges

and new additions at the Global Toy Fair in Los Angeles to our

retail and international distribution customers, our 2024 product

offering has been very well received. Therefore, with International

sales forecast to grow in the second half of the current financial

year, this bodes well for the Group's strategic focus in this

area.

In summary, Character Group continues to have a strong product

offering, a robust balance sheet, with a net cash position cash and

considerable unutilised working capital facilities in place.

Despite a challenging macro-economic environment, the business

continues to trade satisfactorily, therefore we expect to increase

sales and profitability for the current financial year as a whole,

relative to FY 2023.

We look forward to updating shareholders on the outcome of the

2023 Christmas trading period at the time of its forthcoming

AGM.

THE CHARACTER GROUP PLC

11 December 2023

GROUP INCOME STATEMENT

for the year ended 31 August 2023

12 months 12 months

ended ended

31 August 12 months 12 months 31 August 12 months 12 months

2023 ended ended 2022 ended ended

Result 31 August 31 August Result 31 August 31 August

before 2023 2023 before 2022 2022

highlighted highlighted Statutory highlighted highlighted Statutory

items items Result items items Result

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ----- ------------- -------------- ----------- ------------- -------------- -----------

Revenue 122,591 - 122,591 176,402 - 176,402

Cost of sales (89,805) - (89,805) (135,036) - (135,036)

--------------------- ----- ------------- -------------- ----------- ------------- -------------- -----------

Gross profit 32,786 - 32,786 41,366 - 41,366

Other income 473 - 473 502 - 502

Selling and

distribution

expenses (8,534) - (8,534) (8,260) - (8,260)

Administrative

expenses (19,425) - (19,425) (22,173) - (22,173)

Operating profit 5,300 - 5,300 11,435 - 11,435

Finance income 173 - 173 51 - 51

Finance costs (269) - (269) (207) - (207)

Changes in fair

value

of financial

instruments - (510) (510) - 159 159

Profit before tax 5,204 (510) 4,694 11,279 159 11,438

Income tax (1,305) 110 (1,195) (2,018) (30) (2,048)

--------------------- ----- ------------- -------------- ----------- ------------- -------------- -----------

Profit for the

period 3,899 (400) 3,499 9,261 129 9,390

--------------------- ----- ------------- -------------- ----------- ------------- -------------- -----------

Attributable to

owners

of the parent

Profit for the

period 3,499 9,390

--------------------- ----- ------------- -------------- ----------- ------------- -------------- -----------

Earnings per share

(pence) 3

--------------------- ----- ------------- -------------- ----------- ------------- -------------- -----------

Basic earnings per

share 18.08p 46.37p

--------------------- ----- ------------- -------------- ----------- ------------- -------------- -----------

Diluted earnings per

share 17.95p 45.39p

--------------------- ----- ------------- -------------- ----------- ------------- -------------- -----------

GROUP STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 August 2023

Total Total

2023 2022

GBP000's GBP000's

------------------------------------------------------- ---------- ----------

Profit for the year after tax 3,499 9,390

------------------------------------------------------- ---------- ----------

Items that may be reclassified subsequently to

profit and loss

Exchange differences on translation of foreign

operations 421 1,070

Income tax on exchange differences (301) 21

------------------------------------------------------- ---------- ----------

Other comprehensive income for the year, net of

income tax 120 1,091

------------------------------------------------------- ---------- ----------

Total comprehensive income for the year attributable

to equity holders of the parent 3,619 10.,481

------------------------------------------------------- ---------- ----------

GROUP BALANCE SHEET

As at 31 August 2023

2023 2022

GBP000's GBP000's

------------------------------------------------ ---------- ----------

Non - current assets

Intangible assets 2,338 1,963

Investment property 1,388 1,453

Property, plant and equipment 10,009 9,307

Right of use assets 747 1,216

Deferred tax assets 525 542

------------------------------------------------ ---------- ----------

15,007 14,481

------------------------------------------------ ---------- ----------

Current assets

Inventories 17,955 26,173

Trade and other receivables 26,696 24,728

Current income tax receivable 717 576

Derivative financial instruments 57 412

Cash and cash equivalents 10,894 26,646

------------------------------------------------ ---------- ----------

56,319 78,535

------------------------------------------------ ---------- ----------

Current liabilities

Short-term borrowings (1,284) (6,627)

Trade and other payables (26,945) (42,151)

Lease Liabilities (486) (577)

Income tax (2,117) (3,345)

Derivative financial instruments (498) (343)

(31,330) (53,043)

------------------------------------------------ ---------- ----------

Net current assets 24,989 25,492

------------------------------------------------ ---------- ----------

Non-current liabilities

Deferred tax (367) (427)

Lease liabilities (264) (648)

------------------------------------------------ ---------- ----------

(631) (1,075)

------------------------------------------------ ---------- ----------

Net assets 39,365 38,898

------------------------------------------------ ---------- ----------

Equity

Called up share capital 1,074 1,074

Shares held in treasury (1,762) (1,813)

Capital redemption reserve 1,883 1,883

Share-based payment reserve 4,161 3,957

Share premium account 17,751 17,566

Merger reserve 651 651

Translation reserve 971 1,950

Profit and loss account 14,636 13,630

------------------------------------------------ ---------- ----------

Total equity attributable to equity holders of

the parent 39,365 38,898

------------------------------------------------ ---------- ----------

GROUP CASH FLOW

for the year ended 31 August 2023

Group

-------------------------------------------

2023 2022

GBP000's GBP000's

------------------------------------------ ------------- -------------

Cash flow from operating activities

Profit before taxation for the year

after highlighted items 4,694 11,438

------------------------------------------- ------------- -------------

Adjustments for:

Depreciation of property, plant

and equipment 791 556

Depreciation of investment property 65 66

Depreciation of right of use assets 609 632

Amortisation of intangible assets 2,175 1,509

(Profit) on disposal of property,

plant and equipment (52) (3)

Net interest expense 96 156

Financial instruments fair value

adjustments 510 (159)

Share-based payments 204 208

Decrease/(increase) in inventories 8,218 (15,280)

(Increase)/decrease in trade and

other receivables (1,968) 1,291

(Decrease)/increase in trade and

other creditors (15,206) 3,761

------------------------------------------- ------------- -------------

Cash generated from operations 136 4,175

------------------------------------------- ------------- -------------

Finance income 173 51

Finance expense (269) (207)

Income tax paid (3,014) (401)

------------------------------------------- ------------- -------------

Net cash (outflow)/inflow from operating

activities (2,974) 3,618

------------------------------------------- ------------- -------------

Cash flows from investing activities

Payments for intangible assets (2,550) (1,666)

Payments for property, plant and

equipment (1,611) (1,845)

Proceeds from disposal of property,

plant and equipment 164 225

Net cash outflow from investing

activities (3,997) (3,286)

------------------------------------------- ------------- -------------

Cash flows from financing activities

Payment of lease liabilities (671) (538)

Proceeds from issue of share capital 236 299

Purchase of own shares for cancellation - (13,640)

Dividends paid (3,486) (3,280)

Net cash used in financing activities (3,921) (17,159)

------------------------------------------- ------------- -------------

Net decrease in cash and cash equivalents (10,892) (16,827)

Cash, cash equivalents and borrowings

at the beginning of the year 20,019 35,920

Effects of exchange rate movements 483 926

------------------------------------------- ------------- -------------

Cash, cash equivalents and borrowings

at the end of the year 9,610 20,019

------------------------------------------- ------------- -------------

Cash, cash equivalents and borrowings consist of:

Cash and cash equivalents 10,894 26,646

Total borrowings (1,284) (6,627)

--------------------------------------- ------- -------

Cash, cash equivalents and borrowings

at the end of the year 9,610 20,019

--------------------------------------- ------- -------

GROUP STATEMENT OF CHANGES IN EQUITY

for the year ended 31 August 2023

Shares Profit

Called held Capital Share Share-based and

up share in redemption premium Merger payment Translation loss

capital treasury reserve account reserve reserve reserve account Total

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

------------- --------- --------- ----------- --------- --------- ------------ ------------- --------- ---------

The Group

At 1

September

2021 1,181 (1,870) 1,776 17,324 651 3,749 767 21,274 44,852

-------------- --------- --------- ----------- --------- --------- ------------ ------------- --------- ---------

Profit for

the year

after tax 9,390 9,390

============== ========= ========= =========== ========= ========= ============ ============= ========= =========

Net exchange

differences

on

translation

of foreign

operations - - - - - - 1,183 (92) 1,091

Total other comprehensive income/(expense) 1,183 (92) 1,091

------------------------------------------------------------------------------------- ------------- --------- ---------

Total comprehensive income for the year 1,183 9,298 10,481

------------------------------------------------------------------------------------- ------------- --------- ---------

Share-based

payment - - - - - 208 - - 208

Current tax

credit

relating to

exercised

share

options - - - - - - - 18 18

Deferred tax

debit

relating to

share

options - - - - - - - (40) (40)

Dividends - - - - - - - (3,280) (3,280)

Shares Issued - 57 - 242 - - - - 299

Tender offer

fees - - - - - - - (142) (142)

Shares

cancelled on

tender offer (107) - 107 - - - - (13,498) (13,498)

At 31 August

2022 1,074 (1,813) 1,883 17,566 651 3,957 1,950 13,630 38,898

-------------- --------- --------- ----------- --------- --------- ------------ ------------- --------- ---------

Profit for

the year

after tax - - - - - - - 3,499 3,499

============== ========= ========= =========== ========= ========= ============ ============= ========= =========

Net exchange

differences

on

translation

of foreign

operations - - - - - - (979) 1,099 120

Total other comprehensive income/(expense) (979) 1,099 120

------------------------------------------------------------------------------------- ------------- --------- ---------

Total comprehensive income for the year (979) 4,598 3,619

------------------------------------------------------------------------------------- ------------- --------- ---------

Share-based

payment - - - - - 204 - - 204

Deferred tax

debit

relating to

share

options - - - - - - - (106) (106)

Dividends - - - - - - - (3,486) (3,486)

Shares Issued - 51 - 185 - - - - 236

At 31 August

2023 1,074 (1,762) 1,883 17,751 651 4,161 971 14,636 39,365

-------------- --------- --------- ----------- --------- --------- ------------ ------------- --------- ---------

THE CHARACTER GROUP PLC

NOTES TO THE STATEMENT

1. GEOGRAPHICAL DESTINATION OF REVENUE

12 months 12 months

to to

31 August 31 August

2023 2022

GBP000's GBP000's

------------------- ----------- -----------

United Kingdom 61,116 84,605

Rest of the world 61,475 91,797

------------------- ----------- -----------

Total Group 122,591 176,402

------------------- ----------- -----------

2. EXPENSES BY NATURE - Group

12 months 12 months

to to

31 August 31 August

2023 2022

GBP000's GBP000's

-------------------------------------------------------- ----------- -----------

Operating profit is stated after charging/(crediting):

Cost of inventories recognised as an expense

(included in cost of sales) 77,100 117,586

======================================================== =========== ===========

Product development costs incurred 2,609 1,957

Product development costs capitalised (2,550) (1,666)

Amortisation of capitalised product development

costs 2,155 1,489

======================================================== =========== ===========

Product development costs expensed to

cost of sales 2,214 1,780

======================================================== =========== ===========

Debit/(credit) financial instruments fair

value adjustments 510 (159)

Inventories provisions 944 634

Exchange losses 1,513 2,406

Staff costs 11,358 15,171

Depreciation of tangible fixed assets

- owned assets 791 556

Depreciation of investment property 65 66

Profit on disposal of property, plant

and equipment (52) (3)

Depreciation - right of use assets 609 632

Auditor's remuneration 154 160

-------------------------------------------------------- ----------- -----------

3. Earnings per share - group

The earnings used in the calculation of basic and diluted

earnings per share are as follows:

Year ended Year ended

31 August 31 August

2023 2022

Profit after Profit after

taxation taxation

GBP GBP

------------------------------------------------ -------------- --------------

Profit attributable to equity shareholders

of the parent 3,499,000 9,390,000

------------------------------------------------ -------------- --------------

Financial instruments fair value adjustments

net of tax 400,000 (129,000)

------------------------------------------------ -------------- --------------

Profit for adjusted earnings per share 3,899,000 9,261,000

------------------------------------------------ -------------- --------------

Weighted average number of ordinary shares

in issue during the year - basic 19,348,548 20,251,532

Weighted average number of dilutive potential

ordinary shares 148,497 436,409

------------------------------------------------ -------------- --------------

Weighted average number of ordinary shares

for diluted earnings per share 19,497,045 20,687,941

------------------------------------------------ -------------- --------------

Earnings per share before highlighted

items

Basic earnings per share (pence) 20.15p 45.73p

------------------------------------------------ -------------- --------------

Diluted earnings per share (pence) 20.00p 44.77p

------------------------------------------------ -------------- --------------

Earnings per share after highlighted items

Basic earnings per share (pence) 18.08p 46.37p

------------------------------------------------ -------------- --------------

Diluted earnings per share (pence) 17.95p 45.39p

------------------------------------------------ -------------- --------------

4. DIVIDEND - GROUP

12 months 12 months

to to

31 August 31 August

2023 2022

GBP000's GBP000's

------------------------------------------ ----------- -----------

On equity shares:

Final dividend paid for the year ended

31 August 2022

10.0 pence (2021: 9.0 pence) per share 1,937 1,929

Interim dividend paid for the year ended

31 August 2023

8.0 pence (2022: 7.0 pence) per share 1,549 1,351

------------------------------------------ ----------- -----------

18.0 pence (2022: 16.0 pence) per share 3,486 3,280

------------------------------------------ ----------- -----------

The Directors recommend a final dividend of 11.00 pence per

share (2022: 10.00 pence) amounting to GBP2,130,235 (2022:

GBP1,936,577).

If approved by shareholders, the final dividend will be paid on

26 January 2024 to shareholders on the register on 12 January

2024.

5. ANNUAL REPORT AND ACCOUNTS

The financial information set out in the announcement does not

constitute the Company's statutory accounts for the years ended 31

August 2023 and 2022. The financial information for the year ended

31 August 2022 is derived from the statutory accounts for that year

which have been delivered to the Registrar of Companies. The

financial information for the year ended 31 August 2023 is derived

from the statutory accounts for that year and those accounts have

today been published and may be viewed and/or downloaded from the

Company's website at www.thecharacter.com . The auditors reported

on each of those accounts: their report was unqualified, did not

draw attention to any matters by way of emphasis and did not

contain a statement under s498(2) or (3) of the Companies Act 2006.

The audited statutory accounts for the year ended 31 August 2023

will be delivered to the Registrar of Companies following the

Company's Annual General Meeting.

6. ANNUAL GENERAL MEETING

The Annual General Meeting will be held at 2nd Floor, 86-88

Coombe Road, New Malden, Surrey KT3 4QS on Friday, 19 January 2024

at 11.00am.

7. ELECTRONIC COMMUNICATIONS

The full Financial Statements for the year ended 31 August 2023,

incorporating the Notice of Meeting convening the Company's 2024

Annual General Meeting, is available for viewing on and download

from the Group's website: www.character.com .

Enquiries to:

The Character Group plc

Jon Diver, Joint Managing Director

Kiran Shah, Joint Managing Director & Group Finance Director

Office: +44 (0) 208 329 3377

Mobile: +44 (0) 7831 802219 (JD) or Mobile: +44 (0) 7956 278522

(KS)

Panmure Gordon (Nominated Adviser and Joint Broker)

Atholl Tweedie, Investment Banking

Rupert Dearden, Corporate Broking

Tel: +44 (0) 20 7886 2500

Allenby Capital Limited (Joint Broker)

Nick Athanas, Corporate Finance

Amrit Nahal / Tony Quirke, Sales & Corporate Broking

Tel: +44 (0) 20 3328 5656

TooleyStreet Communications Limited (Investor and media relations)

Fiona Tooley

Tel: +44 (0) 7785 703523

Email: fiona@tooleystreet.com

The Character Group plc

FTSE sector : leisure goods:

FTSE AIM All-share: symbol: CCT

Market cap : GBP55m

Email: info@charactergroup.plc.uk

Group website: www.thecharacter.com

Product ranges can also be viewed at

www.character-online.co.uk

CHARACTER GROUP PLC CCT Stock | London Stock Exchange

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR TTBTTMTABMIJ

(END) Dow Jones Newswires

December 12, 2023 02:01 ET (07:01 GMT)

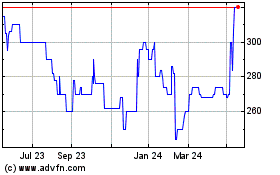

Character (AQSE:CCT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

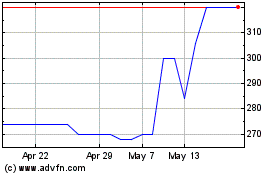

Character (AQSE:CCT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024