Duke Royalty Limited Trading Update (2324M)

13 September 2023 - 4:00PM

UK Regulatory

TIDMDUKE

RNS Number : 2324M

Duke Royalty Limited

13 September 2023

13 September 2023

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Trading Update

Duke Royalty, a provider of alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and North America, is pleased to provide the following

trading and operational update for its first quarter of the

financial year 2024, ending 30 June 2023 ("Q1 FY24"). The Company

also provides guidance on trading for its second quarter, ending 30

September 2023 ("Q2 FY24").

Q1 FY24 Financial Highlights:

-- Recurring cash revenue for Q1 FY24 reached a new record of

GBP6.0 million, an increase of 17% over Q1 FY23, and a GBP300,000

increase on the prior quarter

-- The GBP6.0 million for the quarter meant Duke delivered an

average monthly recurring cash revenue of GBP2.0 million for the

first time in the Company's history, a significant milestone

-- Q1 FY24 total cash revenue reached GBP7.8 million, marking

another quarterly cash revenue record, surpassing the previous

record of GBP6.7 million in Q4 FY22, on account of the Instor

buyback

-- 0.70p interim dividend paid out in April 2023

Overview of quarterly revenue growth:

Recurring Cash Revenue* Total Cash Revenue**

Q1 FY23 GBP5.1 million GBP5.1 million

------------------------ ---------------------

Q2 FY23 GBP5.3 million GBP5.3 million

------------------------ ---------------------

Q3 FY23 GBP5.6 million GBP5.6 million

------------------------ ---------------------

Q4 FY23 GBP5.7 million GBP5.8 million

------------------------ ---------------------

Q1 FY24 GBP6.0 million GBP7.8 million

------------------------ ---------------------

* Recurring cash revenue excludes buyback premium receipts and

cash gains from equity sales

** Total cash revenue is monthly cash distributions from Duke's

royalty partners plus cash gains received from the sales of equity

assets and buyback premiums

Q1 FY24 Operational Highlights:

-- In May 2023, Duke announced the successful exit of its

investment in royalty partner Instor Solutions, Inc. Duke received

net cash of US$11.2 million at closing, delivering a total gain of

US$2.4 million and a triple-digit IRR

-- Duke also completed two material follow-on investments in the quarter as follows:

- a GBP1.9 million investment into New Path Fire and Security to

facilitate its acquisition of BDI Security Limited

- a GBP1.8 million investment int Tristone Healthcare to enable

the company to complete its acquisition of South West Intervention

Service Limited

Financial Forecast for Q2 FY24:

-- Based on current trading, Duke expects to achieve recurring

cash revenue of GBP6.2 million in Q2 FY24

-- The GBP6.2 million of cash revenue would represent a 17%

year-on-year increase (Q2 FY23: GBP5.3 million) and a further

increase on Q1 FY24

Neil Johnson, CEO of Duke Royalty, said:

"We are pleased to report another quarter marked by

record-breaking cash performance, underpinned by solid growth. This

underscores the resilience of Duke's business model, especially in

the face of ongoing economic challenges. Looking ahead, we remain

confident that the consistent quarterly growth we have generated in

recurring revenue will continue, and Duke is committed to working

with our partners for their long-term growth."

Change of Name of Nominated Adviser and Joint Broker

The Company also announces that its Nominated Adviser and Joint

Broker has changed its name to Cavendish Securities plc following

completion of its own corporate merger.

***ENDS***

For further information, please visit www.dukeroyalty.com or

contact:

Neil Johnson / Charles

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 730 613

Cavendish Securities

plc

(Nominated Adviser Stephen Keys / Callum

and Joint Broker) Davidson / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity

(Joint Broker) Adam James / Harry Rees +44 (0) 207 523 8000

SEC Newgate (PR) Elisabeth Cowell / Alice +44 (0) 20 3757 6882

Cho / Matthew Elliott dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBLLLFXKLBBBB

(END) Dow Jones Newswires

September 13, 2023 02:00 ET (06:00 GMT)

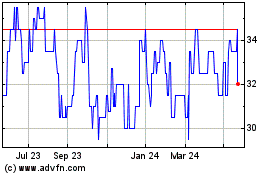

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

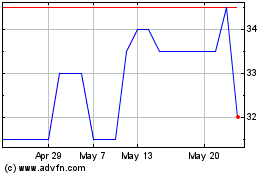

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025