TIDMDSG

RNS Number : 9883W

Dillistone Group PLC

29 April 2021

Dillistone Group Plc

("Dillistone", the "Company" or the "Group")

Final Results

Dillistone Group Plc ("Dillistone", the "Company" or the

"Group"), the AIM quoted supplier of software for the international

recruitment industry, is pleased to announce its audited final

results for the 12 months ended 31 December 2020.

Highlights:

-- New operating structure delivers excellent customer service from reduced cost base

-- Recurring revenues(1) represent 91% (2019: 82%) of Group revenue

-- Recurring revenue covered 97% (2019: 89%) of administrative

expenses before acquisition related and other costs(2)

-- Improved adjusted operating loss(2) of GBP0.166m (2019: loss

GBP0.207m) before acquisition related and other costs

-- Reduced loss for the year of GBP0.663m (2019: loss GBP0.842m)

despite the impact of Covid-19 on the business in 2020

-- Granted CBIL loan of GBP1.5m

-- Cash at year end was GBP1.3m

-- Successful launch of Talentis executive search software (https://www.talentis.global/recruitment-software/insights/) after year end. First revenue now generated.

Definitions:

(1) The component elements of recurring revenues are detailed in

note 5.

(2) .Percentages and amounts based on adjusted profits figures -

see note 4.

Commenting on the results and prospects, Giles Fearnley,

Non-Executive Chairman, said:

"The pandemic had a significant impact on the recruitment sector

from which the Group derives the vast majority of its revenue. As a

result, the business enters 2021 with lower recurring revenues than

it entered the preceding year. However, the Board is pleased to

report that the new operating structure implemented in 2019, and

the further cost reductions implemented as a result of the

pandemic, means that the Group is now operating with a much lower

cost base. Furthermore, the Board believes that as revenues

recover, the efficiencies realised will allow for improved

operational leverage.

"The Group has had a positive start to the year in terms of

trading, with incoming contracts ahead of management's

expectations. Furthermore, the Board believes that Talentis (

https://www.talentis.global/recruitment-software/executive-search-software

), the new product we announced in January 2021, will have a

significant impact on the Group's long-term performance. While the

subscription nature of its revenue model means that realised

revenue in 2021 will not be material, we are pleased to report that

we have now generated our first revenue from the platform, with

initial user feedback being almost universally excellent.

Furthermore, we are pleased to report a rapidly developing sales

pipeline.

"The Group has emerged from a challenging year in a strong

position. Better than expected incoming orders in Q1 2021, improved

operational leverage, a robust balance sheet and an enhanced

product range gives the Board optimism for the future. The Board

expects to issue a further update at the time of the AGM."

Annual Report and Accounts - The final results announcement can

be downloaded from the Company's website (www.dillistonegroup.com).

Copies of the Annual Report and Accounts (in addition to the notice

of the Annual General Meeting) will be sent to shareholders by 22

May 2021 for approval at the Annual General Meeting to be held on

16 June 2021.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Enquiries:

Dillistone Group

Plc

Giles Fearnley Chairman Via Walbrook PR

Jason Starr Chief Executive

Julie Pomeroy Finance Director

WH Ireland Limited (Nominated

adviser)

Head of Corporate

Chris Fielding Finance 020 7220 1650

Walbrook PR

Tom Cooper / Paul

Vann 020 7933 8780

0797 122 1972

tom.cooper@walbrookpr.com

Notes to Editors:

Dillistone Group Plc (www.dillistonegroup.com) is a leader in

the supply and support of software and services to the recruitment

industry. Dillistone operates through the Ikiru People brand

(www.IkiruPeople.com).

The Group develops, markets and supports the FileFinder,

Infinity, Mid-Office, ISV and GatedTalent products.

Dillistone was admitted to AIM, a market operated by the London

Stock Exchange plc, in June 2006. The Group employs around 100

people globally with offices in Basingstoke, Southampton,

Frankfurt, New Jersey and Sydney.

ISV Skills Testing: https://www.isv.online

Recruitment Software:

https://www.voyagersoftware.com/recruitment-software-blog/best-recruitment-software-agencies/

Software for Temps:

https://www.voyagersoftware.com/temporary-recruitment-agency-software/

GatedTalent: https://www.Talentis.global

CHAIRMAN'S STATEMENT

2020 started well for the Group with our early months delivering

results ahead of internal expectations. However, the impact of the

Covid-19 pandemic on our target market - the recruitment sector -

is clear. We have seen many of our clients shrink, with some

clients closing. We have additionally supported many clients

through agreeing discounted periods, contract variations and

deferred terms.

The Board reacted swiftly, taking advantage of various

government schemes, including furloughing, and staff unanimously

supporting a temporary pay-cut (April to September), including all

executive and non-executive directors. In June 2020, the Company

secured a loan of GBP1.5m under the UK Government's Business

Interruption Loan scheme enabling us to continue to deliver and

develop products with confidence.

Development remains key to the Group's future success and we

have continued to invest in our main products as well as actively

developing our first new product for a number of years - Talentis.

Talentis was announced in January 2021 and has been well received

by the market. It utilises AI and big data advances to deliver,

what the Board believes to be, a highly competitive solution for

the needs of recruiters globally.

Looking back at 2020 the pandemic had a significant impact on

revenue with the total falling 21% to GBP6.332m, and recurring

revenue falling 13% to GBP5.745m. There was an adjusted operating

loss in 2020 of GBP0.166m (2019: loss GBP0.207m), mainly due to the

fall in revenue being offset with the full benefits of the

reorganisation carried out in 2019, the benefit of costs savings

measures introduced in 2020 and UK Government support through the

furlough scheme and Australian grants. The operating loss,

including reorganisation and acquisition related items, was

GBP0.821m (2019: loss GBP1.090m).

Dividends

The Group is not recommending a final dividend in respect of the

year to 31 December 2020 (2019: nil).

Staff

2020 has been a challenging year for everyone and on behalf of

the Board I would like to take this opportunity to sincerely thank

every one of our staff for their individual and collective

contributions and for the professional way they have all risen to

the challenges of the pandemic, continuing to deliver for our

clients.

Corporate governance

It is the Board's duty to ensure that the Group is managed for

the long-term benefit of all stakeholders.

Mike Love stepped down as a non-executive director in September

2020. I would like to sincerely thank him, for his outstanding

contribution to the Group over many years. We also welcomed Steve

Hammond to the Group Board in January 2021. Steve is the Chief

Engineering Officer for the Group and oversees and is responsible

for the development for all group products. Details of our

governance processes and my role as Chairman of the Board are

included in the corporate governance section that follows the

Strategic Report.

Outlook

The pandemic had a significant impact on the recruitment sector

from which the Group derives the vast majority of its revenue. As a

result, the business enters 2021 with lower recurring revenues than

it entered the preceding year. However, the Board is pleased to

report that the new operating structure implemented in 2019, and

the further cost reductions implemented as a result of the

pandemic, means that the Group is now operating with a much lower

cost base. Furthermore, the Board believes that as revenues

recover, the efficiencies realised will allow for improved

operational leverage.

The Group has had a positive start to the year in terms of

trading, with incoming contracts ahead of management's

expectations. Furthermore, the Board believes that Talentis (

https://www.talentis.global/recruitment-software/executive-search-software

) the new product we announced in January 2021, will have a

significant impact on the Group's long-term performance. While the

subscription nature of its revenue model means that realised

revenue in 2021 will not be material, we are pleased to report that

we have now generated our first revenue from the platform, with

initial user feedback being almost universally excellent.

Furthermore, we are pleased to report a rapidly developing sales

pipeline.

The Group has emerged from a challenging year in a strong

position. Better than expected incoming orders in Q1 2021, improved

operational leverage, a robust balance sheet and an enhanced

product range gives the Board optimism for the future . The Board

expects to issue a further update at the time of the AGM.

Giles Fearnley

Non-Executive Chairman

CEO's Review

Our Group generates the vast majority of its revenue from the

recruitment sector and, with an estimated 250 million jobs lost

globally in 2020 as a result of the pandemic, it has been a

challenging year, and I'd like to begin my review by thanking my

colleagues across the World for the resilience and efforts they

demonstrated during this exceptional period.

Across our product range, we provide solutions to facilitate

everything from the scheduling of fast moving volume temporary

placements through to the headhunting of CEOs, and from

pre-employment testing of skills through to support with executive

career branding.

Strategy and objectives

For any business dependent on recruitment-based revenues,

Covid-19 constituted an existential risk. As a result, the Board

has taken the view that our overriding objectives need to reflect

our new environment and are consequently:

-- Ensuring our staff and their families stay safe, engaged and effective;

-- Taking appropriate action to maintain a strong and stable

financial position, throughout this period and for the future.

-- Protecting and prioritising our product and development

efforts around solutions that reflect the needs of a post Covid

world; and

-- Taking all reasonable steps we can to help our clients

through a challenging period for the recruitment sector;

While many of our markets remain challenging, it is the current

view of the Board that the existential risk to the business has now

passed and that 2021 will see a return towards normality.

As a result, while we will continue to respond to extraneous

factors, management is now focussed on returning the business to

growth.

Key Performance Indicators (KPIs)

As stated above, objectives changed in 2020 and were based

around dealing with the Covid pandemic. Accordingly, the key KPIs

for 2020 were:

KPI 2020 outcome

Maintain a strong and stable financial GBP1.291m cash at

position year end

Protect and prioritise our product and Development on key

development efforts products continued

and Talentis was

launched in January

2021

Our business model

Following the reorganisation in 2019, the business is now

organised as one trading division - Ikiru People rather than 3

divisions: Dillistone Systems, Voyager Software and GatedTalent.

The reorganisation brought all of these businesses together with a

strong focus on the products we sell.

The majority of our products are commercialised through one or

more of the following:

1. Software as a Service (SaaS) subscription basis; or

2. an upfront licence fee plus a recurring support fee; or

3. a hybrid model incorporating an upfront payment and recurring support and cloud hosting fees.

There is a continuing move away from the upfront licence fee

towards cloud delivery (SaaS) services.

The business operates out of Europe, the US and Australia but

services clients globally. As well as supplying and supporting our

software we also host the software for a significant proportion of

our clients. This is done through Microsoft Azure and AWS cloud

data centres in Europe, the Americas, Singapore and Australia.

Group review of the business

2020 saw recurring revenues fall 13% to GBP5.745m (2019:

GBP6.593m) reflecting the impact of Covid-19. Attrition exceeded

new contract wins in the year. Non-recurring revenues were also

impacted by Covid-19 and fell 58% to GBP0.485m (2019: GBP1.160m).

As a result, overall revenues decreased by 21% to GBP6.332m (2019:

GBP8.027m) with recurring revenues representing 91% of Group

revenues (2019: 82%). Cost of sales reduced 31% to GBP0.584m (2019:

GBP0.849m).

Adjusted EBITDA(1) was down 9% to GBP1.168m (2019: GBP1.282m).

There was an adjusted operating loss of GBP0.166m (2019: loss

GBP0.207m) and there was a pre-tax loss before acquisition related

items and reorganisation and other adjustments of GBP0.259m (2019:

loss GBP0.298m). The operating loss for the year reduced to

GBP0.821m (2019: loss GBP1.090m) with reorganisation and other

costs totalling GBP0.442m (2019: GBP0.578m) and acquisition related

amortisation of GBP0.213m (2019: GBP0.305m). The loss for the year

was GBP0.663m (2019: loss GBP0.842m). Net cash at the year end was

GBP1.291m (2019: GBP0.402m).

(1) Adjusted EBITDA is adjusted operating profit with

depreciation and amortisation added back. See note 5 .

Covid-19

The Covid-19 pandemic has had a major impact on the world

economy and in our target market - recruitment. This has affected

our business with many of our clients shrinking and with other

clients ceasing to trade, directly impacting our revenue.

We reacted swiftly to control the impact of Covid-19 on our

business, taking the following actions:

-- Taking advantage of the UK Government furlough scheme

-- Implementing a temporary pay cut (April to October)

-- Switching to home working for the vast majority of staff

-- Offering support packages to our clients to help them survive

the period and, hopefully, remain as customers

-- Using Government support in other jurisdictions where appropriate

-- Agreeing the postponement of repayments on our GBP500,000

bank loan for 6 months. We are on track to repay this loan in full

by 30 June 2021

-- Obtaining a GBP1.5m loan under the Government's Business Interruption Loan scheme

-- Making necessary redundancies in light of the reduced trading activity.

While we believe the existential threat to the business has

passed, uncertainty still remains around the impact of the

pandemic. We have performed stress testing on our cashflows, to

determine what is the maximum strain that the business could bear

over the next 12 months.

Further details of this work are contained in Note 2 on Basis of

Preparation. We are pleased to note that, with the funding support

in place, our Balance Sheet remains strong.

Financial Review

Total revenues decreased by 21% to GBP6.332m (2019: GBP8.027m)

with recurring revenues decreasing by 13% to GBP5.745m (2019:

GBP6.593m) and non-recurring revenues by 58% to GBP0.485m (2019:

GBP1.160m). Third party resell revenue amounted to GBP0.102m in the

period (2019: GBP0.274m).

Cost of sales decreased to GBP0.584m (2019: GBP0.849m).

Administrative costs, excluding acquisition related items and other

costs and excluding depreciation and amortisation, fell 22% to

GBP4.580m (2019: GBP5.896m). This was in part due to the full year

impact of the reorganisation carried out in 2019 and the additional

measures that were taken in 2020 to reduce the cost base.

Depreciation and amortisation (excluding acquisition related

amortisation and one-off write-offs) decreased to GBP1.334m (2019:

GBP1.489m).

Acquisition related and other costs totalled GBP0.655m (2019:

GBP0. 883m) and were in respect of:

-- the amortisation of intangibles arising from acquisitions GBP0.213m (2019: GBP0.305m).

-- other costs of GBP0.442m (2019: GBP0.578m) which included the

write-off of intangibles discussed below.

Recurring revenues covered 97% of administrative expenses before

acquisition related and reorganisation and other costs (2019: 89%).

The administrative costs, excluding depreciation and amortisation

of our own internal development and before acquisition related and

reorganisation and other costs, are covered 125% (2019: 112%) by

recurring revenues.

The Group benefitted from an income tax credit in 2020 of

GBP0.251m (2019: credit GBP0.339m). The 2020 credit reflects the

R&D tax credits available in the UK with the assumption that

tax losses will be surrendered for the R&D tax credit payment

where possible. It also reflects a prior year adjustment of a

credit of GBP0.108m as the tax computations in respect of prior

years were finalised and agreed. The acquisition related items tax

credit of GBP0.041m (2019: GBP0.058m) reflects the reduction in

deferred tax that arises as amortisation is charged in the income

statement. The deferred tax charge also reflects the change in

deferred tax rate to 19% (from 17%) and has been reflected through

the prior year adjustment.

Loss for the year before acquisition related and reorganisation

and other costs amounted to GBP0.116m (2019: loss GBP0.030m). The

2020 adjusted loss benefitted from tax income of GBP0.143m (2019:

tax income of GBP0.268m). The statutory loss for the year was

GBP0.663m (2019: loss GBP0.842m). Basic loss per share (EPS) was

(3.37)p (2019: (4.28)p). Fully diluted EPS was to (3.37)p (2019:

(4.28p)). Adjusted basic EPS fell to (0.59)p (2019: (0.15p)).

Dillistone Group Plc company results show a loss of GBP0.098m

(2019: loss GBP1.843m).

Capital expenditure

The Group invested GBP0.971m in property, plant and equipment

and product development during the year (2019: GBP1.100m). This

expenditure included GBP0.969m (2019: GBP1.067m) spent on

capitalised development related costs. The Group also wrote off

intangibles assets with a net book value of GBP0.435m and included

these costs in reorganisation and other costs.

Trade and other payables

As with previous years, the trade and other payables includes

deferred income of GBP2.029m (2019: GBP2.873m), i.e. income which

has been billed in advance but is not recognised as income at that

time. This principally relates to support, SaaS, cloud hosting

renewals and other subscriptions, which are billed in 2020 but are

in respect of services to be delivered in 2021. It also includes

licence revenue for which a support contract is required, and which

is spread over 5 years under IFRS15. Contractual income is

recognised monthly over the period to which it relates. It also

includes deposits taken for work which has not yet been completed;

as such income is only recognised when the work is substantially

complete, or the client software goes "live".

Cash and debt

The Group finished the year with cash funds of GBP1.291m (2019:

GBP0.402m). The Group obtained a loan of GBP1.5m in June 2020 under

the Government CBIL scheme, which is repayable over 6 years with no

repayment in the first year. The Group also received a six month

payment holiday in respect of its June 2019 loan with repayments

totalling GBP0.166m (2019: GBP0.126m). The Group expects to

complete repayment of this loan in June 2021.

Bank borrowings at 31 December 2020 were GBP1.802m (2019:

GBP0.374m). The Group also had a convertible loan of GBP0.408m

(2019: GBP0.412m). It was agreed in the year that the convertible

loan notes held by the Directors, would not be repaid until the

bank loan was repaid.

Jason Starr

Chief Executive Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2020

2020 2019

Note GBP'000 GBP'000

Revenue 5 6,332 8,027

Cost of sales (584) (849)

--------- ---------

Gross profit 5,748 7,178

Administrative expenses (6,569) (8,268)

Operating loss (821) (1,090)

-------------------------------------- ----- --------- ---------

Adjusted operating loss before

acquisition related, reorganisation

and other items 4 (166) (207)

Acquisition related, reorganisation

and other items 7 (655) (883)

--------- ---------

Operating (loss) (821) (1,090)

-------------------------------------- ----- --------- ---------

Financial cost (93) (91)

Loss before tax (914) (1,181)

Tax income 8 251 339

(Loss) for the year (663) (842)

Other comprehensive income/(loss)

Items that will be reclassified

subsequently to profit and

loss:

Currency translation differences 12 (16)

Total comprehensive (loss)

for the year (651) (858)

========= =========

Earnings per share

Basic 9 (3.37)p (4.28)p

Diluted 9 (3.37)p (4.28)p

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2020

Share Share Merger Retained Convertible Share Foreign Total

capital premium reserve earnings loan option exchange

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance

at 1 January

2019 983 1,631 365 1,687 14 106 63 4,849

Comprehensive

income

Loss for

the year - - - (842) - - - (842)

Other

comprehensive

income

Exchange

differences

on

translation

of overseas

operations - - - - - - (16) (16)

Total

comprehensive

loss - - - (842) - - (16) (858)

--------- --------- --------- --------- ------------ --------- --------- ---------

Transactions

with owners

Share option

charge - - - 26 - (12) - 14

--------- --------- --------- --------- ------------ --------- --------- ---------

Total

transactions

with owners - - - 26 - (12) - 14

Balance

at 31

December

2019 983 1,631 365 871 14 94 47 4,005

========= ========= ========= ========= ============ ========= ========= =========

Comprehensive

income

Loss for

the year

ended 31

December

2020 - - - (663) - - - (663)

Other

comprehensive

income/(loss)

Exchange

differences

on

translation

of overseas

operations - - - - - - 12 12

Total

comprehensive

loss - - - (663) - - 12 (651)

--------- --------- --------- --------- ------------ --------- --------- ---------

Transactions

with owners

Share option

charges - - - - - 16 - 16

Total

transactions

with owners - - - - - 16 - 16

Balance

at 31

December

2020 983 1,631 365 208 14 110 59 3,370

========= ========= ========= ========= ============ ========= ========= =========

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

Group

2020 2019

ASSETS GBP'000 GBP'000

Non-current assets

Goodwill 3,415 3,415

Other intangible assets 3,362 4,234

Property, plant and equipment 24 54

Right to use assets 680 754

Investments - -

--------- ---------

Total non-current assets 7,481 8,457

--------- ---------

Current assets

Trade and other receivables 883 1,222

Current tax receivable 186 293

Cash and cash equivalents 1,291 690

--------- ---------

Total current assets 2,360 2,205

--------- ---------

Total assets 9,841 10,662

EQUITY AND LIABILITIES

Equity attributable to owners of

the parent

Share capital 983 983

Share premium 1,631 1,631

Merger reserve 365 365

Convertible loan reserve 14 14

Retained earnings 208 871

Share option reserve 110 94

Translation reserve 59 47

--------- ---------

Total equity 3,370 4,005

--------- ---------

Liabilities

Non-current liabilities

Trade and other payables 271 443

Lease liabilities 638 741

Borrowings 1,749 523

Deferred tax liability 296 340

--------- ---------

Total non-current liabilities 2,954 2,047

Current liabilities

Trade and other payables 2,953 3,977

Lease liabilities 103 82

Borrowings 461 551

Total current liabilities 3,517 4,610

Total liabilities 6,471 6,657

Total liabilities and equity 9,841 10,662

========= =========

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 31 DECEMBER 2020

For the For the For the For the

year year year year

ended ended ended ended

31 December 31 December 31 December 31 December

2020 2020 2019 2019

Operating activities GBP'000 GBP'000 GBP'000 GBP'000

(Loss) before tax (914) (1,181)

Adjustment for

Financial cost 93 91

Depreciation and amortisation 1,984 1,794

Share option expense 16 14

Foreign exchange adjustments arising

from operations (28) (33)

Operating cash flows before 1,151 685

movement in working capital:

Decrease in receivables 360 282

Decrease in inventories - 3

Decrease in payables (1,120) (603)

Taxation refunded 314 167

------------- -------------

Net cash generated from operating

activities 705 534

Investing activities

Purchases of property, plant and

equipment (2) (29)

Sale of Fixed assets - 2

Investment in development costs (969) (1,070)

Net cash used in investing activities (971) (1,097)

Financing activities

Interest paid (84) (83)

Proceeds from bank loan 1,500 500

Bank loan repayments made (166) (126)

Lease payments made (114) (49)

(Repayment)/utilisation of banking

facility (288) 288

Net cash generated from financing

activities 848 530

Net increase/(decrease) in cash and cash

equivalents 582 (33)

Cash and cash equivalents at 690 725

beginning of year

Effect of foreign exchange rate

changes 19 (2)

Cash and cash equivalents at end

of year 1,291 690

------------- -------------

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2020

1. Publication of non-statutory accounts

In accordance with section 435 of the Companies Act 2006, the

Directors advise that the financial information set out in this

announcement does not constitute the Group's statutory financial

statements for the year ended 31 December 2020 or 2019, but is

derived from these financial statements. The financial statements

for the year ended 31 December 2019 have been audited and filed

with the Registrar of Companies. The financial statements for the

year ended 31 December 2020 have been prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union. The financial statements for the year ended 31

December 2020 have been audited and will be filed with the

Registrar of Companies following the Company's Annual General

Meeting. The Independent Auditors Report on the Group's statutory

financial statements for the years ended 31 December 2020 and 2019

were unqualified and did not draw attention to any matters by way

of emphasis and did not contain statements under Section 498(2) or

(3) of the Companies Act 2006.

2. Basis of preparation

The preliminary announcement is extracted from the consolidated

financial statements of the Group. The financial statements of the

subsidiaries are prepared for the same reporting date as the parent

company. Consistent accounting policies are applied for like

transactions and events in similar circumstances.

All intra-group balances, transactions, income and expenses and

profits and losses resulting from intra-group transactions that are

recognised in assets or liabilities are eliminated in full.

A degree of doubt still remains with regard to the impact on the

Group of the COVID-19 outbreak and the continuing lockdown into

2021 and this has been taken into account in considering the

Group's adoption of the going concern basis. The Group has seen

many of its clients shrink and with some clients closing and this

has been built into the 2021 budgets and subsequent years

forecasts. The Group continues to take advantage of the flexible

furlough scheme and has secured a second payroll protection loan in

the US.

A stress test scenario has been modelled that took GBP70,000 per

month off Revenue from May 2021 has been considered. If revenue

were to fall in line with the stress test model, the Company would

take further remedial action to counter the reduction in profit and

cash through a cost cutting exercise that would include staff

redundancies and general cost control measures. On this basis, the

Group's cash reserves would be reduced to an overdrawn GBP212,000

position in November 2021. This would slightly exceed the Group's

overdraft of GBP200,000.

Based on current trading, the stress test scenario is considered

remote. However, it is difficult to predict the overall impact and

outcome of COVID-19 at this stage, particularly if further

lockdowns are required towards the end of 2021. Nevertheless, after

making enquiries, and considering the uncertainties described

above, the directors have a reasonable expectation that the company

has adequate resources to continue in operational existence for the

foreseeable future. For these reasons, they continue to adopt the

going concern basis in preparing the annual report and

accounts.

3. Accounting policies

This preliminary announcement has been prepared in accordance

with the accounting policies adopted in the last annual financial

statements for the year to 31 December 2019.

4. Reconciliation of adjusted profits to consolidated statement of comprehensive income

Note Adjusted Acquisition 2020 Adjusted Acquisition 2019

profits related, profits related

reorganisation reorganisation

and other and other

costs costs

2020 2020* 2019 2019*

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 6,332 - 6,332 8,027 - 8,027

Cost of sales (584) - (584) (849) - (849)

--------- ---------------- --------- --------- ---------------- ---------

Gross profit 5,748 - 5,748 7,178 - 7,178

Administrative

expenses (5,914) (655) (6,569) (7,385) (883) (8,268)

Operating /(loss) (166) (655) (821) (207) (883) (1,090)

Financial income - - - - - -

Financial cost (93) - (93) (91) - (91)

(Loss) before

tax (259) (655) (914) (298) (883) (1,181)

Tax income 143 108 251 268 71 339

(Loss) for the

year (116) (547) (663) (30) (812) (842)

Other comprehensive

loss net of tax:

Currency translation

differences 12 - 12 (16) - (16)

Total comprehensive

(loss) for the

year net of tax (104) (547) (651) (46) (812) (858)

========= ================ ========= ========= ================ =========

Earnings per share

Basic 9 (0.59)p - (3.37)p (0.15)p - (4.28)p

Diluted 9 (0.59)p - (3.37)p (0.15)p - (4.28)p

* See note 7

5. Segment reporting

In 2019, the Group streamlined its corporate structures and

operations to achieve efficiencies across the business. This

resulted in the five UK businesses being combined into one trading

entity subsequently renamed Ikiru People Limited. A similar

reorganisation has occurred in Australia combining our two

companies into one and renamed as Ikiru People Pty Limited. The US

business was renamed Ikiru People Inc. These changes came into

effect on 31 December 2019. Accordingly, for 2020 onwards, the

group is only reporting one trading segment.

Divisional segments

For the year ended 31 December

2020

Ikiru People Central Total

GBP'000 GBP'000 GBP'000

Segment revenue 6,332 - 6,332

------------- -------- --------

Segment EBITDA pre exceptional 1,211 (43) 1,168

Depreciation and amortisation

expense (1,334) - (1,334)

------------- -------- --------

Segment result before

reorganisation and other

costs (123) (43) (166)

Reorganisation and other

costs (442) - (442)

Segment result (565) (43) (608)

Acquisition related amortisation (213) (213)

Operating (loss) (565) (256) (821)

Loan interest/ lease interest (39) (54) (93)

Loss before tax (914)

Income tax income 251

--------

Loss for the year (663)

========

Additions of non-current

assets 1,006 1,006

Divisional segments

For the year ended 31 December

2019

Dillistone Voyager GatedTalent Central Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segment revenue 3,895 3,795 337 - 8,027

----------- -------- ------------ -------- --------

Segment EBITDA pre exceptional 1,021 691 (295) (135) 1,282

Depreciation and amortisation

expense (747) (553) (189) (1,489)

----------- -------- ------------ -------- --------

Segment result before

reorganisation and other

costs 274 138 (484) (135) (207)

Reorganisation and other

costs (180) (172) 1,427 (1,653) (578)

Segment result 94 (34) 943 (1,788) (785)

Acquisition related amortisation - - - (305) (305)

Operating profit/(loss) 94 (34) 943 (2,093) (1,090)

Financial income - - - -

Loan interest/ lease

interest (1) (35) - (55) (91)

Loss before tax (1,181)

Income tax income 339

--------

Loss for the year (842)

========

Additions of non-current

assets 446 1,283 191 - 1,920

Products and services

The following table provides an analysis of the Group's revenue

by products and services:

Revenue

2020 2019

GBP'000 GBP'000

Recurring income 5,745 6,593

Non-recurring income 485 1,160

Third party revenues 102 274

6,332 8,027

========= =========

Revenue

In the analysis above 'Recurring income' represents all income

recognised over time, whereas 'Non-recurring income' and 'Third

party revenues' represent all income recognised at a point in

time.

Recurring income includes all support services, SaaS and hosting

income and revenue on perpetual licenses with mandatory support

contracts deferred under IFRS 15. Non-recurring income includes

sales of new licenses which do not require a support contract, and

income derived from installing licences including training,

installation and data translation. Third party revenues arise from

the sale of third party software.

It is not possible to allocate assets and additions between

recurring, non-recurring income and third party revenue. No

customer represented more than 10% of revenue of the Group in 2020

or 2019.

6. Geographical analysis

The following table provides an estimated analysis of the

Group's revenue by geographic market. The Board does not review the

business from a geographical performance viewpoint and this

analysis is provided for information only. Previously the revenue

was based on billing entity and in 2020 on country of customer.

Revenue

2020 2019

GBP'000 GBP'000

UK 3,717 5,700

Europe 877 928

Americas 1,074 1,034

Australia 295 365

ROW 369 -

6,332 8,027

========= =========

Non-current assets by geographical location

2020 2019

GBP'000 GBP'000

UK 7,460 8,445

US 20 6

Australia 1 6

--------- ---------

7,481 8,457

========= =========

7. Acquisition related, reorganisation and other costs

2020 2019

GBP'000 GBP'000

Included within administrative expenses:

Reorganisation and other costs 78 578

Grants received from overseas jurisdictions (71) -

Amortisation of acquisition intangibles 213 305

Write-off of capitalised development 435 -

--------- ---------

655 883

========= =========

Reorganisation and other costs include severance payments and

loss of office payments. The Write-off of capitalised development

relates to a product that is no longer actively sold.

8. Tax income

2020 2019

GBP'000 GBP'000

Current tax (99) (50)

Prior year adjustment - current

tax (108) (140)

--------- ---------

Total current tax (207) (190)

Deferred tax (123) (67)

Prior year adjustment - deferred

tax 80 (24)

Deferred tax rate change to 19% 40 -

Deferred tax re acquisition intangibles (41) (58)

--------- ---------

Total deferred tax (44) (149)

--------- ---------

Tax (income) for the year (251) (339)

========= =========

Factors affecting the tax credit for

the year

Loss before tax (914) (1,181)

========= =========

UK rate of taxation 19.00% 19.00%

Loss before tax multiplied by the UK

rate of taxation (174) (224)

Effects of:

Overseas tax rates 1 1

Impact of deferred tax not provided 8 108

Enhanced R&D relief (143) (129)

Disallowed expenses 14 43 43

Deferred tax rate change to 19% 40 8

Rate difference between CT rate

and rate of R&D repayment 31 18

Prior year adjustments (28) (164)

Tax (income) (251) (339)

========= =========

9. Earnings per share

2020 2020 2019 2019

Using adjusted Using adjusted

profit profit

(Loss)/ attributable to GBP(116,000) GBP(663,000) GBP(30,000) GBP(842,000)

ordinary shareholders (note

4)

Weighted average number

of shares 19,668,021 19,668,021 19,668,021 19,668,021

Basic (loss) per share (0.59) pence (3.37) pence (0.15) pence (4.28) pence

=============== ============= =============== ===============

Weighted average number

of shares after dilution 19,670,013 19,670,013 19,668,021 19,668,021

Fully diluted (loss) per (0.59) pence (3.37) pence (0.15) pence (4.28) pence

share

=============== ============= =============== =============

Reconciliation of basic to diluted average number of shares:

2020 2019

Weighted average number of shares

(basic) 19,668,021 19,668,021

Effect of dilutive potential ordinary

shares - employee share plans 1,992 -

Weighted average number of shares

after dilution 19,670,013 19,668,021

=========== ===========

There are 953,337 (2019: 1,970,005) share options not included

in the above calculations, as they are underwater or have not yet

vested.

The impact of the convertible loan notes in the period is not

dilutive and therefore does not impact the calculation of the fully

diluted earnings per share.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SEMESAEFSESL

(END) Dow Jones Newswires

April 29, 2021 02:00 ET (06:00 GMT)

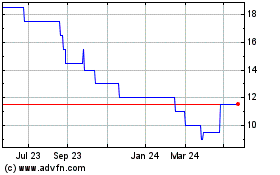

Dillistone (AQSE:DSG.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

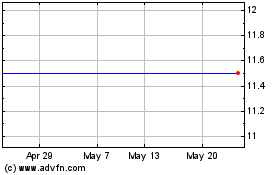

Dillistone (AQSE:DSG.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024