Half-year report

21 January 2025 - 6:00PM

UK Regulatory

Half-year report

DXS INTERNATIONAL PLC

(AQSE: DXSP)

HALF YEAR RESULTS

DXS International plc ("DXS" or the "Company"),

the digital clinical decision support company, is pleased to

provide shareholders with its unaudited interim results for the

half year ending 31 October 2024.

Financial highlights:

- Revenue increased

by 2.2% to £1,730,829 (2023 - £1,693,910).

- Core recurring

revenue model remains resilient.

- Profit after tax of

£1,131 compared to a loss of (£121,567) in 2023, an improvement of

£122,698. It should be noted that, due to the write down of

deferred expenditure in April 2024, there was a very small

depreciation charge of £493 compared to that included in respect of

half year ending 31 October 2023 (£570,007). It should also be

noted that all development costs for ongoing R&D are now

included in the P&L which is in line with new HMRC

guidelines.

- Available cash at

the period end was £96,431 (2023 - £386,122), plus unutilised

debtor drawdowns of £256,670 (2023 £386,122).

- R&D tax credits

on ordinary activities down by 51% due to change in HMRC

allowances.

- Post period end,

the Company has secured a price rise in respect of some NHS

contracts that will marginally improve Revenues for the second half

of the financial year.

Operational highlights:

- Our new SMART

Referral solution continues to show promise with the integration

with the NHS’ Electronic Referral System now complete.

- The recent NHS

announcement to push a financial incentive of £80 million to GP

practices as part of a bid to reduce the elective waiting lists

bodes well for DXS’ SMART Referrals solution.

- Tackling

Cardiovascular Disease (‘CVD’) remains an NHS priority and

therefore, the positive outcomes of improving blood pressure

control during the current Innovate UK Evaluation of DXS’

ExpertCare hypertension solution shows significant promise for

wider system adoption – particularly when in England, blood

pressure control dropped from 70.9% to 66.8% between March and June

2024. (Blood pressure control is reviewed quarterly for

England).

- Started first

ExpertCare commercial contract for the management of hypertension

for a PCN in the East of England.

- We have continued

our committed investment in R&D, even though this is not

reflected in the Balance Sheet.

Outlook

Current lack of available NHS budgets remains a

barrier to closing new sales. Armed with evidence of the

effectiveness of our solutions in solving real problems for both

the patient and the taxpayer, we continue to the believe that it is

a matter of time before new NHS funding specifically aimed at

alleviating NHS pressures by the introduction of innovative digital

solutions becomes more readily available.

In addition, we continue our policy of:

- Gaining evidence

evaluated by third parties proving the effectiveness of our

solutions and demonstrating the ROI to be gained by the NHS .

- Offering a risk

sharing value-based procurement model to the NHS that include

performance based upsides.

- Providing services

to overcome the NHS resource shortage challenges.

- Forming

collaborations with organisations that currently have the skill and

accreditation to work with us.

- The intense focus

is on growing sales, but if it remains slow, appropriate

efficiencies will be considered.

David Immelman, Chief Executive of DXS,

commented:

“Although gaining sales growth remains

frustratingly slow, I repeat my statement from a year ago: We

remain confident that we have exceptionally effective solutions for

helping the NHS to resolve their acknowledged problems and that

this can be demonstrated by provable data which saves millions of

pounds annually, saves patient lives, helps with the resource

shortage and contribute to the NHS Net Zero Targets.”

“Our team remains fuelled with conviction

and enthusiasm for what we have to offer to the NHS and beyond. The

Board continues with salary cost cuts as a contribution to cash

flow.”

The Directors of DXS International plc accept

responsibility for this announcement. This announcement contains

information which, prior to its disclosure, was inside information

as stipulated under Regulation 11 of the Market Abuse (Amendment)

(EU Exit) Regulations 2019/310 (as amended).

INTERIM RESULTS to 31 OCTOBER

2024

Consolidated Income Statement

for the six months ended 31 October 2024

| |

Unaudited Group 6 Months ended 31 Oct

2024 |

|

Unaudited

6 Months ended

31 Oct 2023 |

|

Audited

Year to

30 April 2024 |

| |

Continuing Operations |

|

Continuing Operations |

|

Continuing Operations |

| |

|

£ |

|

|

£ |

|

|

£ |

|

Turnover |

1,730,829 |

|

1,693,910 |

|

3,308,359 |

| Cost of

Sales |

(235,670) |

|

(205,274) |

|

(428,212) |

| Gross Profit |

1,495,159 |

|

1,488,636 |

|

2,880,147 |

| Grant Income |

170,610 |

|

- |

|

136,570 |

| Administration

Costs |

(1,705,272 |

|

(1,132,280) |

|

(2,494,510 |

| Depreciation and

Amortisation |

(493) |

|

(570,007) |

|

(5,399,030) |

| Operating

(loss) |

(39,996) |

|

(213,651) |

|

(4,876,823) |

| Sundry

Income |

1,203 |

|

7 |

|

15 |

| |

(38,793) |

|

(213,644) |

|

(4,876,808) |

| Interest

payable and similar expenses |

(20,076) |

|

(44,828) |

|

(74,842) |

| Loss on

ordinary activities before taxation |

(58,869) |

|

(258,472) |

|

(4,951,650) |

| Tax on (loss)

on ordinary activities |

60,000 |

|

136,910 |

|

212,964 |

| Profit

/ (Loss) for the period |

1,131 |

|

(121,562) |

|

(4,738,686) |

| |

========= |

|

========= |

|

========= |

| Profit per

share |

|

|

|

|

|

|

|

(0p) |

|

0.2p |

|

(7.4)p |

|

|

(0p) |

|

0.2p |

|

(7.4)p |

| |

========= |

|

========= |

|

========= |

Consolidated Statement of other Comprehensive

Income

for the six months ended 31 October 2024

| (Loss) /

Profit |

1,131 |

|

(121,562) |

|

(4,738,686) |

| Other

comprehensive income for the period |

- |

|

- |

|

- |

| |

|

|

|

|

|

| |

1,131 |

|

(121,562) |

|

(4,738,686) |

| |

========= |

|

========= |

|

========= |

STATEMENT of FINANCIAL POSITION

as at 31 October 2024

| |

Unaudited

Group at

31 Oct 2024 |

Unaudited

Group at

31 Oct 2023 |

Audited

Group at

30 April 2024 |

| |

|

£ |

|

£ |

|

£ |

| Fixed

Assets |

|

|

|

| Intangible

Assets |

1,455,000 |

5,942,117 |

1,455,000 |

| Tangible

Assets |

572 |

565 |

1,038 |

| |

_________ |

_________ |

_________ |

| |

1,455,572 |

5,942,682 |

1,456,038 |

| |

_________ |

_________ |

_________ |

| Current

assets |

|

|

|

| Debtors Amounts

falling due within one year |

694,543 |

580,317 |

1,115,272 |

| Cash at bank and

in hand |

96,431 |

386,122 |

90,012 |

| |

_________ |

_________ |

_________ |

| |

790,944 |

966,439 |

1,205,284 |

| Creditors: amounts

falling due within one year |

(880,070) |

(1,189,392) |

(811,205) |

| |

_________ |

_________ |

_________ |

| Net

current assets / (liabilities) |

(89,126) |

(222,953) |

394,079 |

| |

_________ |

_________ |

_________ |

| |

|

|

|

| Total

assets less current liabilities |

1,366,446 |

5,719,729 |

1,850,117 |

|

Creditors: |

|

|

|

| amounts falling

due after more than one year |

(330,134) |

(232,595) |

(345,455) |

| Deferred

income |

(587,795) |

(424,762) |

(1,057,276) |

| |

_________ |

_________ |

_________ |

| |

448,517 |

5,062,372 |

447,386 |

| |

========= |

========= |

========= |

| Capital

and reserves |

|

|

|

| Called up share

capital |

211,273 |

211,273 |

211,273 |

| Share Premium |

3,213,395 |

3,213,395 |

3,213,395 |

| Share option

reserve |

11,589 |

9,451 |

11,589 |

| Retained

earnings |

(2,987,740) |

1,628,253 |

(2,988,871) |

| |

_________ |

_________ |

_________ |

|

Shareholders’ Funds |

448,517 |

5,062,372 |

447,386 |

| |

========= |

========= |

========= |

| |

|

|

|

Statement Of Cash Flows

Six months ended 31 October 2024

| |

Unaudited

Six months ended 31 Oct 2024 |

Unaudited

Six months ended 31 Oct 2023 |

Audited year ended 30 April 2024 |

| |

|

£ |

|

£ |

|

£ |

| |

|

|

|

| Cash flow

from operating activities |

49,629 |

448,174 |

323,384 |

| Interest paid |

(20,076) |

(44,828) |

(74,842) |

| Sundry Income |

1,203 |

7 |

15 |

| R&D tax

credit |

- |

- |

326,564 |

| |

_________ |

_________ |

_________ |

| Net Cash

flow from operating activities |

30,756 |

403,353 |

575,121 |

| |

_________ |

_________ |

_________ |

| |

|

|

|

| Cash flow

from investing activities |

|

|

|

| Payments to

acquire intangible fixed assets |

- |

(651,358) |

(902,828) |

| Proceeds in

respect of tangible fixed assets |

(27) |

- |

(908) |

| |

_________ |

_________ |

_________ |

| |

(27) |

(651,358) |

(993,736) |

| |

_________ |

_________ |

_________ |

| |

|

|

|

| Cash flow

from investing activities |

|

|

|

| Repayment of long

term loans |

(24,310) |

(237,850) |

(457,451) |

| Proceeds on share

issue |

- |

500,000 |

630,628 |

| Share issue

costs |

- |

- |

(36,527) |

| |

_________ |

_________ |

_________ |

| |

(24,310) |

262,150 |

136,650 |

| |

_________ |

_________ |

_________ |

| |

|

|

|

| Net

increase / (decrease) in cash and cash equivalents |

6,419 |

14,145 |

(281,965) |

| Cash and Cash

equivalents at 30 April 2024 |

90,012 |

371,977 |

371,977 |

| |

_________ |

_________ |

_________ |

| |

|

|

|

| Cash and

Cash equivalents at 31 October 2024 |

96,431 |

386,122 |

90,012 |

| |

========= |

========= |

========= |

| Cash and Cash

equivalents consists of: |

|

|

|

| Cash at bank and

in hand |

96,431 |

386,122 |

90,012 |

| |

========= |

========= |

========= |

Net Debt Reconciliation

| |

Current Debt

£ |

Non Current Debt

£ |

Cash

£ |

Total

£ |

| |

|

£ |

£ |

£ |

| |

|

|

|

|

| At 30 April

2023 |

(313,486) |

(720,446) |

371,978 |

(661,954) |

| Non cash flow |

|

374,991 |

|

374,991 |

| Cash flow |

26,857 |

- |

(281,966) |

(255,109) |

| |

_________ |

_________ |

_________ |

_________ |

| |

|

|

|

|

| At 30 April

2024 |

(286,629) |

(345,455) |

90,012 |

(542,072) |

| Cash flow |

8,989 |

15,321 |

6,419 |

30,729 |

| |

_________ |

_________ |

_________ |

_________ |

| At 31 October

2024 |

(277,640) |

(330,134) |

96,431 |

(511,343) |

| |

========= |

========= |

========= |

========= |

The above figures have not been reviewed by the company's

auditors Crowe U.K. LLP.

The Directors of DXS International plc accept

responsibility for this announcement

Contacts:

David Immelman

DXS International plc

www.dxs-systems.com

|

01252 719800 |

AQSE Corporate

Broker and Corporate Advisor

Hybridan LLP

Claire Louise Noyce |

020 3764

2341 |

Notes to Editors

About DXS:

DXS International presents up to date treatment

guidelines and recommendations, from Clinical Commissioning Groups

and other trusted NHS sources, to doctors, nurses and pharmacists

in their workflow and during the patient consultation. This

effective clinical decision support ultimately translates to

improved healthcare outcomes delivered more cost effectively and

which should significantly contribute towards the NHS achieving its

projected efficiency savings.

DXS (AQSE:DXSP)

Historical Stock Chart

From Jan 2025 to Feb 2025

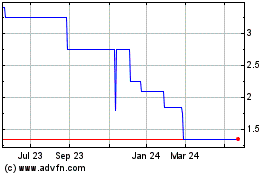

DXS (AQSE:DXSP)

Historical Stock Chart

From Feb 2024 to Feb 2025